Do you know your Saving Rate?

Here is how you calculate it

[Thread]

Here is how you calculate it

[Thread]

Your Saving Rate is an important number to know. It represents how much of your money you are using to improve your financial situation.

The higher your Saving Rate, the bigger the financial strides you are taking each month.

The higher your Saving Rate, the bigger the financial strides you are taking each month.

To calculate your Saving Rate, start by adding the money you contribute to your investments each month:

- Company Pension Plan

- TFSA

- RA

- Rental Property

- Shares/ETFs/Unit Trusts

- Company Pension Plan

- TFSA

- RA

- Rental Property

- Shares/ETFs/Unit Trusts

Next add any additional payments you are making toward debt (this is the amount over an above the minimum you are required to pay each month).

Then add any monthly contributions you are putting towards building your emergency fund.

You shouldn& #39;t add other savings you are making, such as holiday funds or for a car service, since this money is going to be spent in the short term.

You shouldn& #39;t add other savings you are making, such as holiday funds or for a car service, since this money is going to be spent in the short term.

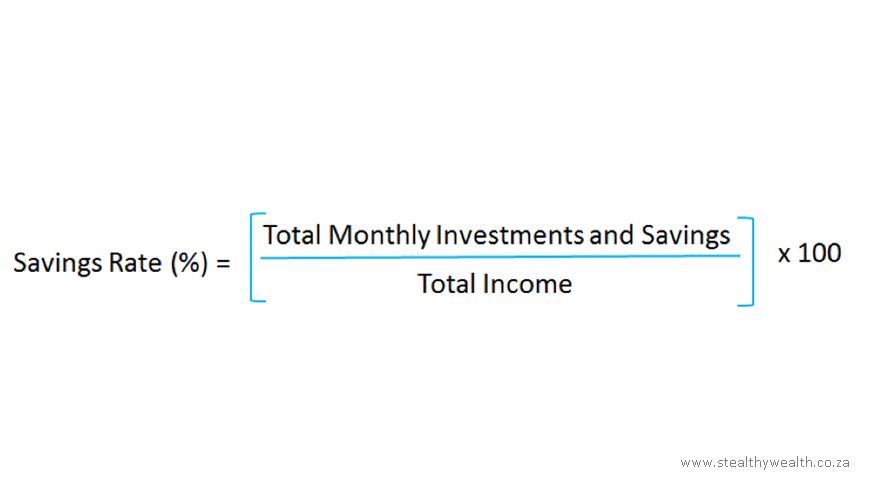

Your Saving Rate is equal to the total amount you are investing, paying extra toward debt, and saving divided by the total amount of income that lands in your bank account each month.

Multiply by 100 to express your Saving Rate as a percentage of your total income.

Multiply by 100 to express your Saving Rate as a percentage of your total income.

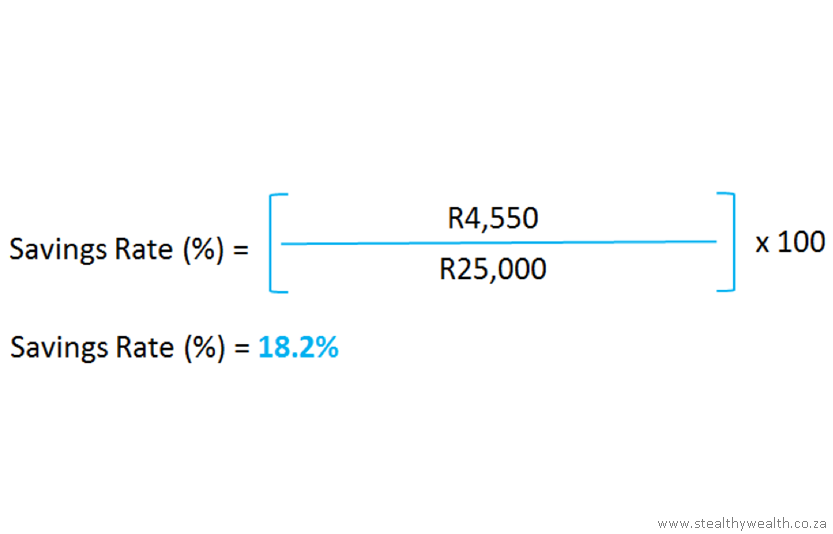

For example, consider someone earning R25,000/month.

They make monthly contributions of:

- R2,750 to a TFSA

- R850 to their emergency fund

- R950 as extra payments toward debt

Their Saving Rate is 18.2%

They make monthly contributions of:

- R2,750 to a TFSA

- R850 to their emergency fund

- R950 as extra payments toward debt

Their Saving Rate is 18.2%

You can improve your Saving Rate by either:

- Spending less or

- Earning more or

- Spending less AND earning more

- Spending less or

- Earning more or

- Spending less AND earning more

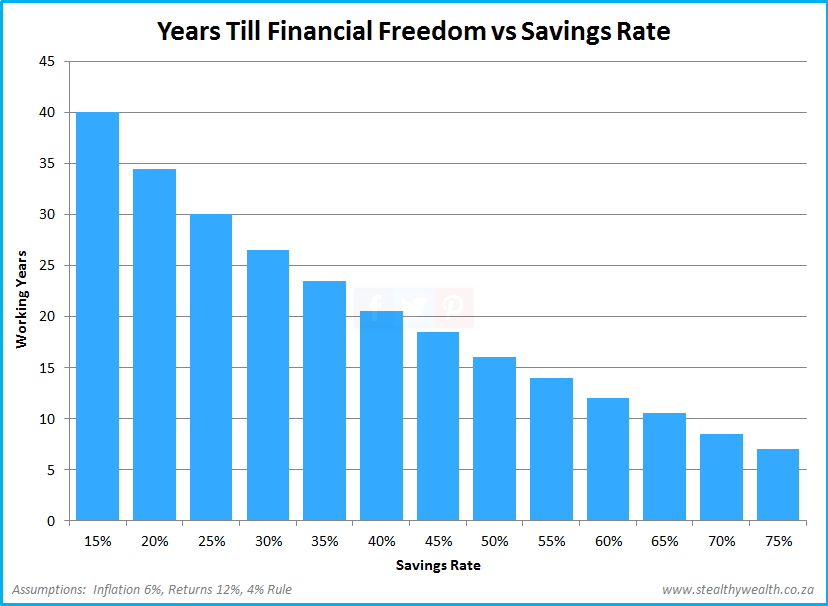

So what is a good Saving Rate value?

Well that depends on many factors. But in general, the higher the better.

Why?

Because your Saving Rate is the ONLY number which determines how long it will take you to achieve financial freedom http://www.stealthywealth.co.za/2020/02/how-long-to-financial-freedom.html">https://www.stealthywealth.co.za/2020/02/h...

Well that depends on many factors. But in general, the higher the better.

Why?

Because your Saving Rate is the ONLY number which determines how long it will take you to achieve financial freedom http://www.stealthywealth.co.za/2020/02/how-long-to-financial-freedom.html">https://www.stealthywealth.co.za/2020/02/h...

Read on Twitter

Read on Twitter