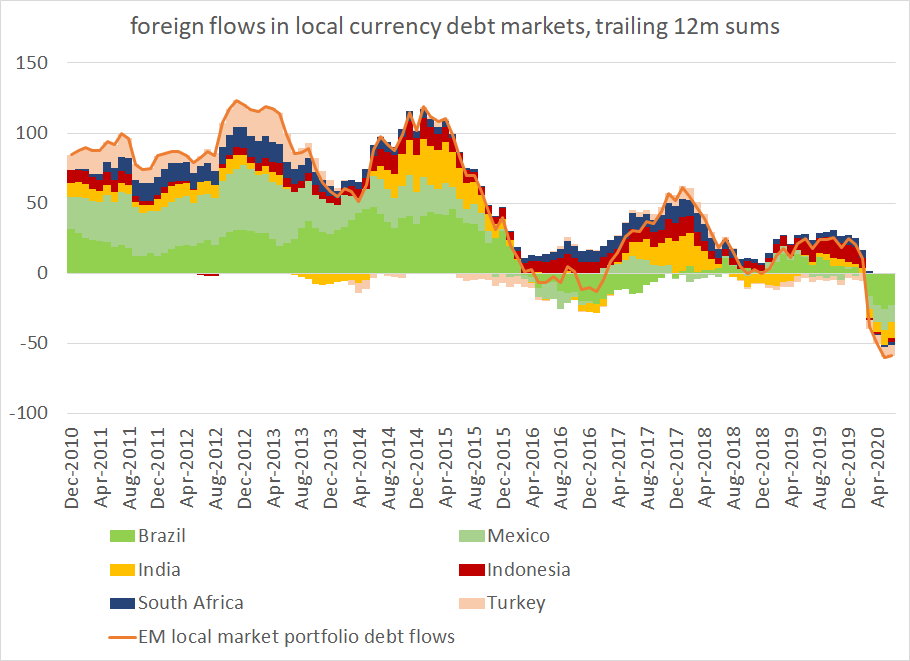

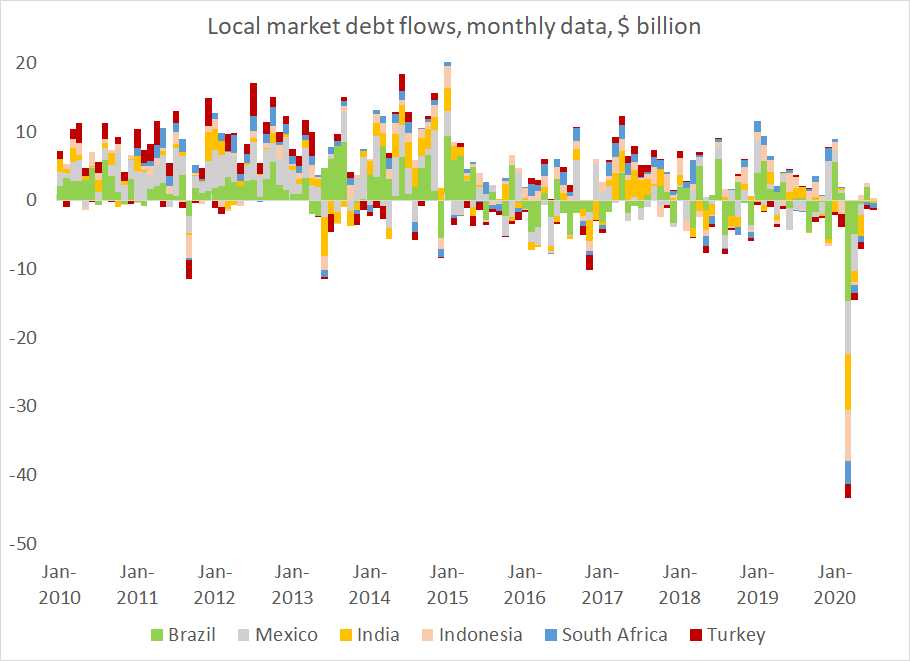

Fiscal deficits in the big emerging economies are largely being financed domestically (with domestic debt bought by domestic investors)

Useful (and BoP consistent) story from @markets

1/x https://www.bloomberg.com/news/articles/2020-08-24/massive-borrowing-sparks-rare-divergence-in-indonesia-bonds-fx?srnd=fixed-income">https://www.bloomberg.com/news/arti...

Useful (and BoP consistent) story from @markets

1/x https://www.bloomberg.com/news/articles/2020-08-24/massive-borrowing-sparks-rare-divergence-in-indonesia-bonds-fx?srnd=fixed-income">https://www.bloomberg.com/news/arti...

Read on Twitter

Read on Twitter