I do not understand the lionization of Singapore.

Singapore is a center for corporate tax avoidance, so it has achieved its success in part at others& #39; expense.

It also has supported its economy through massive state intervention in the fx market https://www.bloomberg.com/opinion/articles/2020-04-13/coronavirus-pandemic-is-wake-up-call-to-reinvent-the-state?srnd=premium&sref=pKfngeVk">https://www.bloomberg.com/opinion/a...

Singapore is a center for corporate tax avoidance, so it has achieved its success in part at others& #39; expense.

It also has supported its economy through massive state intervention in the fx market https://www.bloomberg.com/opinion/articles/2020-04-13/coronavirus-pandemic-is-wake-up-call-to-reinvent-the-state?srnd=premium&sref=pKfngeVk">https://www.bloomberg.com/opinion/a...

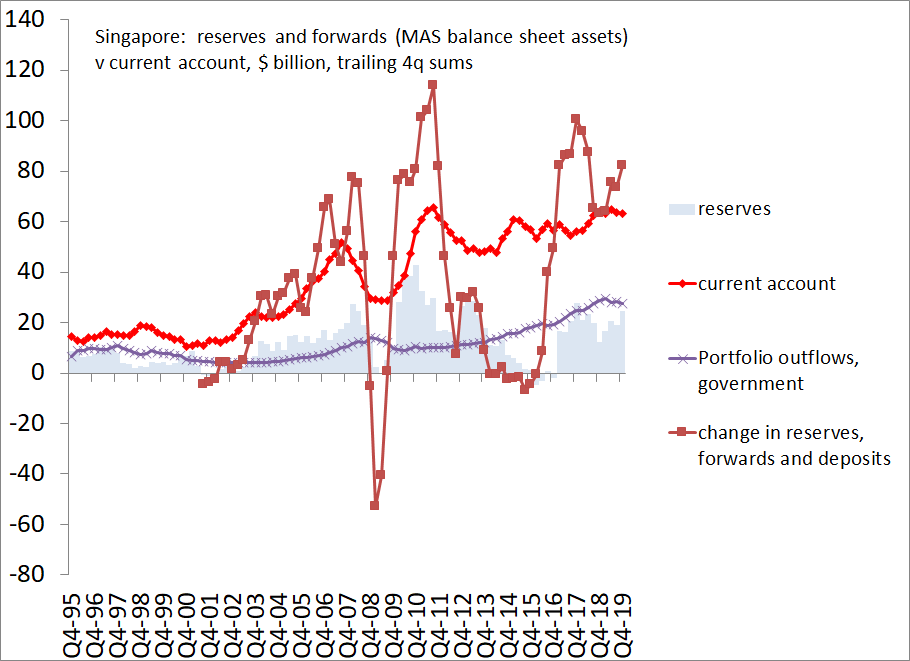

Intervention in the fx market has been around 20% of Singapore& #39;s GDP on sustained basic for many, many years https://www.cfr.org/blog/singapores-shadow-intervention">https://www.cfr.org/blog/sing...

Singapore& #39;s government, not its private sector, thus sits on one of the world& #39;s largest pools of foreign assets.

A pool so large that Singapore& #39;s government refuses to disclose how much it has, or release Singapore& #39;s Net International Investment details

A pool so large that Singapore& #39;s government refuses to disclose how much it has, or release Singapore& #39;s Net International Investment details

Emulating the Singapore model -- taken literally -- would mean that the U.S. and the Euro area would need to start intervening in the fx market to the tune of 10% of GDP or more (a massive increase in the state& #39;s presence in the market)

And I would think the general equilibrium problems of all the world trying to be corporate tax haven and the entire world trying to maintain undervalued exchange rates through extensive state intervention in the fx market would be fairly obvious.

Read on Twitter

Read on Twitter