A weaker dollar means more, not less, accumulation of dollar reserves ... https://www.cfr.org/blog/weaker-dollar-means-more-dollar-reserves">https://www.cfr.org/blog/weak...

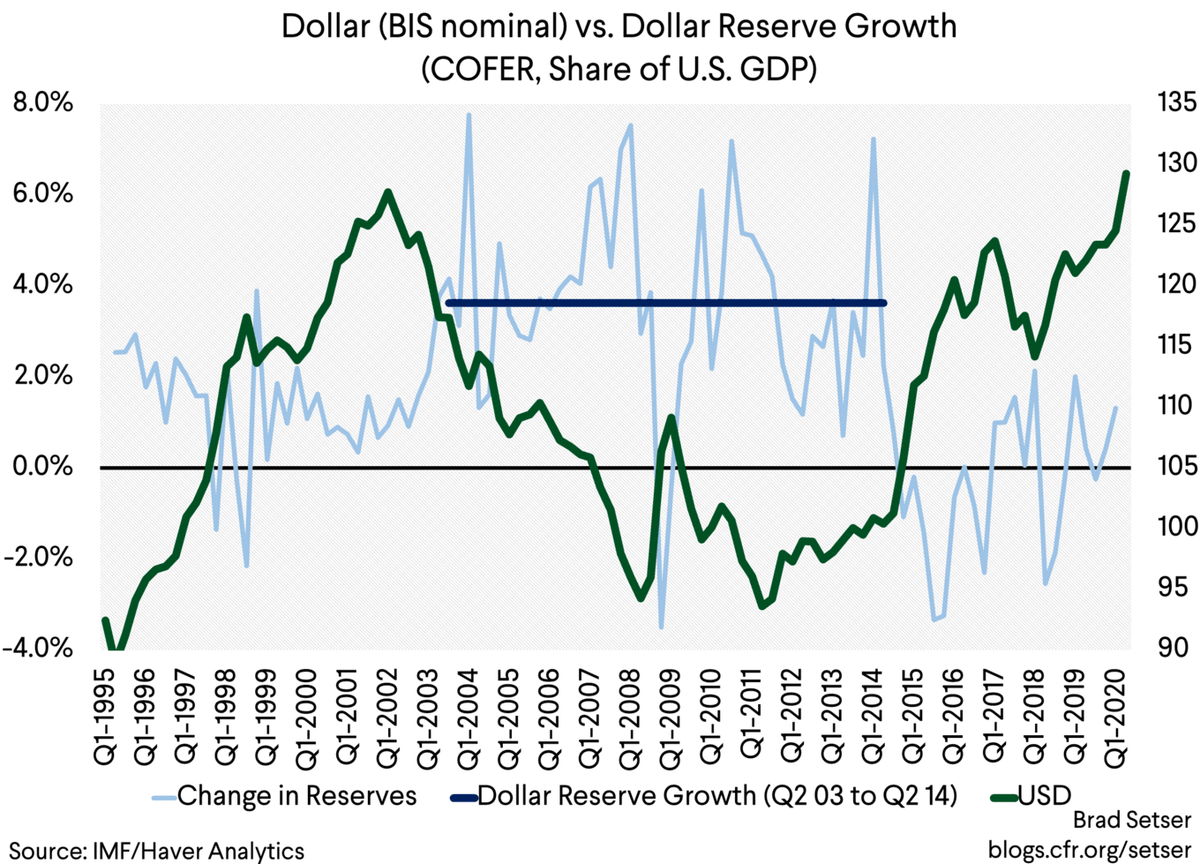

There is often an assumption that dollar weakness is a result of central bank reserve managers shifting away from the dollar --

But the correlation is the other way.

When private investors move away from the dollar, central banks step in (to keep their currencies from rising)

But the correlation is the other way.

When private investors move away from the dollar, central banks step in (to keep their currencies from rising)

It thus isn& #39;t an accident that peak dollar reserve accumulation occurred during the dollar& #39;s decade of weakness ...

(not during its period of recent strength)

(not during its period of recent strength)

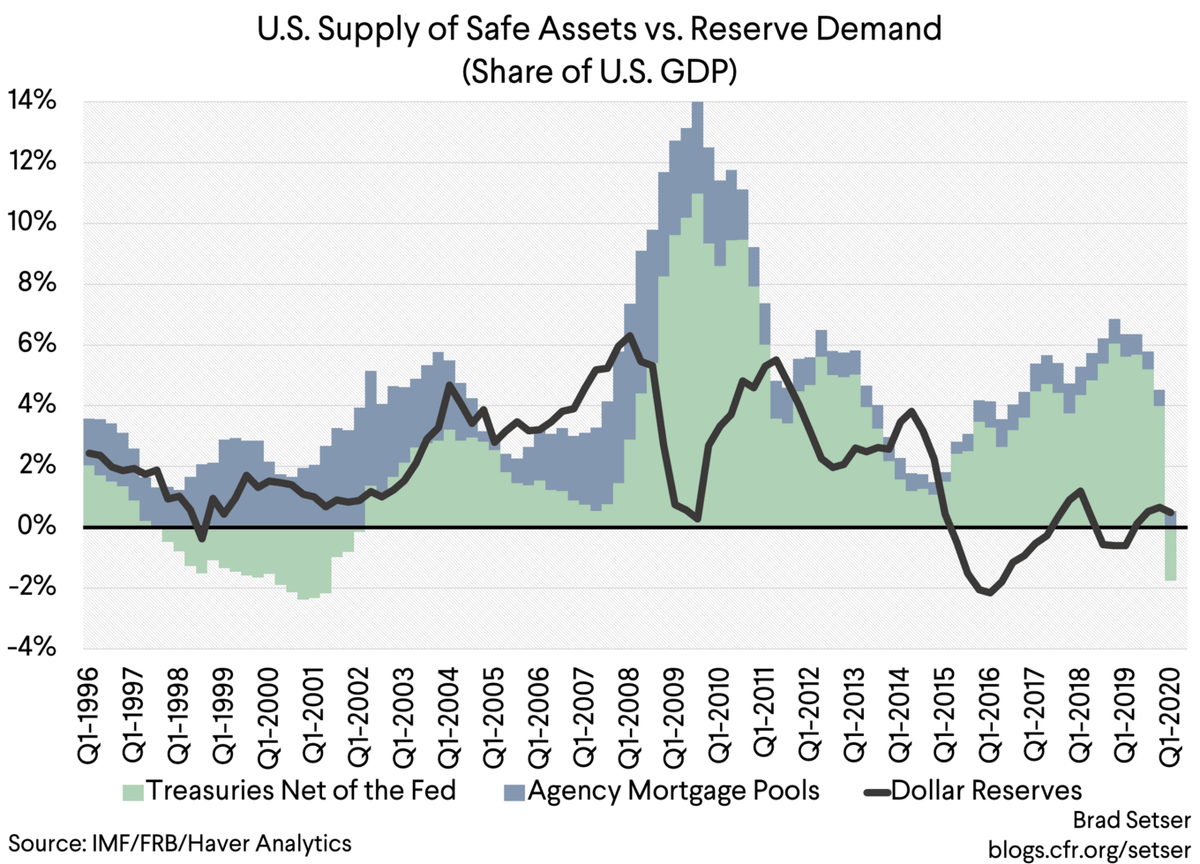

The demand supply for safe assets thus ought to get a bit more attention in the discussion about a global shortage of safe assets --

From 04 to 07, U.S. issuance of Treasuries fell --

But central bank demand for dollars also really rose (EMs resisting appreciation at the time)

From 04 to 07, U.S. issuance of Treasuries fell --

But central bank demand for dollars also really rose (EMs resisting appreciation at the time)

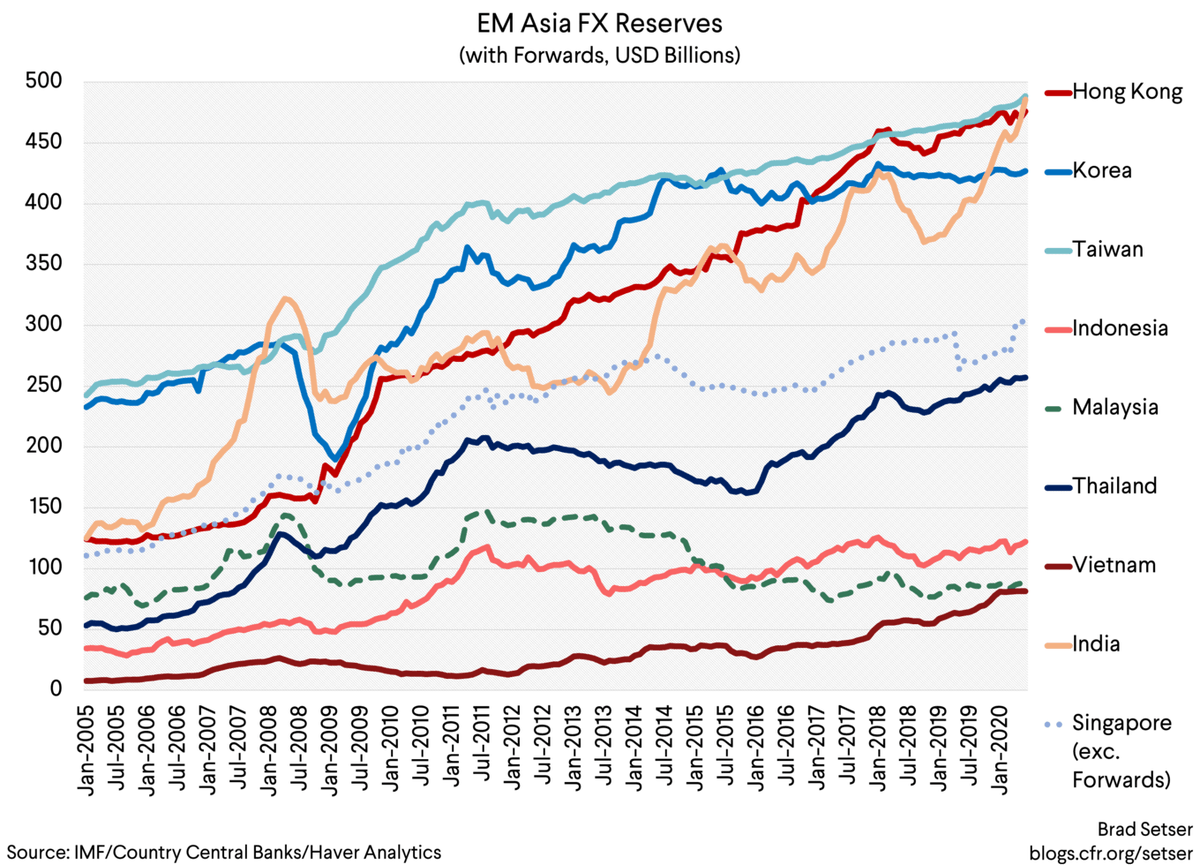

A lot more intervention takes place in the shadows now: it shows up in a rising swaps book, or in a sovereign wealth fund.

But there are already signs that history is repeating itself -- a number Asian economies appear to be resisting pressure for their currencies to appreciate

But there are already signs that history is repeating itself -- a number Asian economies appear to be resisting pressure for their currencies to appreciate

Remember, the dollar cannot depreciate unless another currency appreciates -- and a number of countries (cough, see Taiwan ... ) that are accustomed to relying on substantial exports and trade surpluses for demand tend to resist any appreciation of their currency.

So dollar down, dollar reserves up ...

and dollar down, foreign demand for Treasuries (from central bank reserve managers) up ...

Not intuitive perhaps, but predictable

and dollar down, foreign demand for Treasuries (from central bank reserve managers) up ...

Not intuitive perhaps, but predictable

Read on Twitter

Read on Twitter