Some great new forensic work out from @BIS ( Eren, Schrimpf and Sushko) -- delving into why dollar funding markets ceased up in March.

The story apparently starts with flows out of prime MMFs, and into Treasury MMFs

https://www.bis.org/publ/bisbull14.pdf

1/n">https://www.bis.org/publ/bisb...

The story apparently starts with flows out of prime MMFs, and into Treasury MMFs

https://www.bis.org/publ/bisbull14.pdf

1/n">https://www.bis.org/publ/bisb...

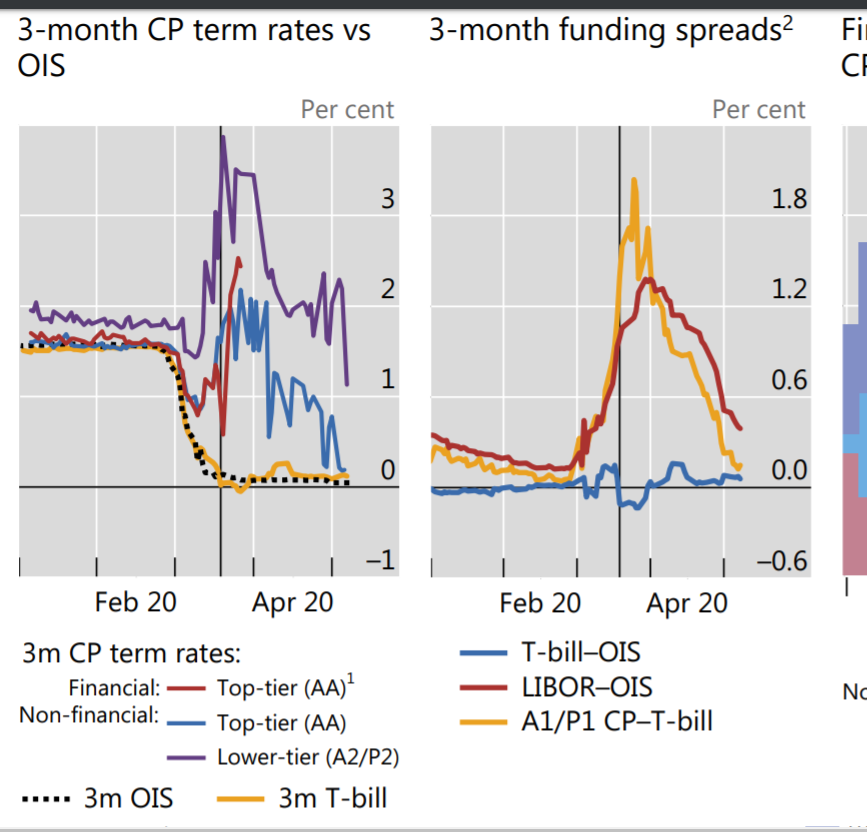

The outflows from prime money market funds, which hold financial commercial paper and fund many offshore banks, led CP rates to rise even as the Fed was cutting rates.

(LIBOR now apparently is set heavily off CP rates as well)

2/n

(LIBOR now apparently is set heavily off CP rates as well)

2/n

The broker dealers were under pressure at the time and couldn& #39;t help the prime MMFs out. They basically stopped doing anything other than overnight lending ...

" Activity in CP and CD markets came close to a halt"

Scary stuff.

Monetary transmission was impaired

3/n

" Activity in CP and CD markets came close to a halt"

Scary stuff.

Monetary transmission was impaired

3/n

wonder how the US government was able to fund itself in March?

"By end-March, government and Treasury MMFs saw inflows in excess of $800 billion, or about

30% of their assets under management. The ensuing investment needs of fund managers pushed T-bill

rates towards zero."

4/n

"By end-March, government and Treasury MMFs saw inflows in excess of $800 billion, or about

30% of their assets under management. The ensuing investment needs of fund managers pushed T-bill

rates towards zero."

4/n

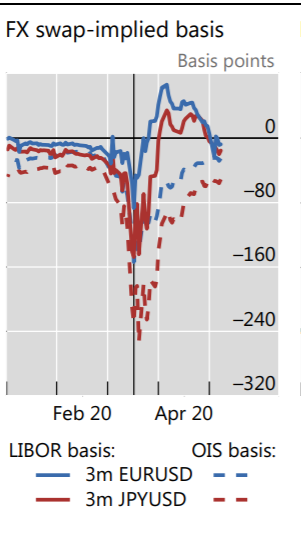

And that in turn put pressure on the cross currency swap market, as it is another way for non-US banks to raise dollar funding

That topic is covered in the second @BIS bulletin released today

https://www.bis.org/publ/bisbull15.htm

6/n">https://www.bis.org/publ/bisb...

That topic is covered in the second @BIS bulletin released today

https://www.bis.org/publ/bisbull15.htm

6/n">https://www.bis.org/publ/bisb...

That pressure from the CP/ CD market led the basis (cost of borrowing dollars through the swaps market) to blow up. Key here is the basis v OIS (risk free). The fed wanted that to be small ...

7/n

7/n

The cost of swapping yen into dollars in particular rose -- and was above the cost of simply borrowing dollars unsecured

(but then note that it fell quickly one the Fed& #39;s swap line was introduced)

8/n

(but then note that it fell quickly one the Fed& #39;s swap line was introduced)

8/n

In fact, the swap lines were so effective at bringing down the cost of swaps that it became attractive to borrow in euros and swap into dollars rather than borrow in dollars directly ...

and that in turn helped bring down dollar LIBOR/ US CP rates

9/n

and that in turn helped bring down dollar LIBOR/ US CP rates

9/n

A tale of the modern LoLR in action ... and the story of a market under immense stress.

Great work from @HyunSongShin and the team at the BIS.

The BIS Bulletin is one of the best (financial) innovations of the COVID crisis ...

10/10

Great work from @HyunSongShin and the team at the BIS.

The BIS Bulletin is one of the best (financial) innovations of the COVID crisis ...

10/10

Read on Twitter

Read on Twitter