With the prime lending rate now at multi-decade lows, a lot of people are asking whether they should be fixing their interest rates.

The answer is NO!

It is pretty much always better to choose a variable interest rate instead of a fixed interest rate.

Here& #39;s why

(A Thread)

The answer is NO!

It is pretty much always better to choose a variable interest rate instead of a fixed interest rate.

Here& #39;s why

(A Thread)

First you need to understand that interest hurts the most at the start of a loan.

At the beginning of a loan, only a small amount of the repayment value goes towards the principle debt. The rest of the payment goes towards interest.

At the beginning of a loan, only a small amount of the repayment value goes towards the principle debt. The rest of the payment goes towards interest.

So it is in your interest (see what I did there?) to have a lower rate at the start of a loan rather than at the end of the loan. Agreed?

And this is where the problem with a fixed interest rate comes in…

And this is where the problem with a fixed interest rate comes in…

The fixed interest rate you will get, is going to be higher than the variable interest rate you would get.

Banks hedge their own risk of the interest rate going up by only allowing the consumer to fix their repayments at a rate higher than the one they were paying before

Banks hedge their own risk of the interest rate going up by only allowing the consumer to fix their repayments at a rate higher than the one they were paying before

So a fixed rate means you will have a higher interest rate at the start of the loan – the part where it hurts the most!

Okay but what about the fact that the current interest rate is super low, let& #39;s lock this in before it moves higher again?

Okay but what about the fact that the current interest rate is super low, let& #39;s lock this in before it moves higher again?

Well yes, maybe rates start rising again. Maybe even aggressively.

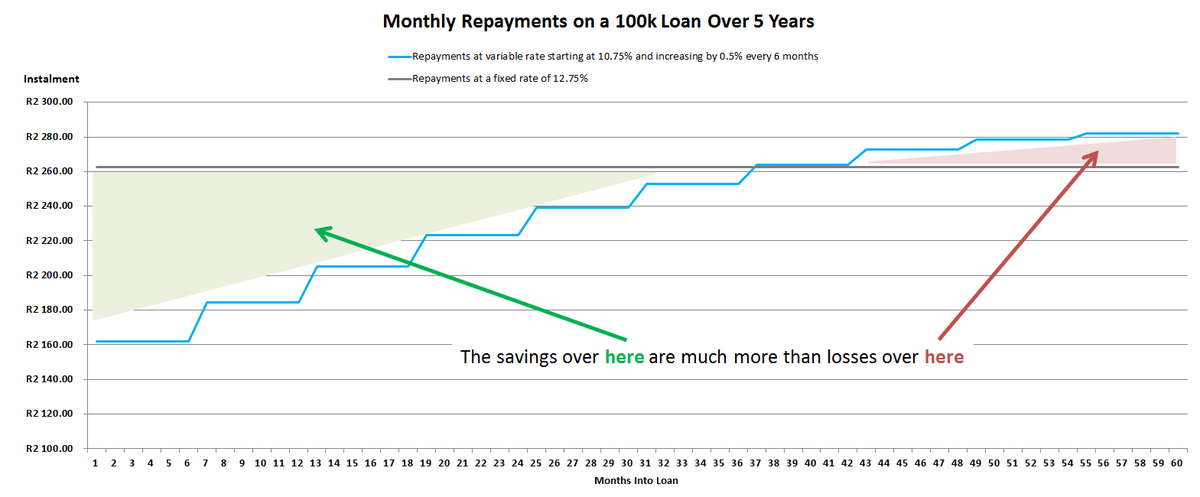

But even then, it will still take a few years for the value of the variable rate to increase and overtake the value of the fixed rate.

But even then, it will still take a few years for the value of the variable rate to increase and overtake the value of the fixed rate.

By the time that happens, the damage caused by a higher fixed interest rate at the start of the loan is only partly offset by the gains of a lower fixed interest rate at the end of the loan.

Check this example of fixed versus variable repayments with an increasing interest rate

Check this example of fixed versus variable repayments with an increasing interest rate

And of course there is the very real possibility that the interest rate drops further. Fixing your rate means you will lose out on that benefit.

So is there ever a time when you should fix your interest rate?

I suppose a case could be made if the fixed rate were only slightly above or even below the variable rate quoted (I don’t think this has ever happened!) –

But even then I would be very hesitant…

I suppose a case could be made if the fixed rate were only slightly above or even below the variable rate quoted (I don’t think this has ever happened!) –

But even then I would be very hesitant…

Always remember, the lenders are not in the business of screwing themselves over. If they are offering a fixed rate, you can be damn sure that the odds are weighted in their favour (and not yours).

The bank is taking on some risk by fixing your rate, and you can be sure that they expect to be rewarded for sticking their neck out. Your fixed rate will always reflect this extra reward they expect.

Just stick with the variable rate

Just stick with the variable rate

Full details and some more examples in this post http://www.stealthywealth.co.za/2019/02/interest-rates-why-fixed-is-broken.html">https://www.stealthywealth.co.za/2019/02/i...

Read on Twitter

Read on Twitter