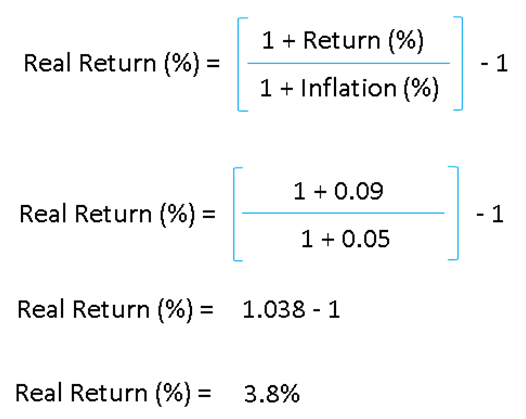

If you get a return of 9%, and inflation is 5%, what is your real return?

You might think it& #39;s (return - inflation)

=> 9% - 5% = 4%

Well, that& #39;s actually just an estimate. Here is how you calculate the real, real return (for real!)

[THREAD]

You might think it& #39;s (return - inflation)

=> 9% - 5% = 4%

Well, that& #39;s actually just an estimate. Here is how you calculate the real, real return (for real!)

[THREAD]

Let& #39;s say you had R100.

And let& #39;s say that, coincidentally, a widget also costs exactly R100

Using some advanced Maths, you can work out that your money can buy you precisely 1 widget.

And let& #39;s say that, coincidentally, a widget also costs exactly R100

Using some advanced Maths, you can work out that your money can buy you precisely 1 widget.

Now, let& #39;s say instead of buying a widget with your R100, you invested it and got a 9% return.

After 1 year, you will have R109

In that same year, inflation (at 5%) will mean the price of the widget is now R105

After 1 year, you will have R109

In that same year, inflation (at 5%) will mean the price of the widget is now R105

So that means you can now buy R109/R105 = 1.038 widgets

I.e. In widget terms (what your money can actually buy) you are 3.8% better off than a year ago

So your real return is 3.8%

(Not quite the estimate of 9% - 5% = 4%)

I.e. In widget terms (what your money can actually buy) you are 3.8% better off than a year ago

So your real return is 3.8%

(Not quite the estimate of 9% - 5% = 4%)

Read on Twitter

Read on Twitter