Some stocks are STRONG BUYS when they fall

Other stocks are SELLS when they fall

How can you tell the difference?

Here are 5 financial yellow flags to help you out...

Other stocks are SELLS when they fall

How can you tell the difference?

Here are 5 financial yellow flags to help you out...

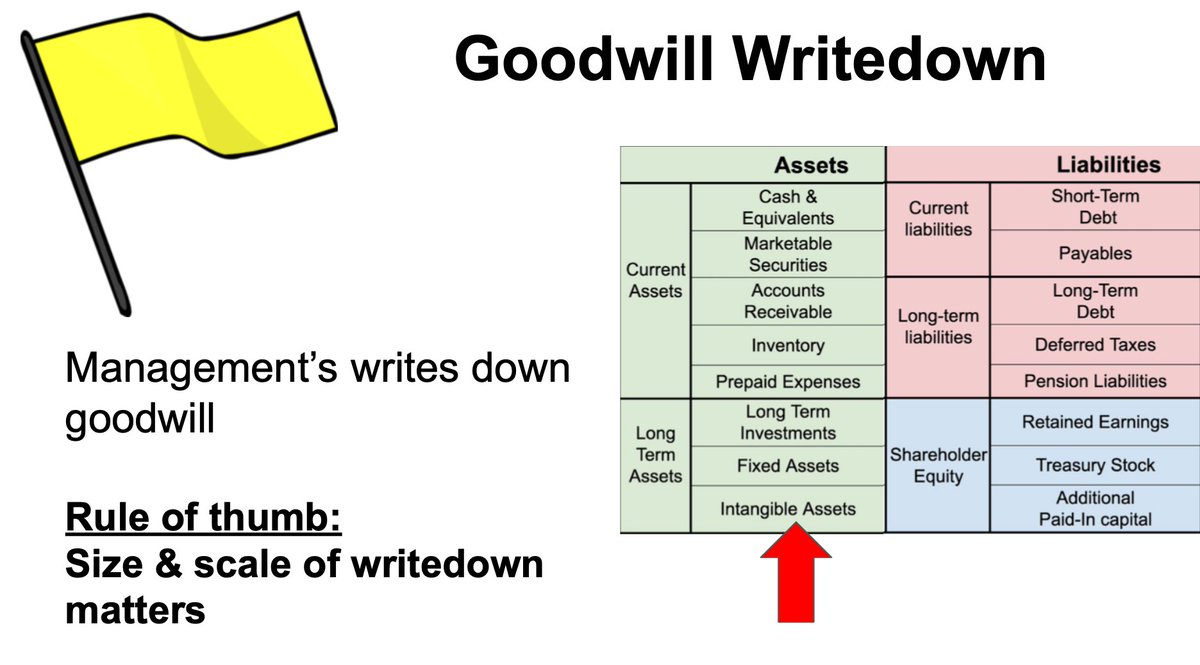

1) GOODWILL

This represents the premium a company pays for an acquisition above its fair market value.

If there’s lots of goodwill on the balance sheet, that’s troubling

This represents the premium a company pays for an acquisition above its fair market value.

If there’s lots of goodwill on the balance sheet, that’s troubling

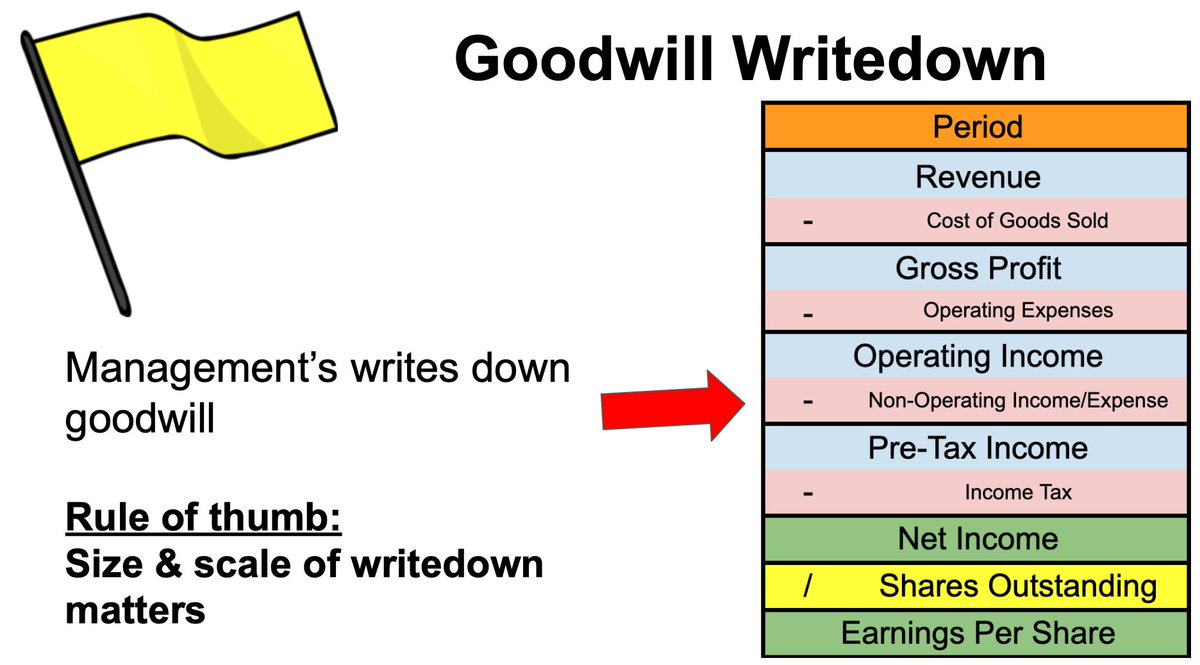

If there’s a major goodwill write-down on the balance sheet, it’s a smoking gun.

When this happens, it means management has wasted a TON of capital.

When this happens, it means management has wasted a TON of capital.

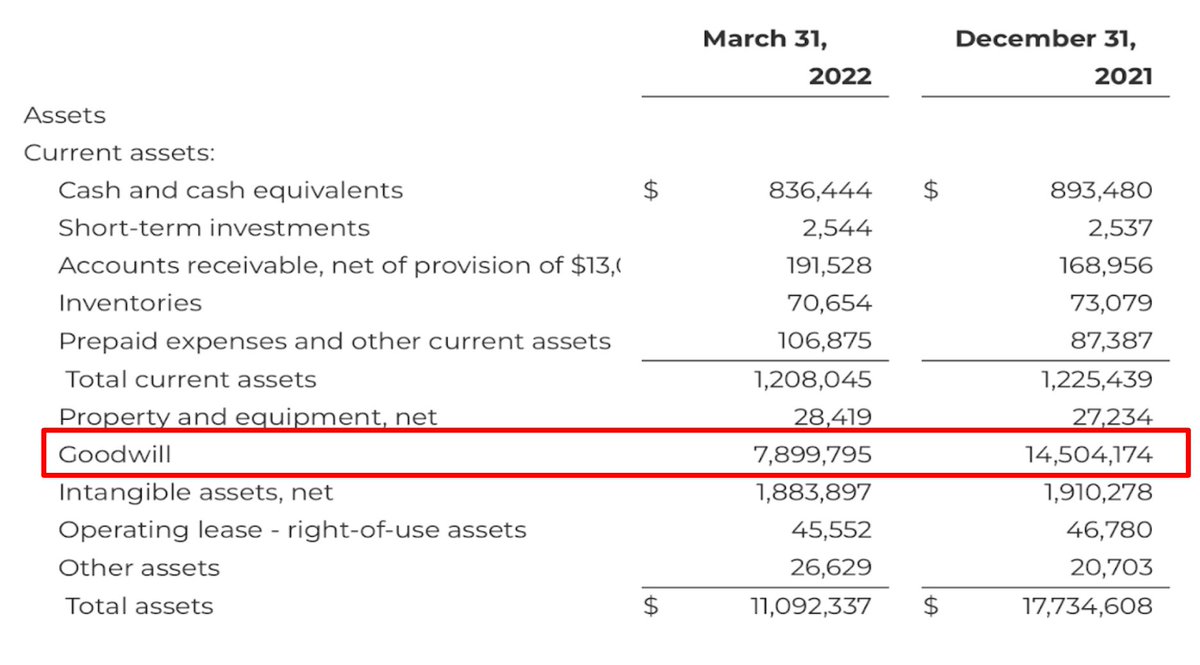

Recent example: Teledoc $TDOC

$14B was a lot in goodwill to begin with. A $6B write-down is awful, too.

Buying Livongo at its price tag = HUGE mistake

$14B was a lot in goodwill to begin with. A $6B write-down is awful, too.

Buying Livongo at its price tag = HUGE mistake

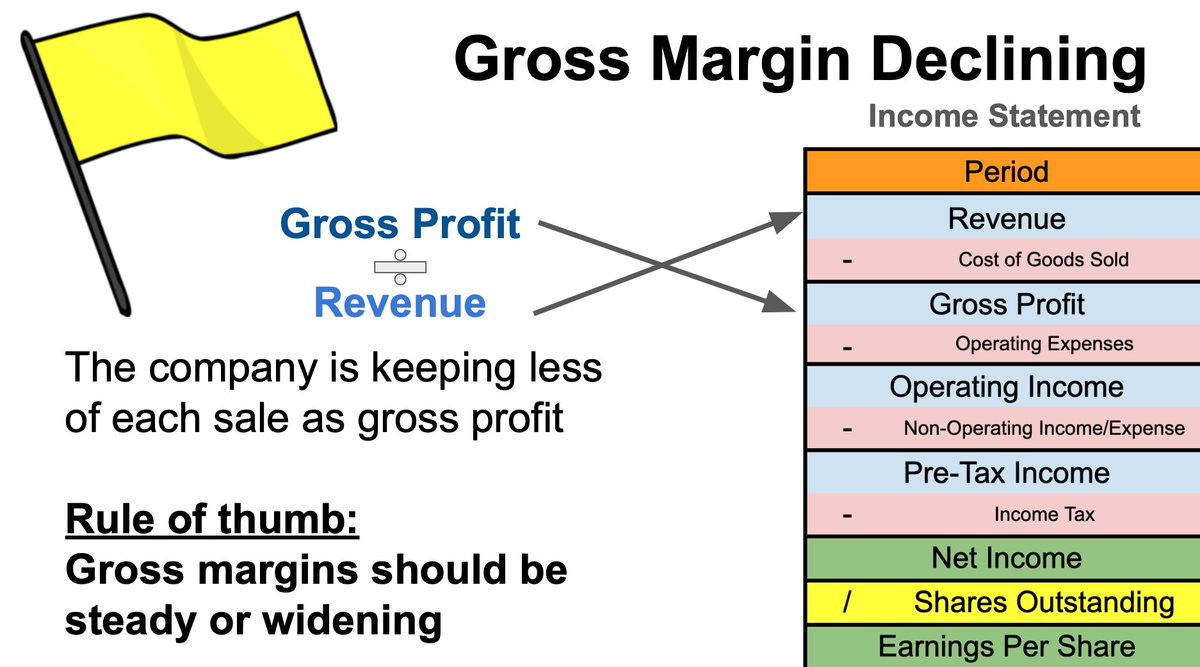

2) Gross Margin Declining

Gross margin = (sales) - (cost of goods sold).

If I run a lemonade stand, it’s (money I earn) - (the supplies to make lemonade)

Gross margin = (sales) - (cost of goods sold).

If I run a lemonade stand, it’s (money I earn) - (the supplies to make lemonade)

Declining gross margins could mean

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Nummertoets een" aria-label="Emoji: Nummertoets een">The competition is eating away business and I lower prices

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Nummertoets een" aria-label="Emoji: Nummertoets een">The competition is eating away business and I lower prices

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Nummertoets twee" aria-label="Emoji: Nummertoets twee">People aren’t that interested in my product anymore

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Nummertoets twee" aria-label="Emoji: Nummertoets twee">People aren’t that interested in my product anymore

Either way, it can be a thesis-busting development

Either way, it can be a thesis-busting development

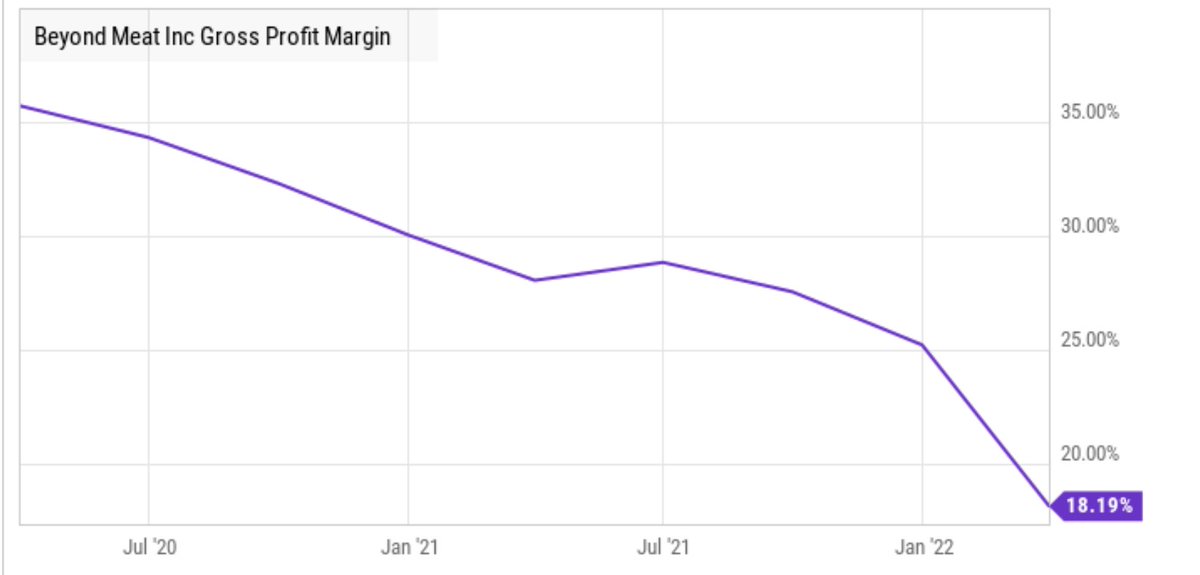

Recent example: Beyond Meat $BYND

The company& #39;s gross margin has been cut in half.

Some of this has to do with product mix (consumer vs restaurant buying). But it& #39;s not the whole story.

Meatless-alternatives are EVERYWHERE now (for cheaper prices)

The company& #39;s gross margin has been cut in half.

Some of this has to do with product mix (consumer vs restaurant buying). But it& #39;s not the whole story.

Meatless-alternatives are EVERYWHERE now (for cheaper prices)

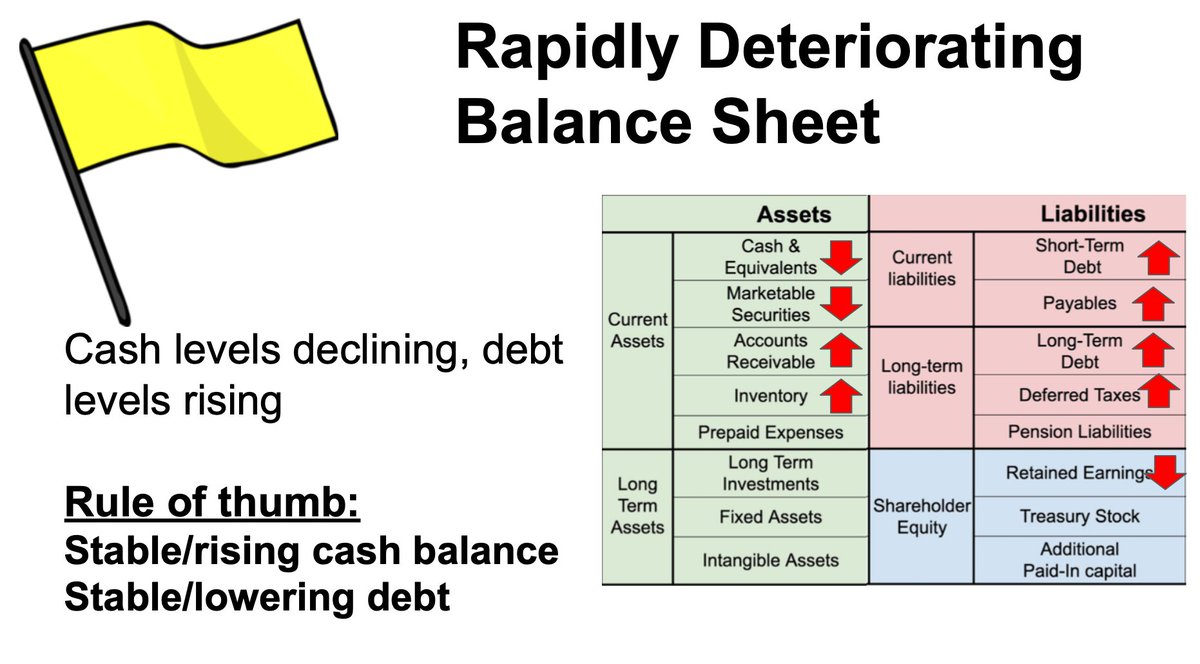

3) Deteriorating Balance Sheet

This includes:

- less cash

- more debt

- higher inventory

As this happens, a company becomes more fragile.

This includes:

- less cash

- more debt

- higher inventory

As this happens, a company becomes more fragile.

Recent example: Peloton $PTON

In the summer of 2020, it had

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Bankbiljet met dollarteken" aria-label="Emoji: Bankbiljet met dollarteken">$1.8 billion in cash

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Bankbiljet met dollarteken" aria-label="Emoji: Bankbiljet met dollarteken">$1.8 billion in cash

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Rode cirkel" aria-label="Emoji: Rode cirkel">$0.5 billion in debt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Rode cirkel" aria-label="Emoji: Rode cirkel">$0.5 billion in debt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚲" title="Fiets" aria-label="Emoji: Fiets">$0.2 billion in inventory

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚲" title="Fiets" aria-label="Emoji: Fiets">$0.2 billion in inventory

Today

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Bankbiljet met dollarteken" aria-label="Emoji: Bankbiljet met dollarteken">$0.9 billion in cash

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Bankbiljet met dollarteken" aria-label="Emoji: Bankbiljet met dollarteken">$0.9 billion in cash

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Rode cirkel" aria-label="Emoji: Rode cirkel">$0.9 billion in debt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Rode cirkel" aria-label="Emoji: Rode cirkel">$0.9 billion in debt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚲" title="Fiets" aria-label="Emoji: Fiets">$1.4 billion in inventory

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚲" title="Fiets" aria-label="Emoji: Fiets">$1.4 billion in inventory

In the summer of 2020, it had

Today

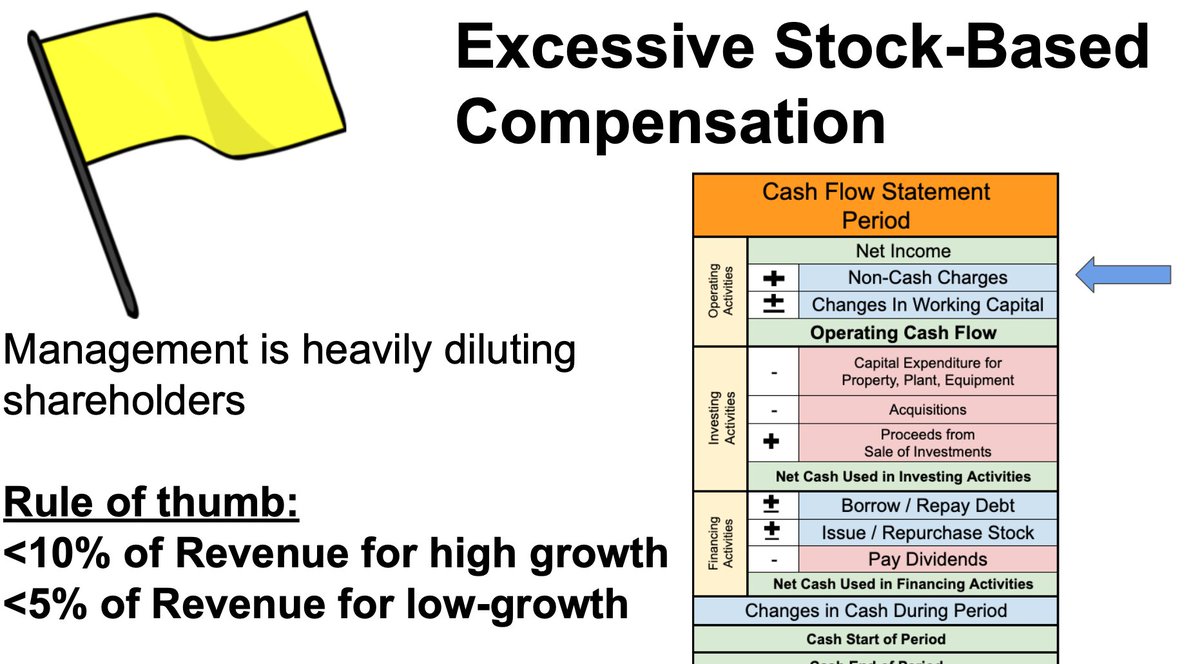

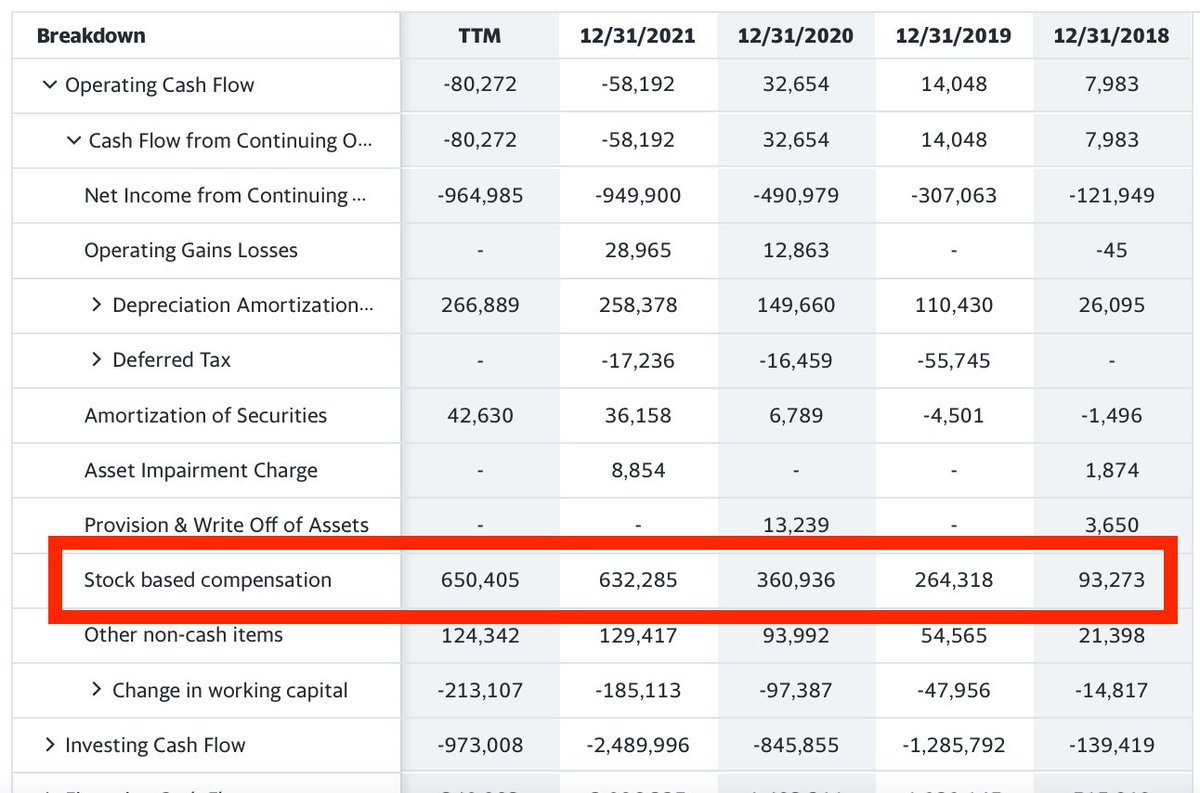

4) Excessive Stock-Based Compensation (SBC)

Lots of companies pay their employees with cash.

On the surface, that’s smart – no money leaves the company’s bank.

Shareholders are diluted, but if it results in better results from happy employees – that’s a fair trade.

Lots of companies pay their employees with cash.

On the surface, that’s smart – no money leaves the company’s bank.

Shareholders are diluted, but if it results in better results from happy employees – that’s a fair trade.

However, sometimes, that compensation gets out of control. The dilution becomes excessive.

It also presents a problem: if the stock tanks, employees may want to be paid in cash instead of stock -- leading to booming operating expenses.

It also presents a problem: if the stock tanks, employees may want to be paid in cash instead of stock -- leading to booming operating expenses.

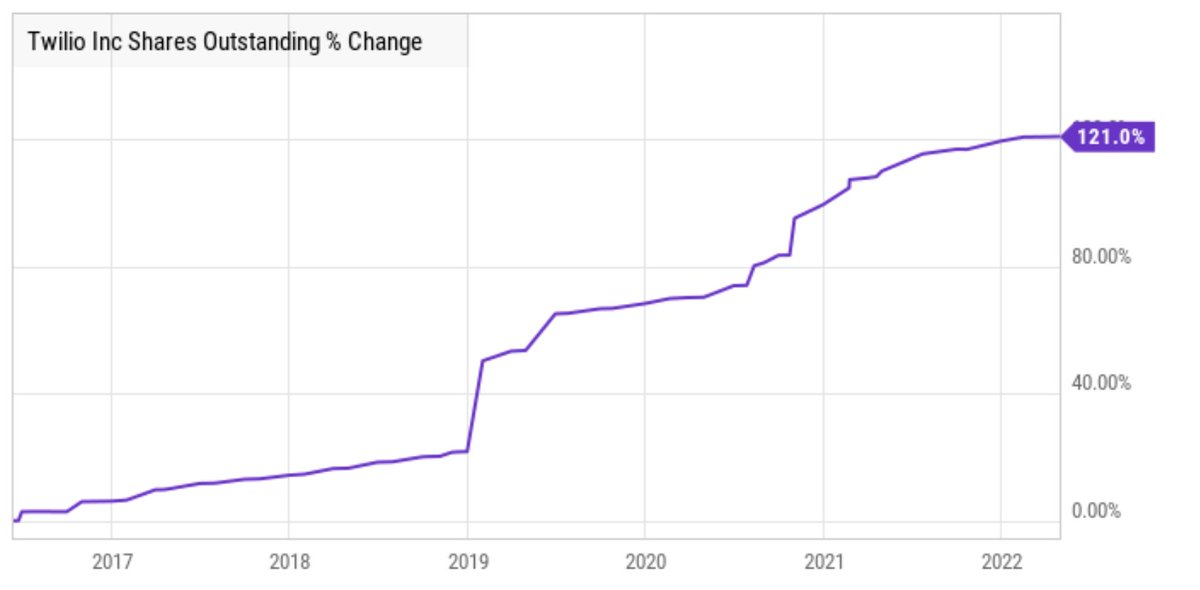

Recent example: Twilio $TWLO

Over the past year, SBC = 20% of revenue.

And it& #39;s steadily rising over the past few years.

Over the past year, SBC = 20% of revenue.

And it& #39;s steadily rising over the past few years.

The result: the number of shares outstanding is up 121% since the company went public.

Some of this has to do with an acquisition. But either way, long-term shareholders now own less than half of what they paid for a few years back

Some of this has to do with an acquisition. But either way, long-term shareholders now own less than half of what they paid for a few years back

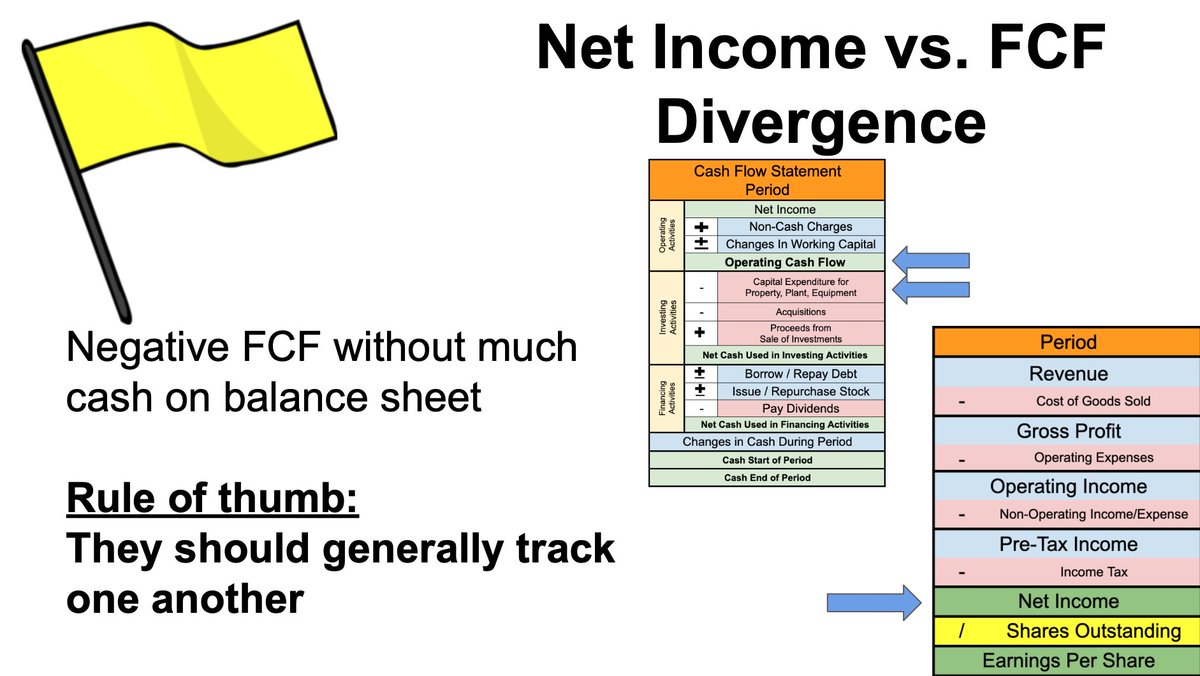

5) Net Income is MUCH higher than free cash flow

Remember:

Net income uses accrual accounting. This smooths things out over time.

Free cash flow uses cash accounting. This is a more realistic narrative of money flows

Remember:

Net income uses accrual accounting. This smooths things out over time.

Free cash flow uses cash accounting. This is a more realistic narrative of money flows

If a company has much higher net income, it’s possible a cash crunch is on the way, leading to fragility.

When tough times hit, you want cash on hand – not promised by someone who may-or-may-not pay you back

When tough times hit, you want cash on hand – not promised by someone who may-or-may-not pay you back

Recent example: Netflix $NFLX

Over the past year, it has

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">Net income of $5.0 billion

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">Net income of $5.0 billion

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldzak" aria-label="Emoji: Geldzak">Free cash flow of ($0.03 billion)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldzak" aria-label="Emoji: Geldzak">Free cash flow of ($0.03 billion)

That& #39;s a difference of over $5 billion!

Over the past year, it has

That& #39;s a difference of over $5 billion!

The problem:

If things don& #39;t work out as planned, the accrual accounting can& #39;t save you.

And that& #39;s what& #39;s happening

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rug van hand met naar rechts wijzende wijsvinger" aria-label="Emoji: Rug van hand met naar rechts wijzende wijsvinger">Competition willing to spend big on content is heating up

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rug van hand met naar rechts wijzende wijsvinger" aria-label="Emoji: Rug van hand met naar rechts wijzende wijsvinger">Competition willing to spend big on content is heating up

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rug van hand met naar rechts wijzende wijsvinger" aria-label="Emoji: Rug van hand met naar rechts wijzende wijsvinger">Subscribers are *leaving* the service

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rug van hand met naar rechts wijzende wijsvinger" aria-label="Emoji: Rug van hand met naar rechts wijzende wijsvinger">Subscribers are *leaving* the service

If things don& #39;t work out as planned, the accrual accounting can& #39;t save you.

And that& #39;s what& #39;s happening

You MUST know how to find these yellow flags to be a long-term investor.

That& #39;s why @BrianFeroldi and I are excited to announce our first ever LIVE course:

The roster for open spots is only open for two more days!

Interested? DM me for a coupon code https://maven.com/brian-feroldi/financials">https://maven.com/brian-fer...

That& #39;s why @BrianFeroldi and I are excited to announce our first ever LIVE course:

The roster for open spots is only open for two more days!

Interested? DM me for a coupon code https://maven.com/brian-feroldi/financials">https://maven.com/brian-fer...

To review the 5 yellow flags

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Lots of goodwill

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Lots of goodwill

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Gross margin declining

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Gross margin declining

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Rapidly deteriorating balance sheet

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Rapidly deteriorating balance sheet

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Excessive stock-based compensation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Excessive stock-based compensation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Significantly more net income than free cash flow

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gele cirkel" aria-label="Emoji: Gele cirkel">Significantly more net income than free cash flow

Read on Twitter

Read on Twitter

Net income of $5.0 billionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldzak" aria-label="Emoji: Geldzak">Free cash flow of ($0.03 billion)That& #39;s a difference of over $5 billion!" title="Recent example: Netflix $NFLXOver the past year, it hashttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">Net income of $5.0 billionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldzak" aria-label="Emoji: Geldzak">Free cash flow of ($0.03 billion)That& #39;s a difference of over $5 billion!" class="img-responsive" style="max-width:100%;"/>

Net income of $5.0 billionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldzak" aria-label="Emoji: Geldzak">Free cash flow of ($0.03 billion)That& #39;s a difference of over $5 billion!" title="Recent example: Netflix $NFLXOver the past year, it hashttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">Net income of $5.0 billionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldzak" aria-label="Emoji: Geldzak">Free cash flow of ($0.03 billion)That& #39;s a difference of over $5 billion!" class="img-responsive" style="max-width:100%;"/>