1. The Money Is Stuck Until You 55

The money in an RA is untouchable until you are 55 (unless you emigrate, or via a court order in divorce proceedings.)

This might be a saving grace for those easily tempted, but personally I wouldn& #39;t want my money stuck in RA prison till 55

The money in an RA is untouchable until you are 55 (unless you emigrate, or via a court order in divorce proceedings.)

This might be a saving grace for those easily tempted, but personally I wouldn& #39;t want my money stuck in RA prison till 55

2. Fees

A retirement annuity is a "wrapper" (as the cool kids call it.) The industry loves layers - an extra place to add fees.

Yes some of the more modern providers have very low fees - but my prayers are with you if your RA is being invested at a LOS https://twitter.com/stealthy_wealth/status/1267449931045974016?s=20">https://twitter.com/stealthy_...

A retirement annuity is a "wrapper" (as the cool kids call it.) The industry loves layers - an extra place to add fees.

Yes some of the more modern providers have very low fees - but my prayers are with you if your RA is being invested at a LOS https://twitter.com/stealthy_wealth/status/1267449931045974016?s=20">https://twitter.com/stealthy_...

3. Government limits what you can invest in

Regulation 28 dictates where you can invest your money. For example no more than 30% is allowed outside SA.

Personally, I don& #39;t like the Pension Police telling me what I can and can& #39;t do.

And the possibility of prescribed assets...

Regulation 28 dictates where you can invest your money. For example no more than 30% is allowed outside SA.

Personally, I don& #39;t like the Pension Police telling me what I can and can& #39;t do.

And the possibility of prescribed assets...

4. Returns likely to be less

There& #39;s plenty research showing equities will likely get you the best risk adjusted returns over the long term.

Reg 28 says you can& #39;t go 100% equity in an RA. So an RA is likely to find itself light in the pants compared to a full equity investment

There& #39;s plenty research showing equities will likely get you the best risk adjusted returns over the long term.

Reg 28 says you can& #39;t go 100% equity in an RA. So an RA is likely to find itself light in the pants compared to a full equity investment

5. Government controls what you do at the end

There& #39;s that pesky rule book again. This time it says that at maturity you can only take 1/3 of your RA as cash. The rest must buy an annuity product.

This might protect some people from themselves, but personally I don& #39;t like it

There& #39;s that pesky rule book again. This time it says that at maturity you can only take 1/3 of your RA as cash. The rest must buy an annuity product.

This might protect some people from themselves, but personally I don& #39;t like it

6. Tax at the end

While RA& #39;s can give a very nice upfront tax benefit, you give some of that tax back later on.

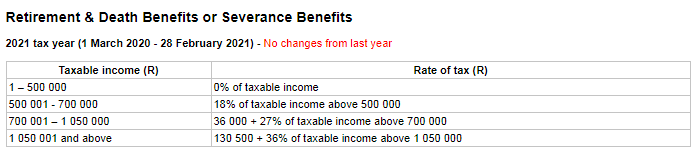

The 1/3 lump sum you are allowed to take out is taxed as per the table below

The income from the annuity you have to buy with the remaining 2/3& #39;s is taxed as income

While RA& #39;s can give a very nice upfront tax benefit, you give some of that tax back later on.

The 1/3 lump sum you are allowed to take out is taxed as per the table below

The income from the annuity you have to buy with the remaining 2/3& #39;s is taxed as income

7. Fees Again

The annuity product you are required to purchase with 2/3rds of your RA when it matures will have fees/be structured in a way that will likely leave you worse off than if you invested the money in your own choice of low cost products.

The annuity product you are required to purchase with 2/3rds of your RA when it matures will have fees/be structured in a way that will likely leave you worse off than if you invested the money in your own choice of low cost products.

8. The RA Tax Deduction Is Paid Back As Cash

Wait, what? How is this a bad thing?

Well, cash is always tempting...

Personally I think the rebate should be paid directly to the RA provider to reinvest on the investors behalf - but that& #39;s just me.

Wait, what? How is this a bad thing?

Well, cash is always tempting...

Personally I think the rebate should be paid directly to the RA provider to reinvest on the investors behalf - but that& #39;s just me.

9. Tax Laws Can Change

Tax laws, income brackets, rebates and exemptions are always changing. There is no ways of knowing what these will be like when your RA matures.

It& #39;s possible that the tax benefits an RA gives you now could be undone by unfavourable tax rates in future

Tax laws, income brackets, rebates and exemptions are always changing. There is no ways of knowing what these will be like when your RA matures.

It& #39;s possible that the tax benefits an RA gives you now could be undone by unfavourable tax rates in future

Read on Twitter

Read on Twitter