White people OWN South Africa, the struggle in South Africa only gave black people the right to vote.

Through his controlling shareholding at Shoprite Holdings Christo Wiese is in charge of what we eat and drink.

As a major shareholder at Invicta Holdings Wiese controls production,sourcing & distribution of building,engineering & agricultural supplies

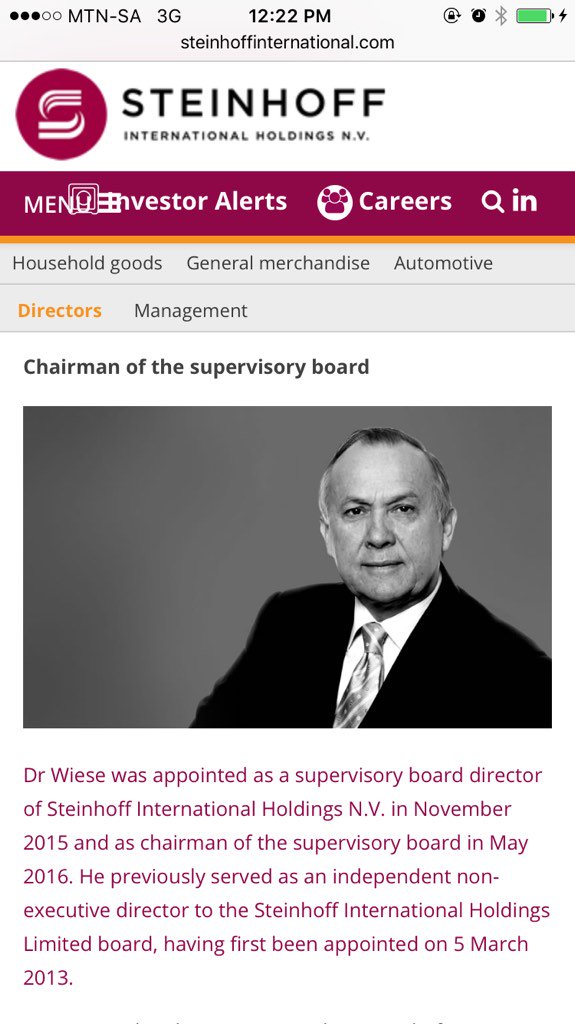

JD Group is a subsidiary of Steinhoff International Holdings and guess who you will find there...Christo Wiese.

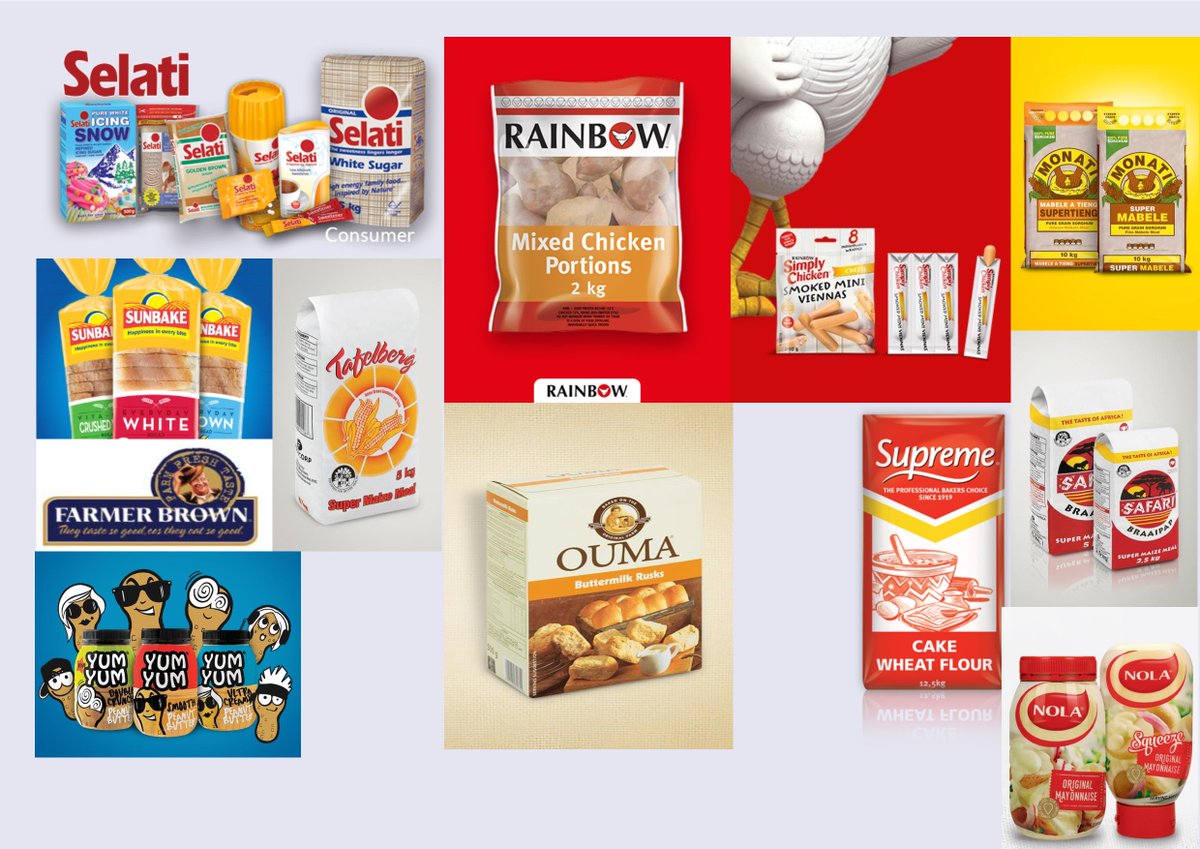

Christo Wiese acquired 34.6% of Brait in July 2011, Brait has a 92.2% shareholding in Premier and these are some of Premier& #39;s brands.

Wiese is a major shareholder in Pallinghurst Resources a natural resources investment company with interests in Platinum, Steel & Gemstones.

The Collins Group is a subsidiary of Tradehold where Wiese is a shareholder, the Collins Groups has an R8 BILLION Property Portfolio.

Christo Wiese is said to be worth $5.1 Billion, his son Jacob Wiese is being groomed to take over from him when he retires.

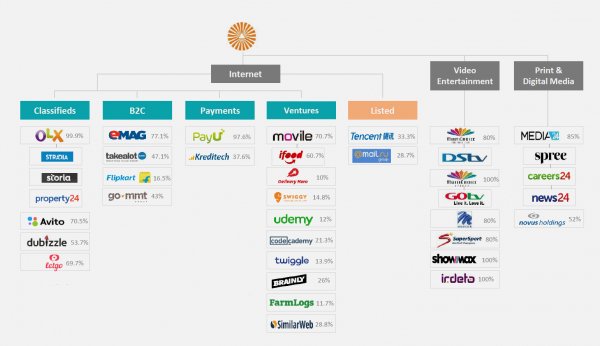

It doesn& #39;t end there, if you don& #39;t like buying newspapers and magazines but prefer to read things online, Koos Bekker has you covered.

Leading book publishers in SA are found here including publishers 4 educational material for schools & FETs are under the control of Bekker.

Now that we know that Bekker controls the media & Dstv,do you think it& #39;s coincidence that the media was mum on the Dstv price fixing scandal

The Godfather needs no introduction, we all know how he controls almost all economic sectors in SA anyway let me try to break it down.

We& #39;ve now seen how Rupert gets us drunk let& #39;s now see how he feeds us and keeps us clean through Remgro& #39;s stake in Unilever.

Rupert& #39;s Remgro has a stake in RCL Foods, these are some of their brands.

Rupert& #39;s Remgro also has interests in Banking & Property through its stake at RMB & FirstRand.

Rupert& #39;s Remgro also has interests in Healthcare through its stake at Mediclinic, Mediclinic has 52 hospitals in South Africa.

Rupert& #39;s Remgro also has interests in Gas, Chemicals and Gas handling equipment through its stake in Air Products.

Rupert& #39;s Remgro also has a stake in Kagiso Tiso Holdings and this is KTH:

Rupert& #39;s Remgro also has a stake in Total.

Rupert& #39;s Remgro also has a stake in PGSI and PGSI holds an interest of 90% in PG Group.

Rupert& #39;s Remgro owns WISPECO Aluminium. Wispeco Aluminium is the largest aluminium extruder and supplier in Africa.

Rupert& #39;s Remgro also has interests in infrastructure through its stake in Grinrod, CIV Holdings, SEACOM & KIEF.

Rupert& #39;s Remgro also has interests in Media through its stake in eMedia.

Rupert& #39;s Remgro also has interests in Sports through its stake in various sports organizations.

Rupert& #39;s Remgro also has interests in publishing and printing through its stake in Caxton&CTP. Caxton& #39;s magazines and newspapers:

That was just Remgro (most of it), I will leave it here for today.

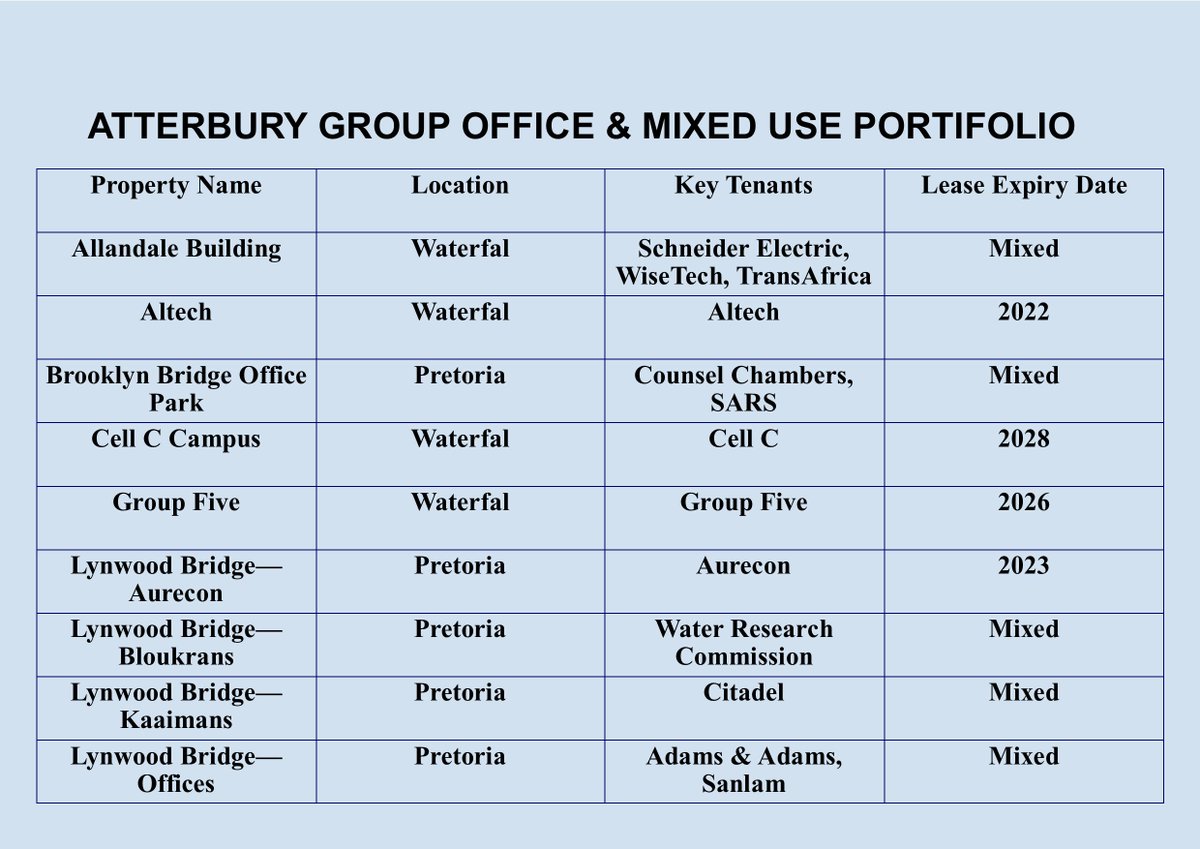

Johann Rupert& #39;s Remgro Ltd has a 28.2% stake at RMB Holdings & RMB Holdings has a 25% stake at the Atterbury Group.

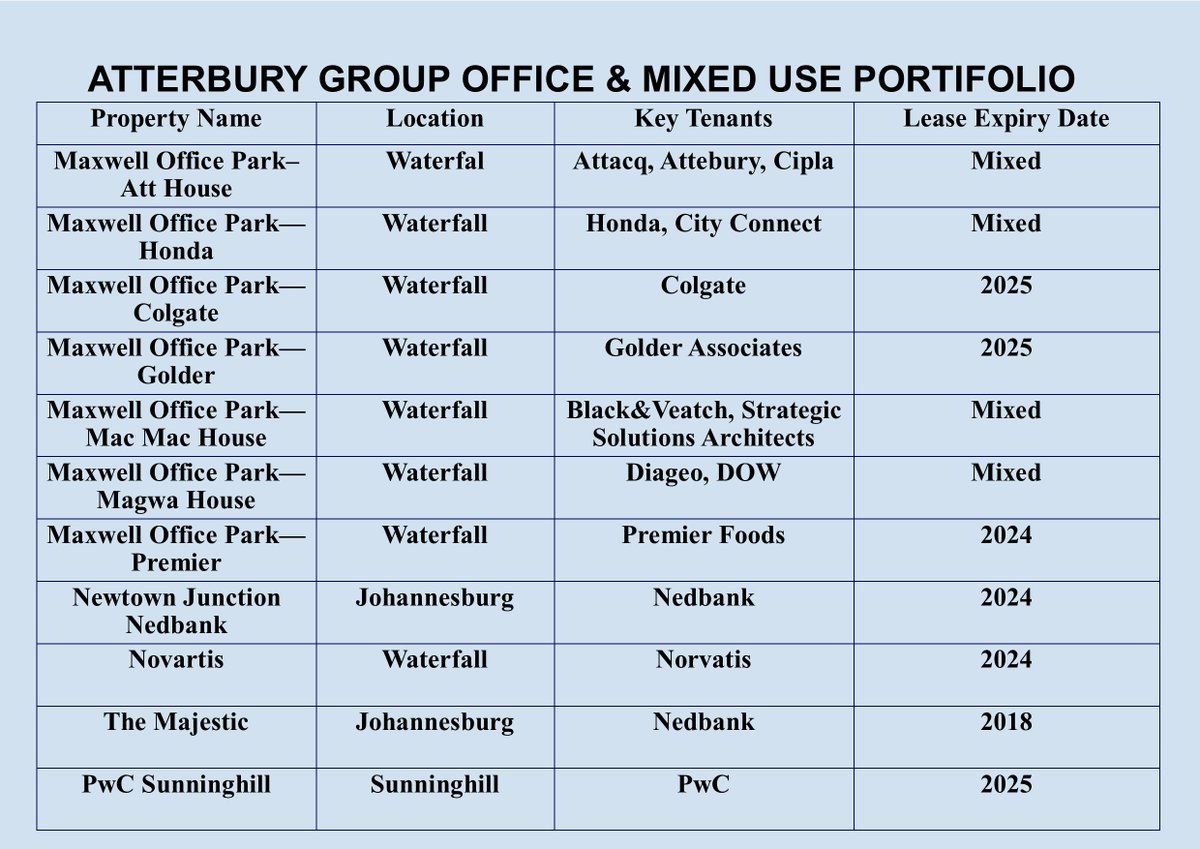

Rupert& #39;s Remgro has a stake at RMBH & RMBH has a stake at Atterbury. Has Atterbury monopolized the commercial property market in Waterfall?

Johann Rupert& #39;s Remgro Ltd has a 28.2% stake at RMB Holdings & RMB Holdings has a 25% stake at the Atterbury Group.

@threadreaderapp unroll

Read on Twitter

Read on Twitter