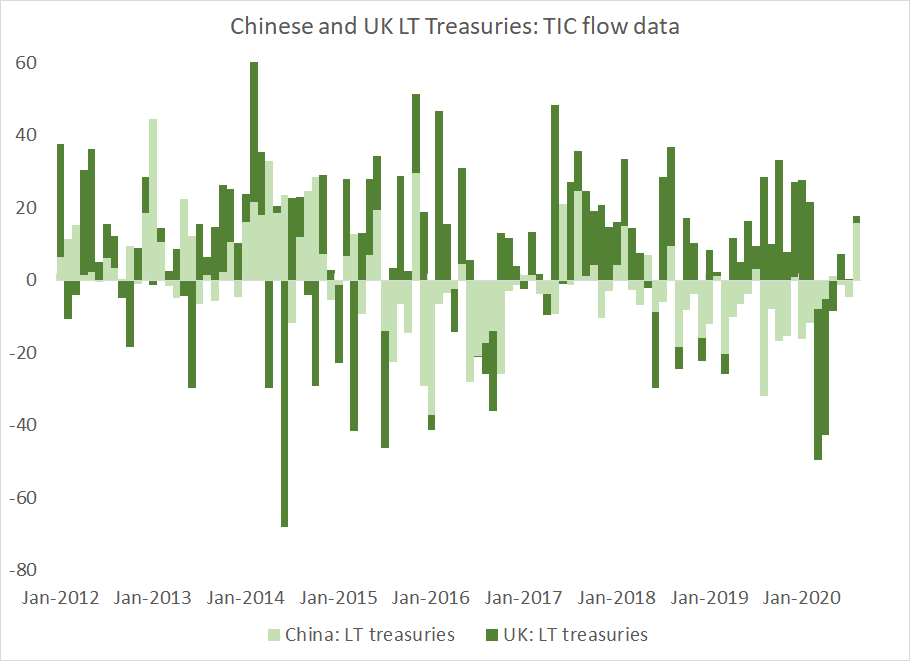

China bought Treasuries in August (TIC transactional data). It isn& #39;t actually that significant to the Treasury market: the Fed matters way more. And the size of the recorded purchases isn& #39;t huge.

But it is the first time in a while that China has shown up as "China"

1/x

But it is the first time in a while that China has shown up as "China"

1/x

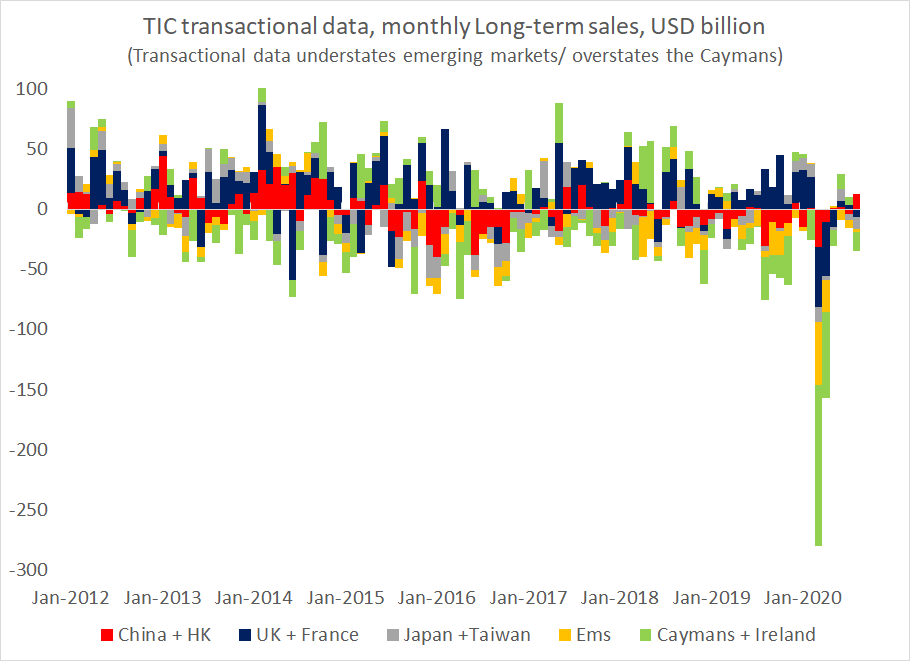

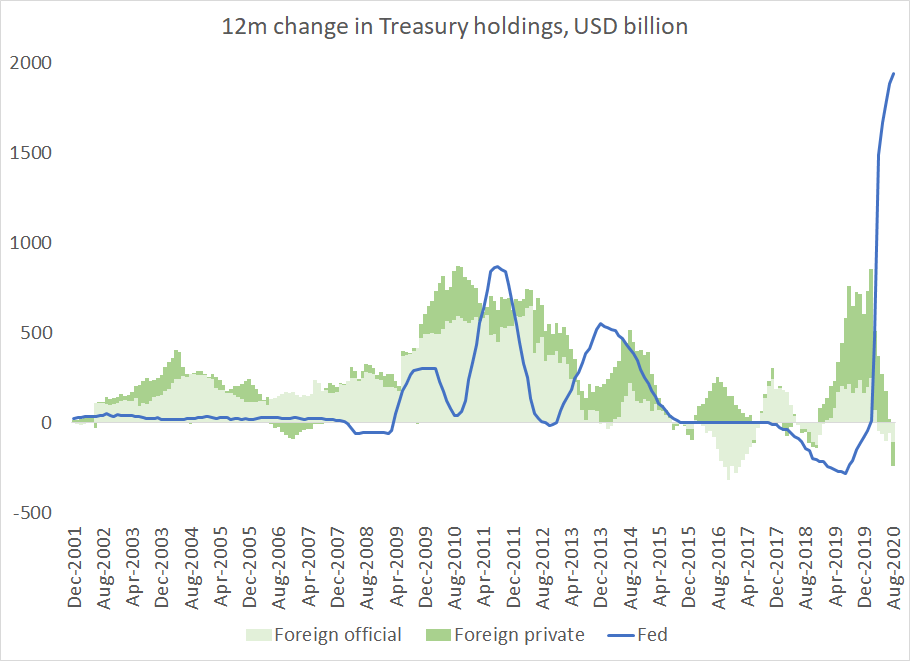

On net, the transactional data shows Treasury sales by the rest of the world (no big deal, the data isn& #39;t that accurate and the Fed is backstopping the market). China actually hasn& #39;t been central to the flows around Treasuries for a while

2/x

2/x

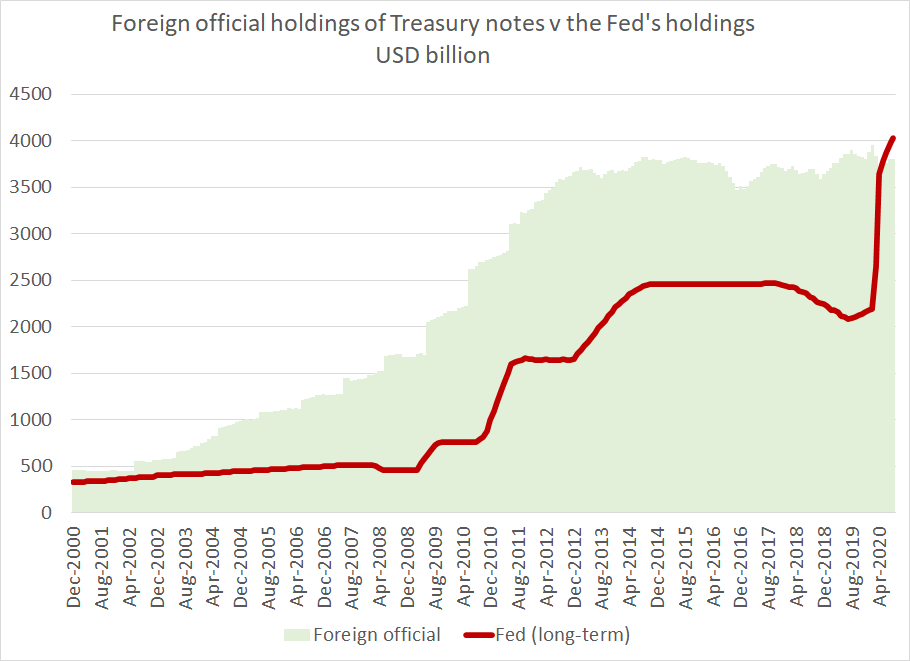

As I have noted before, the Fed now holds more long-term Treasury bonds than all the world& #39;s reserve managers combined

(at least judging from what shows up in the US data)

(at least judging from what shows up in the US data)

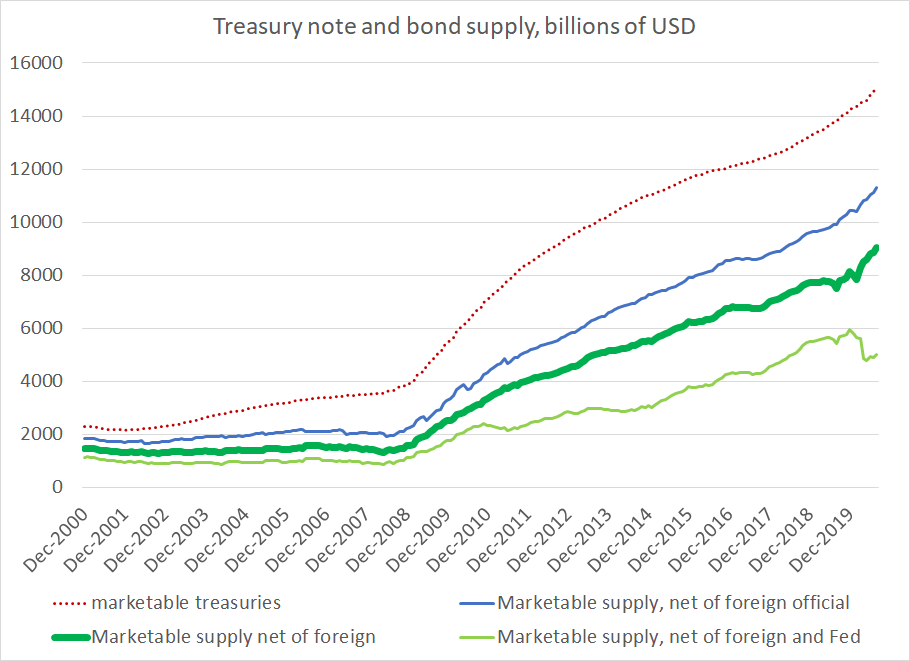

The foreign official bid did keep the supply of Treasuries in private hands from rising once upon a time -- but that was in the years before the global financial crisis, not in the years after.

Right now, the Fed, not the rest of the world is absorbing the net supply*

Right now, the Fed, not the rest of the world is absorbing the net supply*

* with the caveat that this is true over the last 12ms, not over the last 3 -- as the pace of purchases have slowed v Treasury issuance.

One last point, which is a point Robin Brooks has made. When the Fed is buying more than the Treasury is issuing, mechanically, someone has to be selling. Could be the domestic private sector or the rest of the world.*

* (of course, back in March - as Josh Younger and Randy Quarles have both I think highlighted, the scale of foreign selling together with the unwind of the basis trade was putting real pressure on the Treasury market and that in turn forced the Fed to step in)

Read on Twitter

Read on Twitter