1/n a thread on optimism alpha leak

So you wanted to get some OP @optimismPBC alpha anon?

u2028Time for some dune queries and a bit of a glimpse at how we do research at @impossiblefi

So you wanted to get some OP @optimismPBC alpha anon?

u2028Time for some dune queries and a bit of a glimpse at how we do research at @impossiblefi

2/n Everyone of course is starting to look at Optimism now that it is sitting at 6B+ FDV.

However, instead of simply chasing the trends of what’s hot, we @impossiblefi wanted to share a glimpse of our research methodology by going a few steps deeper down the rabbithole

However, instead of simply chasing the trends of what’s hot, we @impossiblefi wanted to share a glimpse of our research methodology by going a few steps deeper down the rabbithole

3/n Everyone’s been asking us: what to do in a bear market

Well there are a few things that tend to not do poorly in a bear market:u2028

1. exchangesu2028

2. protocols with real usage

Well there are a few things that tend to not do poorly in a bear market:u2028

1. exchangesu2028

2. protocols with real usage

4/n Exchanges make money as long as theres volatility or a large amount of users that disagree on price - when users disagree on price, they fundamentally trade in different directions, and thus more trades match (one person thinks something will go up, one thinks will go down)

5/n It is no surprise that in a choppy/crabby market like now, exchanges and liquidity provision can be actually quite lucrative.

And it goes without saying that protocols with real usage and adoption will fare better than those with little more than whitepapers

And it goes without saying that protocols with real usage and adoption will fare better than those with little more than whitepapers

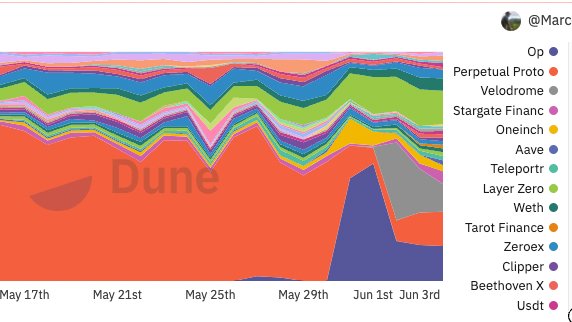

6/n so u2028what protocols are seeing usage in a hot environment like Optimism, you ask anon

well here& #39;s a @DuneAnalytics chart

https://dune.com/Marcov/Optimism-Ethereum

https://dune.com/Marcov/Op... href="https://twitter.com/perpprotocol">@perpprotocol has the most transactions of any protocol on Optimism

(honorable mention to Velodrome (VELO) after its airdrop)

well here& #39;s a @DuneAnalytics chart

https://dune.com/Marcov/Optimism-Ethereum

(honorable mention to Velodrome (VELO) after its airdrop)

7/n But wait Calvin, transactions can be gamed! Not all transactions are created equal! u2028

You are correct anon, so here’s one more great stat

https://dune.com/queries/373875/711867

u2028Perp">https://dune.com/queries/3... v2 has surpassed the $10M in fees collected since the launch of their v2 last Nov (6 months)

You are correct anon, so here’s one more great stat

https://dune.com/queries/373875/711867

u2028Perp">https://dune.com/queries/3... v2 has surpassed the $10M in fees collected since the launch of their v2 last Nov (6 months)

8/n Token terminal quotes this rate at even higher if you prorate the month of May, placing @perpprotocol& #39;s pace at ~31.6M in annual revenues https://tokenterminal.com/terminal/projects/perpetual-protocol">https://tokenterminal.com/terminal/...

9/n That puts @perpprotocol at a 6.22x P/S ratio and a P/E ratio of 15.

u2028What other investments have a P/E ratio this low?

@tokenterminal has the answer:

https://tokenterminal.com/terminal/metrics/pe

Perpetual">https://tokenterminal.com/terminal/... protocol is the only project on P/E leaderboard that is based on optimism

u2028What other investments have a P/E ratio this low?

@tokenterminal has the answer:

https://tokenterminal.com/terminal/metrics/pe

Perpetual">https://tokenterminal.com/terminal/... protocol is the only project on P/E leaderboard that is based on optimism

10/n Results are same for last 30 days, Perp is still the only Optimism-based in this P/E Leaderboard from @tokenterminal

(s/o to a lot of great teams driving good value to their token holders in these markets, like @LooksRare @DecentralGames @ensdomains @iearnfinance)

(s/o to a lot of great teams driving good value to their token holders in these markets, like @LooksRare @DecentralGames @ensdomains @iearnfinance)

11/n So why does it matter that @perpprotocol is a solid earning protocol over the last 6 months you ask?

well, most of crypto twitter isn’t reading the governance forums, except for @cobie& #39;s hilarious postu2028 https://twitter.com/cobie/status/1531999706452267008">https://twitter.com/cobie/sta...

well, most of crypto twitter isn’t reading the governance forums, except for @cobie& #39;s hilarious postu2028 https://twitter.com/cobie/status/1531999706452267008">https://twitter.com/cobie/sta...

12/n https://gov.optimism.io/t/gf-phase-0-proposal-perpetual-protocol/201u2028

Perpetual">https://gov.optimism.io/t/gf-phas... protocol 1 month ago already locked in 9million OP tokens to incentivize users to come use Perpetual protocol u2028Today, that is worth almost $13M in incentives (as of time of writing)

Perpetual">https://gov.optimism.io/t/gf-phas... protocol 1 month ago already locked in 9million OP tokens to incentivize users to come use Perpetual protocol u2028Today, that is worth almost $13M in incentives (as of time of writing)

13/n @tongnk Nick Tong from Perp is 8th in OP delegated for governing OP’s long term growth.

Do you think that these incentives will be the last of the incentives for @optimismPBC& #39;s biggest contributor to gas spent on the chain since inception?

https://app.optimism.io/airdrop/delegates?sortBy=delegated">https://app.optimism.io/airdrop/d...

Do you think that these incentives will be the last of the incentives for @optimismPBC& #39;s biggest contributor to gas spent on the chain since inception?

https://app.optimism.io/airdrop/delegates?sortBy=delegated">https://app.optimism.io/airdrop/d...

14/n 5.4% of all @optimismPBC $OP token is allocated to support projects deployed on Optimism

#allocations-at-a-glance">https://community.optimism.io/docs/governance/allocations/ #allocations-at-a-glance

with">https://community.optimism.io/docs/gove... another 8.8% unallocated for future programs and governance proposals

#allocations-at-a-glance">https://community.optimism.io/docs/governance/allocations/ #allocations-at-a-glance

with">https://community.optimism.io/docs/gove... another 8.8% unallocated for future programs and governance proposals

15/n Want the best part?

Since @tongnk wrote the governance proposal for $OP incentives,

@perpprotocol $PERP is down -64% from when this was announced thanks to the current market conditions.

Since @tongnk wrote the governance proposal for $OP incentives,

@perpprotocol $PERP is down -64% from when this was announced thanks to the current market conditions.

16/n So you get to invest in a protocol that leads a $6B chain (sure 314M circulating mc) in aggregate activity, with another ~$13M in protocol incentives on the way in batch one, and who knows how much more to come in the future, for >60% off?

17/n There are some other great communities of users in the defi derivatives space, see @dYdX @GMX_IO and more - we would be remiss to not take a quick look at other ecosystems.

18/n Unfortunately, dydx does not direct protocol revenues back to dydx stakers (if it does, it& #39;d be an awesome thing for the community) - instead it only directs incentives for safety backstopping, offering currently ~13% APY https://dydx.community/dashboard ">https://dydx.community/dashboard...

19/n @GMX_IO, which i& #39;d love to do a deeper dive on another day for maybe an $AVAX thread another time, is offering a solid 27% APY for staking

https://gmx.io/earn

They& #39;re">https://gmx.io/earn"... also generating good fees too

https://gmx.io/earn

They& #39;re">https://gmx.io/earn"... also generating good fees too

20/n In my experience at @binance , exchanges thrive when there are more venues for traders to arbitrage between (see, @FTX_Official, @Bybit_Official

With dydx, gmx vol strong, and great bridges between so many chains these days u2028It’s now easier than ever to arb crosschain

With dydx, gmx vol strong, and great bridges between so many chains these days u2028It’s now easier than ever to arb crosschain

21/n Sector Comps (circ mc/fdv) in synthetics & perps:

@synthetix_io $SNX: $580M/$710M

@dYdX: $174M/$1.7B

@GMX_IO: $162M/ $281M

@perpprotocol: $87M/$187M

Upside:

FDV room to dydx: 9x

Circ MC room to gmx: 2x

@synthetix_io $SNX: $580M/$710M

@dYdX: $174M/$1.7B

@GMX_IO: $162M/ $281M

@perpprotocol: $87M/$187M

Upside:

FDV room to dydx: 9x

Circ MC room to gmx: 2x

22/n sanity check: spot vs. derivs

@Uniswap v3 did $59M vol last 24hrs, $8.4M rev

@dYdX $0.375B futures vol last 24hrs, $3M rev

@binance spot & fut vol last 24hrs: $7.3B, $26.5B

$UNI FDV: $5B

$dydx FDV: $1.7B

$BNB FDV: $49.3B (plus it has @BNBCHAIN) https://www.coingecko.com/en/exchanges/dydx_perpetual">https://www.coingecko.com/en/exchan...

@Uniswap v3 did $59M vol last 24hrs, $8.4M rev

@dYdX $0.375B futures vol last 24hrs, $3M rev

@binance spot & fut vol last 24hrs: $7.3B, $26.5B

$UNI FDV: $5B

$dydx FDV: $1.7B

$BNB FDV: $49.3B (plus it has @BNBCHAIN) https://www.coingecko.com/en/exchanges/dydx_perpetual">https://www.coingecko.com/en/exchan...

23/n #sectorbeta Though neither @Uniswap @dYdX earn protocol fees today, relative to the volume they do vs. cexes like @binance (~1%), seems like perpetual products are undervalued despite driving more proportional vol.

ceteris paribus, betting on deriv exch > betting on spot

ceteris paribus, betting on deriv exch > betting on spot

24/n Risks to address:

@crypto_noodles did amazing research a few months back on some risks -100% worth a read

https://twitter.com/crypto_noodles/status/1514939701467230212">https://twitter.com/crypto_no...

https://twitter.com/crypto_noodles/status/1516062279371997188

Thankfully,">https://twitter.com/crypto_no... currently PERP team now only represents 2.4% of its own trading volume last 24 hrs

https://dune.com/queries/616146/1150498">https://dune.com/queries/6...

@crypto_noodles did amazing research a few months back on some risks -100% worth a read

https://twitter.com/crypto_noodles/status/1514939701467230212">https://twitter.com/crypto_no...

https://twitter.com/crypto_noodles/status/1516062279371997188

Thankfully,">https://twitter.com/crypto_no... currently PERP team now only represents 2.4% of its own trading volume last 24 hrs

https://dune.com/queries/616146/1150498">https://dune.com/queries/6...

25/n Past insurance and liquidations risks: https://gov.perp.fi/t/proposal-unlocking-perp-tokens-to-sunset-v1-users/761

but">https://gov.perp.fi/t/proposa... last comment in proposal is to give rewards in form of vested PERP so no impact on short term price https://gov.perp.fi/t/use-perp-to-provide-max-op2-op4-to-perp-v1-users/765/50?u=calvin">https://gov.perp.fi/t/use-per...

but">https://gov.perp.fi/t/proposa... last comment in proposal is to give rewards in form of vested PERP so no impact on short term price https://gov.perp.fi/t/use-perp-to-provide-max-op2-op4-to-perp-v1-users/765/50?u=calvin">https://gov.perp.fi/t/use-per...

26/n Additional notes: @synthetix_io also going to get incentives for $OP will also mean more liquidity on Optimism for arbitrage opportunities between its synthetic assets & @perpprotocol products

perp should also add $SUSD futures to further these OP-native arb opportunities

perp should also add $SUSD futures to further these OP-native arb opportunities

27/n What is @impossiblefi doing to contribute to @perpprotocol ? u2028Impossible is on the token listings committee at perp, to help ensure that new markets can be properly prioritized, such as $SUSD

28/n @perpprotocol is built on the shoulders of giants, @Uniswap Univ3 and @chainlink.

$Link marines, u2028seems like chainlink team hasn’t added Perp https://data.chain.link/users ">https://data.chain.link/users&quo... here

two great communities https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handdruk" aria-label="Emoji: Handdruk"> perp

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handdruk" aria-label="Emoji: Handdruk"> perp

but I guess not many of their investors have come yet?

$Link marines, u2028seems like chainlink team hasn’t added Perp https://data.chain.link/users ">https://data.chain.link/users&quo... here

two great communities

but I guess not many of their investors have come yet?

29/n @tempofeng and co have been building since 2018, when they were first accepted into the @binance @BinanceLabs incubation season 1, alongside awesome teams like @DuneAnalytics @InjectiveLabs and more.

30/n They& #39;ve been through 2-3 market cycles, pivoting before launching from a prediction market to build perp, they found ways to find product market fit and bring their tech to more users. The best comp in the pred market space at the time, Augur, is only now $72M FDV.

31/n so anon, you want exposure to @optimismPBC?

You want a good team in it for the long run, contributing a lot of trading volume on a hot new L2, and good revenues to give to stakers?

say hello to @perpprotocol

avg funding rate on FTX last 24 hrs? (-200-390% APY)

You want a good team in it for the long run, contributing a lot of trading volume on a hot new L2, and good revenues to give to stakers?

say hello to @perpprotocol

avg funding rate on FTX last 24 hrs? (-200-390% APY)

32/n Currently, it pays to long $PERP to the tune of 0.5%-1% a day

someone must be hedging some of their PERP, causing significantly negative funding rates.

You want a short squeeze a la @GameStop $GME anon?

someone must be hedging some of their PERP, causing significantly negative funding rates.

You want a short squeeze a la @GameStop $GME anon?

33/n @impossiblefi has of course focused on primary market launches via its launchpad, but @impossiblefi will be furthering its scope in helping support users in finding positive EV opportunities across the space in any market conditions. Stay tuned for more :)

34/n thoughts? feedback? should @impossiblefi do more of these? RT& #39;s and hate all appreciated :) we will only get better if we hear your input

35/n @coingecko& #39;s sector categories super helpful to sort comps

https://www.coingecko.com/en/categories/decentralized-derivatives">https://www.coingecko.com/en/catego...

but you would& #39;ve already known this if you heard the latest @uniwhalesio dao session :)

https://www.coingecko.com/en/categories/decentralized-derivatives">https://www.coingecko.com/en/catego...

but you would& #39;ve already known this if you heard the latest @uniwhalesio dao session :)

36/n big thanks to @DuneAnalytics @tokenterminal @coingecko for all the data and charts in this thread :)

37/a "nfa"

38/a S/O to @0xBinji for a very good chat a few weeks back on @optimismPBC ecosystem for me to dive deeper into the data

Been ages since i bumped into @jinglejamOP @ben_chain and co at hackathons pre-covid too

Been ages since i bumped into @jinglejamOP @ben_chain and co at hackathons pre-covid too

39/n If you haven& #39;t bridged to optimism yet, you can at

https://app.optimism.io/bridge ">https://app.optimism.io/bridge&qu...

you can now use @fraxfinance $FRAX as collateral on @perpprotocol as well!

https://app.optimism.io/bridge ">https://app.optimism.io/bridge&qu...

you can now use @fraxfinance $FRAX as collateral on @perpprotocol as well!

40/n Want to help @IF_Intern and rest of the research team earn a bit extra bonus this quarter for their hard work?

Try out @perpprotocol with our referral link

https://app.perp.com?code=impossible"> https://app.perp.com?code=impossibleapp.perp.com/?code=impossib

<3

Try out @perpprotocol with our referral link

https://app.perp.com?code=impossible"> https://app.perp.com?code=impossibleapp.perp.com/?code=impossib

<3

and we& #39;re hiring at @impossiblefi

if you are interested https://impossiblefinance.notion.site/impossiblefinance/Job-Board-c5a0648bb14944f39888f67f314a1e0d">https://impossiblefinance.notion.site/impossibl...

if you are interested https://impossiblefinance.notion.site/impossiblefinance/Job-Board-c5a0648bb14944f39888f67f314a1e0d">https://impossiblefinance.notion.site/impossibl...

Read on Twitter

Read on Twitter @perpprotocol has the most transactions of any protocol on Optimism(honorable mention to Velodrome (VELO) after its airdrop)" title="6/n so u2028what protocols are seeing usage in a hot environment like Optimism, you ask anonwell here& #39;s a @DuneAnalytics chart https://dune.com/Marcov/Op... href="https://twitter.com/perpprotocol">@perpprotocol has the most transactions of any protocol on Optimism(honorable mention to Velodrome (VELO) after its airdrop)" class="img-responsive" style="max-width:100%;"/>

@perpprotocol has the most transactions of any protocol on Optimism(honorable mention to Velodrome (VELO) after its airdrop)" title="6/n so u2028what protocols are seeing usage in a hot environment like Optimism, you ask anonwell here& #39;s a @DuneAnalytics chart https://dune.com/Marcov/Op... href="https://twitter.com/perpprotocol">@perpprotocol has the most transactions of any protocol on Optimism(honorable mention to Velodrome (VELO) after its airdrop)" class="img-responsive" style="max-width:100%;"/>