When you buy the Satrix MSCI World ETF, this is what you are getting.

[Thread]

[Thread]

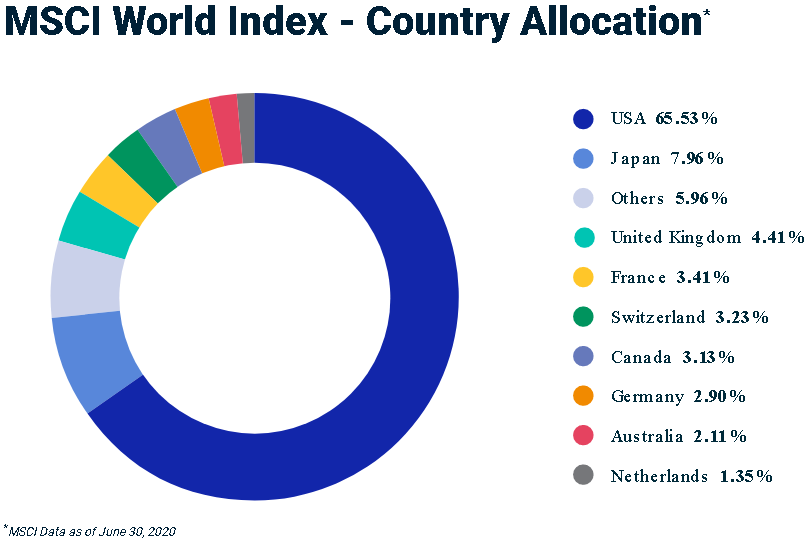

The ETF invests in 23 different countries. This means your investment is spread all across the globe giving you geographical and currency diversification.

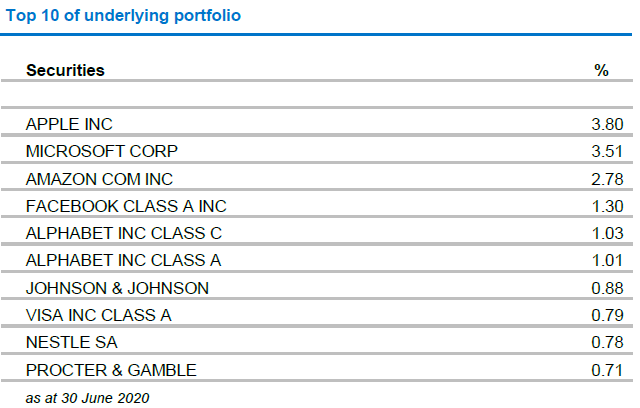

Your money is invested in the top companies in the world run by some of the world& #39;s best business leaders. A lot of these companies are household names - e.g. Apple, Amazon, Visa, Nestle.

The ETF invests in over 1600 different companies, so you get massive diversification

The ETF invests in over 1600 different companies, so you get massive diversification

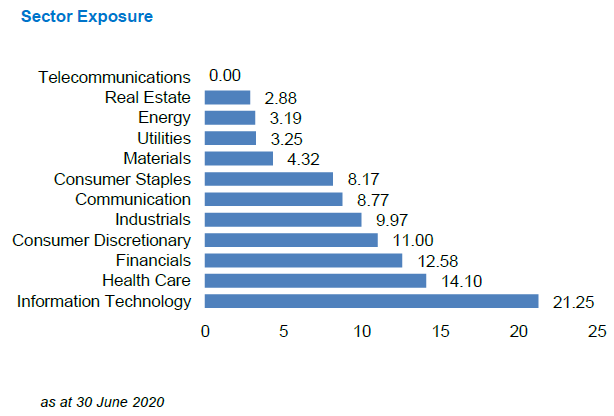

And what does an investment that diversifies you across geographies, currencies, companies and sectors cost?

The Total Expense Ratio (TER) is just 0.35%

A Unit Trust with similar exposure is a lot more pricey - I have seen some bumping up against 2% - that& #39;s 5x more expensive!

The Total Expense Ratio (TER) is just 0.35%

A Unit Trust with similar exposure is a lot more pricey - I have seen some bumping up against 2% - that& #39;s 5x more expensive!

The Satrix MSCI World ETF is a total return fund. That means that instead of paying the dividends out to investors, the dividend is automatically used to buy more of the companies the ETF invests in.

Can you put it in a TFSA?

Yes, the Satrix MSCI World ETF is available to invest in inside of an TFSA

Yes, the Satrix MSCI World ETF is available to invest in inside of an TFSA

Sources used for this thread:

Satrix

https://satrix.co.za/fund/mdd/STXWDM

MSCI">https://satrix.co.za/fund/mdd/...

https://www.msci.com/developed-markets

https://www.msci.com/developed... href=" https://www.msci.com/documents/10199/149ed7bc-316e-4b4c-8ea4-43fcb5bd6523">https://www.msci.com/documents...

Satrix

https://satrix.co.za/fund/mdd/STXWDM

MSCI">https://satrix.co.za/fund/mdd/...

https://www.msci.com/developed-markets

Read on Twitter

Read on Twitter