Of the many charges assigned, one is as MD of DNHPDCL with an annual revenue of 2000+ crores. Applied for DIN & all. Exciting times ahead.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">

To clarify, it is a small power distribution company. Very small for a power distribution company but going to be good learning exp for me.

This is one steep learning curve. From the whole JERC, ARR & Truing up stuff to merit order dispatch, open access & PPAs a lot to learn.

Coal shortage due to recent floods & resultant severely reduced output from various generating units making this job even tougher.

Btw had I mentioned that we incurred a loss of 77 Crores last year. Loss was higher at 180 Crores if we excluded interest income.

It is an excellently performing DISCOM with the lowest tariff and the least AT&C losses in the country. We went into losses mostly due to unprepared jump into Open Access.

Some correction has already happened. More being done. Decisions have effects. And then those effects also have effects. Second and higher order effects become equally important.

Taking cue from pvt sector experience, we have introduced fortnightly team meetings where presentations are made by team members.

These presentations vary from issues that we are facing now and how to tackle them to crazy future plans and how to be prepared.

We also have started financial modelling with various sensitivity parameters. A first for us. Good learning too. Now using simple three statement model.

Optimising power purchase cost through better day ahead and term ahead planning being taken up. We have big data, but didn& #39;t do big data analysis. Starting with that.

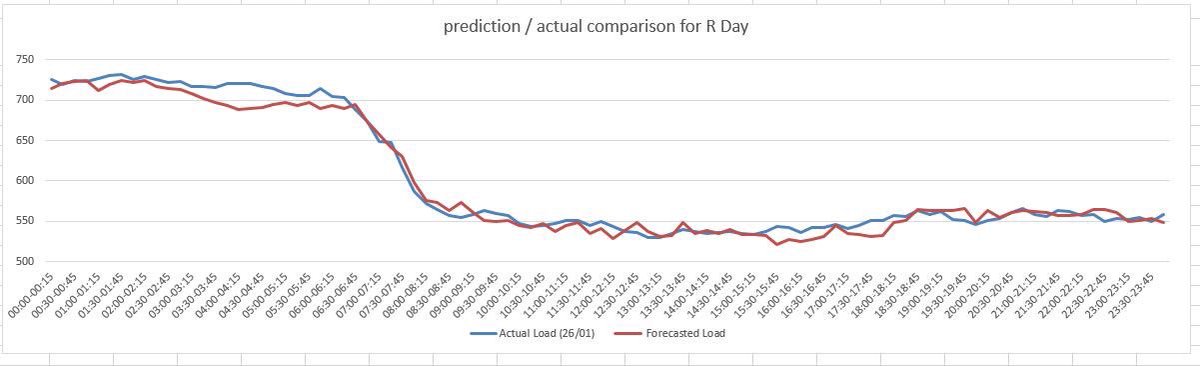

A near perfect load forecasting using Recurrent neural network for Republic day helped us save quite a bit in day ahead selling. #BigData #AI #PublicSector

Happy to share that DNHPDCL has been able to achieve a 91.35% reduction in our losses & bring it down from -68.13 Cr (PBT) in 2016-17 to -5.89 Cr in 2017-18.

On technical side, we were able to get the T&D losses down from 5.4% the previous year to 4.47% this year.

On technical side, we were able to get the T&D losses down from 5.4% the previous year to 4.47% this year.

Our revenues for 2017-18 at 2378.78 Cr, saw 20% jump from 1968.93 Cr in 2016-17. This was mainly due to open access consumers coming back to the Discom thanks to a lower tariff & a higher power cost at the exchange.

Read on Twitter

Read on Twitter