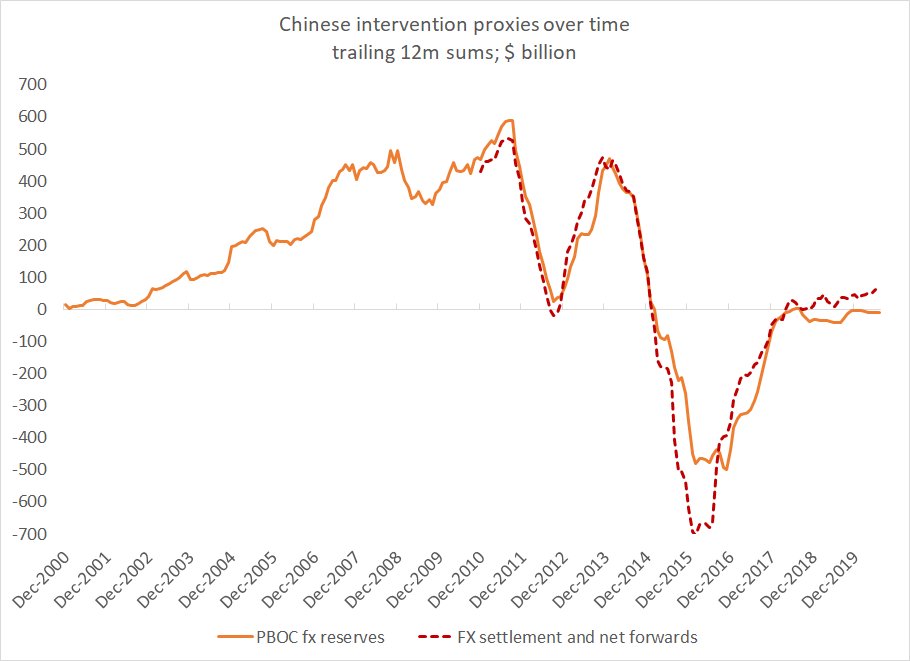

My "shadow intervention" alarm bells are starting to go off --

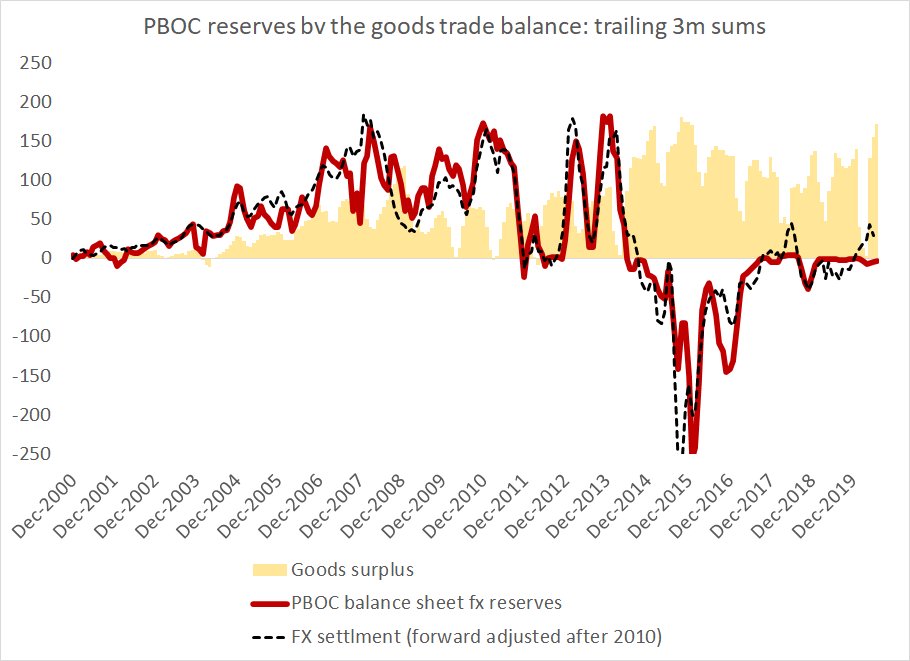

Something is happening in China. The July trade surplus (goods) was $60b. Per my @ExanteData friends (in market watch) inflows into CNY bonds were $20b.

And PBOC balance sheet reserve were flat

1/x

Something is happening in China. The July trade surplus (goods) was $60b. Per my @ExanteData friends (in market watch) inflows into CNY bonds were $20b.

And PBOC balance sheet reserve were flat

1/x

Obviously there is a "missing" outflow right now -- and it has to be massive for current account and the financial account to balance now that the current account has shot up. The goods surplus is again a good current account proxy b/c tourism imports are down ...

2/x

2/x

The current account and reserves can diverge at times - in 14/15 lower oil prices increased China& #39;s current account surplus even as the CNY& #39;s real appreciation & the the authorities decision to let the CNY slip v the dollar triggered large outflows (including a carry unwind)

3/x

3/x

But right now there isn& #39;t the kind of noise that one would typically associated with enormous private outflows from China -- and the outflows needed to balance the current account surplus and inflows into CNY bonds are now large.

4/x

4/x

There is one other small thing that caught my attention, which may be nothing -- the PBOC balance sheet data release (at least in HAVER) didn& #39;t include the PBOC& #39;s non-reserve foreign assets. That& #39;s a bit unusual ...

and it makes me wonder what& #39;s there

5/x

and it makes me wonder what& #39;s there

5/x

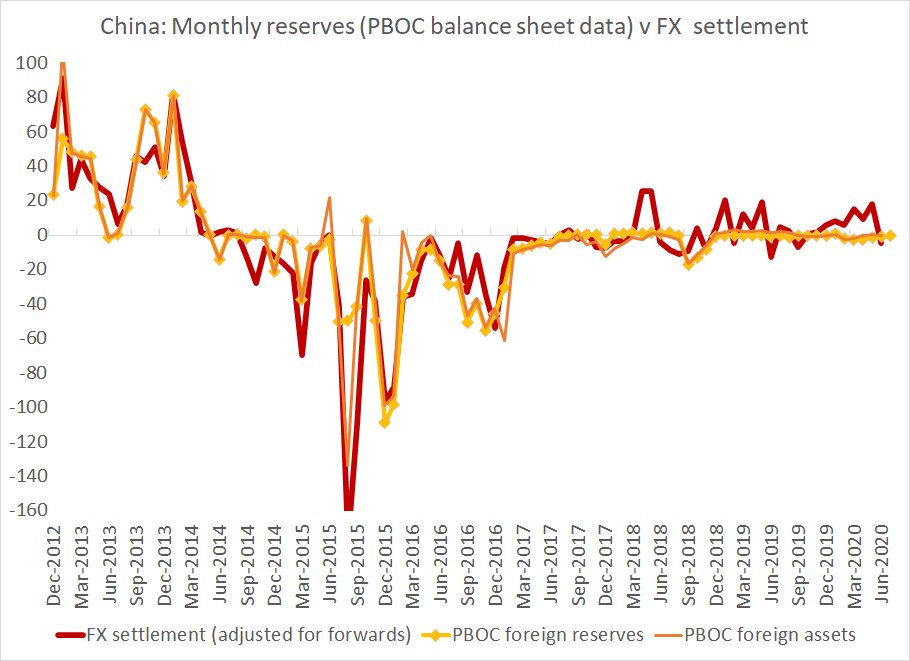

But it is generally clear that the PBOC balance sheet number is now massaged (it is meant to show no change, and no intervention so to speak) and thus lacks information content (it doesn& #39;t even line up with BoP reserves).

Fx Settlement for now seems a bit more reliable.

6/x

Fx Settlement for now seems a bit more reliable.

6/x

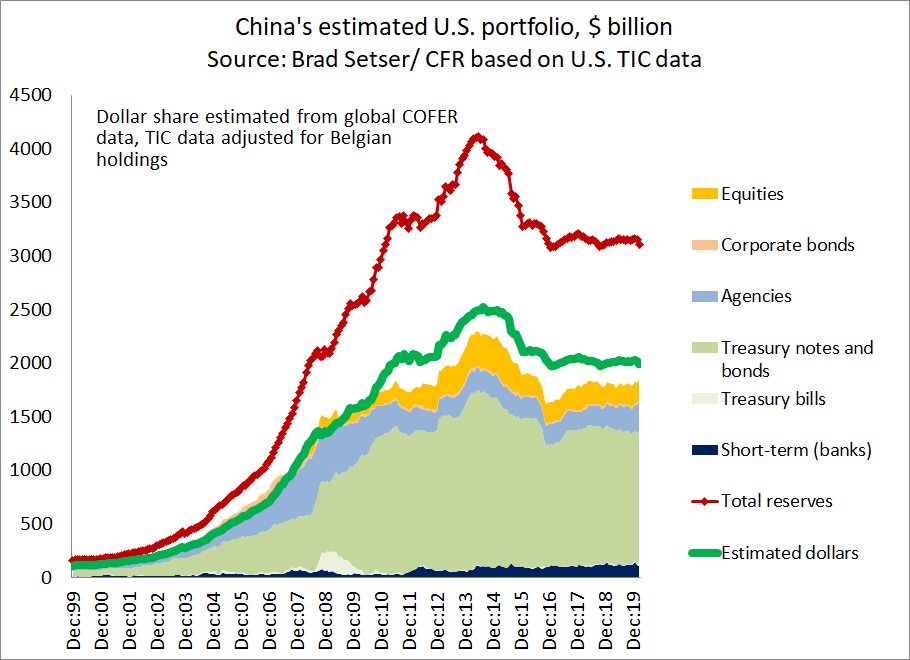

One last point, in reaction to all the current fans of the Borio/ Disyatat (2011) paper --

in the run up to the global crisis, net outflows from China and gross outflows to China were basically the same. Reserve growth was more or less explained by the basic balance.

7/x

in the run up to the global crisis, net outflows from China and gross outflows to China were basically the same. Reserve growth was more or less explained by the basic balance.

7/x

And the growth in China& #39;s portfolio holdings/ claims on the US (Chinese flows at the time were not intermediated through private banks) is basically explained by the growth in China& #39;s reserves

8/x

8/x

There is also no meaningful gross v net issue even now for Taiwan ...

Reserves and portfolio outflows from the lifers fully correspond to the current account

9/x

Reserves and portfolio outflows from the lifers fully correspond to the current account

9/x

In fact, the lack of any inflows into Taiwanese banks or Taiwanese bonds which would correspond with offshore investors using TWD obtained via swaps was one of the important clues STW and I used in our big paper on Taiwan

10/x

https://www.cfr.org/sites/default/files/pdf/shadow-fx-intervention-in-taiwan-solving-a-usd-100-bn-enigma.pdf">https://www.cfr.org/sites/def...

10/x

https://www.cfr.org/sites/default/files/pdf/shadow-fx-intervention-in-taiwan-solving-a-usd-100-bn-enigma.pdf">https://www.cfr.org/sites/def...

Read on Twitter

Read on Twitter