A common comment I receive, in public and in private, is that I don’t understand trade in services.

The U.S. after all, is a big exporter of high-end services, and runs a big trade surplus in services.

But, well, I actually have looked pretty closely at the data.

1/many

The U.S. after all, is a big exporter of high-end services, and runs a big trade surplus in services.

But, well, I actually have looked pretty closely at the data.

1/many

The more I looked, the less impressed I was …

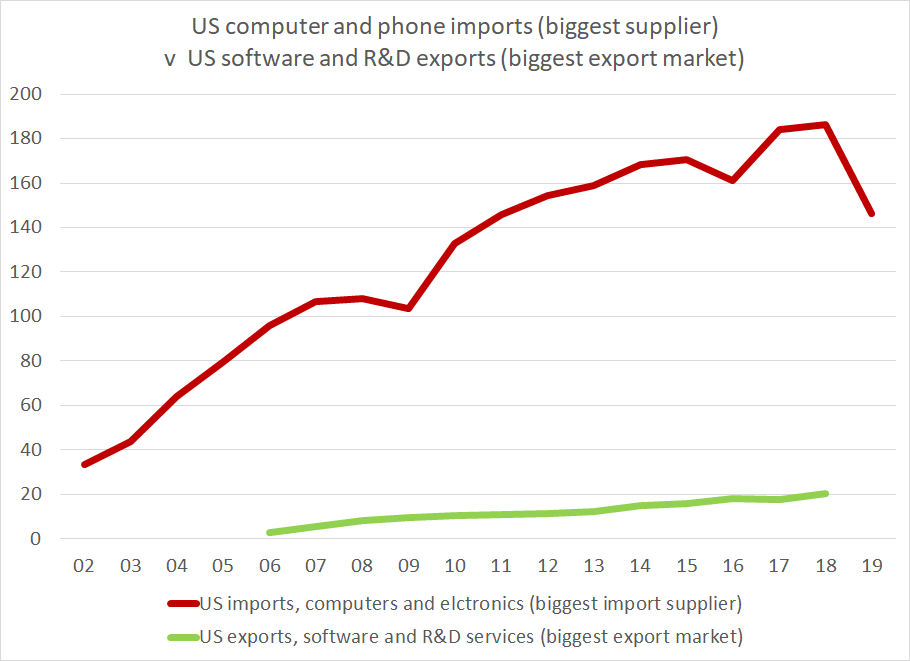

Consider a plot of US imports of computers and phones from our biggest supplier (guess who … ) against US exports of software and R&D services to our biggest export market (guess who … )

2/x

Consider a plot of US imports of computers and phones from our biggest supplier (guess who … ) against US exports of software and R&D services to our biggest export market (guess who … )

2/x

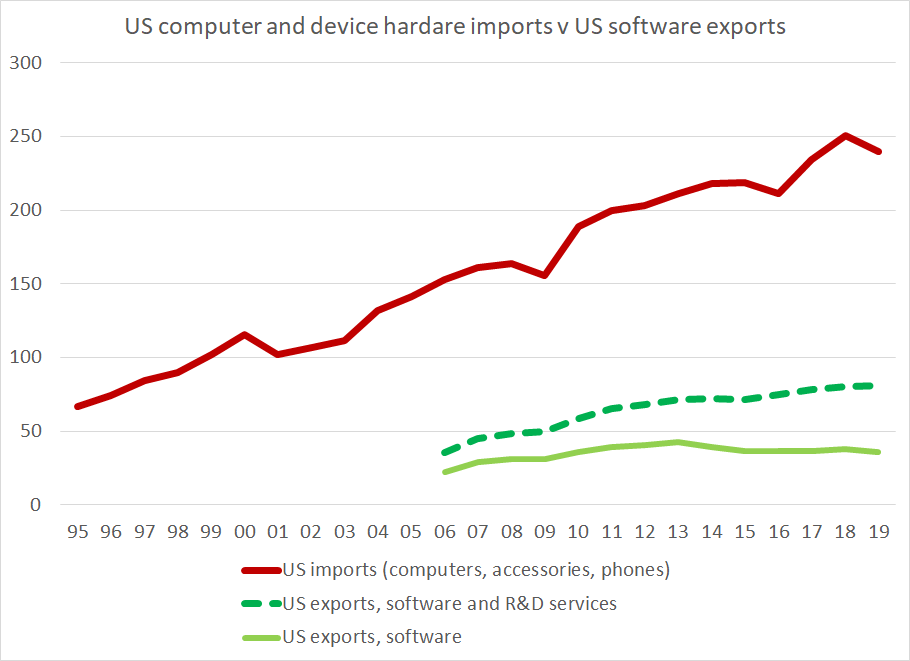

Lest anyone think I am cherry picking by choosing the dominant supplier and biggest export market, look at imports of computer hardware (and “devices”) for all countries, v exports of software to all countries (and also exports of both software and R&D services)

3/x

3/x

Why R&D services?

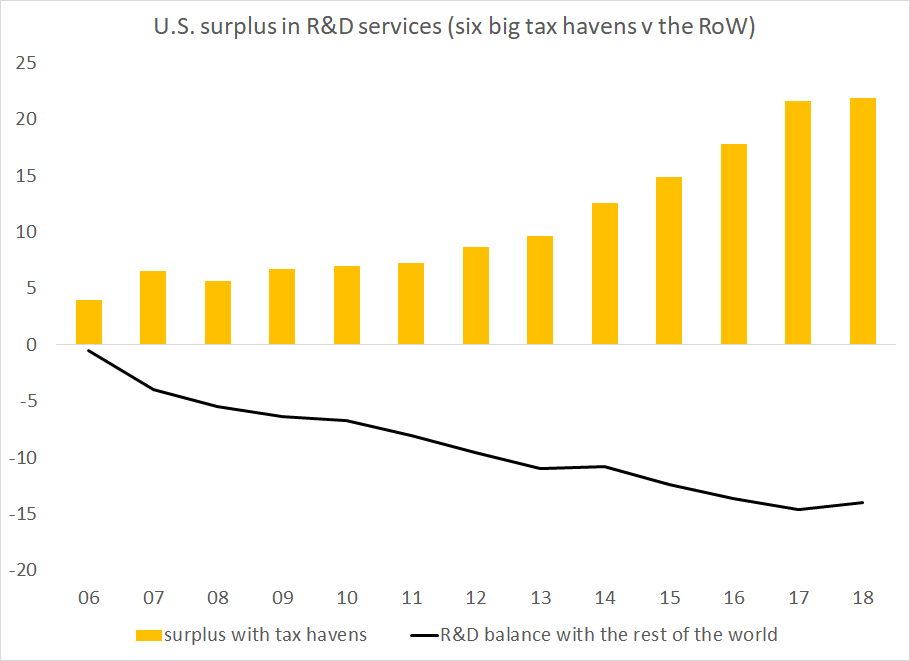

Study the tax structure of companies that use R&D cost shares … and look at how fast U.S. exports of R&D services to tax hubs have been growing relative to U.S. exports of these services to some big markets.

4/x

Study the tax structure of companies that use R&D cost shares … and look at how fast U.S. exports of R&D services to tax hubs have been growing relative to U.S. exports of these services to some big markets.

4/x

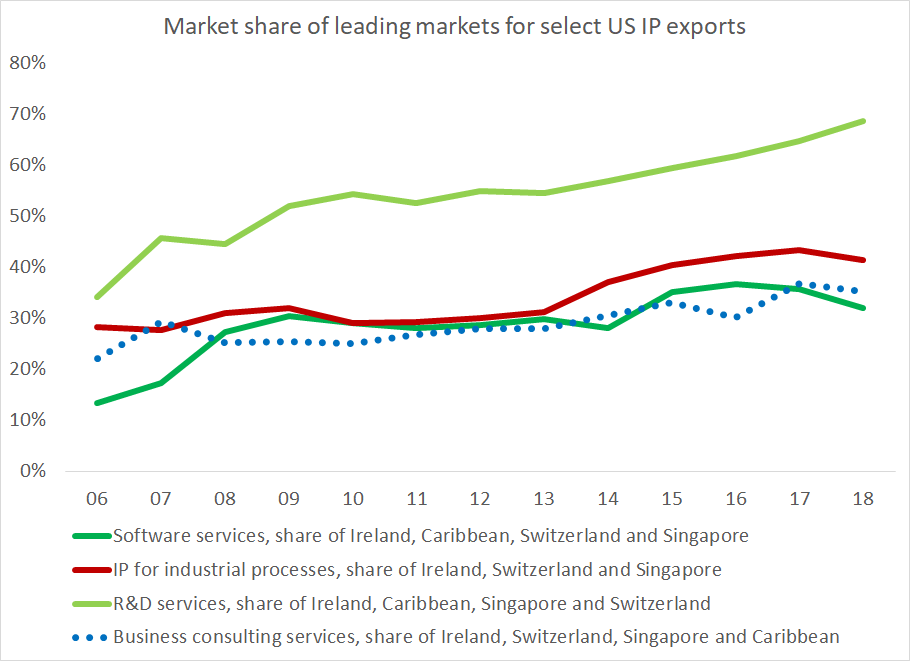

Tis true that I don’t consider this evidence of gains from trade through increased specialization, and thus don’t celebrate all growth in services trade.

The U.S. actually exports more R&D services than software. More business consulting services too.

5/x

The U.S. actually exports more R&D services than software. More business consulting services too.

5/x

And the “low tax jurisdictions” (i.e. hubs for legal corporate tax avoidance) account for a larger share of U.S. exports of R&D services than of software.

In a number of service categories, tax havens account for between a third and two thirds of total services exports.

6/x

In a number of service categories, tax havens account for between a third and two thirds of total services exports.

6/x

Now, look at a plot of US exports of software to Ireland relative to US exports of software to China.

7/x

7/x

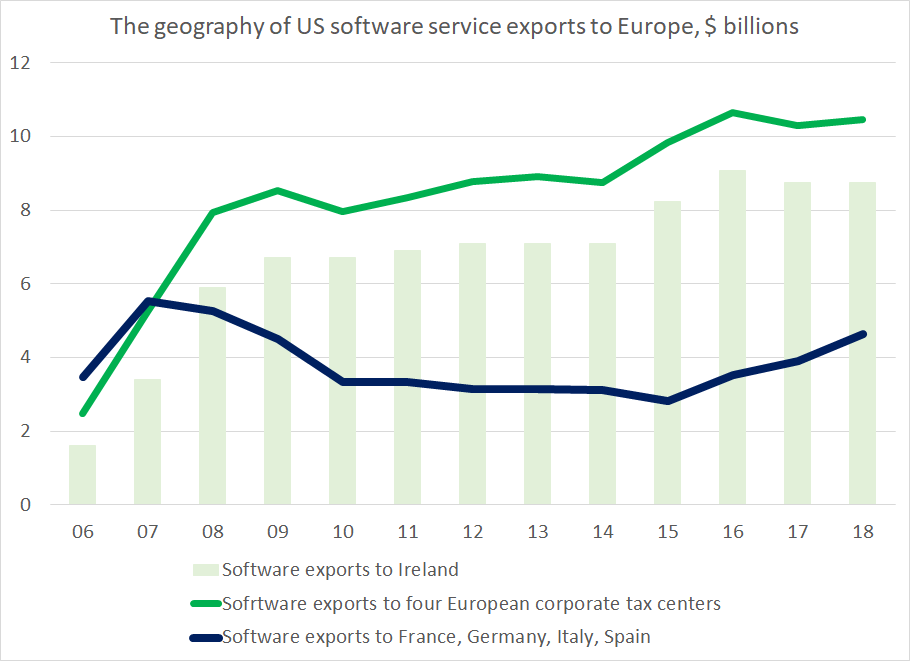

And consider a plot of US exports of software to European “business” (ha, tax) centers compared to US software exports to France, Germany, Italy and Spain (the biggest four markets on the continent)

8/x

8/x

The European data makes it clear that low exports to China aren’t just a function of China’s low level of IP protection.

Something, I wonder what, is pulling software exports, R&D exports and business services exports toward Ireland …

9/x

Something, I wonder what, is pulling software exports, R&D exports and business services exports toward Ireland …

9/x

And software is actually less distorted that some other categories. The surplus in R&D services is entirely with tax havens.

10/x

10/x

Exports of IP related to industrial processes sound legit.

But U.S. exports of “IP related to industrial processes” are increasingly directed toward global pharma manufacturing centers (all low tax jurisdictions).

11/x

But U.S. exports of “IP related to industrial processes” are increasingly directed toward global pharma manufacturing centers (all low tax jurisdictions).

11/x

And the UK Caribbean accounts (not entirely legit) accounts for two times as many financial services exports as the UK (mostly legit) – and about eight times as much as China.

12/x

12/x

So I do take trade in services seriously. I just tend to think the data (for now) tells us much more about tax policy than it tells us about actual trade.

Services trade is wonderful in theory, but perhaps not so much in practice (for now)

13/x

Services trade is wonderful in theory, but perhaps not so much in practice (for now)

13/x

And for what it is worth, it is obvious from the combined offshore revenues of the US tech sector than US services exports are undercounted – their “exports” show up as offshore profits, for reasons that I tried to explain in this blog post.

14/x https://www.cfr.org/blog/apples-exports-arent-missing-they-are-ireland">https://www.cfr.org/blog/appl...

14/x https://www.cfr.org/blog/apples-exports-arent-missing-they-are-ireland">https://www.cfr.org/blog/appl...

(hint, tax)

https://www.cfr.org/blog/tax-games-big-pharma-versus-big-tech

15/x">https://www.cfr.org/blog/tax-...

https://www.cfr.org/blog/tax-games-big-pharma-versus-big-tech

15/x">https://www.cfr.org/blog/tax-...

Now for a bit of throat clearing.

The detailed services data comes out with a long lag, b/c it often comes from tax data. So the 19 data isn& #39;t out yet.

& services trade is often mismeasured, so legit exports may be undercounted.

16/x

The detailed services data comes out with a long lag, b/c it often comes from tax data. So the 19 data isn& #39;t out yet.

& services trade is often mismeasured, so legit exports may be undercounted.

16/x

And U.S. services exports to some countries are often suppressed to protect confidential firm data. I filled in data gaps (Ireland, software, 2018) by using the number from the previous year, or using a higher level of aggregation (other Western Hemisphere)

17/x

17/x

But I think the geography of US services trade -- in its current incarnation -- largely speaks for itself.

and in this case, the bilateral trade data does actually convey useful information.

18/18

and in this case, the bilateral trade data does actually convey useful information.

18/18

Read on Twitter

Read on Twitter