1. Preparation

2. Outreach

3. Navigating the process

4. Partner meetings + closing

Below you& #39;ll find a tweet-sized summary of @mccabe& #39;s incredible guest post from last week, with templates, references, and timelines.

1/ Ultimately, fundraising is an exercise in building trust. Each partner at a fund generally only makes 1-3 early-stage investments per year, and their career is ultimately staked to how successful these investments are. Each investment is incredibly significant to the fund.

2/ Note: This guide is for founders of tech businesses who have raised their seed round and are thinking forward to their next fundraise. It’s most relevant for Series A, but a lot of the same concepts apply for seed rounds, Series B, and to a certain extent Series C.

3/ Step 0: Why and when to raise

Why raise: To accelerate your business – not because you are running out of money. VC’s don’t invest because you need money. They invest because they believe their equity stake will be worth a lot more in the future.

Why raise: To accelerate your business – not because you are running out of money. VC’s don’t invest because you need money. They invest because they believe their equity stake will be worth a lot more in the future.

4a/ When to raise: Series A is often described as the “Product-Market Fit Round” – you want to show that you’ve convinced a slice of your market that your product is valuable enough to pay for (or if it’s free, use very regularly), and ... https://a16z.com/2017/02/18/12-things-about-product-market-fit/">https://a16z.com/2017/02/1...

4b/ ... that this user base is growing. While seed rounds are intended to explore an idea and find some fit in the market, raising a Series A helps you pour more fuel on the fire.

4c/ Investors ultimately want to invest in growth. If a company is growing faster than its peers, it can make up for lower ARR especially if the business seems defensible and sustainable. It’s helpful to speak with your seed investors to understand what milestones to hit.

4d/ Try to have at least 8 months of runway when going out to raise. The most important thing is that your business continues to show signs of success. If you only have 4-6 months of runway, it might make sense to raise a bridge round from inside investors to gain leverage.

5/ Step 1: Preparation

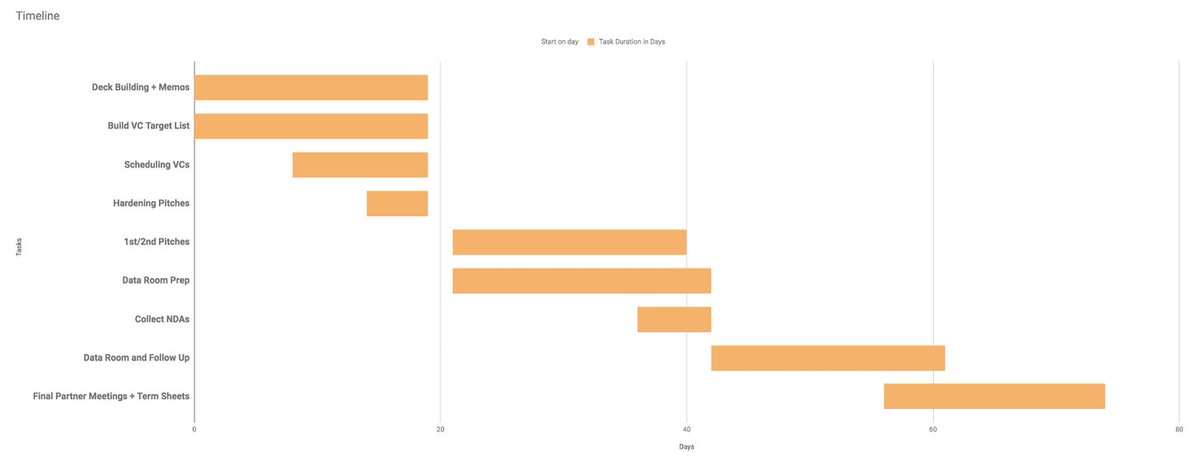

Plan to spend 8-16 weeks from beginning to term-sheet, and at least 4 weeks just building the deck and supporting materials. Taking time to get the narrative right and crystallizing your points will lead to a stronger deck and a smoother process.

Plan to spend 8-16 weeks from beginning to term-sheet, and at least 4 weeks just building the deck and supporting materials. Taking time to get the narrative right and crystallizing your points will lead to a stronger deck and a smoother process.

6/ Materials to prepare, at a minimum:

1. A short blurb about your business, w/ headline numbers that indicate the business is doing well

2. A short teaser deck (3-7 slides)

3. A longer presentation deck (12-15 slides)

4. A 2-3 year forecast

1. A short blurb about your business, w/ headline numbers that indicate the business is doing well

2. A short teaser deck (3-7 slides)

3. A longer presentation deck (12-15 slides)

4. A 2-3 year forecast

7/ The key is that your materials tell a compelling story. They need to explain what you’re building, why you’re building it, and how your strategy will capture considerable revenue. The better this story ties everything together, the more your business will seem insightful.

8/ Optional: Metrics deck or a data room. Sometimes you will get asked for this at Series A, sometimes not. It helps if you ask your prospective VCs in the first meeting whether they’ll ask for it. https://www.rippling.com/blog/company-news/rippling-series-a-pitch-deck-and-memo/">https://www.rippling.com/blog/comp...

9/ Three references for building pitches:

https://www.sequoiacap.com/article/writing-a-business-plan/

https://www.sequoiacap.com/article/w... href=" https://piktochart.com/blog/startup-pitch-decks-what-you-can-learn/

https://piktochart.com/blog/star... href=" https://medium.com/@zebulgar/how-to-raise-money-before-launch-a3544ef4dba6">https://medium.com/@zebulgar...

https://www.sequoiacap.com/article/writing-a-business-plan/

10/ When raising remotely, add:

1. A Loom of your product flow explaining how you made key design decisions

2. An appendix of interesting information you yourself have read or viewed that inspired your approach

3. A compilation of customer testimonials https://twitter.com/caitlinbolnick1/status/1290375205362098177">https://twitter.com/caitlinbo...

1. A Loom of your product flow explaining how you made key design decisions

2. An appendix of interesting information you yourself have read or viewed that inspired your approach

3. A compilation of customer testimonials https://twitter.com/caitlinbolnick1/status/1290375205362098177">https://twitter.com/caitlinbo...

11/ Make sure to set time aside to “Harden the Pitch”: Prepare your materials to about 70% completeness, find 4-6 people in your network who have fundraised at Series A, are friendly investors who know the space, or are growth stage investors. Practice your pitch with them.

12/ Step 2: Outreach

Planning your outreach is probably the most overlooked and tedious part of building a successful process. Your goal at this stage is to build a long list of funds who could lead your round – on that can fill the majority of your round.

Planning your outreach is probably the most overlooked and tedious part of building a successful process. Your goal at this stage is to build a long list of funds who could lead your round – on that can fill the majority of your round.

13/ Put together a list of 50-60 funds you want to talk to. Then figure out the partner you’d want to work with at the fund. Comb through your network to identify strong introductions to those partners. Warm introductions can make a huge difference. #gid=0">https://docs.google.com/spreadsheets/d/14eNxvGZTsBWHdd7uHA49RxkBq67sj07mfLDvsHyk9dg/edit #gid=0">https://docs.google.com/spreadshe...

14/ The best intros come from a successful founder from within that fund’s existing portfolio. The stronger the referral source, the more interest and excitement that partner will have when meeting you and reviewing your pitch content.

15/ If you might fundraise in the next 6-12 months and don’t have many good relationships with funds, schedule coffee meetings with top tier investors your network can introduce you to. Starting cold with investors when you begin fundraising isn’t optimal.

16/ Step 3: Navigating the process

You now have your pitch materials and your investor list ready. Your ultimate goal is to end up with multiple interested funds who have completed their diligence and want to invest all at the same time.

You now have your pitch materials and your investor list ready. Your ultimate goal is to end up with multiple interested funds who have completed their diligence and want to invest all at the same time.

17/ Approach this with the eyes of a project manager. You should be building a calendar and keeping notes for each VC, including progress and feedback, and be in regular contact with each fund you’re speaking to. Here& #39;s a tracker template. #gid=0">https://docs.google.com/spreadsheets/d/14eNxvGZTsBWHdd7uHA49RxkBq67sj07mfLDvsHyk9dg/edit #gid=0">https://docs.google.com/spreadshe...

18/ You should coordinate your outreach to have first meetings with of the funds within a 2-3 week period. Making sure all these first pitches happen in a constrained period of time means you won’t have one VC getting ahead of the others.

19/ Your role here is to create a market for the equity you’re selling. Don’t create a market of one buyer that was able to get to a decision fastest. Thus, the importance of keeping all the funds on similar timelines.

20/ Don& #39;t do more than 4-5 pitches a day and leaving a suitable buffer each side of pitches to restore your energy, give you time to get to your next meeting without stress, and to allow a meeting to go late when they need to. With 50-60 funds, that’s going to take 3 weeks.

21/ Once you’re through the grueling first pitch phase, you’ll move on to a second pitch, along with customer references, VCs diligencing your data, projections, etc. Once again, focus on coordination.

22/ To keep everyone moving, it’s OK to follow-up a week after your last touchpoint. If there’s seemingly no corresponding interest for a week or two, then better to file that VC in a different bucket and focus on the funds who are reciprocating.

23/ This will be painful, but some VCs just won’t be interested in your company or will be too focused on other deals. Some genuinely just won’t understand your business. Silence, or outright rejection, are tough pills to swallow for any founder, but this is normal.

24/ Find ways to process and deal with this energy. Try not to take it out on the investor in question. Have a close friend/colleague/early investor who ideally understands the process on stand-by either to vent to or to get reassurance.

25/ YC estimates you need to speak to 30 funds to get 1 TS. Treat each fund with the respect that shows you believe they might invest while avoiding wasting time with those that won& #39;t.

Having five VC partners interested in investing after the diligence phase is a success.

Having five VC partners interested in investing after the diligence phase is a success.

26/ Step 4: Partner meetings + closing

If you’ve made it this far, kudos, you’ll need that kind of perseverance to fundraise successfully.

If you’ve made it this far, kudos, you’ll need that kind of perseverance to fundraise successfully.

27/ You’ve now built some relationships and fund partners have spent a lot of time on your business. You may be working with this partner for years to come and they’re also thinking the same thing. Find ways to speak with those partners and show your excitement for the deal.

28/ At this point it’s likely that the partner wants to get this deal done, and now needs to convince their partnership. This is when you get called in to partner meetings. The partner you’ve been working with now generally turns into your co-conspirator in the partner meeting.

29/ After a partner meeting, you& #39;ll typically get a response quickly. If you get a term sheet, congrats! But now you are on the clock. There’s no hard and fast rule but it can be hard to keep a term sheet open for more than 1-2 weeks. Some VCs will only give you 24-48 hours.

30/ Either way, you should establish clearly how much time you will need, and understand that if you go beyond this deadline the TS could be withdrawn.

If other funds are still interested, you can let them know you have a term sheet and that they’ll need to make a decision soon.

If other funds are still interested, you can let them know you have a term sheet and that they’ll need to make a decision soon.

31/ If this term-sheet is not from your first choice fund, asking to speak to references can buy you some time. If you leverage a TS to push another fund to make a decision and they have not completed their diligence, it can force them to pass when they might not otherwise.

32/ Most of the time, I would not recommend sharing which fund offered you the term sheet or what the valuation is. However, transparency can be perceived as a sign of confidence and that you’re ready to accept that term sheet.

33/ For the valuation, don’t forget you’ve built this synchronized process keeping many funds in the loop for a reason. Rather than helping the fund set a valuation, focus the conversation on what you want to raise, reiterate why you need this capital, and potentially...

34/ ...identify other terms you may be more sensitive about (e.g. one board seat vs two, option pools, founder stock revesting). YC put together a great post on the ideal Series A term-sheet, but it’s also good to speak with your legal support. https://www.ycombinator.com/library/4P-a-standard-and-clean-series-a-term-sheet">https://www.ycombinator.com/library/4...

35/ Once you’ve signed a TS it can still take 3-6 weeks to actually get the money in the bank. Funds will perform additional legal diligence and prepare the stock purchase agreement. This is a good time to identify who will be taking their pro-rata, and other value-add angels.

36/ Once you sign the stock purchase agreement you can breathe deeply. Make sure to celebrate this achievement. But also use this moment to refocus and energize your team for the next stage of your business. The hard work of building a business continues.

37/ It& #39;s important to state here that rounds close in a lot of different ways. There is no one size fits all approach. This guide is intended to offer some structure around the fundraising process and alleviate the uncertainty and anxiety founders experience.

38/ For MUCH much more, check out the full post below.

If you have any questions hit up @mccabe, the brains behind this post. And a big shoutout to @jpgg @eoghan @zebulgar and Riley Newman for their help with this post. https://www.lennyrachitsky.com/p/a-playbook-for-fundraising">https://www.lennyrachitsky.com/p/a-playb...

If you have any questions hit up @mccabe, the brains behind this post. And a big shoutout to @jpgg @eoghan @zebulgar and Riley Newman for their help with this post. https://www.lennyrachitsky.com/p/a-playbook-for-fundraising">https://www.lennyrachitsky.com/p/a-playb...

Read on Twitter

Read on Twitter