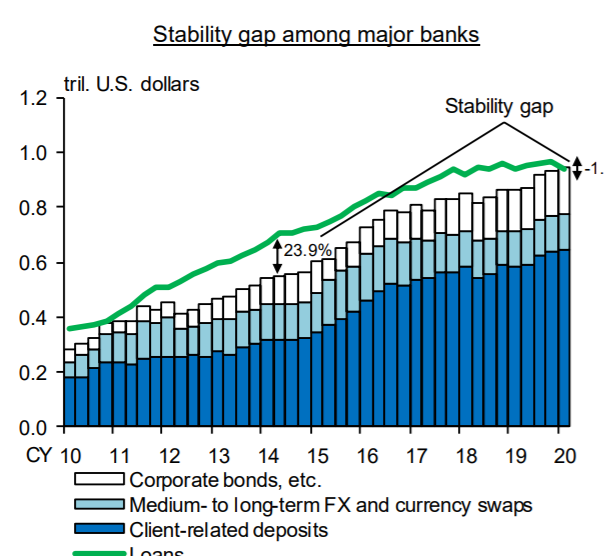

"It is of paramount importance to ensure foreign currency liquidity in times of stress, given that Japanese banks, major banks in particular, have substantially increased needs for foreign currency funding"

clear enough I think

https://www.boj.or.jp/en/research/brp/fsr/data/fsr200421b.pdf">https://www.boj.or.jp/en/resear...

clear enough I think

https://www.boj.or.jp/en/research/brp/fsr/data/fsr200421b.pdf">https://www.boj.or.jp/en/resear...

I have become a fan of Japan& #39;s Financial System Report over the last year. This one didn& #39;t disappoint.

Hard to disagree with this

Hard to disagree with this

Looks like the BoJ thinks Japanese banks have just enough long-term funding to cover their fx loan book. Chart clearly shows the growth in that book over the last 10 years (something the BIS has also noted)

Looking only at loans tho may be a bit narrow -- the overall financial system (not just the banks if I am reading this chart correctly) has exposure to foreign bonds + investment trusts that invest in foreign bonds as well

Large financial institutions have increased their fx credit risk exposure recently (including to CLOs)

The lifers have obviously added to their foreign portfolios substantially over time as well, as this chart shows

the lifers hedge ratio has stayed constant in recent years (at just under 60 percent for the biggest companies), but with rising overall holdings, that implies both a growing hedging need and a growing unhedged book

tis late, and I am not sure on this but the numbers here seem smaller than the fx securities numbers reported by the life insurance association, so the total hedging need is likely larger than the $300b implied in the chart above (from the biggest insurers).

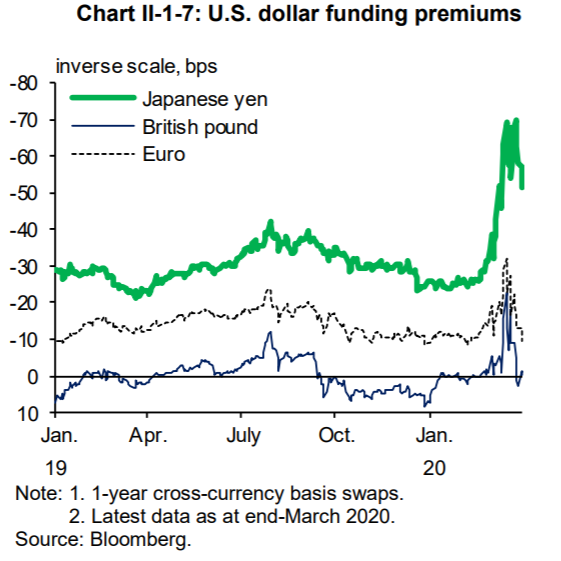

Not a secret that the BoJ is the biggest user of the Fed& #39;s swap facility.

And even so yen funding premiums are still relatively high

And even so yen funding premiums are still relatively high

Gotta respect the chart game of the BoJ amid a global pandemic ...

https://www.boj.or.jp/en/research/brp/fsr/data/fsr200421b.pdf">https://www.boj.or.jp/en/resear...

https://www.boj.or.jp/en/research/brp/fsr/data/fsr200421b.pdf">https://www.boj.or.jp/en/resear...

But would like to see a bit more on the total fx funding need of the main commercial banks, post bank. Nochu and the insurers ...

only skimmed the report, but that wasn& #39;t immediately clear (likely because of an ongoing desire not to disclose too much about Post bank)

only skimmed the report, but that wasn& #39;t immediately clear (likely because of an ongoing desire not to disclose too much about Post bank)

h/t to the FT, which showed that it is really the "Financial Times" with its coverage of the Financial System Report ... https://www.ft.com/content/ec534450-a1e9-47c5-bb28-3785178f4e7a">https://www.ft.com/content/e...

Read on Twitter

Read on Twitter