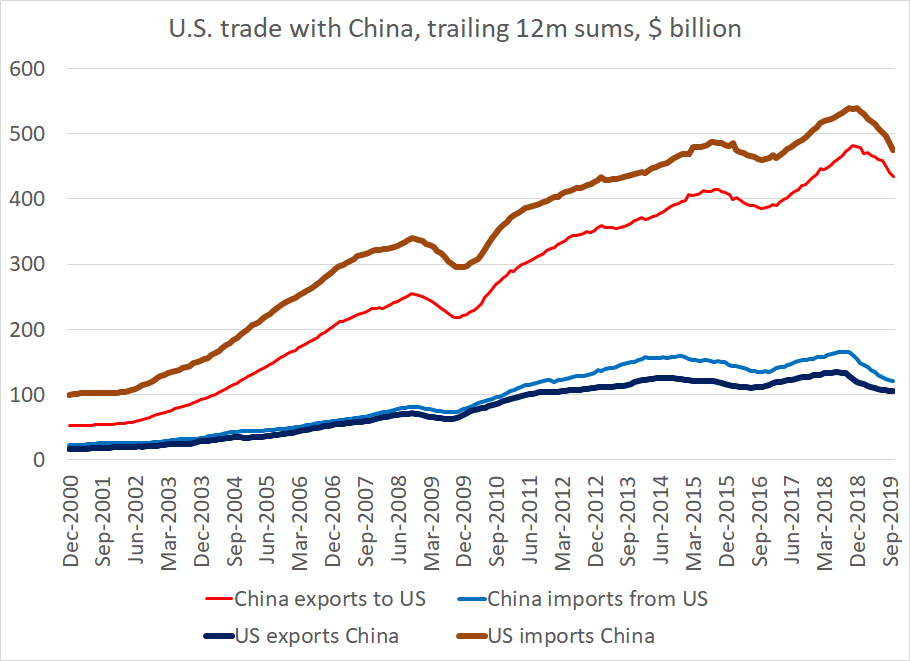

The tariffs have had the (desired) impact on bilateral US trade with China. The bilateral deficit is down $50b YTD.

And with (goods) imports down 23% in October while exports (goods) "only" down 3%, the decline in the bilateral deficit is accelerating ...

1/x

And with (goods) imports down 23% in October while exports (goods) "only" down 3%, the decline in the bilateral deficit is accelerating ...

1/x

The last round of 15% tariffs is having an impact -- the pace of the fall in US imports has picked up since September (Chinese data shows the same thing)

2/x

2/x

The modest y/y fall in exports is deceptive. China imported no soybeans last fall, so the base is low -- and China is now buying a few beans and more pork.

Falls elsewhere has offset the better ag numbers.

(chart below uses Chinese data)

3/x

Falls elsewhere has offset the better ag numbers.

(chart below uses Chinese data)

3/x

If you look at overall data the striking thing is the fall in consumer goods imports: real consumer goods imports were down 7% y/y in October. That& #39;s likely an inflated base (beat the tariffs last year) + last round of tariffs.

(auto imports weak b/c of GM strike too)

4/x

(auto imports weak b/c of GM strike too)

4/x

Impact of last round tariffs + weak capex (less drilling + uncertainty impact on business capex) = smaller overall trade deficit even with weak exports ...

5/x

5/x

with overall imports down, evidence of trade diversion is limited --

It is there for Taiwan, and Vietnam (still buried in the monthly bilateral data tho, BEA needs to fix that). But not so much elsewhere. Imports from the EA are 7% so a bit above NGDP but only a bit.

6/x

It is there for Taiwan, and Vietnam (still buried in the monthly bilateral data tho, BEA needs to fix that). But not so much elsewhere. Imports from the EA are 7% so a bit above NGDP but only a bit.

6/x

and with Mexico, auto sector weakness has overwhelmed any trade diversion. Import growth from Mexico remains weak (especially given the weakness in the peso)

7/x

7/x

Bottom line: tariffs clearly changing patterns of bilateral trade. And if you hike tariffs enough, the associated fiscal tightening (plus some short-term drag from uncertainty) should impact overall trade balance.

underlying data is here:

https://www.bea.gov/news/2019/us-international-trade-goods-and-services-october-2019">https://www.bea.gov/news/2019...

underlying data is here:

https://www.bea.gov/news/2019/us-international-trade-goods-and-services-october-2019">https://www.bea.gov/news/2019...

Read on Twitter

Read on Twitter