Argentina is doing a virtual road show to market its bond exchange this week. And by all accounts it faces an uphill challenge -- in part, I fear, because some bond holders retain unrealistic expectations about Argentina& #39;s ability to pay.

https://www.economist.com/the-americas/2020/04/23/argentinas-make-or-break-moment

1/n">https://www.economist.com/the-ameri...

https://www.economist.com/the-americas/2020/04/23/argentinas-make-or-break-moment

1/n">https://www.economist.com/the-ameri...

The bonds offered in the exchange offer investors some real long-term upside -- a par bond with a coupon that steps up to 4.75 should be worth more than 30-35 cents over time.

But investors seem more focused on the absence any near term coupon

2/n

But investors seem more focused on the absence any near term coupon

2/n

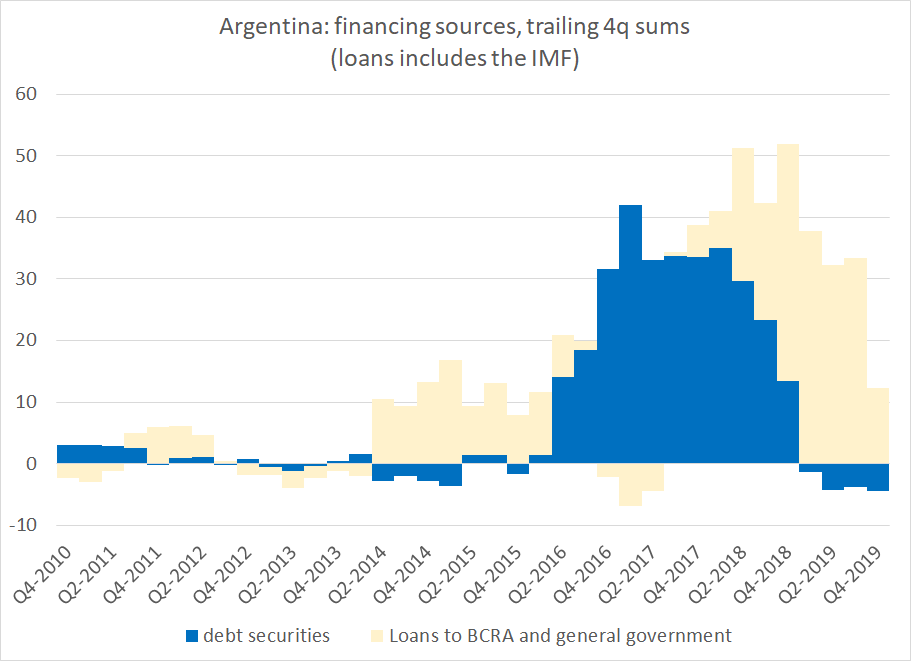

The lack of coupon though comes from the IMF, which isn& #39;t willing to lend Argentina more to pay private debt. It is in a sense the price bond holders are paying for all the debt service (and capital flight) the IMF financed back in 18 and 19

3/n

https://www.imf.org/en/Publications/CR/Issues/2020/03/20/Argentina-Technical-Assistance-Report-Staff-Technical-Note-on-Public-Debt-Sustainability-49284">https://www.imf.org/en/Public...

3/n

https://www.imf.org/en/Publications/CR/Issues/2020/03/20/Argentina-Technical-Assistance-Report-Staff-Technical-Note-on-Public-Debt-Sustainability-49284">https://www.imf.org/en/Public...

Argentina& #39;s GDP fell in the second half of 19, and it is forecast to fall another 5-6% this year thanks to the coronavirus. Moving into a primary fiscal surplus in that kind of downturn isn& #39;t feasible (nor is it desirable)

4/n

4/n

One key question in any restructuring is what kind of long-term growth to assume.

And here, if you want a path to sustainability, it is generally a good idea that future growth won& #39;t differ too much from past growth

5/n

And here, if you want a path to sustainability, it is generally a good idea that future growth won& #39;t differ too much from past growth

5/n

Over the past ten years, under the Peronist& #39;s/ Kirchner and under the more right leaning Macri, Argentina really hasn& #39;t generated any sustained growth

(the blip in output in 2017 was linked to the debt fueled consumption bubble that got Argentina into trouble)

(the blip in output in 2017 was linked to the debt fueled consumption bubble that got Argentina into trouble)

Some creditors have been arguing that Argentina is just facing a short-term liquidity problem, and thus the reduction in coupon (to 3.75 to 4.75) in the par exchange isn& #39;t warranted.

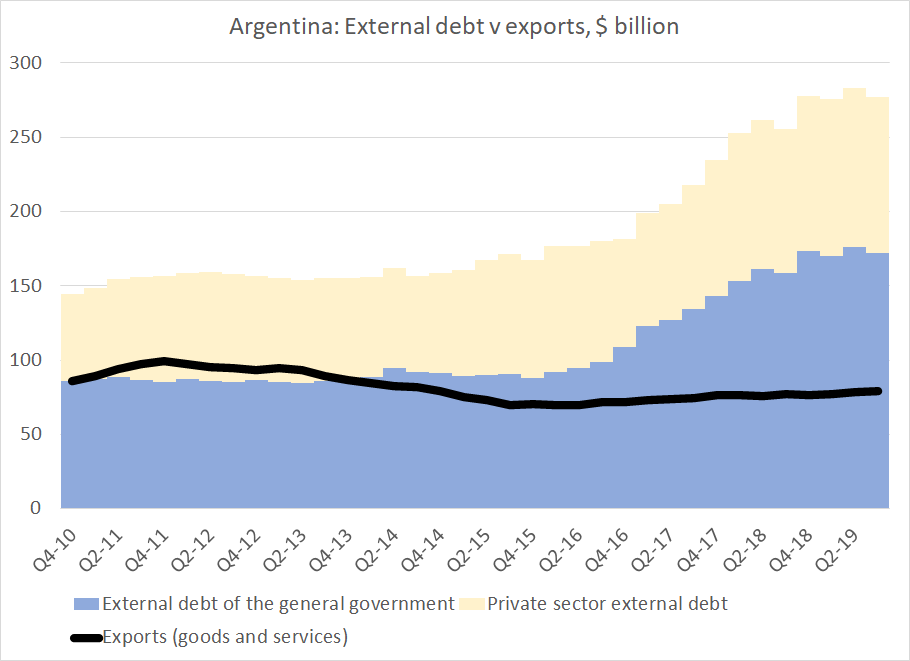

But Argentina& #39;s external debt really has soared ...

7/n

But Argentina& #39;s external debt really has soared ...

7/n

That increase in external debt is partially tied to the peso& #39;s depreciation (and fx denominated debts). But without a weaker peso, Argentina cannot generate the fx needed repay its external debt in real terms. Dollar GDP cannot just be assumed back up imo ...

8/n

8/n

Macri& #39;s policy mix (fiscal and external deficits financed by bonds, with an open capital account allowing large scale capital flight) led public external (that is held by non-residents) debt to double in a very short-period of time

9/n

9/n

The external debt of the government doubled thanks to heavy borrowing from non-residents (and overall external debt rose by ~ $100b) while payment capacity (exports) was flat.

that created a solvency problem -- which in a par exchange, means coupon reduction

10/n

that created a solvency problem -- which in a par exchange, means coupon reduction

10/n

There is also concern that Argentina now isn& #39;t doing enough fiscal adjustment -- which is normal.

Though I would hope creditors recognize that the corona virus downturn isn& #39;t the right time for austerity.

11/n

Though I would hope creditors recognize that the corona virus downturn isn& #39;t the right time for austerity.

11/n

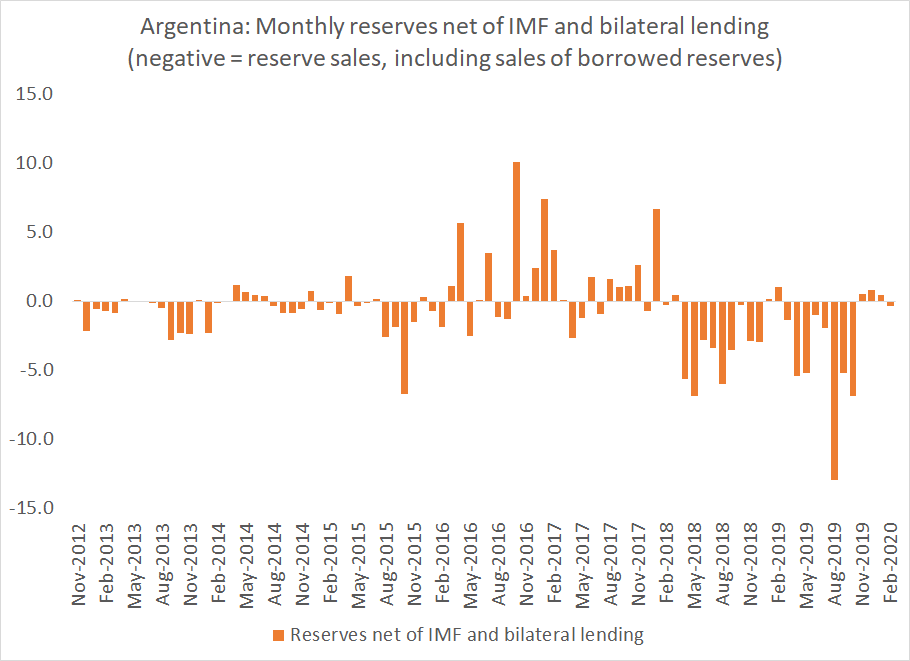

But the adjustment needed to pay external bonds isn& #39;t juts fiscal -- Argentina needs a current account surplus, and the government needs to capture that surplus in its reserves.

The new government actually has been doing that, thanks to its capital controls

12/n

The new government actually has been doing that, thanks to its capital controls

12/n

To sum up, it is important to think about debt sustainability in external terms -- not just in the usual public debt framework. Argentina& #39;s basic problem is that the public sector levered up (over-levered up) a narrow export base.

And while there is no doubt room to adjust this exchange at the margin, I don& #39;t see how Argentina can provide bond holders a totally different exchange structure and have a chance to return to sustainability.

The risk bondholders face in my view is that there is no guarantee that if Argentina defaults there is no guarantee that Argentina will come back with a "par" exchange --

Read on Twitter

Read on Twitter