"Nothing has really changed since the 2008-09 crisis." - Satyajit Das http://www.marketwatch.com/story/inside-the-global-elites-bag-of-financial-tricks-2017-02-21">https://www.marketwatch.com/story/ins...

Satyajit Das was one of a number of folks who saw the last crash coming, even as future "heroes" like Ben Bernanke remained blissfully clueless. "Traders, Guns & Money" from 2006 was a great book. https://www.bloomberg.com/opinion/articles/2018-12-23/world-will-pay-for-not-reining-in-debt-growth">https://www.bloomberg.com/opinion/a...

"Cutting interest rates to zero or below made borrowing easier to service. Quantitative easing and central bank support made it easier to buy debt. Engineered increases in asset prices raised collateral values, reducing pressure on distressed borrowers and banks."

"All these policies, however, avoided the need to deleverage. In fact, they actually increased borrowing, especially demand for risky debt, as income-starved investors looked farther and farther afield for returns." #FedHistory #REACH

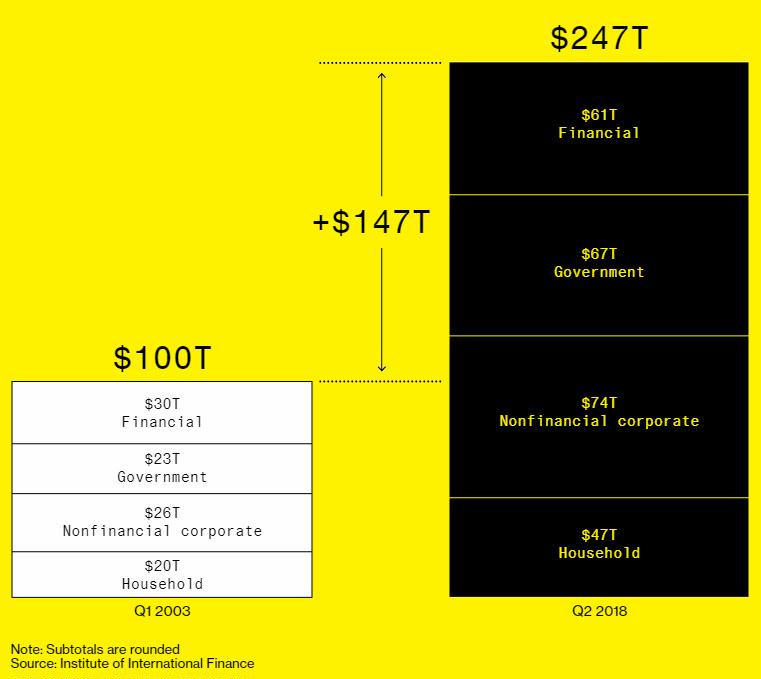

"Since 2007, global debt has increased from $167 trillion ($113 trillion excluding financial institutions) to $247 trillion ($187 trillion excluding financial institutions). Total debt levels are 320 percent of global GDP, an increase of around 40 percent over the last decade."

"All forms of borrowing have increased: household, corporate & government... U.S. government debt is approaching $22 trillion, up from around $9 trillion a decade ago, an increase of 40% of GDP."

"Outstanding of CCC-rated debt (one step above default) is currently 65 percent above 2007 levels. Leveraged debt outstanding (which includes high-yield bonds and leveraged loans) stands at around $3 trillion, double the 2007 level."

"Since the 1990s, too, much economic activity has been debt-driven."

"In 2007, policymakers passed up the opportunity to devise a slow, controlled correction because it would have necessitated defaults and creditor losses. That might at least have allowed an equitable sharing of losses, with the most vulnerable protected."

"Instead, leaders arrogantly gambled that their policy toolbox would make their debt problems disappear. The breathing space they purchased was wasted. Sovereign states used interest rate savings to finance increased expenditures rather than debt reduction."

"Previous restructurings show that early default helps cauterize the wound, minimize loss & facilitate recovery. The longer the delay, the higher the cost and bigger the adjustment necessary."

"Not wanting defaults on their watch, policymakers have been less than honest, including with themselves, about the options to deal with unsustainable debt. "

"They’ve effectively transferred the costs to the next generation. One way or another, though, those costs will have to be paid." https://www.bloomberg.com/news/articles/2015-05-06/bernanke-inc-lucrative-life-of-a-former-fed-chairman">https://www.bloomberg.com/news/arti...

Global debt https://www.bloomberg.com/graphics/2018-year-in-money/">https://www.bloomberg.com/graphics/...

"Five Doom Loops to Navigate in 2019" - Satyajit Das https://www.bloomberg.com/opinion/articles/2019-01-01/five-doom-loops-investors-may-confront-in-2019">https://www.bloomberg.com/opinion/a...

Read on Twitter

Read on Twitter