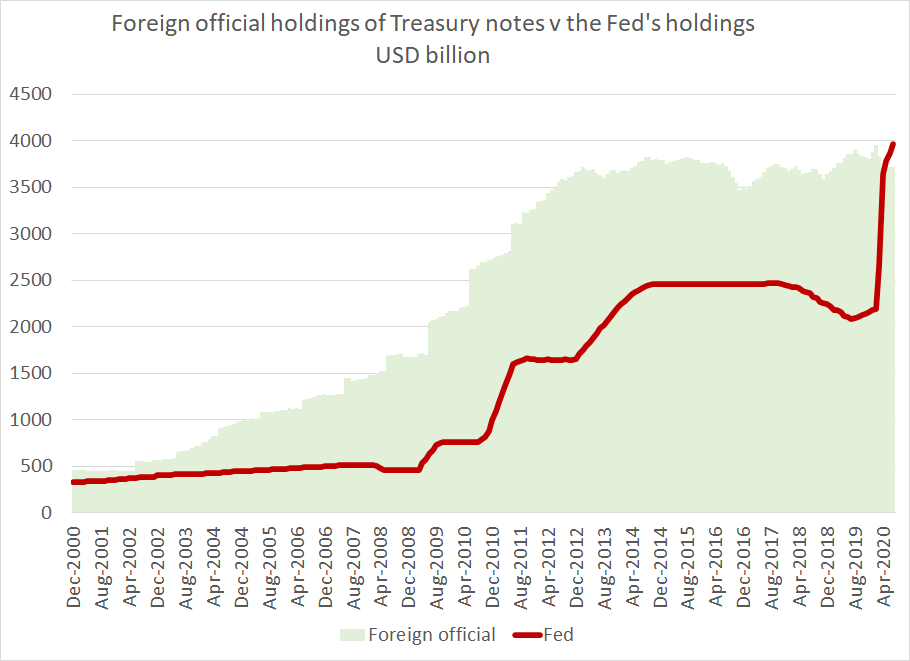

The Fed now holds more long-term Treasury bonds or notes than all the world& #39;s central banks combined.

Confirms something I been arguing for a while -- the Fed, not China or anyone else, ultimately can set US long-term rates.

1/x

Confirms something I been arguing for a while -- the Fed, not China or anyone else, ultimately can set US long-term rates.

1/x

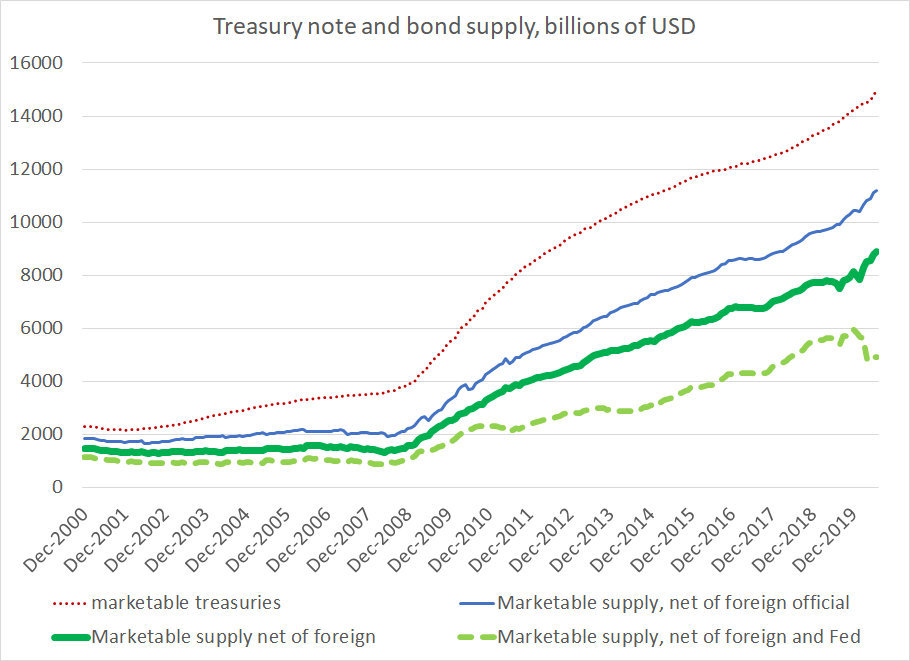

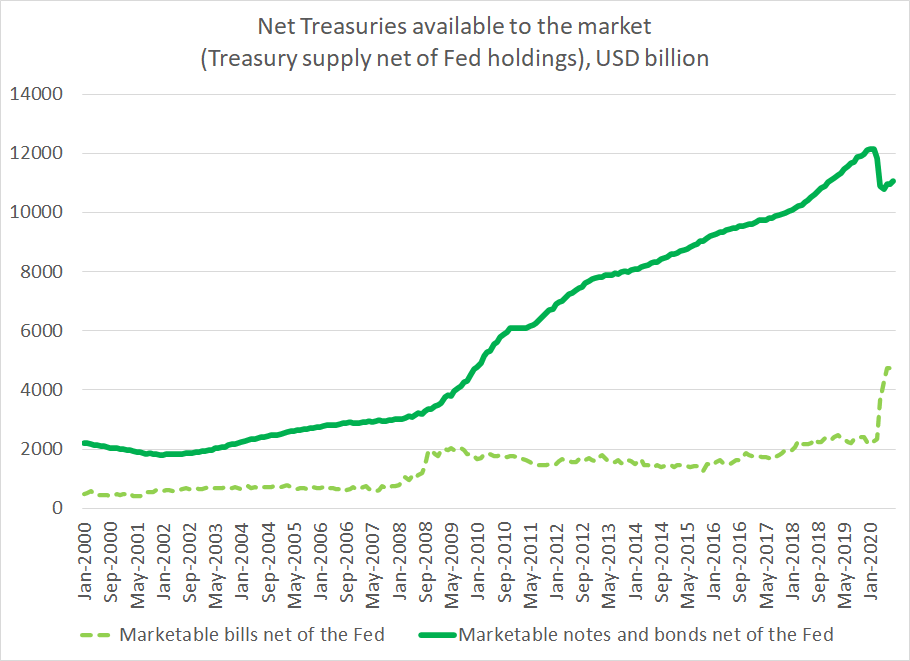

The supply of notes and long-term bonds has been rising -- though at a slower pace than the deficit, which has been financed mostly by bills.

Foreign demand hasn& #39;t kept up. But the amount of long-term Treasuries the market needs to hold has gone down, thanks to the Fed

2/x

Foreign demand hasn& #39;t kept up. But the amount of long-term Treasuries the market needs to hold has gone down, thanks to the Fed

2/x

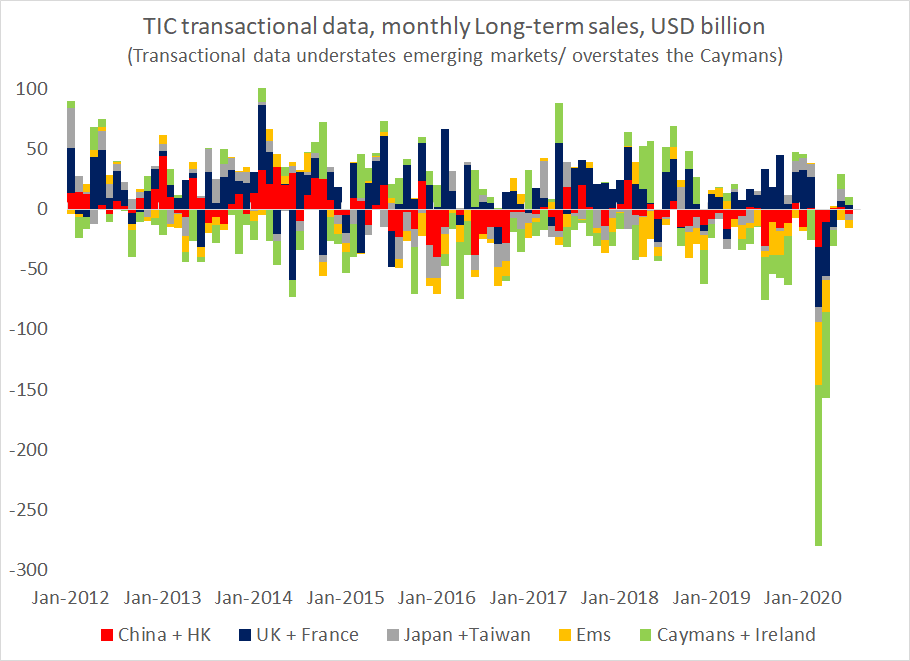

I can thus see why today& #39;s TIC data release (on foreign purchases of US assets) didn& #39;t get much attention --

the drama for now is elsewhere

4/x

the drama for now is elsewhere

4/x

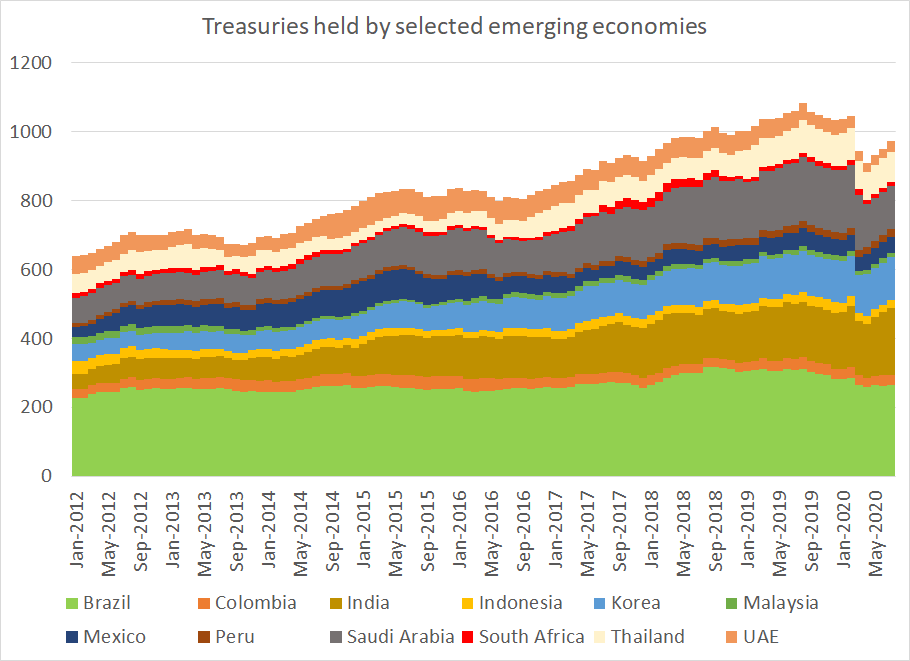

The Treasuries held by those EMs who actually need Treasuries to cushion against shocks is rising again

5/x

5/x

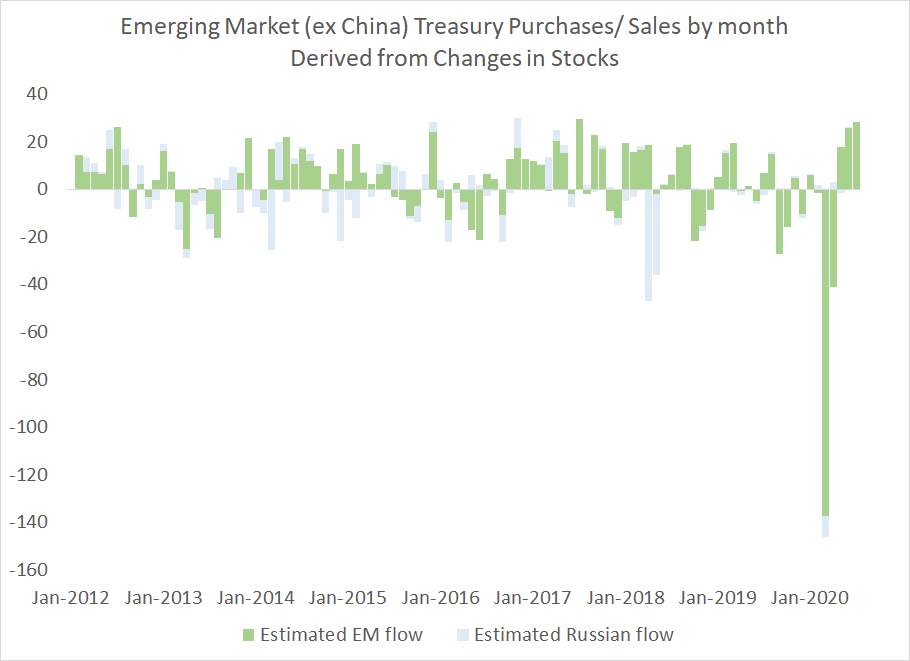

The stock data (valuation adjusted) suggests modest purchases by EM central banks, setting China aside

6/x

6/x

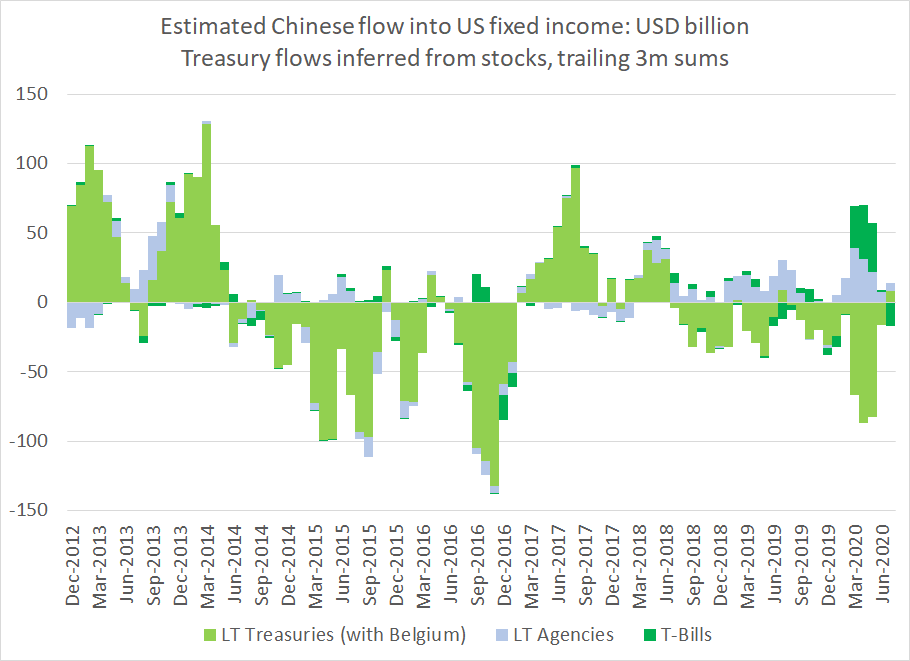

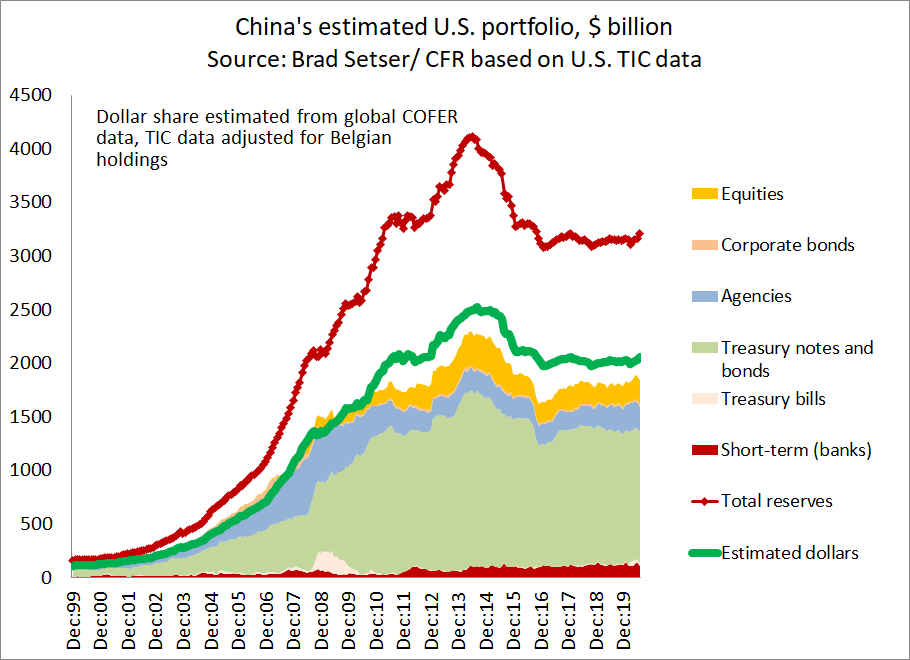

And China& #39;s BoP surplus isn& #39;t showing up in the US data right now --

(that is consistent with the low reported growth in China& #39;s reserves)

7/x

(that is consistent with the low reported growth in China& #39;s reserves)

7/x

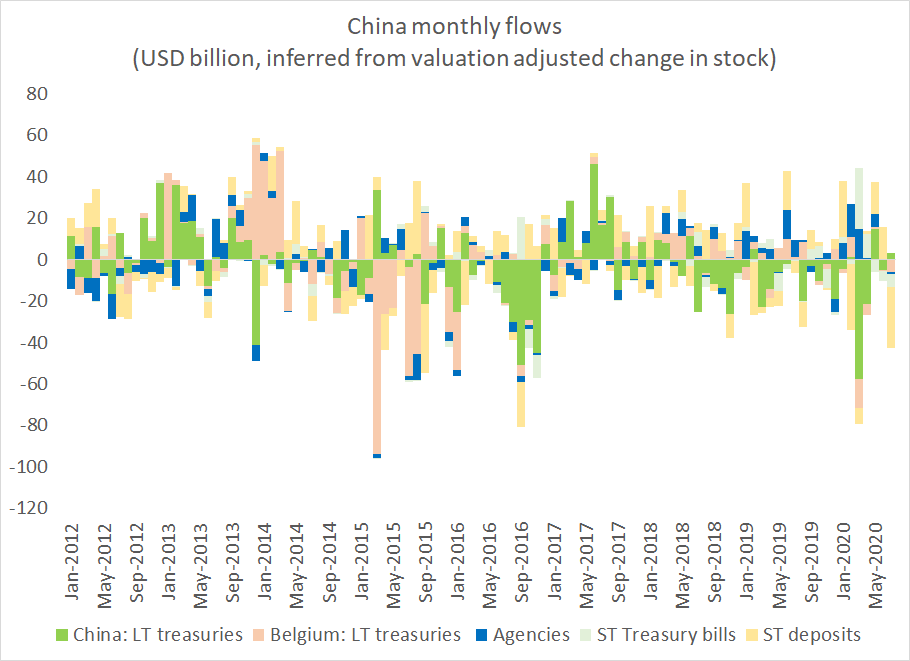

China& #39;s short-term deposits fell, but I wouldn& #39;t make too much of that -- there are lots of ways of holding short-term funds in dollars outside of the US

8/x

8/x

Right now the drama in the Chinese data is all on the trade side, not on the US flows side.

The mystery of where to find the financial offset for China& #39;s trade surplus thus remains ...

9/9

The mystery of where to find the financial offset for China& #39;s trade surplus thus remains ...

9/9

Read on Twitter

Read on Twitter