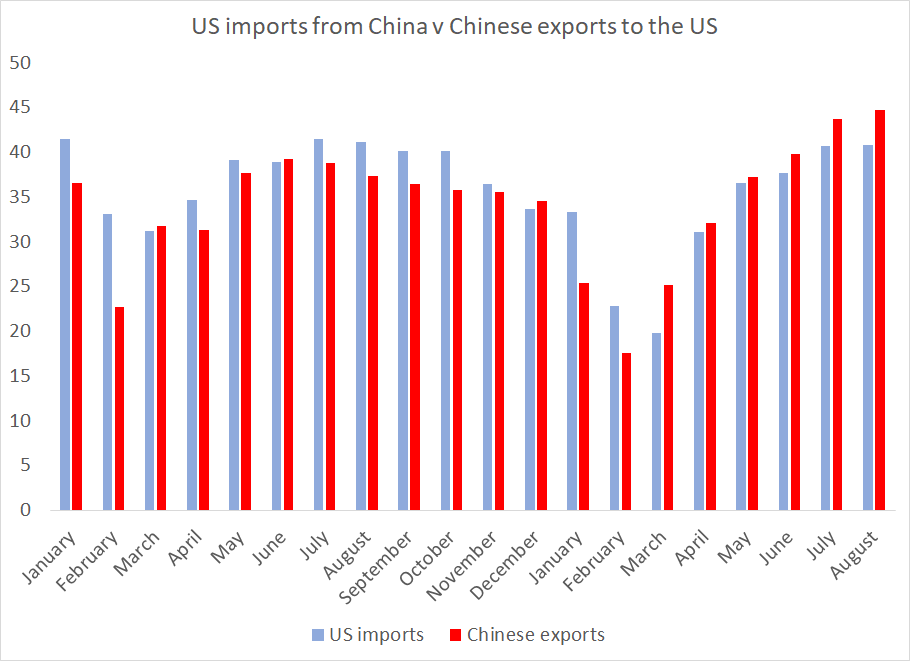

Earlier this week I wrote about the gap between the US import data from China and the Chinese data on exports to the US. In August, these Chinese data showed a 20% y/y increase in exports to the US -- while the US import data was flat

https://www.cfr.org/blog/record-chinese-bilateral-surpluses-united-states-are-not-mirrored-us-trade-data

1/x">https://www.cfr.org/blog/reco...

https://www.cfr.org/blog/record-chinese-bilateral-surpluses-united-states-are-not-mirrored-us-trade-data

1/x">https://www.cfr.org/blog/reco...

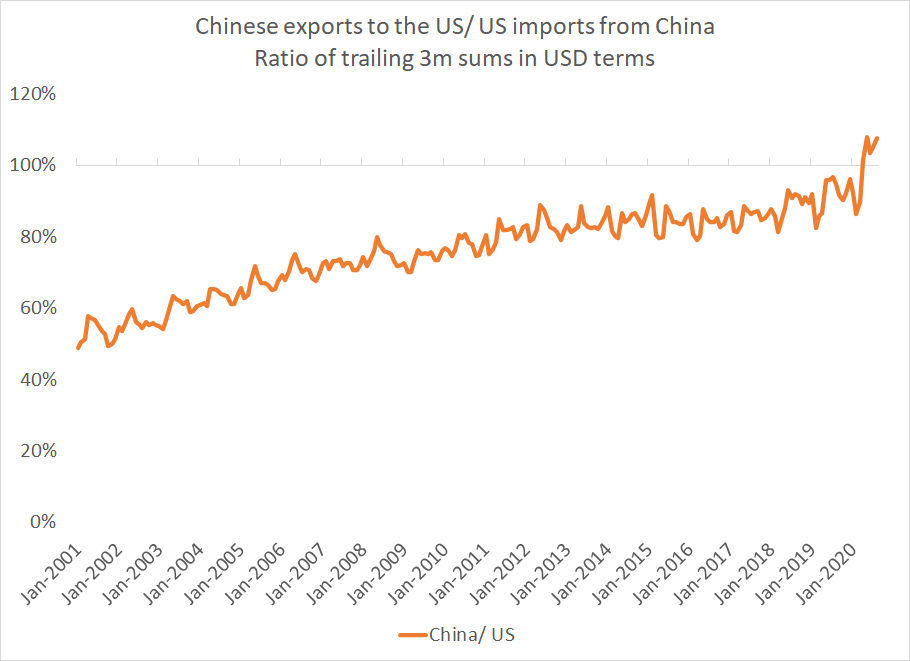

I looked at this a bit more formally by taking the ratio of China& #39;s exports to the US to US imports from China, with both as a trailing 3m sum.

Historically, China& #39;s exports are below those of the US -- and pre-trade war, they were generally ~ 85% of US imports.

2/x

Historically, China& #39;s exports are below those of the US -- and pre-trade war, they were generally ~ 85% of US imports.

2/x

Obviously that has changed -- China is now more reporting substantially more exports to the US than the US does imports, and a bigger surplus with the US than the reported US deficit with China.

What& #39;s more, the same change hasn& #39;t taken place vis a vis the EU

3/x

What& #39;s more, the same change hasn& #39;t taken place vis a vis the EU

3/x

This is a reasonably large data gap -- one that matters for assessing say the elasticity of China& #39;s trade with respect to the tariff, as well as assessing the impact of the tariff on the bilateral balance!

4/x

4/x

Two possible explanations for the discrepancy:

1) Chinese exporters are inflating their export receipts (a way of getting $ into China, it implies more inflow pressure and a smaller "true" Chinese trade surplus ...

or

5/x

1) Chinese exporters are inflating their export receipts (a way of getting $ into China, it implies more inflow pressure and a smaller "true" Chinese trade surplus ...

or

5/x

2/ US importers are understating their imports from China (and attributing imports to other locations) so as to minimize their tariff bill ...

I would bet on 2) but who knows ...

6/x

I would bet on 2) but who knows ...

6/x

in any case, the numbers on one of the biggest bilateral trade flows in the world have stopped adding up ...

something relatively big is going on. a 20 percentage point gap in the y/y data is quite unusual

7/7

something relatively big is going on. a 20 percentage point gap in the y/y data is quite unusual

7/7

Read on Twitter

Read on Twitter