Day in the Life of a Hedge Fund Analyst

Few live to tell the tale.

"Was it like Billions?"

"Describe ur investment process?"

"What did u learn?"

I get these questions all the time, but for a while I was afraid of answering publicly. No more!

Hedge fund story time.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">/

Few live to tell the tale.

"Was it like Billions?"

"Describe ur investment process?"

"What did u learn?"

I get these questions all the time, but for a while I was afraid of answering publicly. No more!

Hedge fund story time.

1/  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏰" title="Wekker" aria-label="Emoji: Wekker"> 6AM Pre-Market Review

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏰" title="Wekker" aria-label="Emoji: Wekker"> 6AM Pre-Market Review

Wake up thinking about ur overnight positions.

What happened during London/Asia trading?

Scan the major news on ur way to office.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Kantoorgebouw" aria-label="Emoji: Kantoorgebouw">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Kantoorgebouw" aria-label="Emoji: Kantoorgebouw"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚕" title="Taxi" aria-label="Emoji: Taxi">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚕" title="Taxi" aria-label="Emoji: Taxi"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚶♀️" title="Lopende vrouw" aria-label="Emoji: Lopende vrouw">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚶♀️" title="Lopende vrouw" aria-label="Emoji: Lopende vrouw">

Think about how ur getting screwed by beta (general macro, FOMC, inflation, etc.) cuz ur net long (or net short).

Wake up thinking about ur overnight positions.

What happened during London/Asia trading?

Scan the major news on ur way to office.

Think about how ur getting screwed by beta (general macro, FOMC, inflation, etc.) cuz ur net long (or net short).

2/ 7AM Portfolio Review

U& #39;ll typically have ~250 names in the portfolio "universe" (stocks w/ active positions & those on watchlist but already modeled).

Review each thesis vis-a-vis new market conditions. Anything changed?

Should u downside/upsize any?

New trade opportunities?

U& #39;ll typically have ~250 names in the portfolio "universe" (stocks w/ active positions & those on watchlist but already modeled).

Review each thesis vis-a-vis new market conditions. Anything changed?

Should u downside/upsize any?

New trade opportunities?

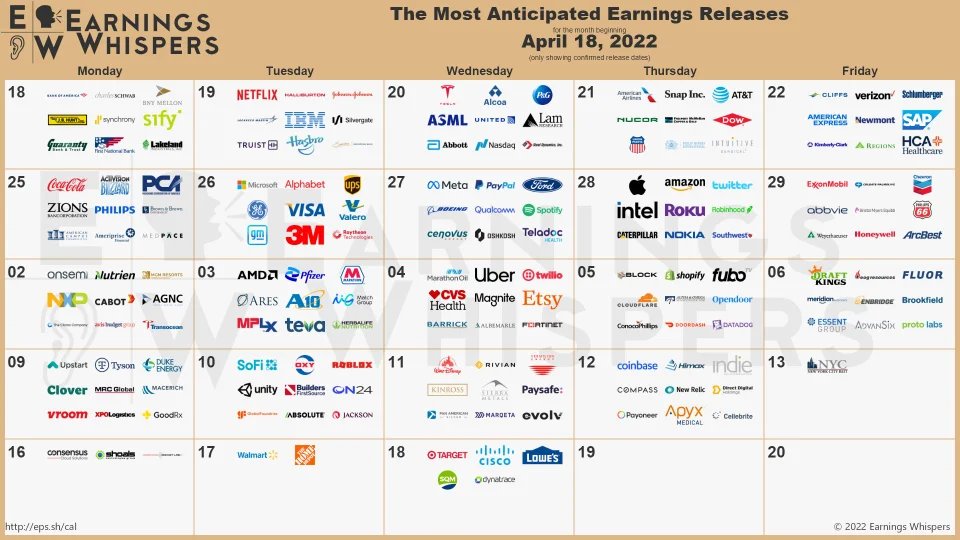

Here& #39;s a checklist of top items to check per company:

- Any earnings calls this week?

- Any product releases?

- Any new sell-side reports? Downgrades/Upgrades?

- Any M&A rumors in the space?

- Any management change announcements?

- Any guidance revisions?

- Any legal happenings?

- Any earnings calls this week?

- Any product releases?

- Any new sell-side reports? Downgrades/Upgrades?

- Any M&A rumors in the space?

- Any management change announcements?

- Any guidance revisions?

- Any legal happenings?

3/ 8AM Plan out your daily/weekly agenda

Major types of events that& #39;ll populate ur calendar:

- Investor day at XYZ

- Q1-Q4 earnings call

- XYZ road show

- Dinner event w/ IR (investor relations) at XYZ

- Private buy-side bus trip (w/ mgmt @ XYZ) arranged by GS

- JPM conference

Major types of events that& #39;ll populate ur calendar:

- Investor day at XYZ

- Q1-Q4 earnings call

- XYZ road show

- Dinner event w/ IR (investor relations) at XYZ

- Private buy-side bus trip (w/ mgmt @ XYZ) arranged by GS

- JPM conference

4/ 9AM Team meeting just before markets open

Discuss w/ ur PM:

- whether overnight news impacts/changes ur thesis on each open position

- prep work & questions u compiled for XYZ upcoming event later in the day

- pre-mortem on some new positions ur considering adding to the book

Discuss w/ ur PM:

- whether overnight news impacts/changes ur thesis on each open position

- prep work & questions u compiled for XYZ upcoming event later in the day

- pre-mortem on some new positions ur considering adding to the book

5/ 10AM Listen to XYZ earnings call

Every day a subset of the ~250 companies in ur universe will have earnings calls.

When start:

pre-market, during, or post-market

Structure:

- first CEO gives his spiel

- then CFO gives his spiel

- then sell-side analysts ask dumb questions

Every day a subset of the ~250 companies in ur universe will have earnings calls.

When start:

pre-market, during, or post-market

Structure:

- first CEO gives his spiel

- then CFO gives his spiel

- then sell-side analysts ask dumb questions

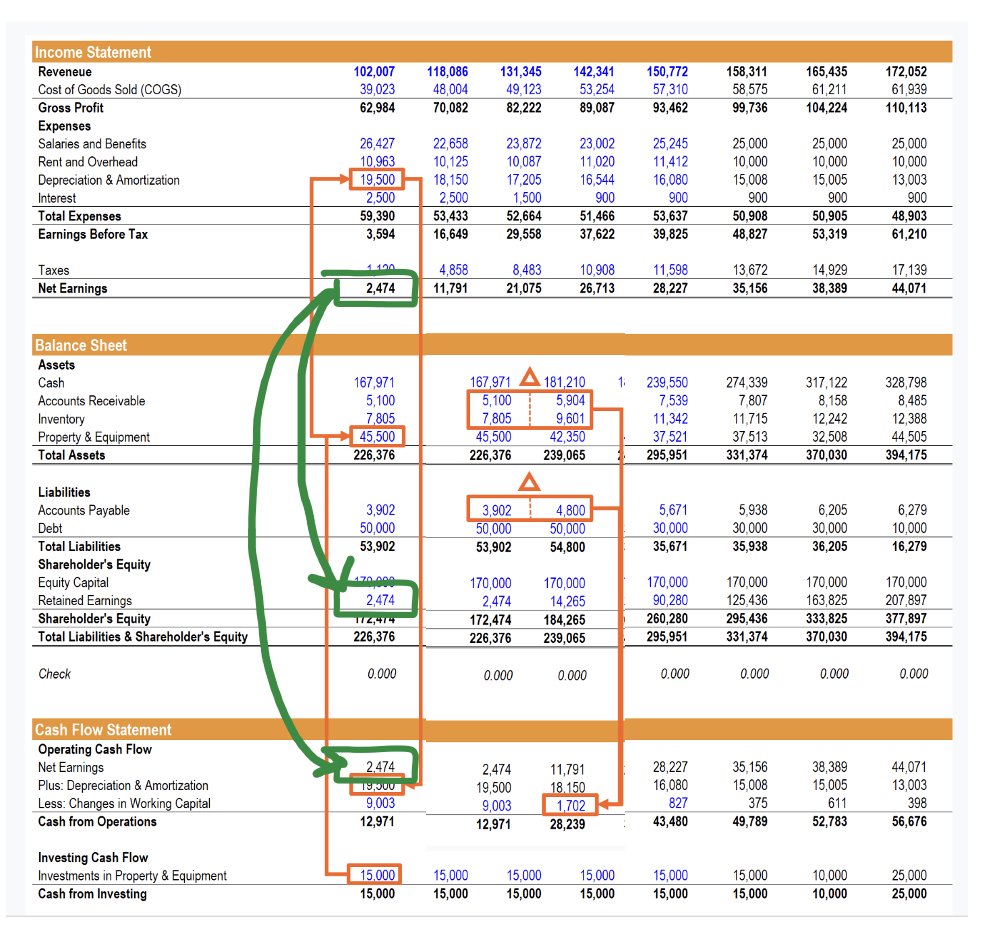

6/ 11AM - 3PM: Read/make/revise financial models

This is the crux of ur job.

So lemme describe what exactly this entails.

A "financial model" is just 3 accounting statements stacked on top of each other in Excel:

- income stmt (IS)

- cash flow stmt (CFS)

- balance sheet (BS)

This is the crux of ur job.

So lemme describe what exactly this entails.

A "financial model" is just 3 accounting statements stacked on top of each other in Excel:

- income stmt (IS)

- cash flow stmt (CFS)

- balance sheet (BS)

Why & how to "link" the 3 statements:

The reason why analysts stack all 3 on top of each other is cuz all interwoven:

- net profit:

flows from bottom of IS to retained earnings in BS & first line of CFS

- working capital:

from CFS, is the diff btw current assets & liabilities

The reason why analysts stack all 3 on top of each other is cuz all interwoven:

- net profit:

flows from bottom of IS to retained earnings in BS & first line of CFS

- working capital:

from CFS, is the diff btw current assets & liabilities

Where do you get financial models from?

Typically, u buy from sell-side & modify as necessary.

Historical statements are found in all 10K/Qs. Easy to verify.

But what u really want to modify are the projections of FUTURE metrics.

After all this is the fundamental analyst alpha.

Typically, u buy from sell-side & modify as necessary.

Historical statements are found in all 10K/Qs. Easy to verify.

But what u really want to modify are the projections of FUTURE metrics.

After all this is the fundamental analyst alpha.

7/ 4pm Coffee & gossip

Markets just closed. Your PM is doing some intense clean-up/post-mortem or squeezing in post-market adjustments.

You get coffee, run into other analyst, & complain/brag about headcount at other teams, who& #39;s allocations getting slashed, who& #39;s doubled, etc.

Markets just closed. Your PM is doing some intense clean-up/post-mortem or squeezing in post-market adjustments.

You get coffee, run into other analyst, & complain/brag about headcount at other teams, who& #39;s allocations getting slashed, who& #39;s doubled, etc.

8/ 4:30pm Post-Mortem

Markets just closed, so u got some reflecting to do:

Any major gains?

Any major losses?

Why did the moves happen?

Did u anticipate them?

How can u better anticipate & respond going forward?

See https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> below on how to do a post-mortem: https://twitter.com/FabiusMercurius/status/1393319910575538176">https://twitter.com/FabiusMer...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> below on how to do a post-mortem: https://twitter.com/FabiusMercurius/status/1393319910575538176">https://twitter.com/FabiusMer...

Markets just closed, so u got some reflecting to do:

Any major gains?

Any major losses?

Why did the moves happen?

Did u anticipate them?

How can u better anticipate & respond going forward?

See

9/ 7pm-9pm

[--- Insert Boring Mandatory Dinner Event ---]

U tell ur boss ur there for info gathering.

U tell urself ur there to hobnob in case book blows up tomorrow & #39;n u gotta jump ship to Millennium.

Ur really there to stuff ur face w/ schnapps & salmon heuer d& #39;oeuvres.

[--- Insert Boring Mandatory Dinner Event ---]

U tell ur boss ur there for info gathering.

U tell urself ur there to hobnob in case book blows up tomorrow & #39;n u gotta jump ship to Millennium.

Ur really there to stuff ur face w/ schnapps & salmon heuer d& #39;oeuvres.

10/ 9:30pm Asian markets open

I will not check markets.

I will not check markets.

I will n---

HOLY SHIT! BABA DOWN 9% ALREADY?!?!

WTF tere& #39;s like no news.

Damn retail stocks!

U whip out ur laptop & start planning how u& #39;ll respond tomorrow. More post-mortems in the queue... https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦♀️" title="Facepalmende vrouw" aria-label="Emoji: Facepalmende vrouw">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦♀️" title="Facepalmende vrouw" aria-label="Emoji: Facepalmende vrouw">

I will not check markets.

I will not check markets.

I will n---

HOLY SHIT! BABA DOWN 9% ALREADY?!?!

WTF tere& #39;s like no news.

Damn retail stocks!

U whip out ur laptop & start planning how u& #39;ll respond tomorrow. More post-mortems in the queue...

Read on Twitter

Read on Twitter