I asked 25 of the smartest investors I know what they consider GOOD and GREAT growth rates by company stage. Here’s what I learned  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

1/ In the early stages, investors don’t care about month-over-month growth

Percentages with a small base don’t mean much. This sentiment was true across every investor I talked to, e.g.

Percentages with a small base don’t mean much. This sentiment was true across every investor I talked to, e.g.

"We don’t anchor on the specific % for MoM growth because the % represents a pretty small $ difference with small denominators. For example, 10% vs. 20% growth at $100K ARR isn’t substantial. I look at MoM only really as a proxy for how fast it ramps to $1m ARR."

— @kimberlywtan

— @kimberlywtan

That being said, if you’re looking for a month-over-month benchmark below $1m ARR, answers typically fell in the 15%-25% range.

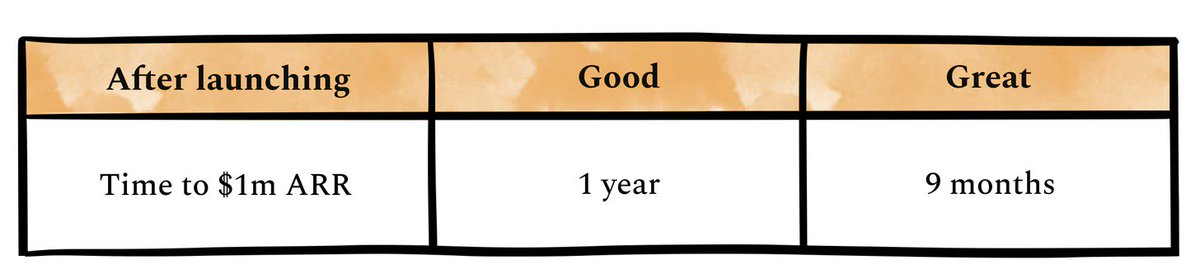

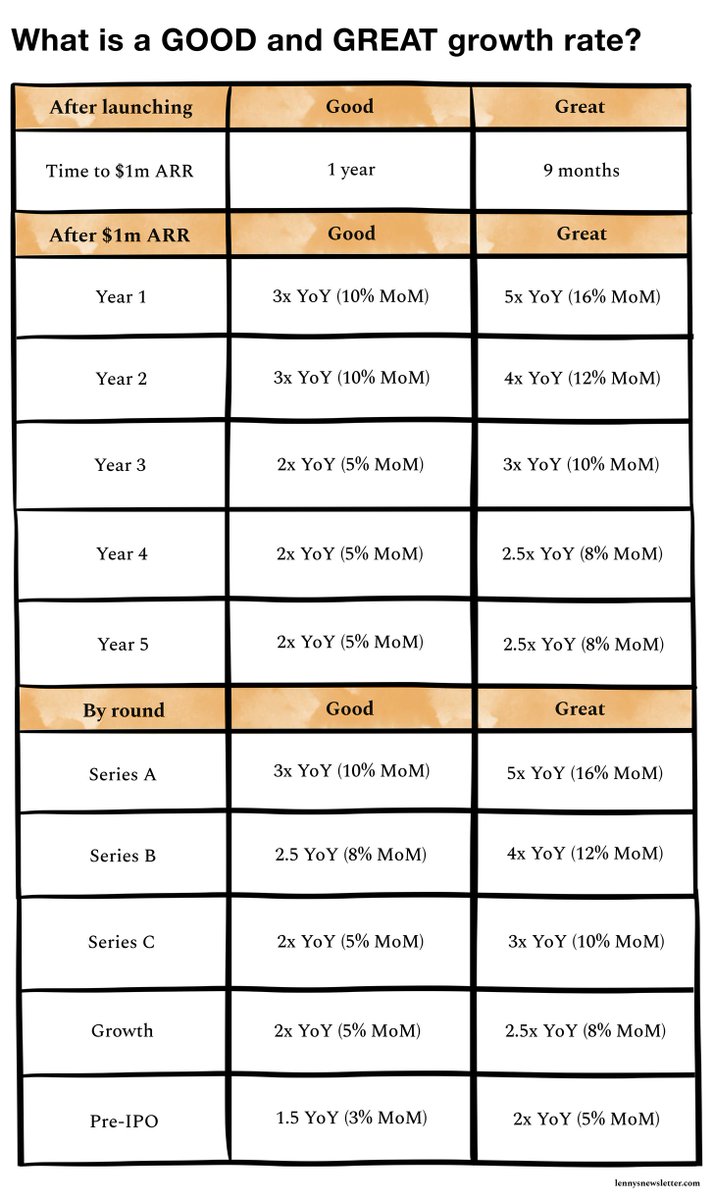

2/ Instead, for early-stage B2B businesses, investors focus on how quickly they ramp to $1m ARR after going live

"In the early stages it’s mostly about time from launch to your current ARR. If you grew to $500k ARR in 3mo post-launch, that’s more impressive than $1m in 24mo...

"In the early stages it’s mostly about time from launch to your current ARR. If you grew to $500k ARR in 3mo post-launch, that’s more impressive than $1m in 24mo...

...post-launch. Generally, 0 to $1m ARR in 12mo or shorter is great. There are obvious exceptions to this—not every company’s success can be measured in ARR since launch (Figma, OSS, etc.).” — @absoluttig

"Velocity is everything post-launch. As the company matures, it’s less about convincing investors to dream the dream and more about proving the dream is real, executable, and monetizable.” — @gracewenge

Broadly, the expectation is that getting to $1m ARR within a year of launch is GOOD, and getting there in three quarters (9 months) is GREAT.

As @sandhya said, "You start the growth clock the month you go GA."

As @sandhya said, "You start the growth clock the month you go GA."

For this reason, you want to be strategic about when you launch:

"The great irony is that once you start having numbers, investors start to really care what those numbers are.” — @caitlinbolnick1

"The great irony is that once you start having numbers, investors start to really care what those numbers are.” — @caitlinbolnick1

However, a couple of investors specifically said that they don’t care about how long it takes you to get going, as long as when you do get going, it really gets going:

“We’re less concerned about ramp to $1mm of ARR, or growth rates every year after launch. Some of our...

“We’re less concerned about ramp to $1mm of ARR, or growth rates every year after launch. Some of our...

"...winners took several years to really get going and find strong PMF. But once they do, we want them to take off. In other words, if a business grew revenues from $500k > $5mm this year, I wouldn’t care whether it was launched 1 or 5 years ago."

3/ If you don’t have strong immediate ARR growth, you can show success in other ways

Without fast ARR growth, you’ll need to show strong signals that people really want your product—through high retention and efficiency.

Without fast ARR growth, you’ll need to show strong signals that people really want your product—through high retention and efficiency.

"Revenue growth is really an output for what else is happening in the business—basically how much customers love the product and how efficient it is to get more of them. Cohorted revenue retention and/or purchase behavior (ideally U-shaped cohorts where net revenue retention...

...goes up over a year) and marketing spend/revenue (efficiency) are the most important factors to the health and velocity of a business." — @rebeccakaden

And in the early days, it’s often a trap to focus too much on growth:

"It’s a huge mistake to focus on the growth number before getting retention. You can often hit the ‘great’ number at an early stage by brute force because the numbers are so small. Unfortunately,...

"It’s a huge mistake to focus on the growth number before getting retention. You can often hit the ‘great’ number at an early stage by brute force because the numbers are so small. Unfortunately,...

...that won’t translate to continued growth, and then you’ll end up in a worse place than if you’d spent longer to hit the fundamentals."

— @ellenchisa

— @ellenchisa

4. Along those same lines, for early-stage consumer businesses, it’s all about intensity of engagement, virality, and retention—not revenue

Early-stage consumer investors look for how intensely people use the product, and share the product, versus revenue growth.

Early-stage consumer investors look for how intensely people use the product, and share the product, versus revenue growth.

For example, @mvernal shared: "For consumer, I focus on engagement and retention first and foremost. >50% DAU/MAU or >50% D30 retention is excellent. If you have both of those, only then do I worry about whether you can grow it."

And @bonatsos: "For non-transactional consumer companies (i.e. consumer media), I would love to see an awesome K-factor that would lead to a distribution advantage over time. For transactional consumer companies (i.e. marketplaces or e-commerce), I’m super-eager to see if...

...they have ‘organic’ growth of 20% MoM or more, and understand if it’s sustainable. This again would lead to a distribution advantage over time."

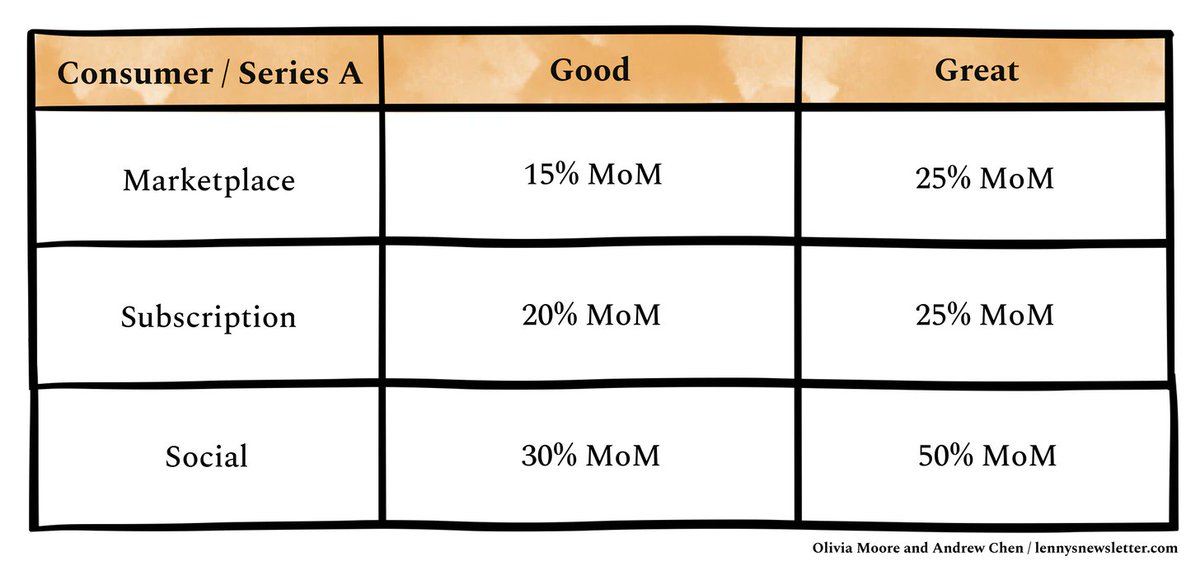

Along those lines, @omooretweets and @andrewchen generously pulled data on what growth rates they’ve been seeing recently across three categories of consumer businesses approaching Series A:

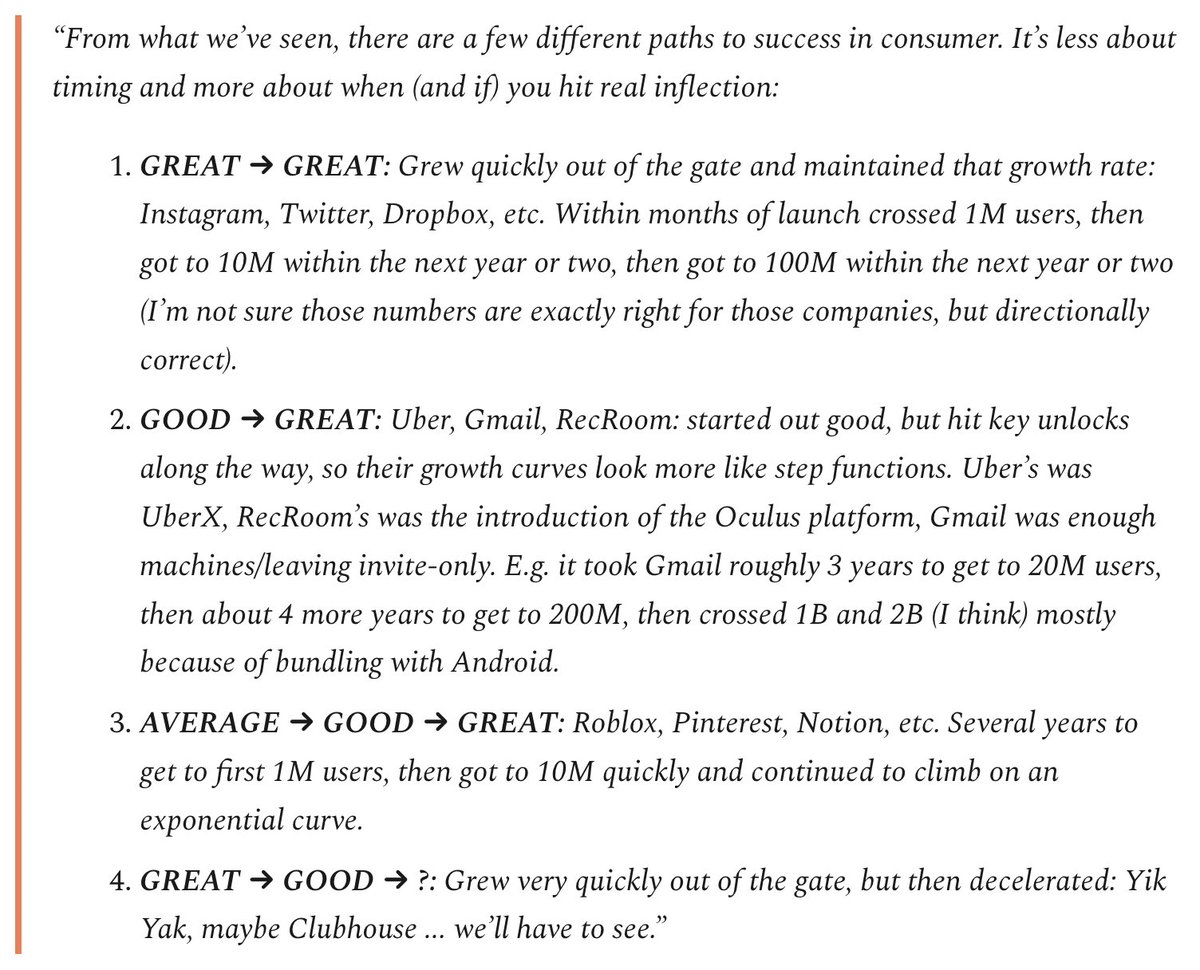

In case these benchmarks scare you, Todd Jackson (First Round) also reflected on how there’s no one way to succeed in consumer.

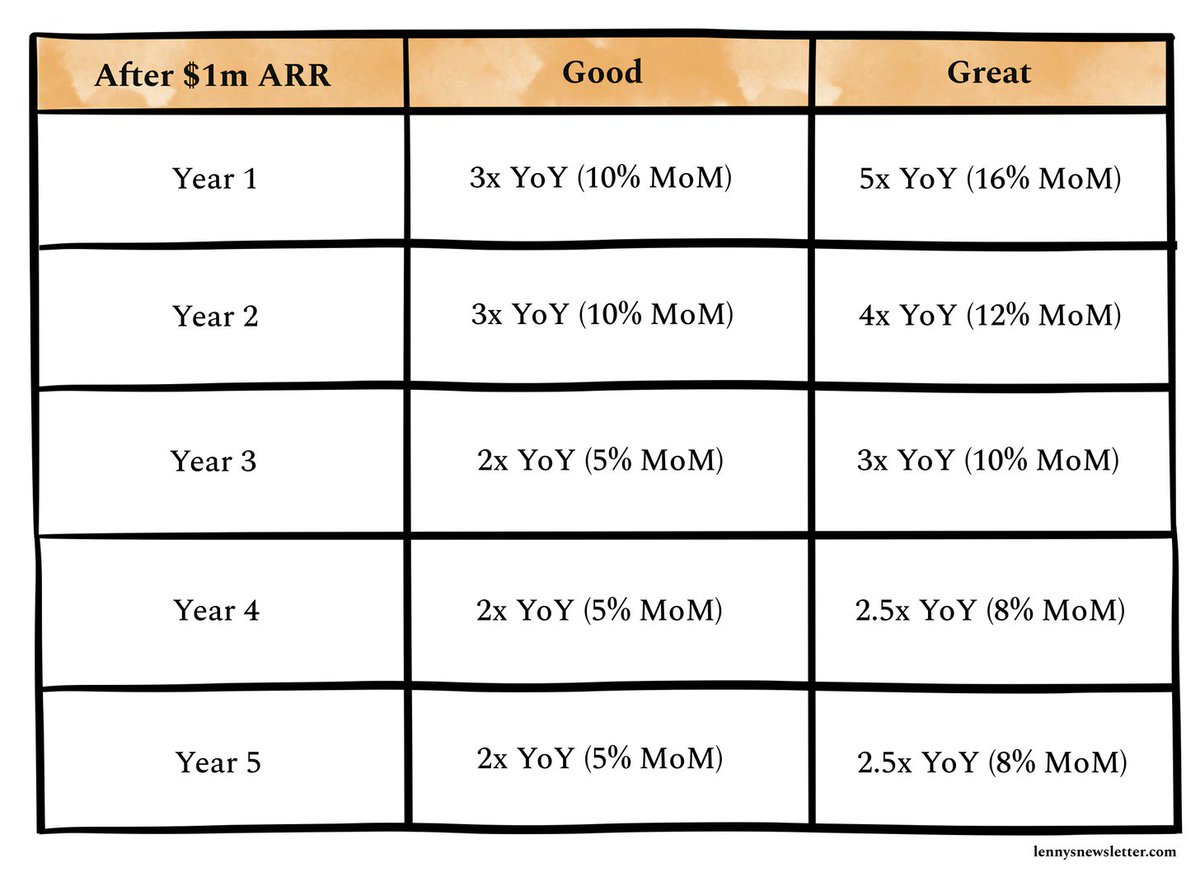

5. Once you’re off and running, expectations around growth rate from B2B and B2C businesses are fairly standard

Though consumer social businesses have a slightly elevated bar because, as @mduboe pointed out, they’ve delayed monetization.

Although markets these days: “You and I both see companies raise at the Series A with only a few hundred K in ARR (from 0 in revenue at the seed).”

Although markets these days: “You and I both see companies raise at the Series A with only a few hundred K in ARR (from 0 in revenue at the seed).”

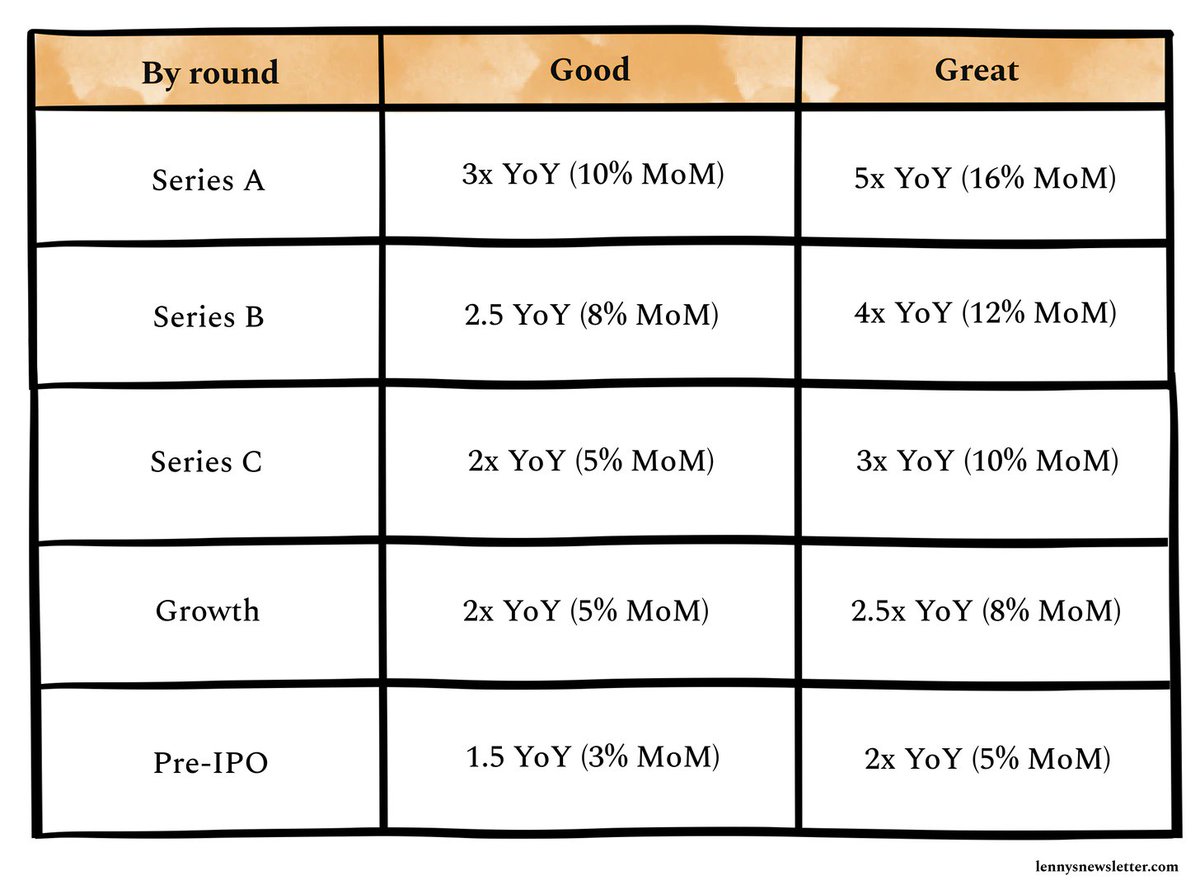

6. By funding round, expected growth rates are also fairly consistent across investors

(For reference, investors roughly equate Series A to $1-5m in revenue, Series B to $5-10m, and Series C to $10m+)

(For reference, investors roughly equate Series A to $1-5m in revenue, Series B to $5-10m, and Series C to $10m+)

These benchmarks apply to B2B, B2C, and even GMV businesses (e.g. marketplaces), with an important caveat:

"What is key for GMV businesses is that both GMV and take rate are growing at healthy rates. Strong GMV growth signifies healthy product-market fit...

"What is key for GMV businesses is that both GMV and take rate are growing at healthy rates. Strong GMV growth signifies healthy product-market fit...

… (commonly a leading indicator), and a strong take rate signifies a willingness for the customer to pay for the platform." — @jpgg

Remember: All these benchmarks are just rules of thumb. Every investor mentioned that growth rates are just one piece of the puzzle when they evaluate a business.

If you do hit these benchmarks, at any stage of the process, you’ll have investors beating down your door.

If you do hit these benchmarks, at any stage of the process, you’ll have investors beating down your door.

But, as @caitlinbolnick1 so eloquently put it, "If it’s a hot category or space, oftentimes all these fundamentals go right out the window."

Don& #39;t miss the full post for more  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger"> https://www.lennysnewsletter.com/p/what-is-a-good-growth-rate?s=w">https://www.lennysnewsletter.com/p/what-is...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger"> https://www.lennysnewsletter.com/p/what-is-a-good-growth-rate?s=w">https://www.lennysnewsletter.com/p/what-is...

HUGE  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gevouwen handen" aria-label="Emoji: Gevouwen handen"> to @absoluttig @andrewchen @ArraMalek @arshammem @ataussig @bonatsos @caitlinbolnick1 @daniel_levine @eladgil @ellenchisa @gracewenge @grante23 @jpgg @km @kimberlywtan @lpolovets @mduboe @mvernal @ninaachadjian @omooretweets @patrickachase @rebeccakaden @sandhya @tjack

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gevouwen handen" aria-label="Emoji: Gevouwen handen"> to @absoluttig @andrewchen @ArraMalek @arshammem @ataussig @bonatsos @caitlinbolnick1 @daniel_levine @eladgil @ellenchisa @gracewenge @grante23 @jpgg @km @kimberlywtan @lpolovets @mduboe @mvernal @ninaachadjian @omooretweets @patrickachase @rebeccakaden @sandhya @tjack

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" title="I asked 25 of the smartest investors I know what they consider GOOD and GREAT growth rates by company stage. Here’s what I learned https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" title="I asked 25 of the smartest investors I know what they consider GOOD and GREAT growth rates by company stage. Here’s what I learned https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>