Despite marijuana being legal in Canada for 2 years, Canadian cannabis brands are having a tough time getting consumers to notice them.

This is a case study of bad marketing strategy that highlights the importance of strong brand management.

Let’s see what went wrong. (1/n)

This is a case study of bad marketing strategy that highlights the importance of strong brand management.

Let’s see what went wrong. (1/n)

Pot producers spent millions in marketing trusting that people would flock to their brands in an emerging $6 billion market.

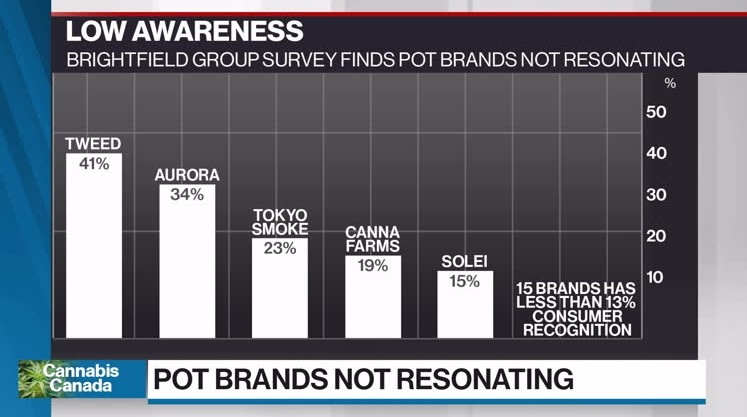

Most of that money was completely wasted. A survey that polled 3,000 Canadians in the Q1 of 2019 found that brand awareness remains low.

Most of that money was completely wasted. A survey that polled 3,000 Canadians in the Q1 of 2019 found that brand awareness remains low.

No brand in Canada has more than 41% recognition among current cannabis users, with most falling between 1% and 15%.

Less than half of consumers familiar with leading brands actually go out and buy them.

Less than half of consumers familiar with leading brands actually go out and buy them.

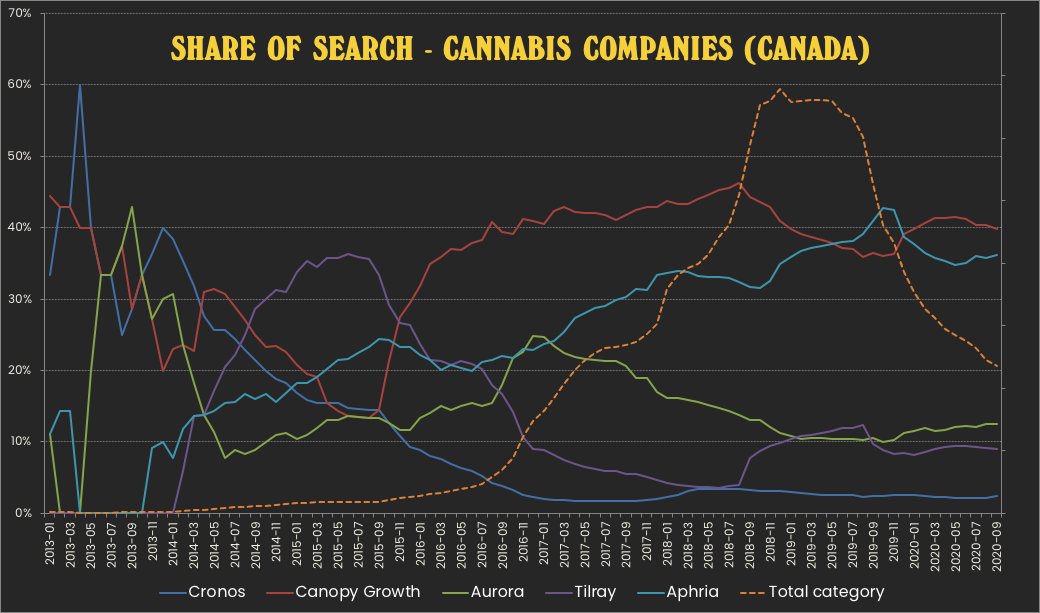

Industry players have focused on raising capital, but this hasn’t translated into strong customer relationships.

No-one has been able to build a strong brand.

No-one has been able to build a strong brand.

Cannabis companies blame the strict advertising regulations placed on them which bans mass advertising, sponsorship, contests, endorsements and promotions that associate cannabis with attractive lifestyles.

The same restrictions also apply to alcohol and tobacco.

The same restrictions also apply to alcohol and tobacco.

To get around the restrictions, Cannabis brands’ advertising have focused on & #39;educating consumers& #39;.

This has led to a real lack of differentiation and distinctiveness: vague, bland, and very same-y.

This has led to a real lack of differentiation and distinctiveness: vague, bland, and very same-y.

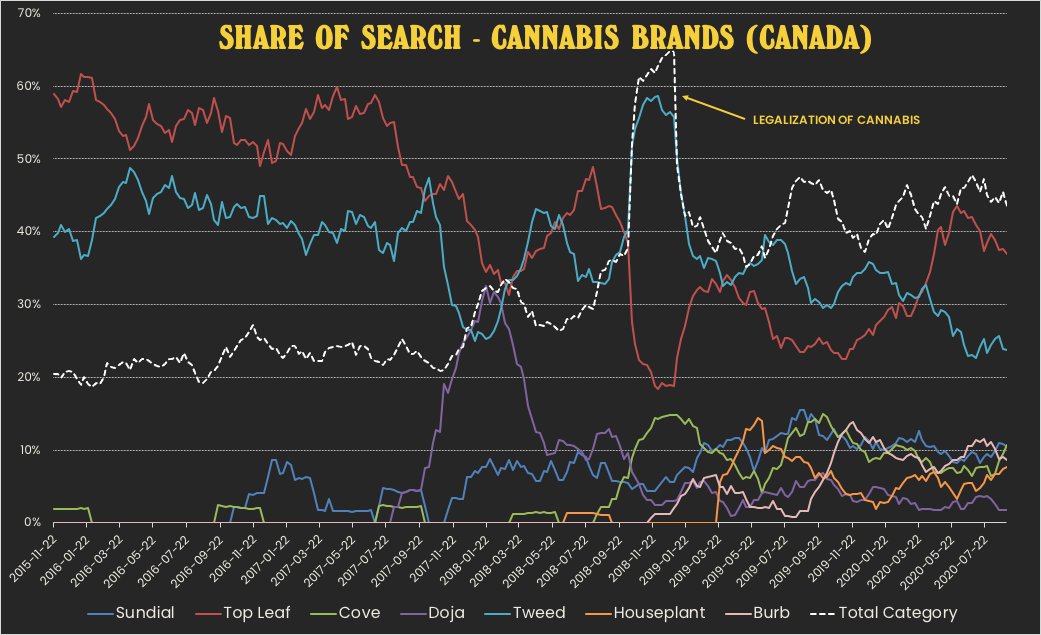

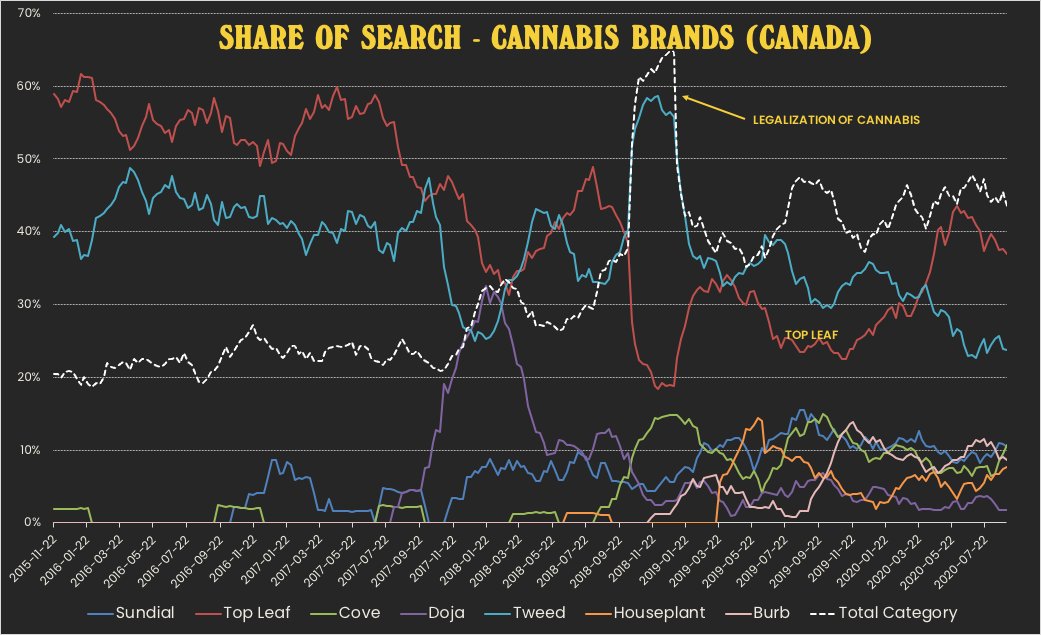

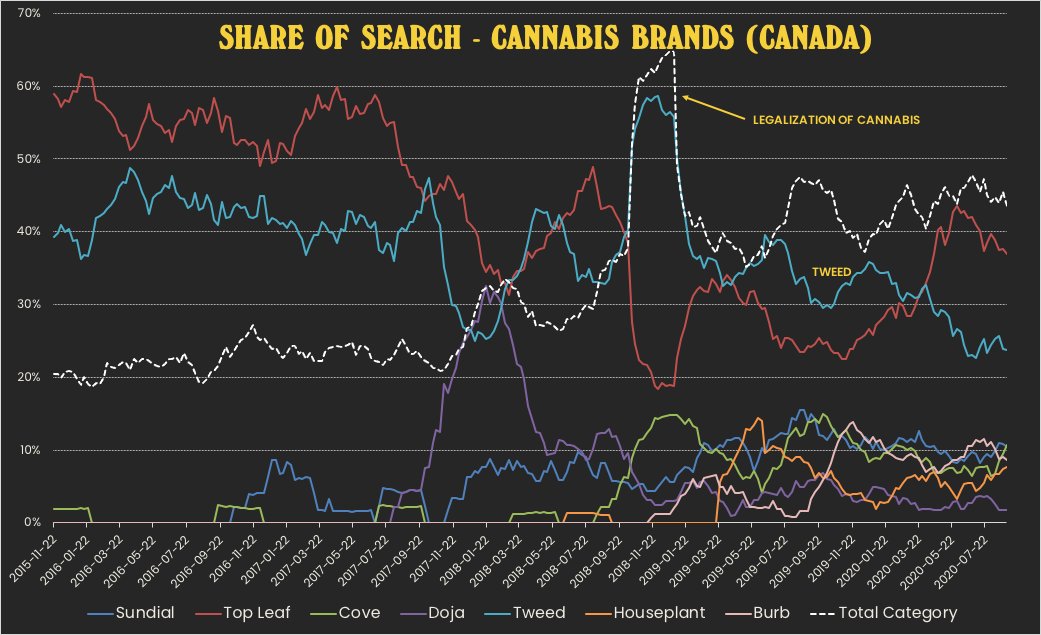

@TopLeafCan are the biggest brand in 2020 with ~40% market share, they’ve been growing steadily in a flat market & stealing customers from rival brands.

Is it a coincidence they seem to have the most personality? They’re all about “the good sh*t”.

Is it a coincidence they seem to have the most personality? They’re all about “the good sh*t”.

Former favourites knocked off their perch by Top Leaf, @TweedInc skyrocketed during legalization but has failed to maintain momentum. Market share losses have stabilized since Covid, but they’re sitting firmly at #2 with ~25% and no signs of future growth.

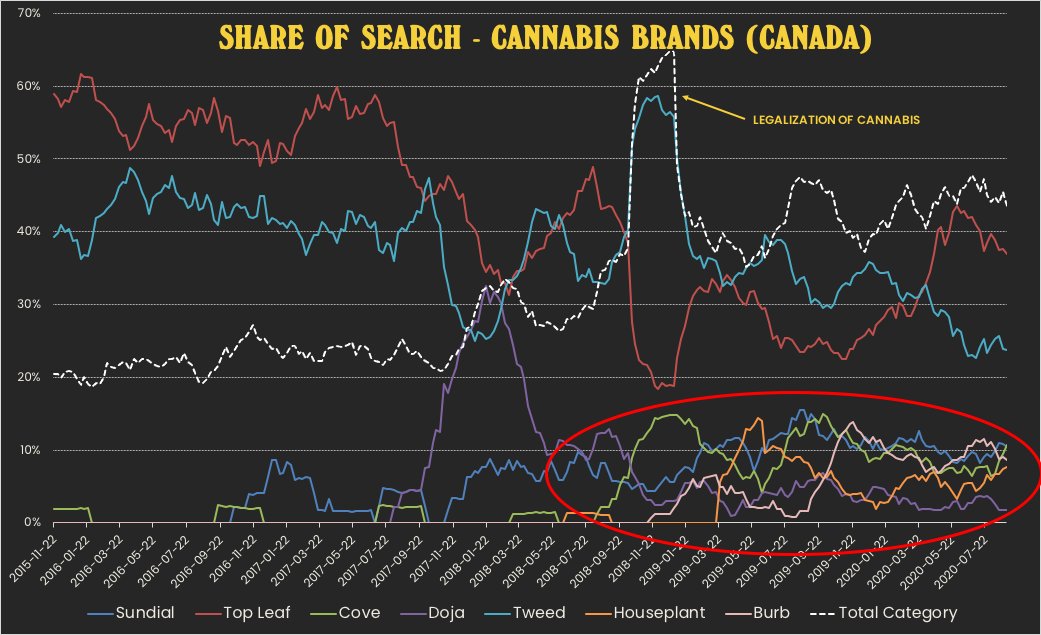

Then there& #39;s everyone else...

It’s a dog-eat-dog world at the bottom, and everyone is struggling to break out. @sundialcannabis, Burb and @fireandflowerco are holding steady at 10% SoM, while & #39;premium& #39; brand Doja trickles along at >5%.

It’s a dog-eat-dog world at the bottom, and everyone is struggling to break out. @sundialcannabis, Burb and @fireandflowerco are holding steady at 10% SoM, while & #39;premium& #39; brand Doja trickles along at >5%.

However, Cronos Group& #39;s Cove appears to be on a huge growth trajectory since July - they must be doing something right!

Still, no company has moved up the ladder from functional marketing to building a connection with consumers.

Like alcohol and tobacco companies, they need to transcend the products they& #39;re selling.

In other words, they need to create a real brand.

Like alcohol and tobacco companies, they need to transcend the products they& #39;re selling.

In other words, they need to create a real brand.

This is a massive failure of strategy & brand management for everyone involved.

1. Cannabis companies need to completely re-think their marketing strategies. What they& #39;re doing now clearly isn& #39;t working. https://www.ianbarnard.ca/post/do-you-have-a-strategy">https://www.ianbarnard.ca/post/do-y...

1. Cannabis companies need to completely re-think their marketing strategies. What they& #39;re doing now clearly isn& #39;t working. https://www.ianbarnard.ca/post/do-you-have-a-strategy">https://www.ianbarnard.ca/post/do-y...

2. They need to really understand the market and the different types of consumer behaviour in it.

The lack of distinction between the brands is a major red flag that no real segmentation, targeting or positioning work has been done. https://www.ianbarnard.ca/post/the-right-way-to-segment-a-market">https://www.ianbarnard.ca/post/the-...

The lack of distinction between the brands is a major red flag that no real segmentation, targeting or positioning work has been done. https://www.ianbarnard.ca/post/the-right-way-to-segment-a-market">https://www.ianbarnard.ca/post/the-...

3. And they need to get smarter about using their websites to persuade people to try their products.

With the restrictions around advertising, their websites are the #1 asset in selling their brand. https://www.ianbarnard.ca/post/how-to-steal-customers-from-your-online-competitors">https://www.ianbarnard.ca/post/how-...

With the restrictions around advertising, their websites are the #1 asset in selling their brand. https://www.ianbarnard.ca/post/how-to-steal-customers-from-your-online-competitors">https://www.ianbarnard.ca/post/how-...

Read on Twitter

Read on Twitter