Depreciation is one of the biggest reasons why the rich buy real estate

Let me break down exactly what it is and why:

Let me break down exactly what it is and why:

First, let& #39;s define & #39;depreciation& #39; in general terms

It is the decline in the value of an asset over time

Example:

The moment you drive a new car off the lot, it depreciates in value. (Try to sell it the next day & it will be worth less money)

Depreciation implies loss

It is the decline in the value of an asset over time

Example:

The moment you drive a new car off the lot, it depreciates in value. (Try to sell it the next day & it will be worth less money)

Depreciation implies loss

In real estate, depreciation is used as a tax benefit

To explain this further, let& #39;s first talk about how to calculate depreciation on an investment property

To explain this further, let& #39;s first talk about how to calculate depreciation on an investment property

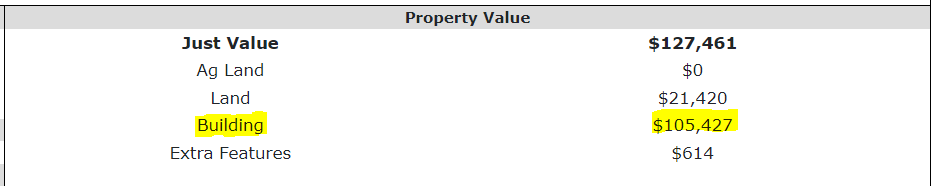

First, you need to find the value of your building, excluding the land value (land doesn& #39;t depreciate)

You can find this on the property appraiser& #39;s website of the county your property is located in

You can find this on the property appraiser& #39;s website of the county your property is located in

Second, an asset is depreciated over 27.5 years

(This is only for residential property)

So, take the building value and divide it by 27.5

(This is only for residential property)

So, take the building value and divide it by 27.5

For example, let& #39;s say you buy a $300,000 property.

$240,000 = building

$60,000 - land

To calculate depreciation:

$240,000 / 27.5 years = $8,727 deduction per year

$240,000 = building

$60,000 - land

To calculate depreciation:

$240,000 / 27.5 years = $8,727 deduction per year

Now that you know how to calculate depreciation - let& #39;s talk about why it& #39;s so great

Two reasons

Two reasons

1/ That $8,727 above is a yearly tax deduction to offset your taxable income

It lowers the amount of income you have to pay taxes on

You can do this for every property you have, every year, for 27.5 years

It lowers the amount of income you have to pay taxes on

You can do this for every property you have, every year, for 27.5 years

2/ You are depreciating an asset that is appreciating.

On your taxes, your asset looks like it is & #39;depreciating& #39; or going DOWN in value

But the real estate market is appreciating over time = your property is going UP in value

On your taxes, your asset looks like it is & #39;depreciating& #39; or going DOWN in value

But the real estate market is appreciating over time = your property is going UP in value

You are literally "having your cake and eating it too"

You have the benefit of a tax break as if your asset is going down in value

at the same time

You have the benefit of more equity since your asset is going up in value

You have the benefit of a tax break as if your asset is going down in value

at the same time

You have the benefit of more equity since your asset is going up in value

The depreciation tax benefit is one of the reasons why real estate is a great asset to invest in

You don& #39;t get this major benefit in other asset classes

You don& #39;t get this major benefit in other asset classes

If you enjoyed this thread:

1. Follow me @GetMoneySmarter for more threads on real estate

2. RT the tweet below to share this thread with the community https://twitter.com/GetMoneySmarter/status/1534942808724885504">https://twitter.com/GetMoneyS...

1. Follow me @GetMoneySmarter for more threads on real estate

2. RT the tweet below to share this thread with the community https://twitter.com/GetMoneySmarter/status/1534942808724885504">https://twitter.com/GetMoneyS...

Read on Twitter

Read on Twitter