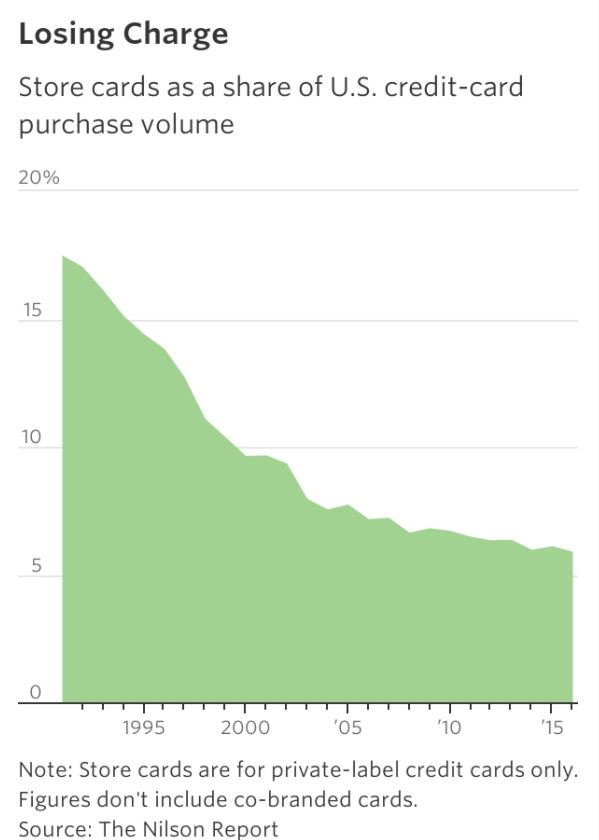

Lower underwriting standards --> rising charge offs from store-brand CC& #39;s. Companies like Affirm are on the right side of this trend.

http://on.wsj.com/2z1X9PN ">https://on.wsj.com/2z1X9PN&q...

http://on.wsj.com/2z1X9PN ">https://on.wsj.com/2z1X9PN&q...

"In October, the payments made to the five point-of-sale lenders in our analysis were nearly four times what they were in January 2018"

At least 15% of each of the other companies’ borrowers also had loans with the industry giant, Affirm, in Q3& #39;19

http://bit.ly/2N0Z91j ">https://bit.ly/2N0Z91j&q...

At least 15% of each of the other companies’ borrowers also had loans with the industry giant, Affirm, in Q3& #39;19

http://bit.ly/2N0Z91j ">https://bit.ly/2N0Z91j&q...

"BNPL sector harmed from reduced availability of funding, higher funding costs and reduced demand as unemployment spiked...face an even harder hit b/c of reliance on young consumers -~40% of Afterpay’s millennial customers are vulnerable to unemployment" https://on.ft.com/2WLZ7js ">https://on.ft.com/2WLZ7js&q...

To stay that POS lending is "having a moment" is a misnomer. Of course retailers want to curb plummeting sales volume by partnering with affirm, sezzle, afterpay, etc to boost conversions

Ultimately dont see how this is beneficial for any party invovled

https://bit.ly/2K4AcjX ">https://bit.ly/2K4AcjX&q...

Ultimately dont see how this is beneficial for any party invovled

https://bit.ly/2K4AcjX ">https://bit.ly/2K4AcjX&q...

Affirm seeing merchant signings up 40% from March 1-April 30 vs. Jan 1-Feb 29% https://www.youtube.com/watch?v=dCWRxcTtUrs">https://www.youtube.com/watch...

"Total US outstanding balances originated through POS installment lending solutions stood at $94B in 2018. Those balances are expected to exceed $110B in 2019 and to account for around 10% of all unsecured lending."

https://mck.co/2ZzHmFs ">https://mck.co/2ZzHmFs&q...

https://mck.co/2ZzHmFs ">https://mck.co/2ZzHmFs&q...

Read on Twitter

Read on Twitter