I am too empirical for the theoreticians

But given this debate, it seems worth setting out the stylized facts about the actual financing of the US deficit that I think any theory needs to explain

1/n https://twitter.com/JWMason1/status/1283943414996832256">https://twitter.com/JWMason1/...

But given this debate, it seems worth setting out the stylized facts about the actual financing of the US deficit that I think any theory needs to explain

1/n https://twitter.com/JWMason1/status/1283943414996832256">https://twitter.com/JWMason1/...

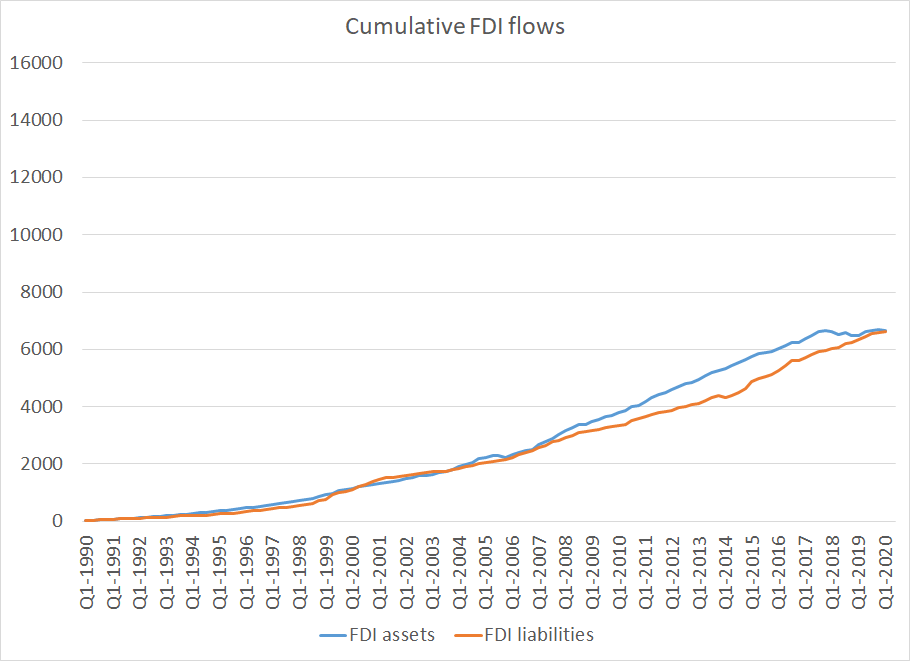

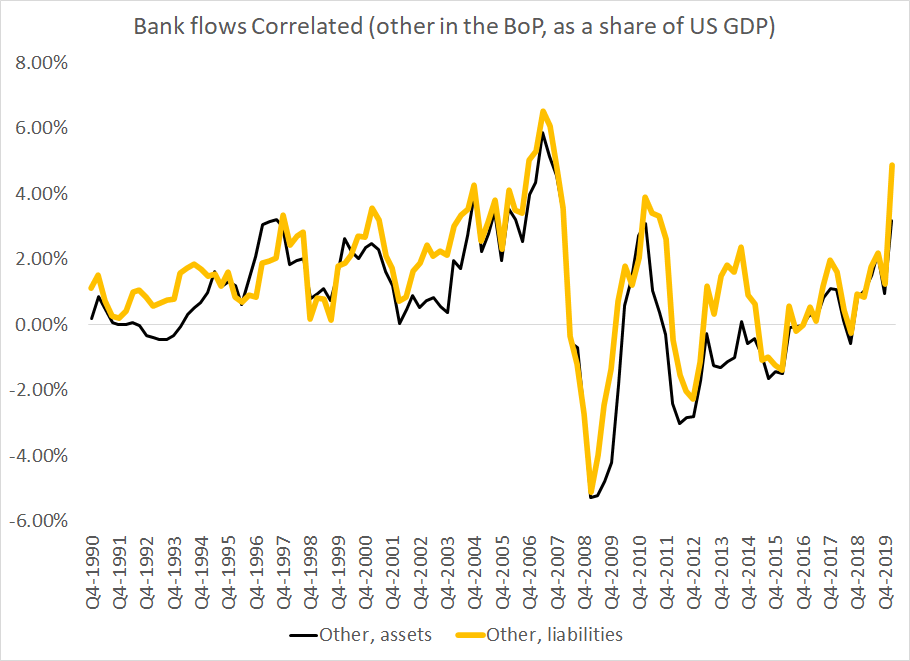

Bank flows (other in BoP speak) in and out of the US are in fact correlated. That& #39;s why they haven& #39;t accounted for the bulk of US current account financing over time.

The scale here has been set by cumulative portfolio flows (also over 30 years)

2/n

The scale here has been set by cumulative portfolio flows (also over 30 years)

2/n

Portfolio flows (and a disaggregation shows this is debt flows) haven& #39;t by contrast been correlated after 1995 --

Inflows far exceed outflows. So an explanation for the funding of the US current account deficit needs to explain this discrepancy.

3/n

Inflows far exceed outflows. So an explanation for the funding of the US current account deficit needs to explain this discrepancy.

3/n

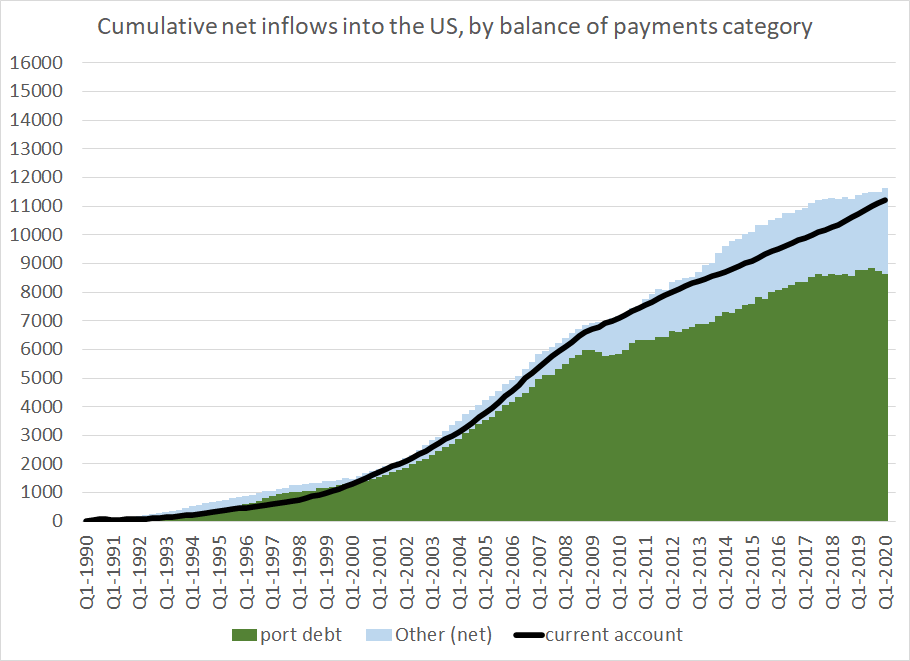

There is also no large discrepancy in FDI flows (i.e. FDI hasn& #39;t been the net source of funding for the US current account deficit, despite some popular accounts of how the desire by private investors to "invest" in the US drives the deficit)

4/n

4/n

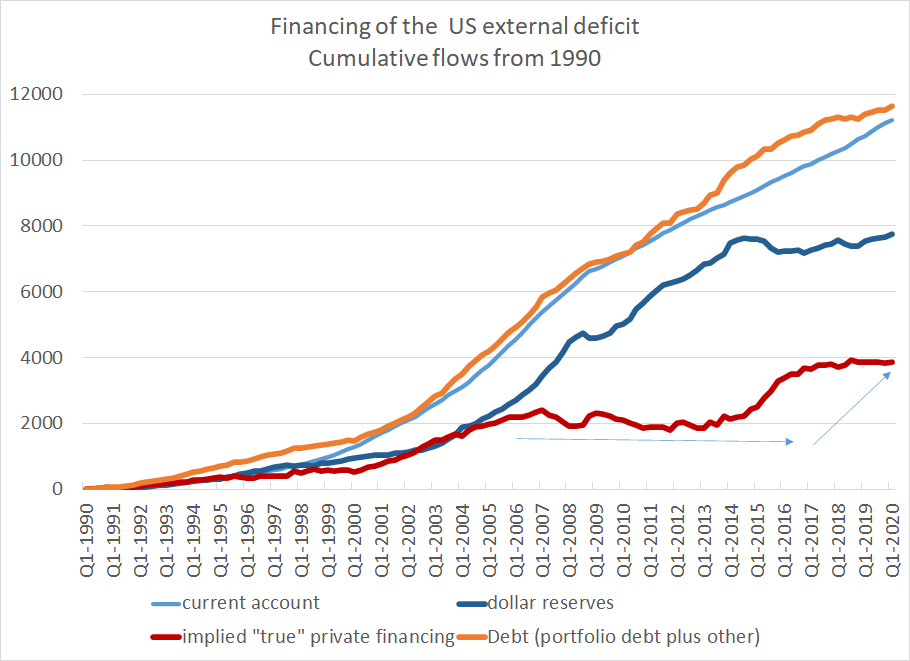

The buildup of portfolio debt claims on the US thus accounts for the net inflow that has financed (in the sense that the US built up a net debt position over time, and owes the world money) the US current account (basically trade) deficit

5/n

5/n

Bank inflows (on net) have become more important recently, partially b.c of CLO accounting (CLOs are typically Caymans held loans to the US administered by US banks and show up as a Cayman claim in other as the Fed has explained).

Basically, for most periods of time, to explain the US current account deficit you in a financial account sense need to explain the difference between foreign demand for US bonds and US demand for foreign bonds

6/n

6/n

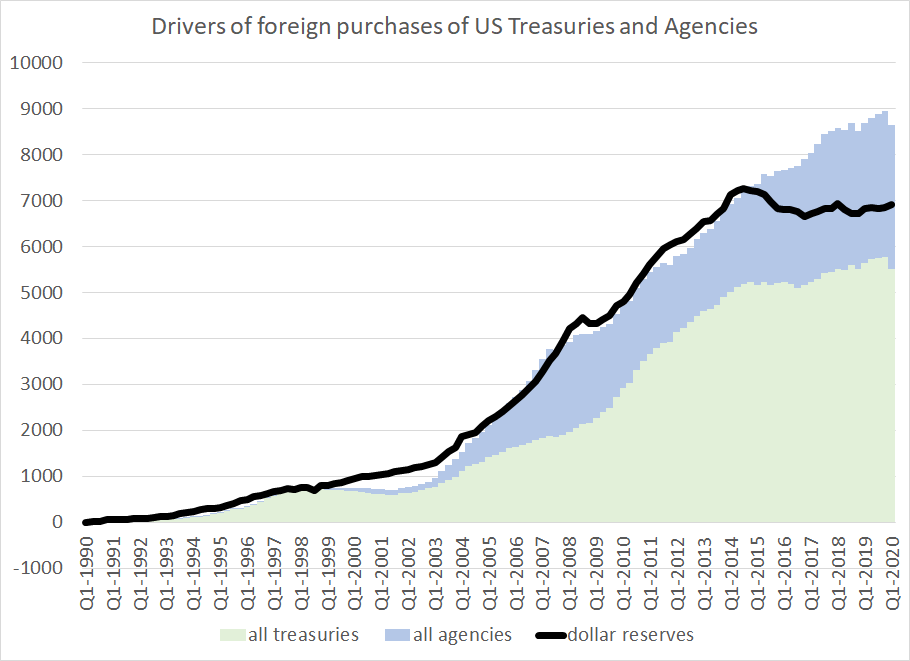

Foreign purchases of US corporate bonds tend to match US purchases of foreign corporate bonds (less so recently tho) -- the discrepancy is largely from massive foreign demand for US Treasuries.

And that is very correlated with demand for dollar reserves by official actors

7/n

And that is very correlated with demand for dollar reserves by official actors

7/n

And while reserve demand in Latin America largely comes from the official sector taking the other side of private inflows (to buffer v financial outflows) that isn& #39;t the case in Asia

8/n

8/n

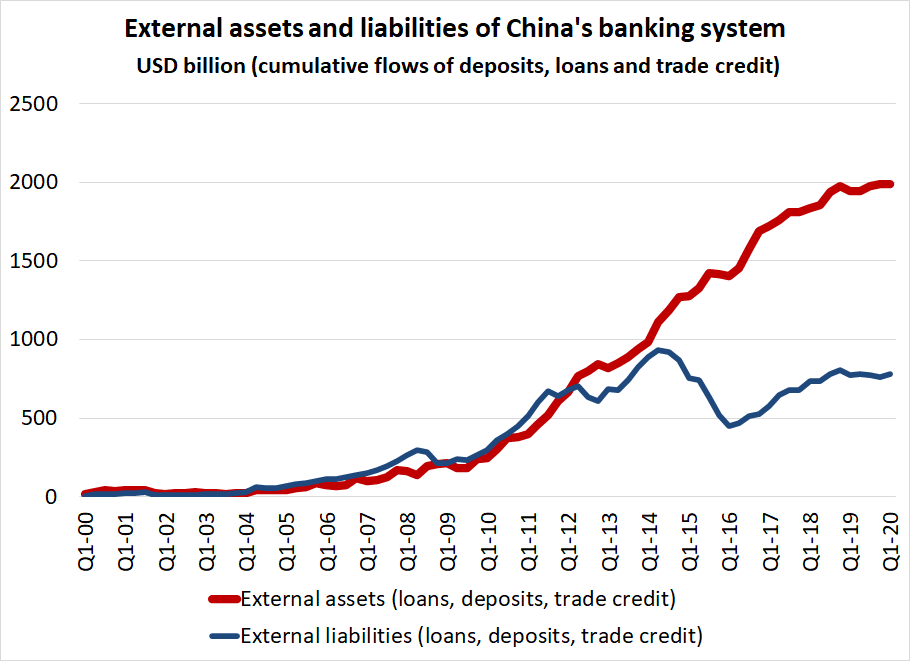

Now bank outflows have become more important as an offset for China& #39;s surplus recently (with two way flows, but the shift is a shift toward less two way flows as Chinese banks funded the Belt and Road and Go out and the like)

9/n

9/n

The bulk of China& #39;s external assets (and the net claim on the world) still comes from China& #39;s stockpile of reserves

(which was funded by a current account surplus not net financial inflows)

10/n

(which was funded by a current account surplus not net financial inflows)

10/n

So if you want to explain (in the grand sweep of things) the US current account deficit, you need to explain the accumulation of fx reserves and official assets in creditor countries, and portfolio inflows into the US

(not two way bank flows)

11/n

(not two way bank flows)

11/n

that& #39;s doesn& #39;t tho mean that two way bank flows don& #39;t matter -- the BIS has highlighted how gross positions can impact financial stability, and it is clear that the runup in bank flows/ positions from 04 to 07 was a leading indicator of the global crisis

12/n

12/n

I have explored these themes in a set of lectures that generally became blog posts -- this post, for example, is based on a talk at the Central Bank of Ireland

13/n https://www.cfr.org/blog/mapping-capital-flows-us-over-last-thirty-years">https://www.cfr.org/blog/mapp...

13/n https://www.cfr.org/blog/mapping-capital-flows-us-over-last-thirty-years">https://www.cfr.org/blog/mapp...

And this post was based on work I did for a conference in Iceland (I like islands in the North Atlantic, obviously)

14/n https://www.cfr.org/blog/three-sudden-stops-and-surge">https://www.cfr.org/blog/thre...

14/n https://www.cfr.org/blog/three-sudden-stops-and-surge">https://www.cfr.org/blog/thre...

And that in turn became this paper

15/n

http://www.centerforfinancialstability.org/iceland.php ">https://www.centerforfinancialstability.org/iceland.p...

15/n

http://www.centerforfinancialstability.org/iceland.php ">https://www.centerforfinancialstability.org/iceland.p...

Now it is no doubt true that private portfolio flows (see my work on Asian insurers) have become more important recently, but Taiwan& #39;s purchases of bonds is gross outflow (There is no offsetting inflow b/c of Taiwan& #39;s financial account restrictions)

16/n

16/n

And some private portfolio flows aren& #39;t really private -- think of the role of Korea& #39;s National Pension Service in generating a gross and net outflow from Korea which turns into demand for US financial assets

17/n

17/n

But I do agree with Pettis that to explain the U.S. current account deficit you need to understand the source of the inflows into the US -- and for much of the last twenty years that was a one way portfolio inflow to the US from reserve managers in Asia

18/18

18/18

Read on Twitter

Read on Twitter