1/ Here are some observations (O), misconceptions (M), and Predictions (P). regarding COVID-19, business and investing.

Please retweet if you like and find them useful. And tweets with the most ♥︎& #39;s, I will expound upon further in a series of blog posts.

Please retweet if you like and find them useful. And tweets with the most ♥︎& #39;s, I will expound upon further in a series of blog posts.

3/ (O) Starting with COVID-19: Most people have forgotten what “flatten the curve” means. It is done to delay the peak of active cases, to not stress a healthcare system. The actions are not done primarily to solve virus spread.

4/ (O) Epidemiologists (both real and armchair ones) remind me of @nntaleb remark that – “The problem of knowledge is that there are many more books on birds written by ornithologists than books on birds written by birds and books on ornithologists written by birds” #NNTaleb

5.1/ (M) Politicians world-wide followed “expert advice” – Criticisms of their actions being late are dumb because early data was sparse anyway, falsified, and not recorded universally in the same manner.

5.2/ Bayes Theorem tells you to update your priori as fresh evidence becomes available, and that happened as COVID-19 escalated. Most governments, therefore, acted correctly.

6.1/ (O) Where they failed is not giving every citizen a mask. Even a 50% (probability) effective mask will reduce a viral spread by 75% (probability) if both people wear one.

6.2/ It is a no-brainer solution to send every household a mask in the mail. Total cost $1bn dollars (328M Americans). And fine people $1000 if they go out in public not wearing one. "Kiss principle: Keep it Simple, Stupid"

7.1/ (M) COVID-19 is not a black swan event. There are dozens of movies about pandemics. And speaking of black swans – they are not about frequency or rare events – they are about disproportionate effects i.e. Fat tails.

7.2/ Governments shut down economies because of the fat tail of the distribution. There was a small probability (ex ante) of enormous death toll because of exponential growth of the virus (power laws).

8/ (O) Political bias is destroying truth discovery. For instance, most people in the United States are living examples of confirmation bias of their left/right stance pre-COVID-19 on how they view the actions of the Trump Administration post-COVID-19. @realDonaldTrump

9.1/ (O) Mainstream and social media, despite their reach have inexplicably been giving false narratives because of availability (limited information) bias, political bias, confirmation bias, anchoring (on old data from other countries), herd mentality, and self-serving biases.

9.2/ The incentive structure of media needs to change from advertising dollars to something that supports truth, science and common sense. @fbnewsroom @CNBC @nytimes @Reuters @WSJ @business @thetimes @BBCWorld @washingtonpost @Twitter @jack

10.1/ (O) If you despise or disagree with your elected official. i.e. @POTUS @BorisJohnson... Look around the world today...

10.2/ If you think you have it bad, then consider @narendramodi Kim Jong-un @jairbolsonaro Erdogan @trpresidency Khomeini @NicolasMaduro Viktor Orban – As H. L. Mencken once said “A good politician is quite as unthinkable as an honest burglar.”

11/ (M) Comparing COVID-19 data country to country may seem like a fun armchair sport, but is a futile endeavour – As Mark Twain said “Facts are stubborn things, but statistics are pliable.” – Data reported is not equal.

12/ (O) Countries also vary on Demographics, Geography/Urbanisation, Social customs, Genetics, Behavior and the Lockdown rules put in place. Inferences and snap conclusions are usually wrong when there are confounding variables.

13.1/ (M) Countries needed to be locked down: 1) to flatten the curve 2) to buy time to get medical equipment 3) to buy time to collect data (testing) 4) to lessen the viral spread between places. It was not about freedom or taking away your rights as a citizen.

13.2/ And for all those against opening up the economy this month, it is not about not caring about the health and welfare of citizens.

14.1/ COVID-19 is not a government conspiracy. Whether you are for/against, left/right, rich/poor, young/old etc… in no universe could you say this was one smooth, cunning and organised plan.

14.2/ Everything in between the hard actions and deliverables was mostly shambolic, chaotic and dysfunctional – just as all bureaucracies tend to deliver.

15.1/ (O) The one certainty is COVID-19 affects people with pre-existing medical conditions more so than a healthy individual.

15.2/ This includes things as simple as diet, smoking, poor lifestyle, vitamin D deficiency, stress, etc. The takeaway here is that everyone should do their best to kick destructive habits and take care of themselves if they aren’t doing so already.

16.1/ (M) COVID-19 is a health scare, not an economic crisis. Stock markets did not fall because people were getting sick or dying. Stock markets fell because businesses were being told to close in country after country.

16.2/ Closing a business is equivalent to zero revenue, zero profits, zero economics.

17/ (M) As of May 12th 2020, there are 4.3M COVID-19 cases worldwide and 288K deaths. There are 7.8B people in the world today. Wondering why stock markets are rallying? Stock markets do not care about 0.05% of the world population testing positive for COVID-19.

18.1/ (M) The global economy was voluntarily shut down by Governments – a self-induced economic “pause”. Stock markets reacted negatively to this because of uncertainty, causing the fastest bear market (-35%) in history in 4 weeks culminating on March 23rd 2020.

18.2/ Indiscriminate selling took place because of leverage and margin calls. When the expected PV of future cash flows falls, the market price of a company goes down. Pressing “play” again results in uncertainty being removed in some businesses.

19.1/ (M) The S&P 500 is an index of 500 largest companies in the United States weighted by market capitalization. It is not “the” stock market, it is “a” market of stocks.

19.2/ At $28T, it may count for 75% of the total US market capitalisation ($38T) but it represents 500 companies out of 4000 public companies in the US (12.5%).

19.3/ It may be a gauge where capital is efficiently being allocated on aggregate, but it is not a gauge on how businesses are performing on average.

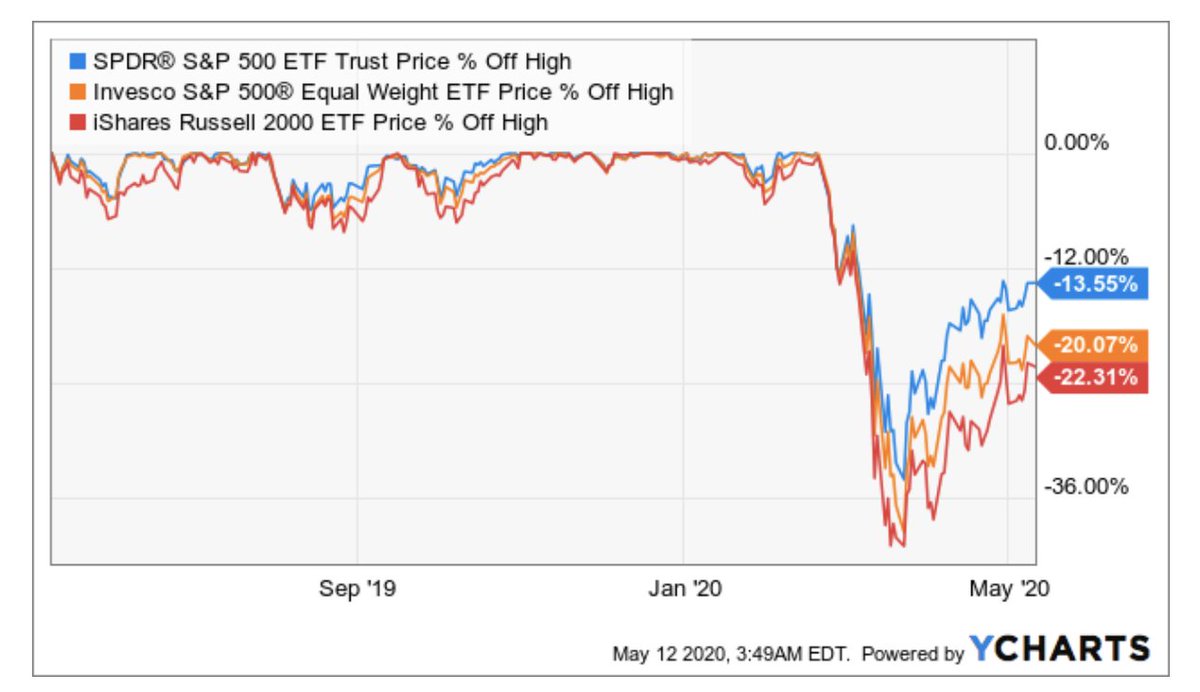

20.1/ (M) If you think “The $SPY is overvalued”...Then 1) Look elsewhere. Look Deeper. Don’t buy the $SPY 2) An equal weight S&P 500 $EWI $RSP is underperforming $SPY by -7%.

20.2/ The Russell 2000 $IWM is underperforming $SPY by -10% 3) Other country’s market indices are down still in a bear market $FTSE 100 (-23%) $CAC 40 (-26%) $DAX 30 (-21%)

Home country bias and assuming the $SPY is the same US stock market it once was is foolish.

Home country bias and assuming the $SPY is the same US stock market it once was is foolish.

21.1/ (O) Why have the $NASDAQ $QQQ and $SPX regained their losses so fast? Because not all companies are equal. Not all companies have been closed for business. Technology companies have shown their anti-fragility and gained through disorder. $FB $AMZN $AAPL $MSFT $NFLX $GOOG.

21.2/ They now make up +20% of the total market capitalisation of the $SPY.

22/ (M) To bet on a crash back to March 23rd lows, is a bet against 20% of the index that is growing in a pandemic. The $FAANGM trade was the best trade in the last 5 years as their prices snowballed. In retrospect, Mr Market priced these businesses correctly.

23.1/ (O) They are not just US companies...Each of the $FAANGM are global monopolies in separate niches in growth markets. Each of them a TAM of 7.8bn people (and corporations) and their market capitalisations reflect that.

23.2/ $FB = communication, $AMZN = commerce, $MSFT = productivity, $NFLX = entertainment, $GOOG = information, $AAPL = you (identity and ego).

24.1/ (M) The world has not seen organisations like this before because they are global and algorithmic in what they offer as a service and/or produce.

24.2/ It is a coincidence they are all located in the United States and therefore pricing the $SPY above other major stock indices of other countries.

25.1/ (M) This is also why it is dumb to point to US GDP growth of -4.8% and Unemployment of -14.7% and compare it to “the stock market” i.e. $SPY. $FAANGM (20% of $SPY) is collecting a toll from every country in the world and billions of people.

25.2/ Further, markets are forward looking discounting machines. Trailing statistics matter little unless they are over/under estimated and need to be recalibrated.

26.1/ (O) People make up markets. People learn. Markets learn. At the start of this 3 months ago, information was low and uncertainty was high.

26.2/ Just like the public have learnt how to behave (social distancing) to reduce infection, markets have learnt how businesses are each affected by COVID-19. Markets are discriminating companies and sectors correctly in the environment when you look beneath the index surface.

27.1/ (M) Will $6T of QE and government spending cause inflation? Capitalism and Technology are deflationary. Therefore, there was less than expected inflation and growth in the last decade in the US.

27.2/ Any growth is likely to have occurred because of increases in debt per capita.This will produce growth at lower and lower costs of capital, but it obeys the Law of Diminishing Returns.

28.1/ (O) Capitalism will drive down prices over time because any excess profits in a market will invite competition, producing excess supply, and overcapacity relative to demand. Prices in most markets, if balanced, will move toward the cost of production.

28.2/ Excess returns will move toward the cost of capital. Technology accelerates this process. Hence the deflationary forces felt in a developed economy. Marc Andreessen @pmarca @a16z should have written, “Software is eating the world and inflation”.

29.1/ (O) Consumers win in this environment and if a country is optimising for welfare and the quality of life of its citizens, they should embrace it. Not experiment with accounting and optimise what they believe to be healthy inflation. Asset prices will reflect reality.

29.2/ Redundant assets are worth zero. Productive assets are always worth something in an inflationary or deflationary environment.

30.1/ (M) Anyone who promotes Bitcoin $BTC to protect against hyperinflation is talking about their book. Trading bitcoin is akin to trading sardines. It is not a productive use of capital.

30.2/ Love or hate his behavior @elonmusk finds productive uses of capital that have a net benefit to society.

31/ (O) @realDonaldTrump is also loved and hated. The irony is the Trump policies on 1) Reducing immigration and increasing border control 2) bringing manufacturing back to the US 3) Penalising China on trade and other behavior all have some merit in the backdrop of COVID-19.

32.1/ (P) Marginal producers of products or services will shrink or die in 2020. There was too much capital in private markets financing “disruptive” companies that were putting lipsticks on pigs.

32.2/ @WeWork is the marginal producer of office space (with a dumb financing model of borrow long and lend short). @Uber is the marginal supplier of taxi services. @Airbnb is the marginal supplier of accommodation. @SoftBank is the marginal supplier of capital. $UBER $SFTBY

33.1/ (P) 3 sectors of the economy not disrupted in the last 10 years are Education, Construction & Healthcare. This is because they are 1) Complex systems 2) Bureaucratic with legal & regulatory red tape. 3) Require an overhaul in terms of stakeholder alignment & business models

33.2/ COVID-19 has exposed the weakness in all 3 categories and they are now prime for innovation and disruption. These sectors will have positive effects on all people in society and quality of life, if we allocate capital to them.

34.1/ (P) COVID-19 is a lucky break and test-run for the world. There is a probability of 1 that another pandemic will emerge in the next 0-1000 years, and probably will be much worse in contagion and mortality. It’s biology and evolution.

34.2/ The systems, equipment, research and procedures invested in now by Governments will be worth many-fold – As Benjamin Franklin said “an ounce of prevention is worth a pound of cure” – And this is why @elonmusk @SpaceX mission is to develop a second civilization on Mars.

35.1/ (M) While most are looking at COVID-19 as a weight on the economy bringing it to a standstill, it is actually an accelerant of secular trends that have been taking place in the last 5 years.

35.2/ Namely 1) Retail moving from offline to online $SHOP $AMZN 2) Advertising from traditional medium $WPP $OMC to online $FB $GOOG 3) Overpriced traditional education to online @coursera @khanacademy @youtube. 4) Fixed cost structures to variable Cloud systems $MSFT @Azure.

35.3/ Lastly, 5) Cord cutting your home cable and switching to online streaming $DIS $NFLX. You can not fight inevitable trends.

36.1/ (O) 50% of new businesses die within 3 years. 80% within 5 years. COVID-19 brings death earlier to the aged population and speeds up the mortality of new businesses like your neighbourhood restaurant.

36.2/ It is not about equality and fairness between small local businesses and large chains, if you are the marginal supplier and don’t have scale economics, your business is fragile.

36.3/ Death of a business today is better than delaying the inevitable, as resources – both tangible and human capital – can be allocated to other endeavours. You either evolve or die.

37/ (P) Coming out of COVID-19 successfully as a company requires decent stakeholder management of shareholders, creditors, employees, customers, and community. If you are not running a balanced organisation in 2020 from now on you’re likely digging your own grave.

38/ (P) If blockchain doesn’t find use cases to disrupt while incumbents in various industries are contracting & under intense financial pressure, it’s fair to say that the technology serves no actual purpose. This is prime time to decentralise rent takers e.g. @Uber @Airbnb $FB

39/ (O) Two years ago Cannabis was the spaghetti being flung on walls to treat every single health ailment. Looks like they fired the marketing teams as they missed the COVID-19 cures.

40/ (O) Whatever happened to Brexit? The talk and frenzy for 3 years hasn’t been covered by the media in months.

41/ (O) Modern Monetary Theory was an oddity when it surfaced as protocol for running the economy last year. It was mostly rejected as flawed. Now in the COVID-19 era, many of its fiscal principles are being conducted to induce inflation and stimulate the economy.

42.1/ (P) Finally – President Trump will win reelection in 2020 unless there is a detrimental political misstep.

42.2/ Because, 1) Joe Biden can’t campaign and Trump can do 2 hours live TV every day for another couple of months

42.3/ 2) More and more fiscal and monetary stimulus can keep corporates in business and citizens able to pay bills 3) The election will be won on the success of the war on COVID-19, and Trump has a record here, Biden does not.

Read on Twitter

Read on Twitter