Mitigating #ClimateChange is as much about taking up new techs as about leaving others behind

Most studies focus on #coal& #39;s global downfall but another #energy tech decline is looming

Read my new paper on #nuclear w/ @JochenMarkard et alia https://doi.org/10.1016/j.erss.2020.101512

THREADhttps://doi.org/10.1016/j... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

Most studies focus on #coal& #39;s global downfall but another #energy tech decline is looming

Read my new paper on #nuclear w/ @JochenMarkard et alia https://doi.org/10.1016/j.erss.2020.101512

THREAD

This paper& #39;s goal is to: (1) investigate if #nuclear power is a tech in decline or not by (2) studying several indicators of decline from a technology #innovation system perspective

We don& #39;t know yet *how to know* if one technology is in decline - this paper addresses this gap/1

We don& #39;t know yet *how to know* if one technology is in decline - this paper addresses this gap/1

Learning if #nuclear is in decline is crucial because it would limit the range of tech options to combat #ClimateChange

Whether you think that is for the better or for the worse, a global nuclear decline would fundamentally reshape viable pathways to #energy decarbonization/2

Whether you think that is for the better or for the worse, a global nuclear decline would fundamentally reshape viable pathways to #energy decarbonization/2

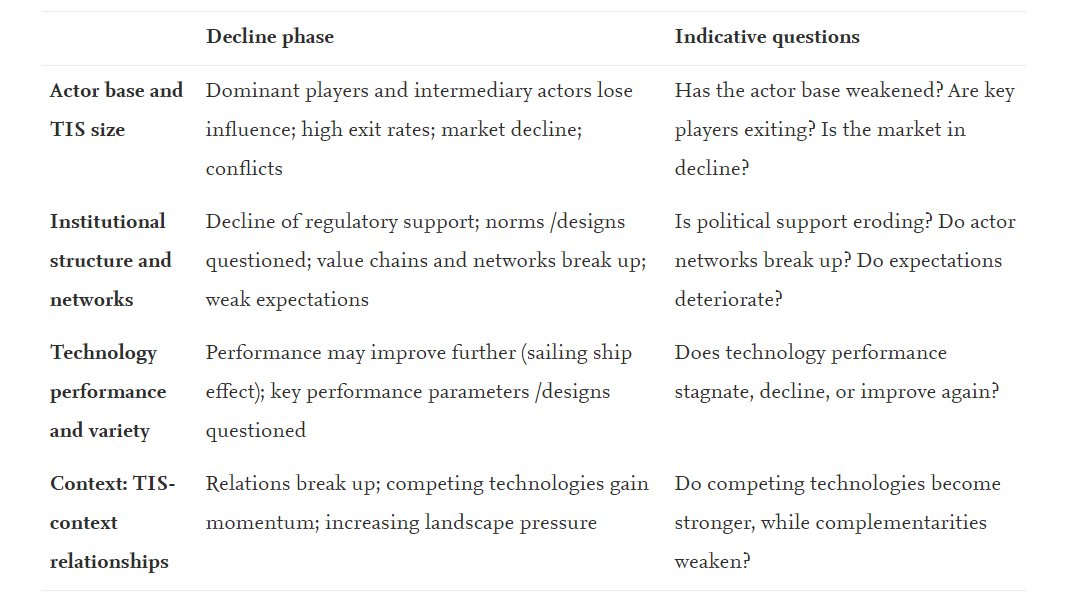

Socio-technical systems are complex beasts. That& #39;s why assessing if STSs are in decline isn& #39;t straightforward: looking at prices & sales volumes isn& #39;t enough.

We investigated 4 dimensions of technology innovation systems through the #nuclear industry lifetime across the globe./3

We investigated 4 dimensions of technology innovation systems through the #nuclear industry lifetime across the globe./3

SIDENOTE: Don& #39;t get confused by its name. The Technology Innovation System framework is a way of looking at socio-technical systems built around one tech. It& #39;s helpful for the early stages of a tech but also when it matures. See @JochenMarkard paper  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">/4 https://doi.org/10.1016/j.techfore.2018.07.045">https://doi.org/10.1016/j...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">/4 https://doi.org/10.1016/j.techfore.2018.07.045">https://doi.org/10.1016/j...

Before going into results, we limit our scope to (stationary) #nuclear reactor design & construction (D&C) for civil power generation.

We acknowledge the relevance of the fuel, waste, and dismantling segments - as well as military uses - but consider D&C the industry& #39;s core./5

We acknowledge the relevance of the fuel, waste, and dismantling segments - as well as military uses - but consider D&C the industry& #39;s core./5

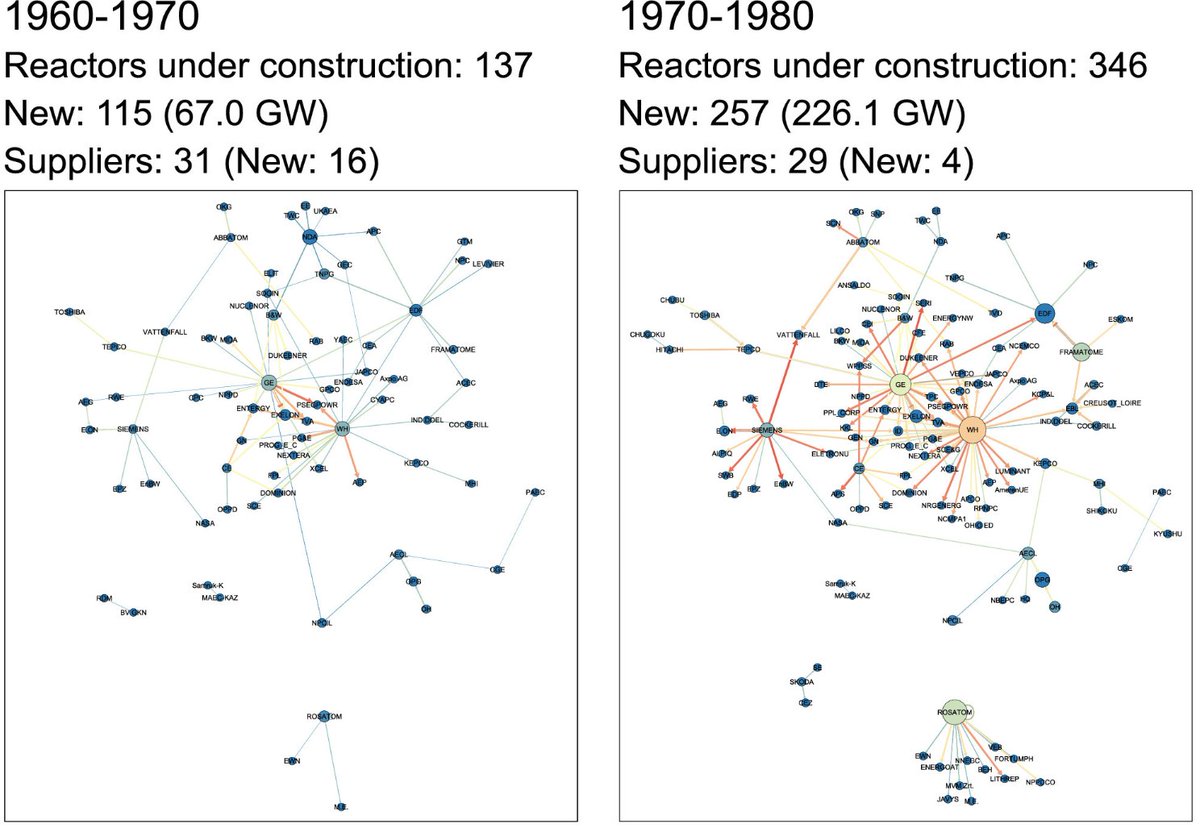

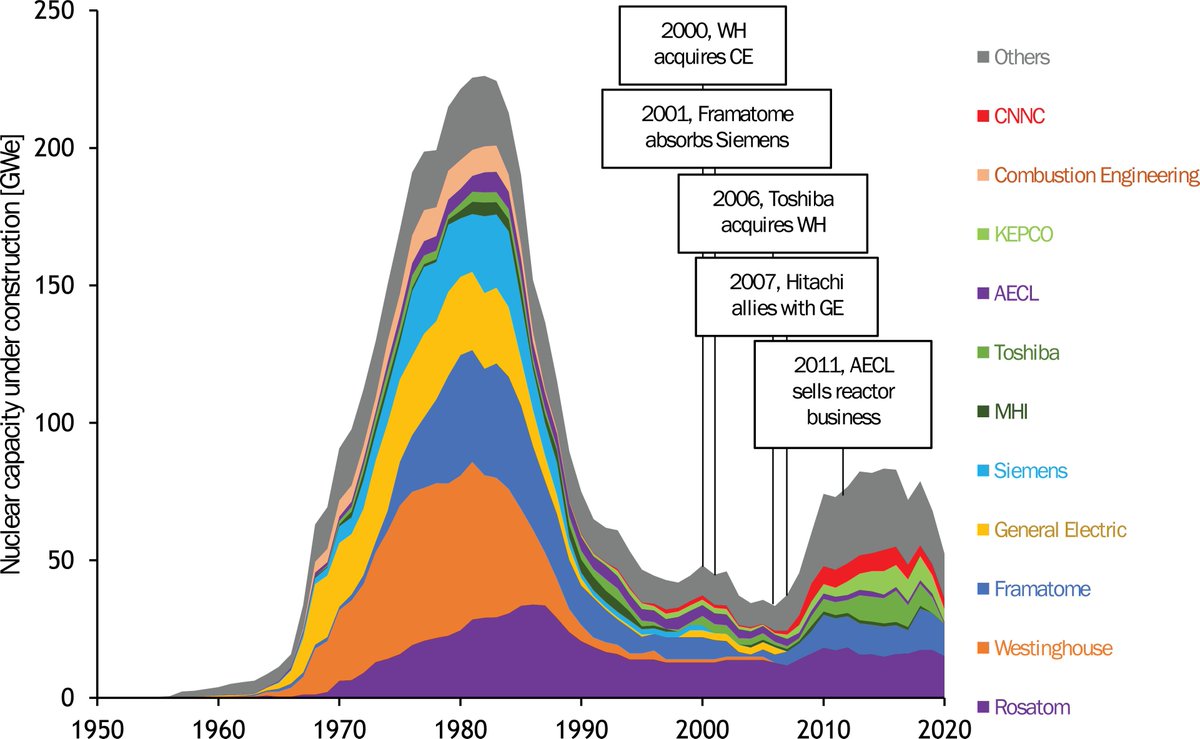

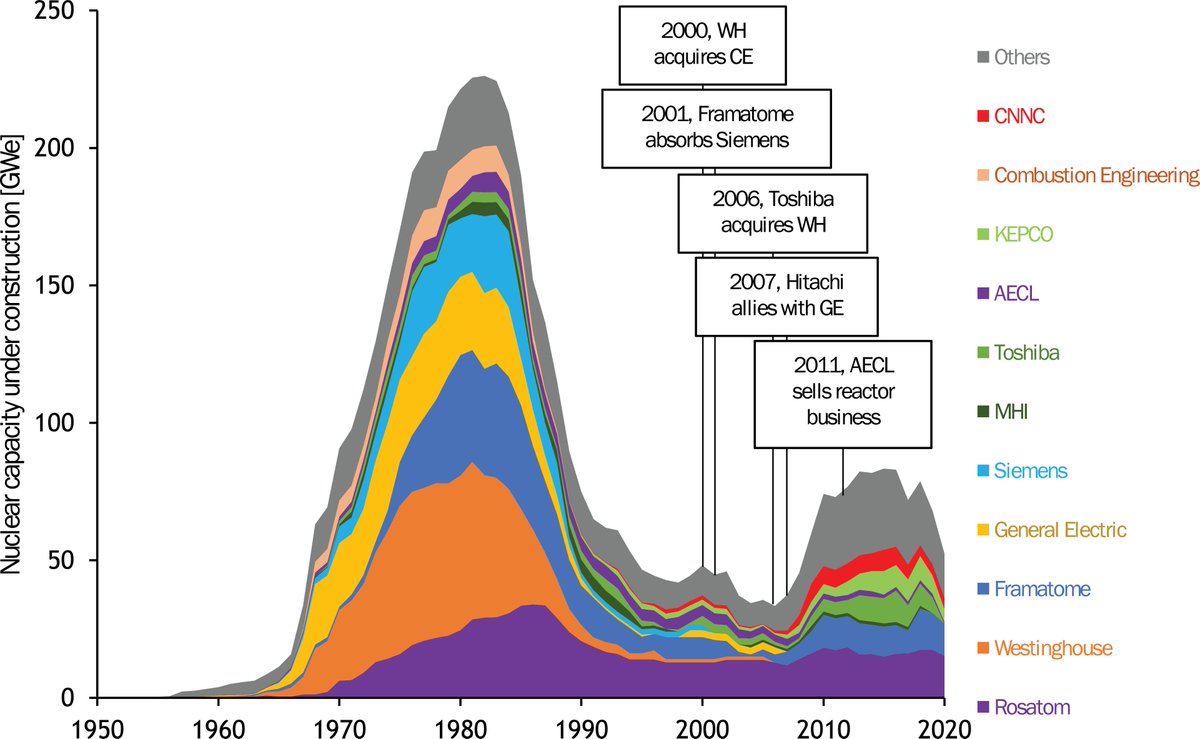

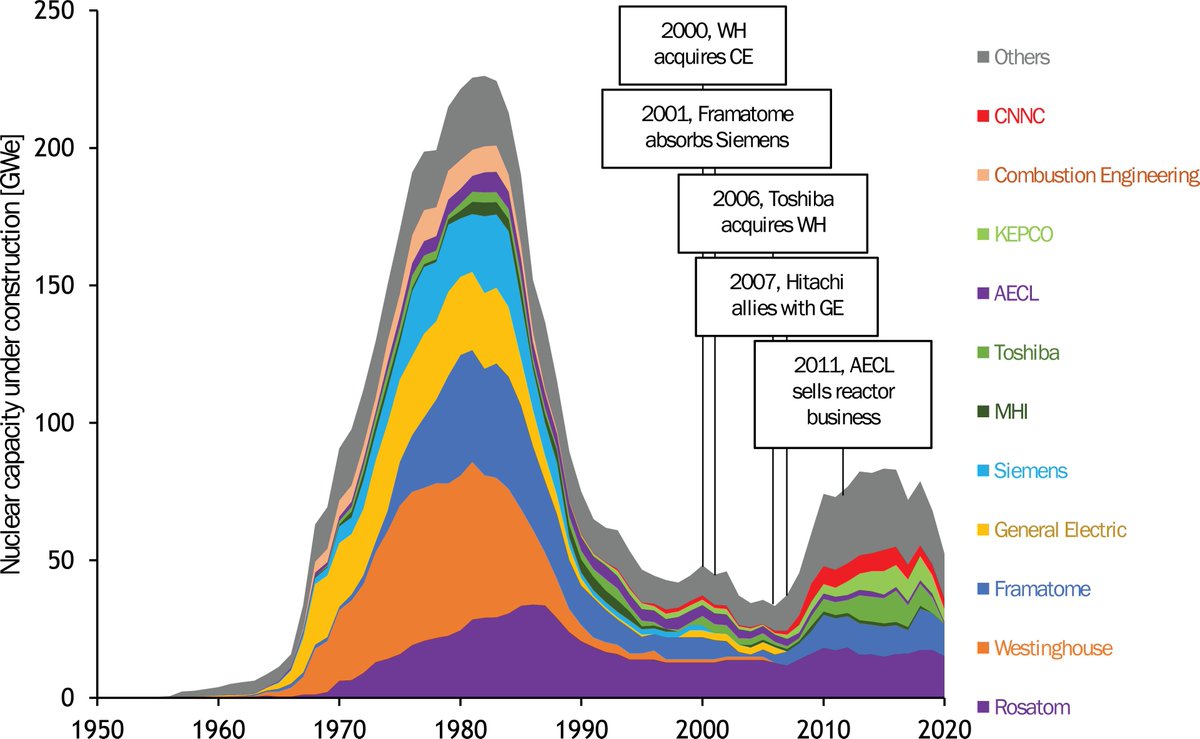

(1) The #nuclear reactor D&C has always been a highly concentrated business. Since the 1960s, 11 firms have delivered over 70% of the nuclear power capacity installed worldwide. Although those at the helm of the industry have shifted over time./6

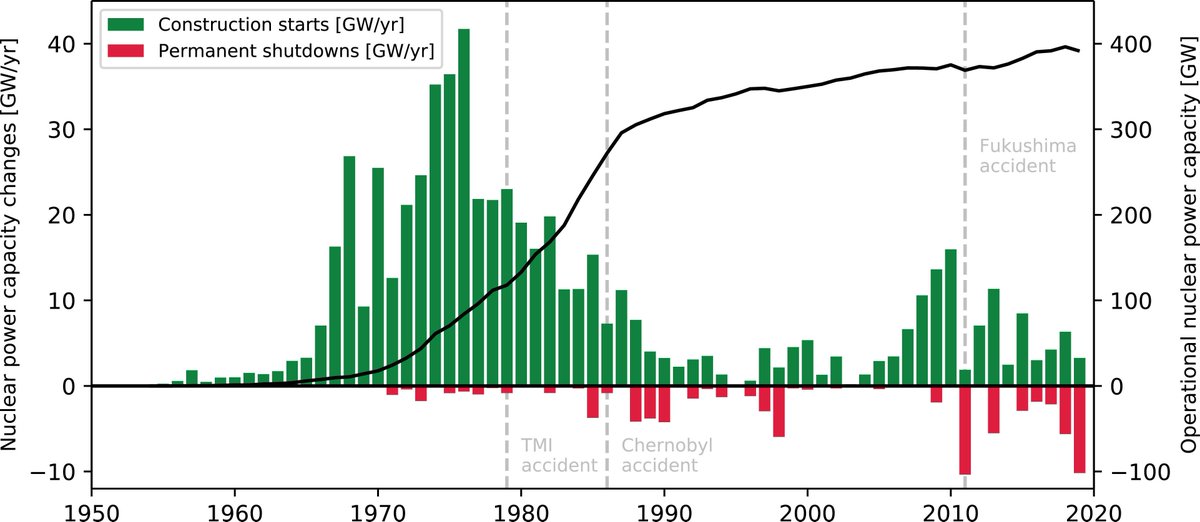

After the booming expansion of the 60s-70s, #nuclear constructions fell drastically. Despite showing remarkable resiliency, many of the principal reactor suppliers of that initial growth wave exited the D&C business./7

FOOTNOTE: against common knowledge, the woes of the #nuclear industry that ended its initial growth pre-date major accidents in TMI and Chernobyl. The 1988 book "Collapse of an industry" by Campbell explores the complex interplay of factors curbing the industry growth in the US/8

The uptick in #nuclear constructions of the late 2000s had a very different cast of actors. It was headed by state-owned firms from Russia, France, South Korea, and China, followed by Japanese Hitachi and Toshiba. Private, North-American firms & Siemens played no part in it./9

Overall, we observe (a) consolidation & exit of private firms, (b) survival & entry of state-owned enterprises, (c) a general shift from Western to Eastern actors.

Many new entrants (e.g. working on small modular #nuclear reactors) don& #39;t appear because no constructions yet./10

Many new entrants (e.g. working on small modular #nuclear reactors) don& #39;t appear because no constructions yet./10

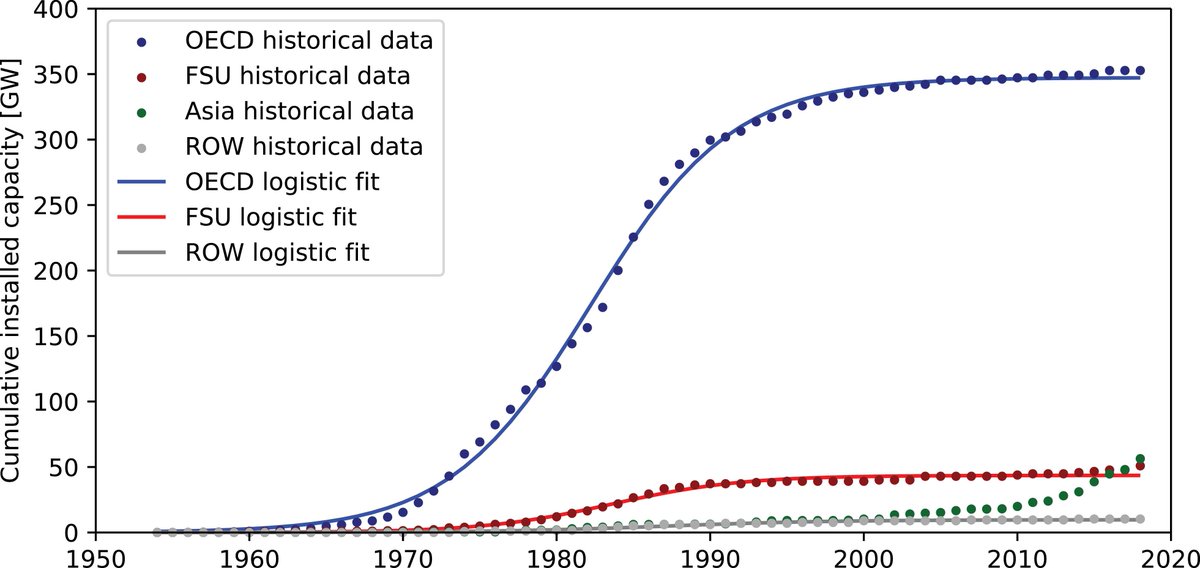

(2) #Nuclear market size and diffusion: After initial rapid expansion, the diffusion of nuclear power stagnated in OECD countries and the Former Soviet Union area, signalling decline.

Not so in Asia, where diffusion might continue to grow if it avoids the fate of the FSU area/11

Not so in Asia, where diffusion might continue to grow if it avoids the fate of the FSU area/11

(3) Regulatory and political support: #Nuclear power use is a highly contested political issue - as we know well in #EnergyTwitter.

Cold numbers paint a mixed picture. Since 1970, 18 jurisdictions have started using #Nuclear, while 10 have exited it./12

Cold numbers paint a mixed picture. Since 1970, 18 jurisdictions have started using #Nuclear, while 10 have exited it./12

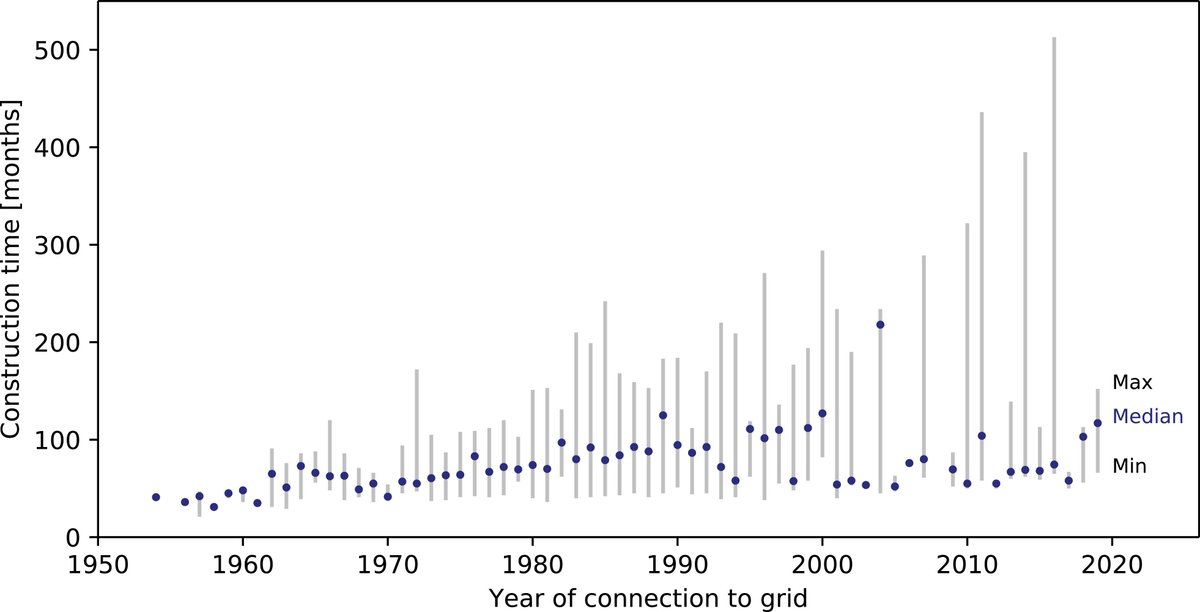

(NOT IN THE PAPER) The decline in RD&D budgets for #nuclear fission - only in OECD countries - provides a stronger suggestion that political support is weakening for #nuclear power [with the potential exception of the US]./13

(4) The network of #nuclear D&C customer-suppliers: During the 60s-70s, the largest US firms in #nuclear - GE & WH - built a dense and far-reaching network w/ customers all around the globe. The antecessors of today& #39;s ROSATOM grew leveraging the URSS& #39;s power on its satellites/14

After the 1980s, the loss of the top US firms as active nuclear D&C suppliers left a fragmented and loosely connected network. A few big players supply only to a handful of customers, often in their home markets, in one clear sign of #nuclear& #39;s decline on a global stage./15

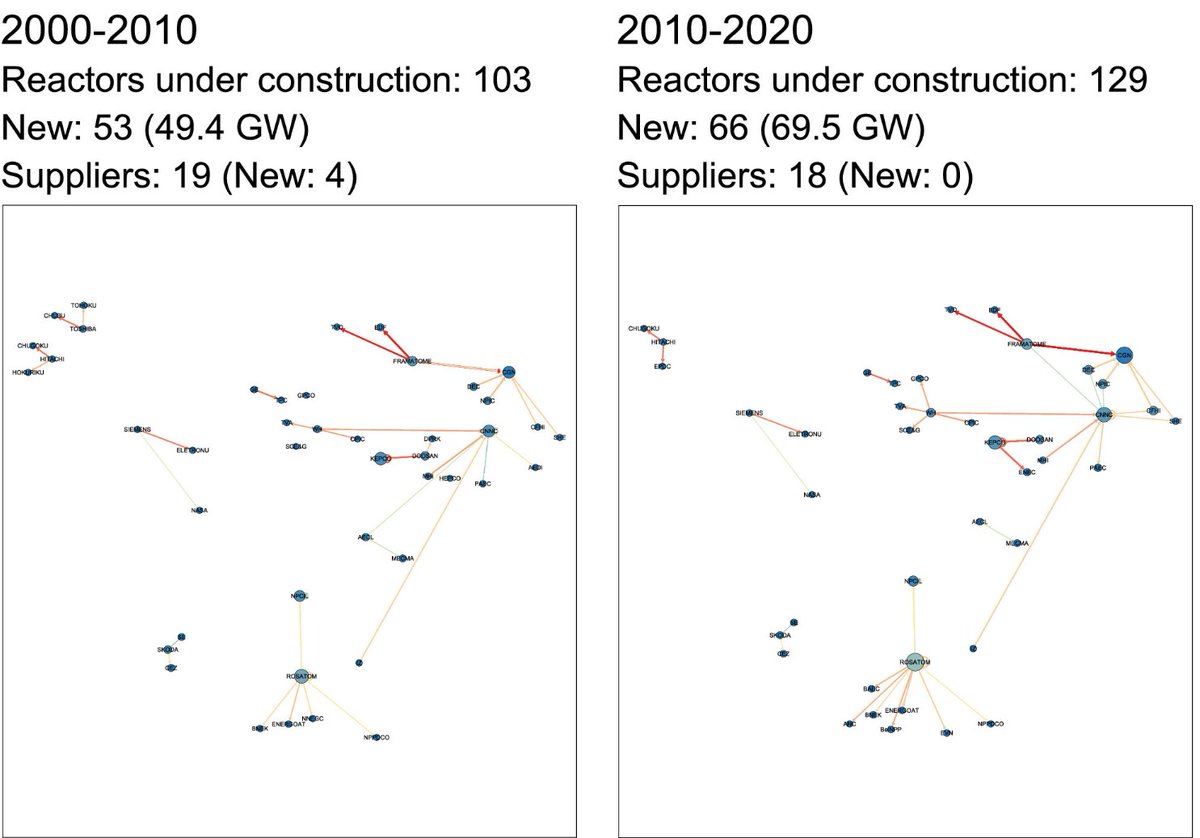

(5) Expectations: For decades, the @IEA and the @iaeaorg have published outlooks for the share of electricity that #nuclear would provide to the world by 2020 & 2030.

After improving hopes in the early 2000s, both have regularly decreased their projections every year since./16

After improving hopes in the early 2000s, both have regularly decreased their projections every year since./16

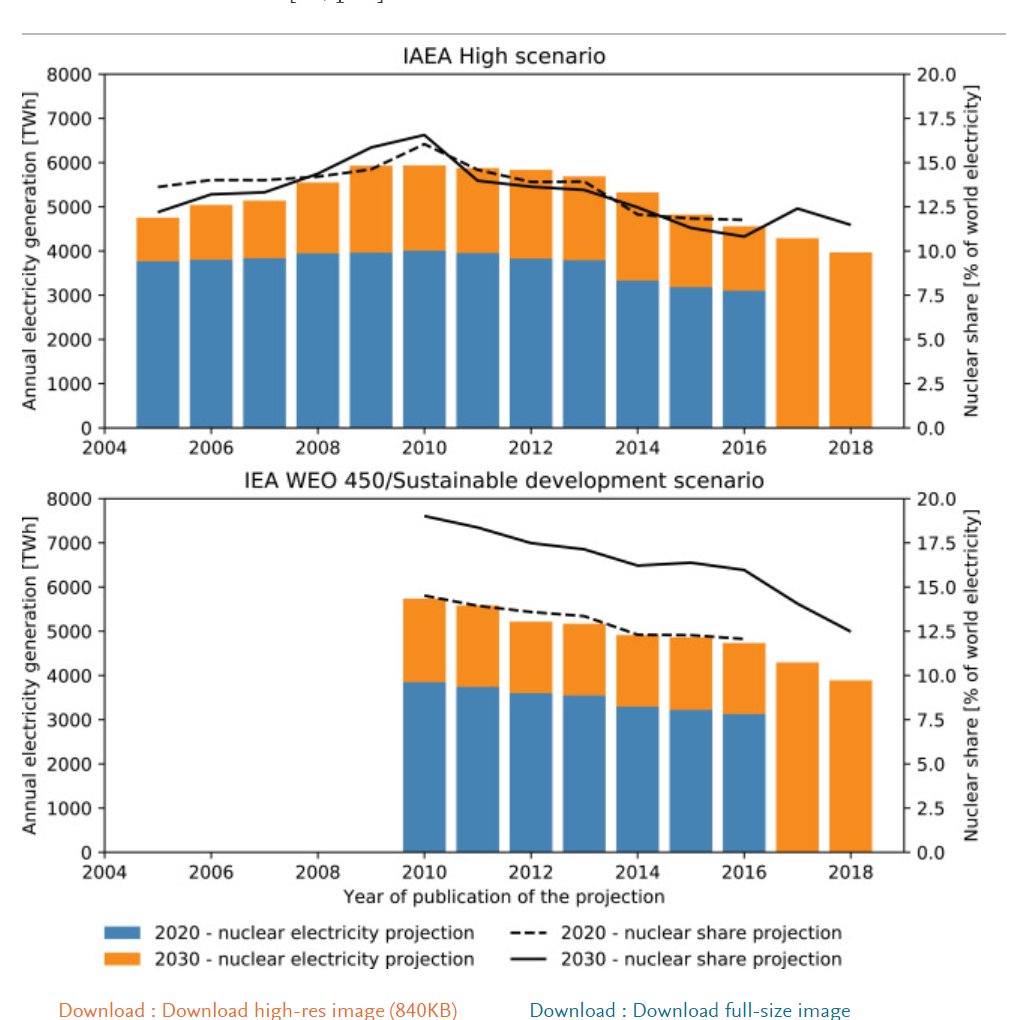

(6) Costs & construction times: Others have written extensively on the ups-and-downs of #nuclear costs (see @J_Lovering or @jgkoomey)

For us, #nuclear construction times, whose median has shortened but dispersion has massively increased, sums the noisy signal on costs too/17

For us, #nuclear construction times, whose median has shortened but dispersion has massively increased, sums the noisy signal on costs too/17

As it happens with costs, #nuclear construction times point to divergent trends around the globe: while in some regions there are projects finishing on time & on budget, others suffer long delays and cost overruns. Decline processes, if present, are not uniformly spread./18

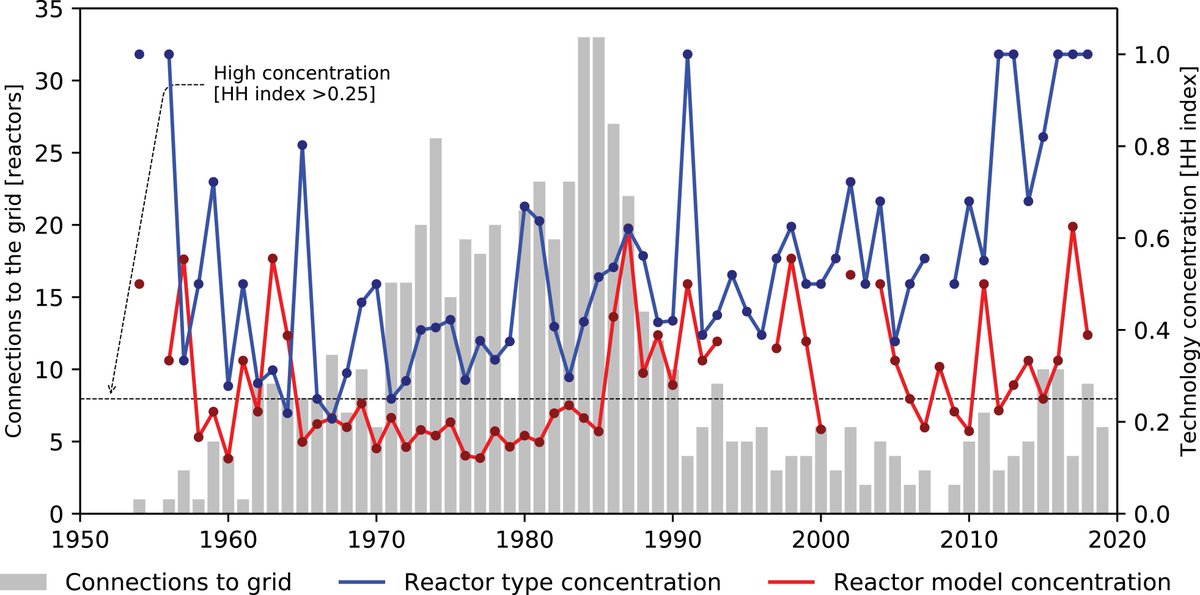

(7) Technology variation: Decreasing variety is a well-known sign of tech maturity. #Nuclear power has mostly converged into a single type of reactor (PWR). Reactor models, after an increase in diversity ~2010, seems to be concentrating again around a few ones./19

Concentration around few #nuclear reactor types and models is not, per se, a signal of decline. But if decline mechanisms in some regions are linked to tech characteristics, low diversity could hinder escaping a downward path./20

(8) Wider context: Liberalization of #electricity markets and accidents had negative effects on the industry; the effects of climate change and demand growth are mixed, and geopolitical considerations have positively affected #nuclear power./21

Most pressing element, competition/complementarity w/ #renewables can

1) Accelerate #nuclear decline - falling RE and storage costs lower new nuclear attractiveness

2) Revert decline - #nuclear as a complement of RE to achieve deep decarbonization

(1) seems to be stronger/22

1) Accelerate #nuclear decline - falling RE and storage costs lower new nuclear attractiveness

2) Revert decline - #nuclear as a complement of RE to achieve deep decarbonization

(1) seems to be stronger/22

CONCLUSION: the overall picture is negative. Based on a variety of indicators, we suggest that #nuclear is indeed a tech in decline globally.

Does this mean that the nuclear TIS is on its deathbed? Absolutely not./23

Does this mean that the nuclear TIS is on its deathbed? Absolutely not./23

Even if no or very few new #nuclear power plants were to be built in the future, it is very likely that existing ones will continue to operate for many years. And they will need dismantling later on.

Moreover, there are strong “state niches” such as Russia, China and France. /24

Moreover, there are strong “state niches” such as Russia, China and France. /24

#Nuclear decline has major implications for the ongoing #energy transition. It will make more difficult to count on #Nuclear as an option to decarbonize energy systems but it could open up opportunities for more decentralized power grids./fin

Thanks for reading! If you have arrived at the end, then you are interested enough in having a look at the whole paper!

Let me know if you hit a paywall!

"Destined for decline? Examining nuclear energy from a technological innovation systems perspective"

https://doi.org/10.1016/j.erss.2020.101512">https://doi.org/10.1016/j...

Let me know if you hit a paywall!

"Destined for decline? Examining nuclear energy from a technological innovation systems perspective"

https://doi.org/10.1016/j.erss.2020.101512">https://doi.org/10.1016/j...

Read on Twitter

Read on Twitter

![(NOT IN THE PAPER) The decline in RD&D budgets for #nuclear fission - only in OECD countries - provides a stronger suggestion that political support is weakening for #nuclear power [with the potential exception of the US]./13 (NOT IN THE PAPER) The decline in RD&D budgets for #nuclear fission - only in OECD countries - provides a stronger suggestion that political support is weakening for #nuclear power [with the potential exception of the US]./13](https://pbs.twimg.com/media/EWW_zm0XYAMZY9g.jpg)