Brilliant first draft of world economic history from @adam_tooze in the London Review of Books

1/x https://www.lrb.co.uk/the-paper/v42/n08/adam-tooze/shockwave">https://www.lrb.co.uk/the-paper...

1/x https://www.lrb.co.uk/the-paper/v42/n08/adam-tooze/shockwave">https://www.lrb.co.uk/the-paper...

But since it is a first draft, I do want to push back on one thing. Adam notes that all three of the world& #39;s big economic blocks (US/ Europe/ China) entered into the corona crisis with important weaknesses. The US has competent central bankers, but divided politics. 2/x

Europe has a fractured fiscal policy, and some weak banks.

China& #39;s weakness? Too much debt.

Most would no doubt agree.

3/x

China& #39;s weakness? Too much debt.

Most would no doubt agree.

3/x

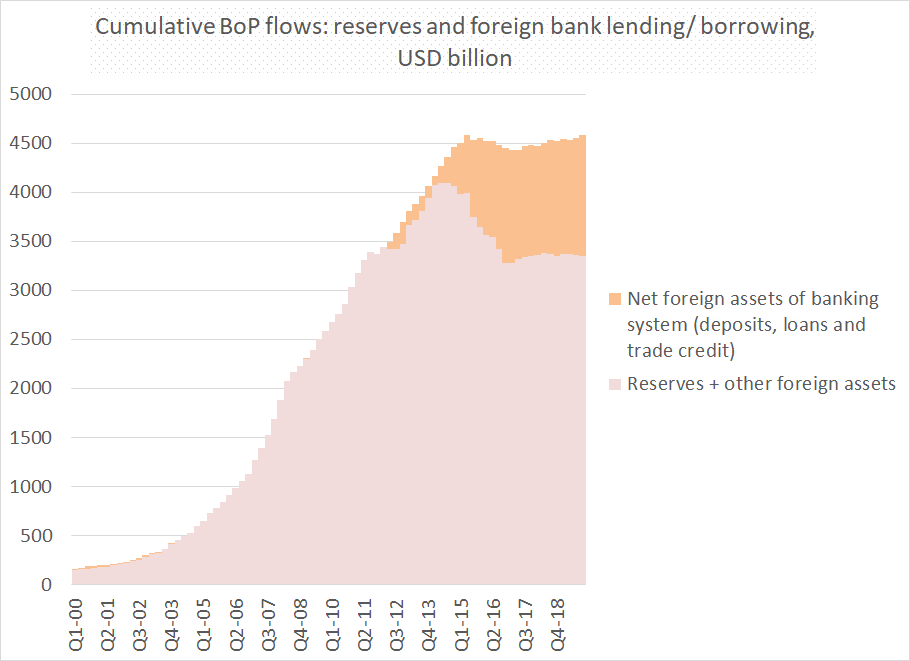

But, well, China interacts with the world economy most as a creditor and an exporter, as it has run current account surpluses for the last thirty some years and it still runs a massive trade surplus in manufactures.

Liquid fx assets far exceed fx external debts

4/x

Liquid fx assets far exceed fx external debts

4/x

I know lots of people don& #39;t trust the Chinese data, but if you do a deep dive into the balance payments looking for hidden debt and hidden assets you get the same result

(remember, China is the world& #39;s biggest development lender ... )

5/x

(remember, China is the world& #39;s biggest development lender ... )

5/x

The reserves China has lost since 2014 have essentially been converted into less liquid bank loans to the rest of the world (the banking system is net long foreign assets to the tune of $1 trillion, per the BoP)

6/x

6/x

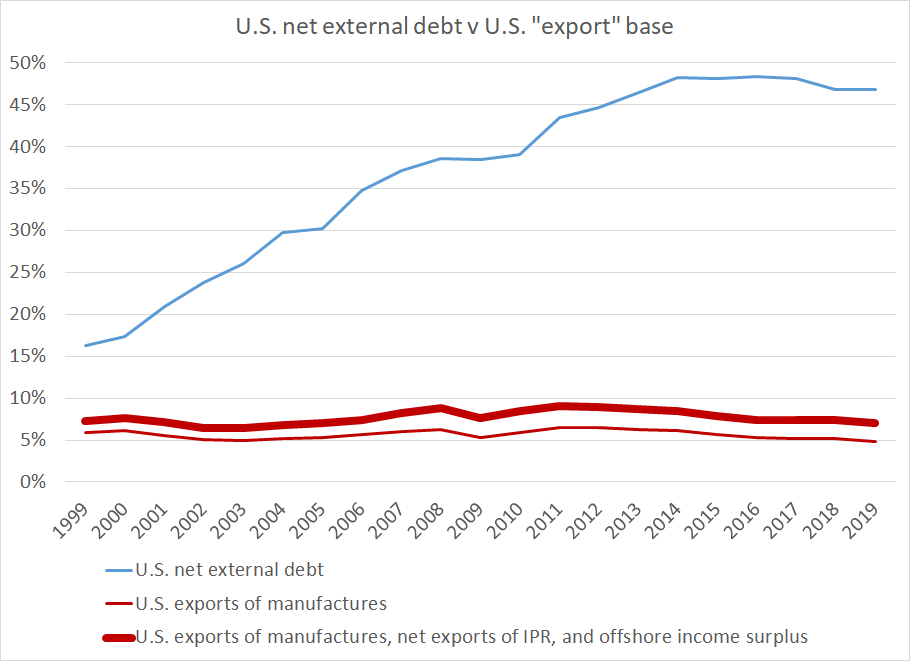

The US by contrast interacts with the global economy as a debtor (borrowing via bonds), and as an importer (including as a big importer of medical equipment as @ChadBown documents). The U.S. net external debt position is still almost 50% of GDP

7/x

7/x

Now it is true that the US external debt isn& #39;t viewed as much of a vulnerability any more -- the debt is basically Treasuries held abroad, which is safer than the securitized mortgages that blew up in 08. Foreign demand for dollars is stable. The borrows at a low rate

8/x

8/x

But the Fed& #39;s provision of dollars to the world masks the fact that the US in a sense has to provide dollars so that the world& #39;s financial institutions can safely hold all their claims on the US.

It is part of a global system where the US is the borrower, not a lender.

9/x

It is part of a global system where the US is the borrower, not a lender.

9/x

And -- as the chart above makes clear -- the US external debt rests on a fragile export base (one that will become more fragile over time if global aircraft demand is permanently reduced) even if you account for US IP exports

10/x

10/x

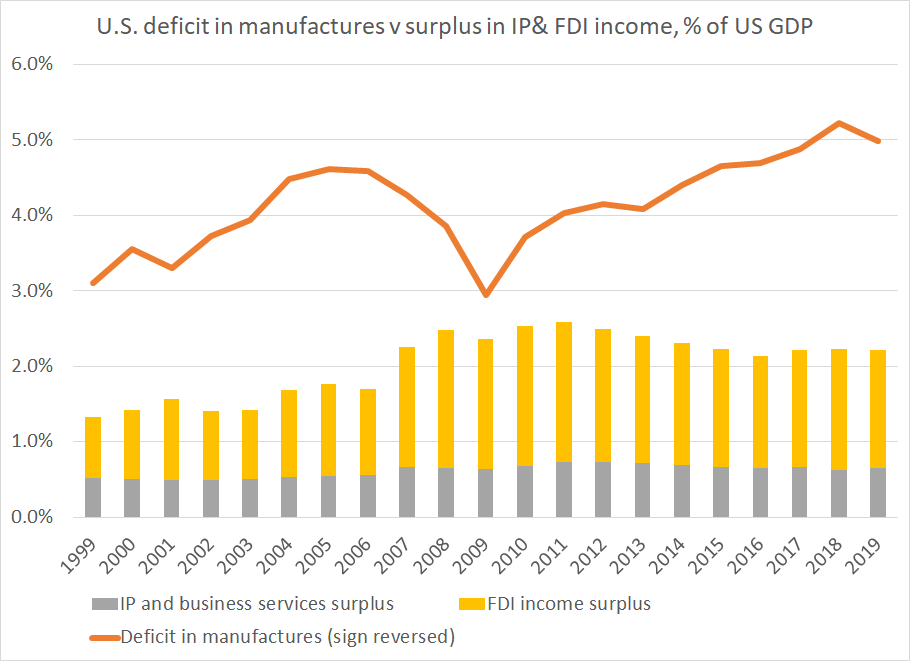

Those who argue that the US deficit in manufactures doesn& #39;t matter because the US exports so much IP leave out two things:

a) IP exports in the trade data are pretty small (and mostly to tax havens). The "IP" profit largely shows up as offshore income (again, in tax havens); &

a) IP exports in the trade data are pretty small (and mostly to tax havens). The "IP" profit largely shows up as offshore income (again, in tax havens); &

and b) those exports and the associated profits have actually been falling relative to the U.S. deficit in manufactures ...

especially after 2012 or so

12/x

especially after 2012 or so

12/x

Point being -- the notion that China is a big debtor leaves out that it is a global creditor. That& #39;s why I prefer to characterize China& #39;s problem as too much savings -- the internal debt is a consequence of that, and poses fewer risks as a result

13/x

13/x

And the centrality of the Fed to global crisis response shouldn& #39;t mask what I think are some real weaknesses in the US economic model --not just in US politics.

14/14

14/14

Read on Twitter

Read on Twitter