U.S. corporate tax reform didn& #39;t get rid of the incentive for big multinationals to play tax games.

"“The location of intellectual property is more of a tax-planning exercise than movements of people and activities,” said Thomas Horst," https://www.wsj.com/articles/companies-save-billions-in-taxes-by-shifting-assets-around-globe-11586347201">https://www.wsj.com/articles/...

"“The location of intellectual property is more of a tax-planning exercise than movements of people and activities,” said Thomas Horst," https://www.wsj.com/articles/companies-save-billions-in-taxes-by-shifting-assets-around-globe-11586347201">https://www.wsj.com/articles/...

As @RichardRubinDC notes, there has been a "huge" surge in reported investment in Ireland and firms buy IP from their subs no tax jurisdictions (and then get IP asset in Ireland that they can depreciate over time to reduce their Irish tax bill -- a "Green Jersey" so to speak)

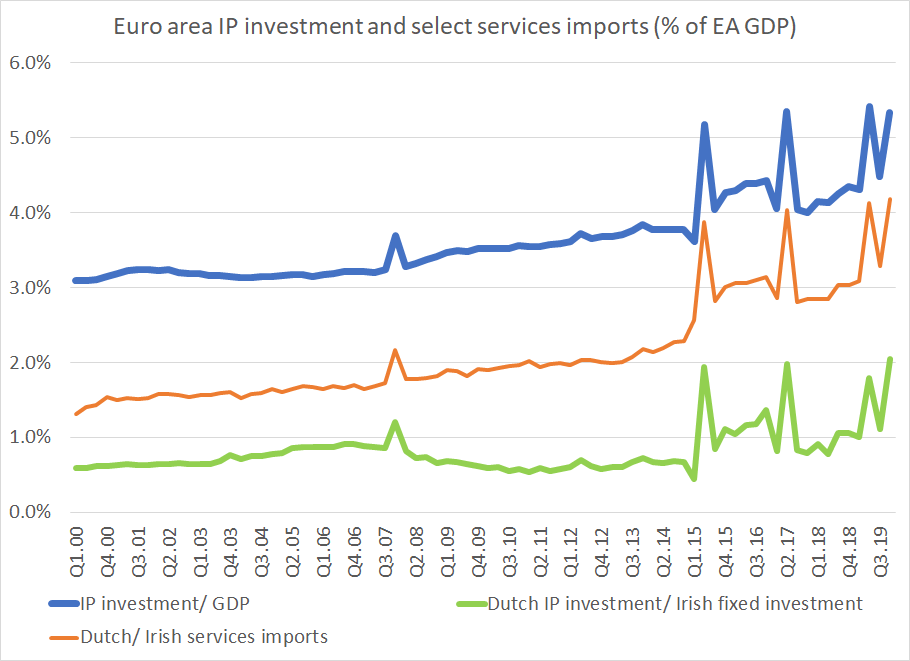

If anyone asks why IP investment in the euro area has surged by over a percentage point of euro area GDP in the last few years, that& #39;s why -- it is a side effect of replacing the double Irish even more Irish centric tax structures.

Read on Twitter

Read on Twitter