Since we all had such fun with GDP math this week, why don& #39;t we close it out with a quick thread on how today& #39;s monthly spending numbers set us up heading into Q4.

https://www.bea.gov/news/2020/personal-income-and-outlays-september-2020">https://www.bea.gov/news/2020...

https://www.bea.gov/news/2020/personal-income-and-outlays-september-2020">https://www.bea.gov/news/2020...

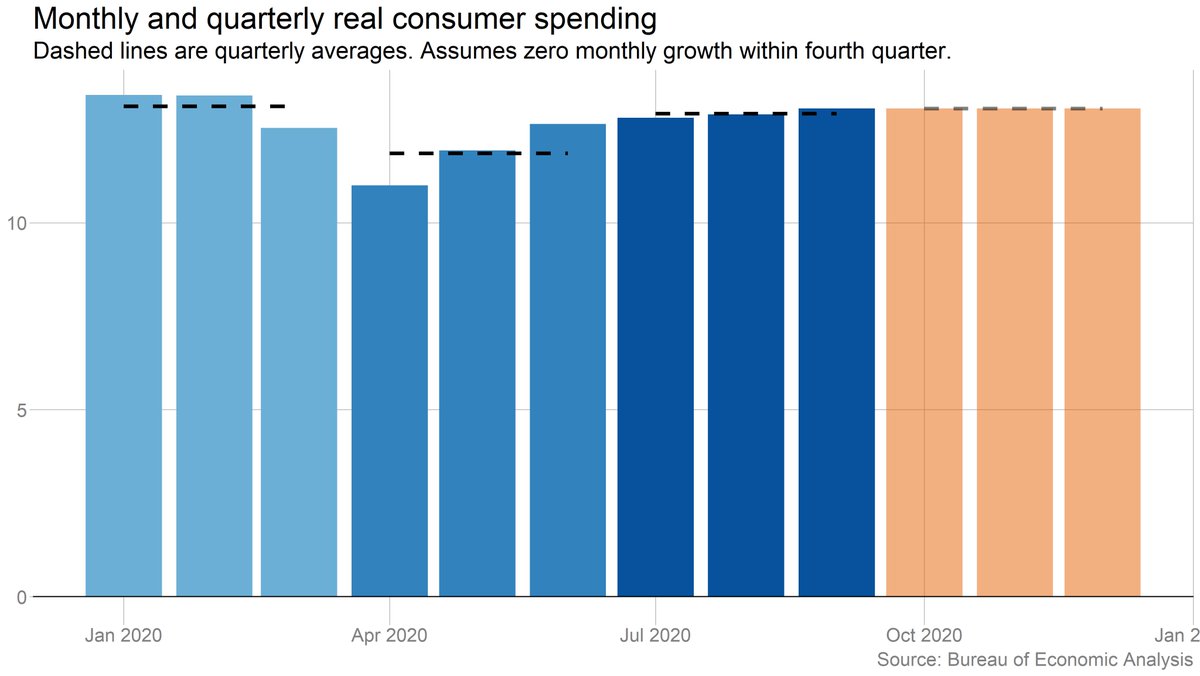

As a reminder, GDP is based on quarterly averages. That means that when there are big month-to-month moves within a quarter, it can lead to some funny quarterly results.

I ran through the math on this in more detail here: https://twitter.com/bencasselman/status/1321164732745674759">https://twitter.com/bencassel...

I ran through the math on this in more detail here: https://twitter.com/bencasselman/status/1321164732745674759">https://twitter.com/bencassel...

In the third quarter, growth (in both overall GDP and consumer spending) was relatively weak month-to-month. But quarterly growth looked strong because the big gains in May and June meant the quarter had a head start.

In fact, real consumer spending would have risen 6.6% (non-annualized) in Q3 even if there had been NO monthly growth during the quarter. (We did get some growth, of course, so the actual figure was 8.9%.)

But those modest monthly growth rates in Q3 mean that Q4 doesn& #39;t have nearly as strong a jumping-off point. If we got zero monthly growth in Q4, spending would rise just 1% for the quarter.

Of course, we probably will get some monthly spending growth. But perhaps not much. @EconomicsRisk is forecasting 1.3% growth in consumer spending for the quarter (5.2% annualized), which implies < 0.25% average monthly growth during the quarter.

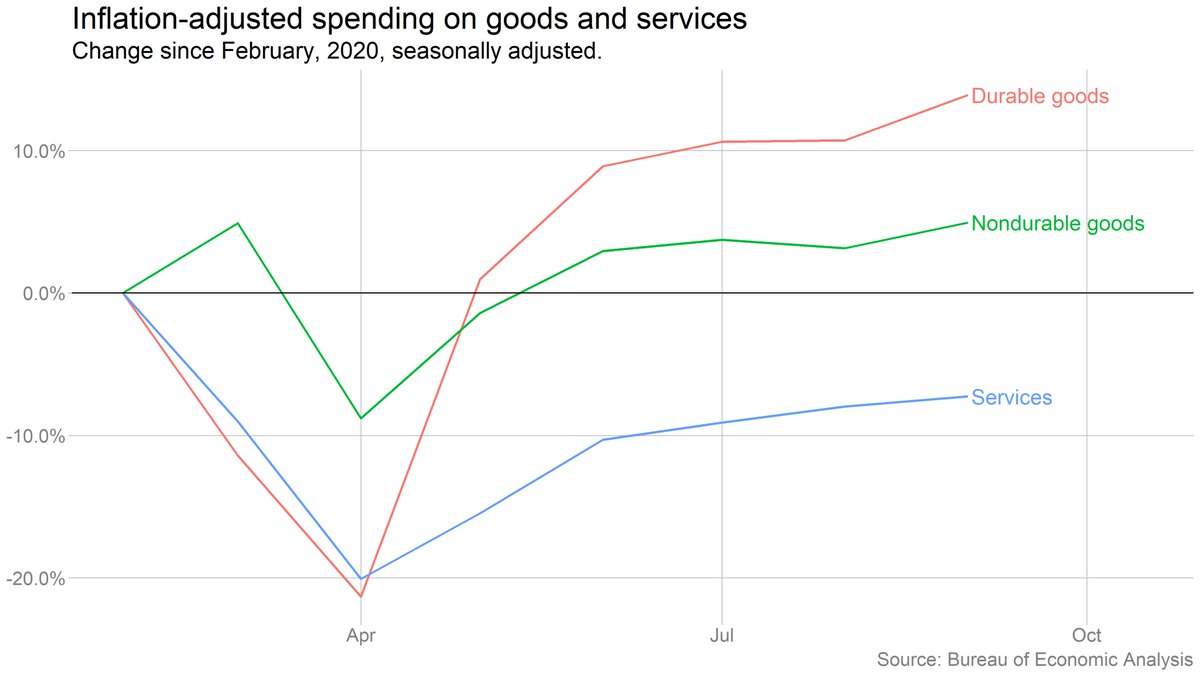

Lastly, a reminder that these aggregate spending figures obscure some enormous compositional shifts. Spending on services is still way below pre-pandemic levels and recovering only slowly. Meanwhile spending on goods (esp. durable goods) has surged.

And yes, I did forget to include the units on that monthly spending chart. It& #39;s in trillions of 2012 dollars.

Read on Twitter

Read on Twitter