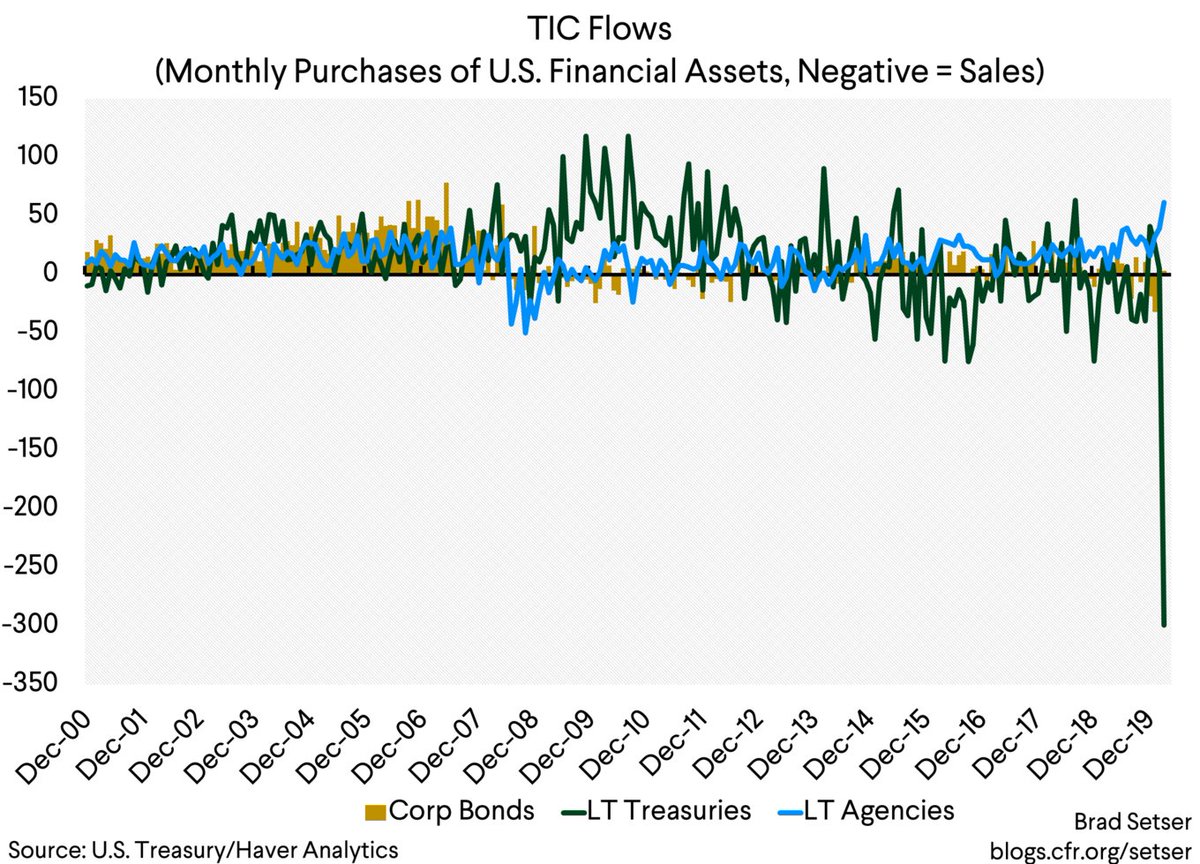

Central banks around the world sold well over $100 billion in long-term Treasuries in March. Those sales came when private U.S. investors were also selling. The dollar& #39;s role in global reserves thus made the Fed& #39;s job harder, not easier https://www.cfr.org/blog/did-dollars-position-leading-reserve-currency-help-hold-treasury-yields-down-spring">https://www.cfr.org/blog/did-...

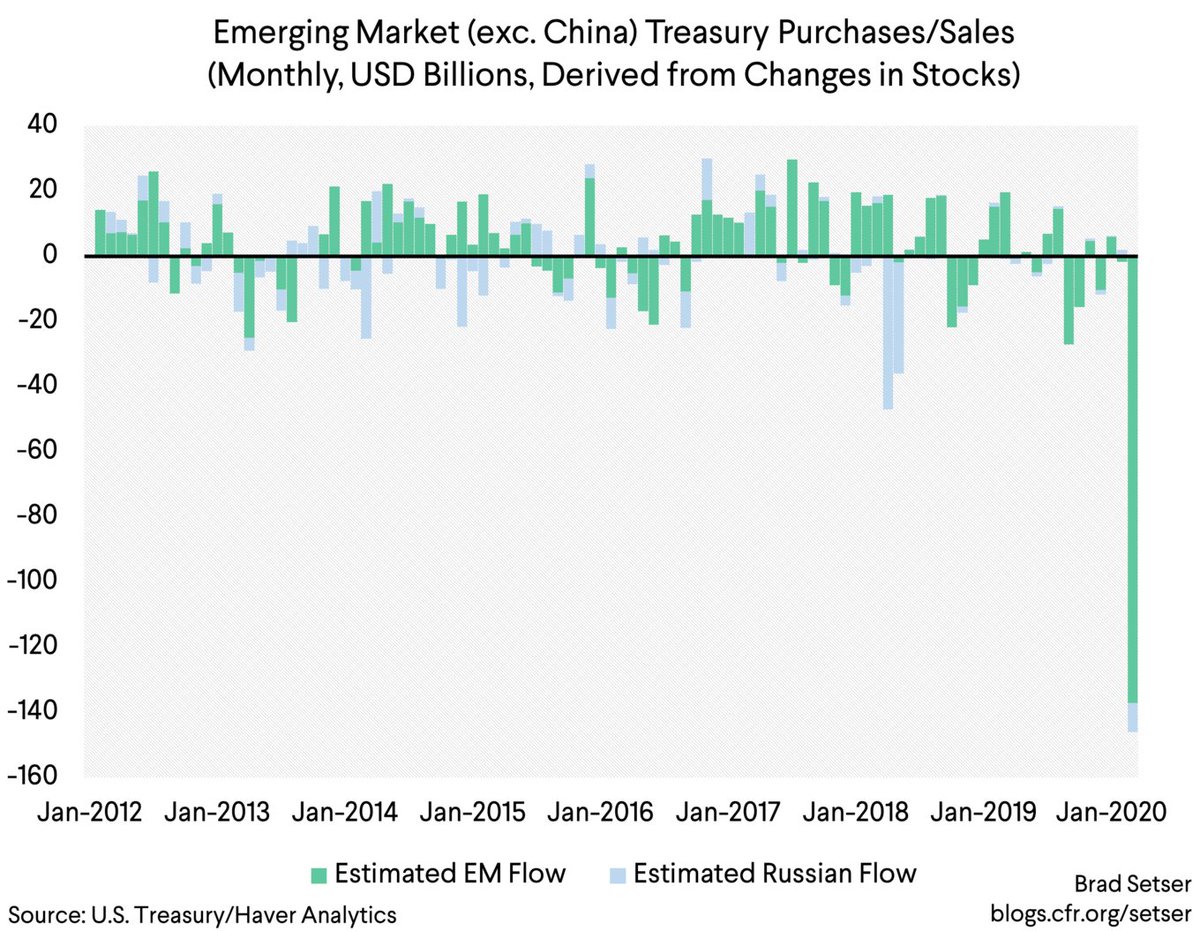

One key thing to remember is that 10y Treasury yields were rising in mid March. Banks were under funding stress as firms drew on standing credit lines. The cash-futures basis trade was blowing up. And EM central banks were forced sellers ...

The Fed of course stepped in and saved the day, buying over $450b of notes and bonds in March alone (reducing the stock held by the market) and bringing the 10y rate back down.

But the fall in yields was due to the Fed, not a result of the dollar& #39;s role as a reserve currency!

But the fall in yields was due to the Fed, not a result of the dollar& #39;s role as a reserve currency!

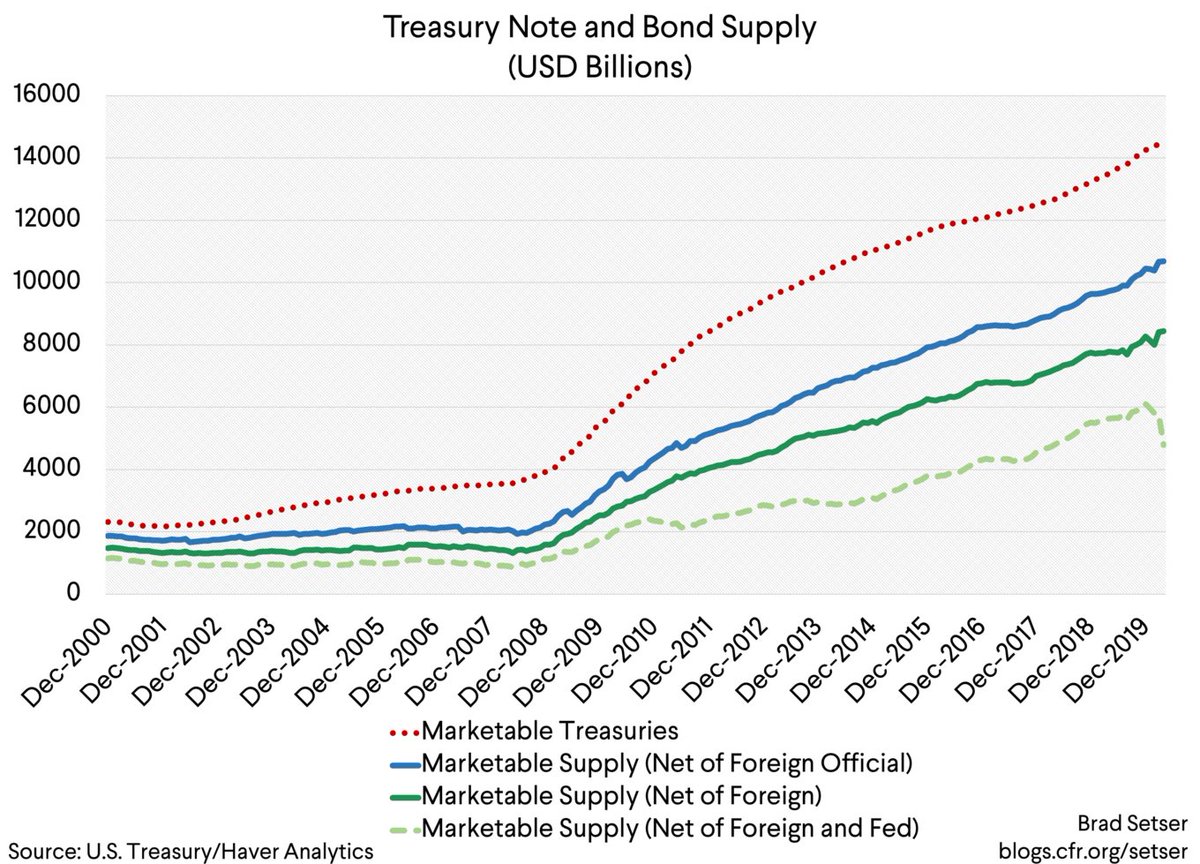

The events of March to me settle a long-standing debate -- is the impact of foreign central banks on the Treasury market best modeled as a constant (dollar share of global reserves), or as a flow.

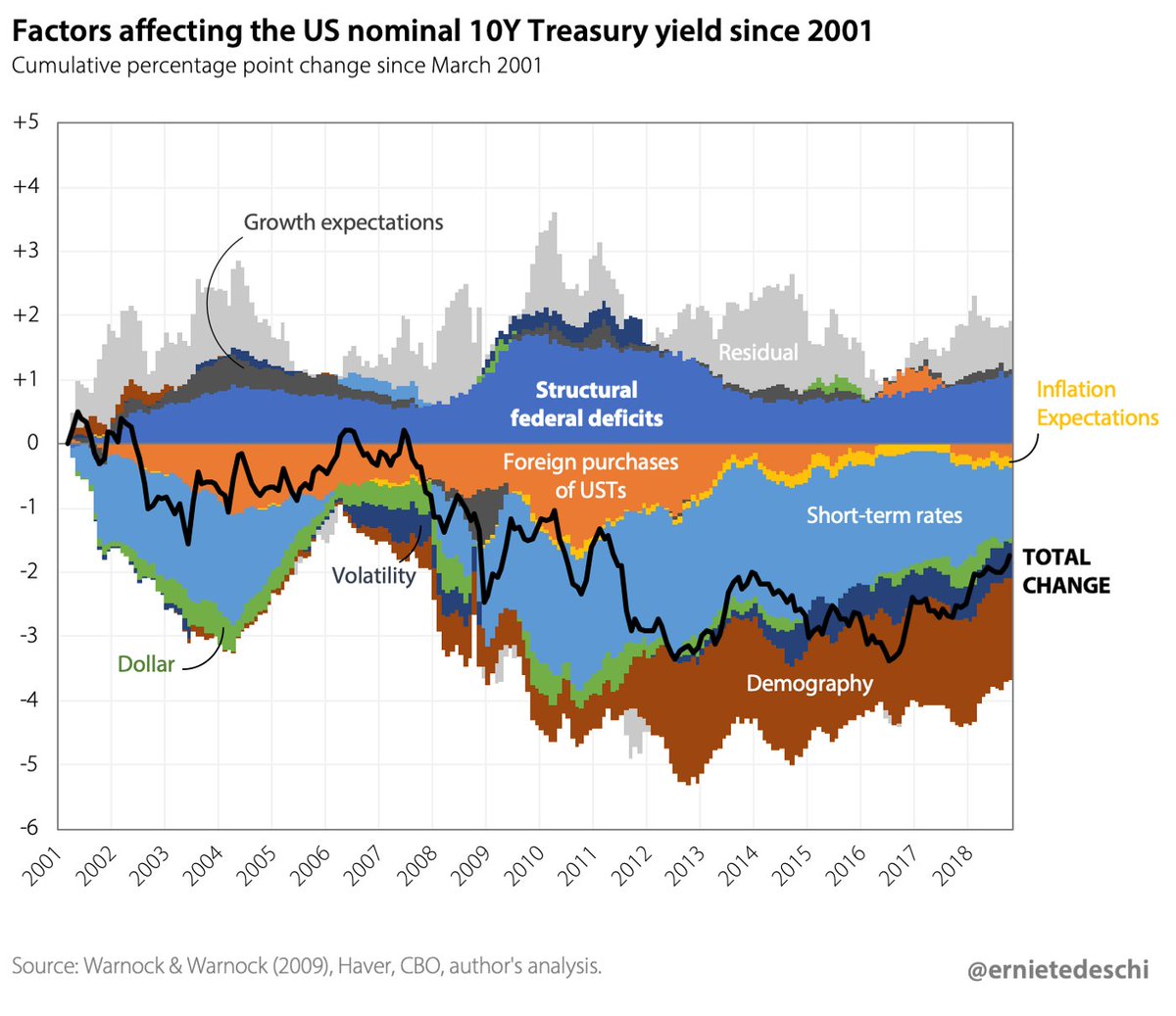

Would love to see an updated @ernietedeschi chart here!

Would love to see an updated @ernietedeschi chart here!

I obviously think the "flow" matters. China and others held down 10y yields before the global crisis b/c their reserve purchases exceeded Treasury issuance by a mile (they were forced into Agencies). And the sales of EM central banks in March worked in the other direction

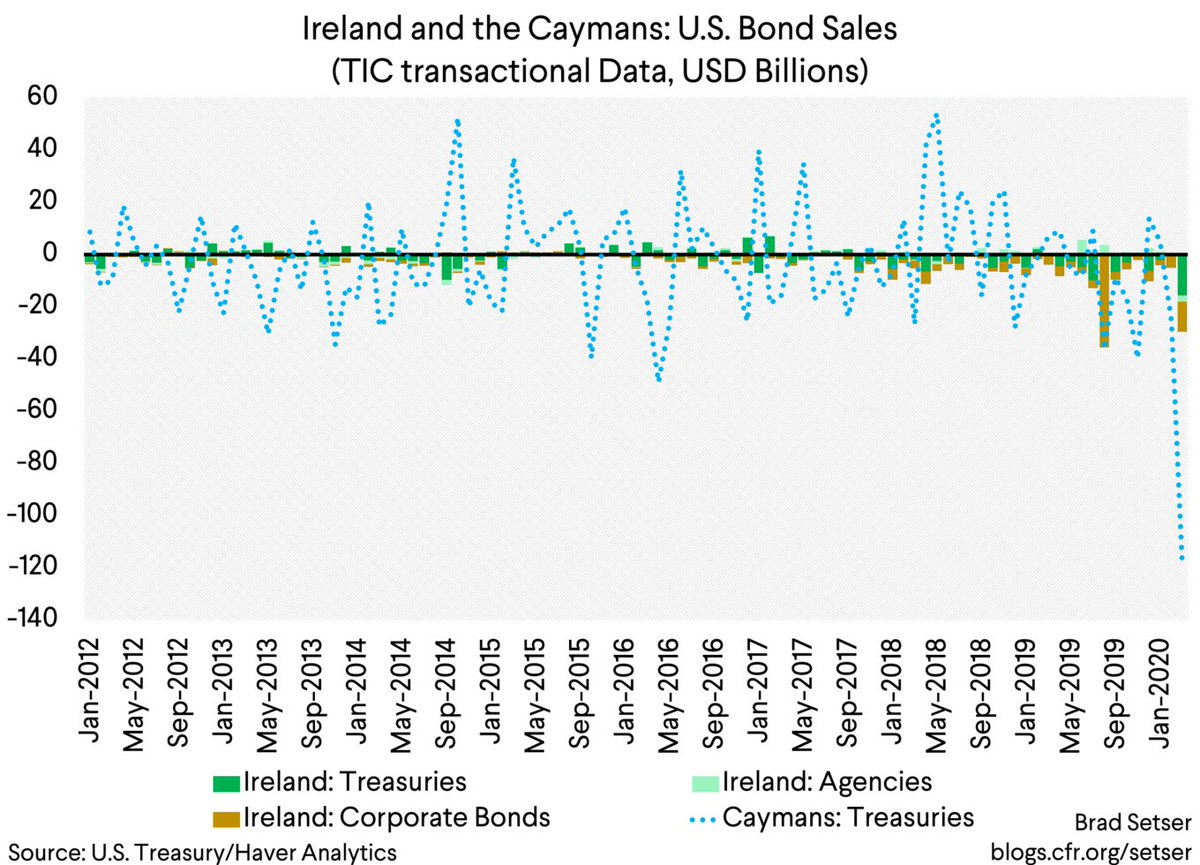

And I conclude with a bit of old fashioned TIC blogging -- the massive sales by the Caymans in the "transactions" numbers (for LT Treasuries) weren& #39;t mirrored fully in the holdings data.

Leads here would be appreciated ...

Leads here would be appreciated ...

It is easy to understand purchases and sales in London as the transactions of global central banks (and others). But the reallocation away from the Caymans (the transactions data) to official accounts (in the holdings data) in March is a bit strange.

(very technical tho)

(very technical tho)

Read on Twitter

Read on Twitter