The Markets have been pretty bleak & I am sure many people wish they had gone into stables earlier.

Sometimes it& #39;s easier to hedge your portfolio, instead of selling all your spot.

A thread on hedging & how to use the included hedging calculator (find calculator at the end!)

Sometimes it& #39;s easier to hedge your portfolio, instead of selling all your spot.

A thread on hedging & how to use the included hedging calculator (find calculator at the end!)

First, what is hedging?

Hedging is a risk management strategy employed to offset losses in investments by taking the opposite position in a related asset.

The reduction in risk provided by hedging also typically results in a reduction in potential profits.

Hedging is a risk management strategy employed to offset losses in investments by taking the opposite position in a related asset.

The reduction in risk provided by hedging also typically results in a reduction in potential profits.

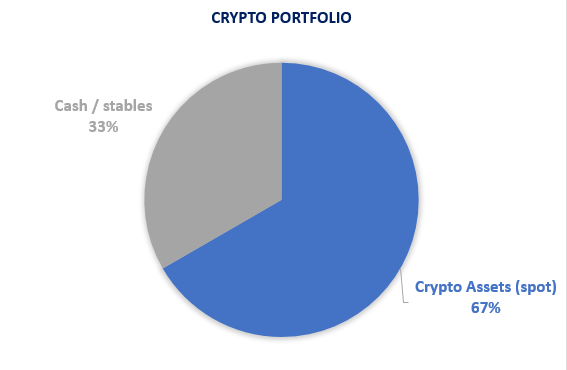

Let& #39;s say your portfolio looks like this:

33% - Cash / stablecoins

67% - Crypto Assets (spot holding)

At this point you may want to hedge, to offset some of the losses you will make on your crypto assets if the market nukes.

You therefore want to take a short position.

33% - Cash / stablecoins

67% - Crypto Assets (spot holding)

At this point you may want to hedge, to offset some of the losses you will make on your crypto assets if the market nukes.

You therefore want to take a short position.

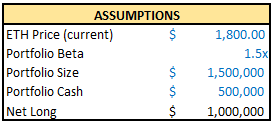

First, some assumptions:

We will short ETH to hedge

We need to estimate our portfolio beta against ETH therefore (how much our portfolio moves versus ETH)

In the case we will assume our beta is 1.5, this means if ETH moves 1%, our portfolio will move 1.5%

We will short ETH to hedge

We need to estimate our portfolio beta against ETH therefore (how much our portfolio moves versus ETH)

In the case we will assume our beta is 1.5, this means if ETH moves 1%, our portfolio will move 1.5%

Okay, so lets assume our total portfolio size is $1,500,000 (big assumption lmao)

This means we are & #39;net& #39; long $1,000,000 (66% crypto assets allocation)

ETH is at $1,800 right now so let& #39;s assume we want to short here.

This means we are & #39;net& #39; long $1,000,000 (66% crypto assets allocation)

ETH is at $1,800 right now so let& #39;s assume we want to short here.

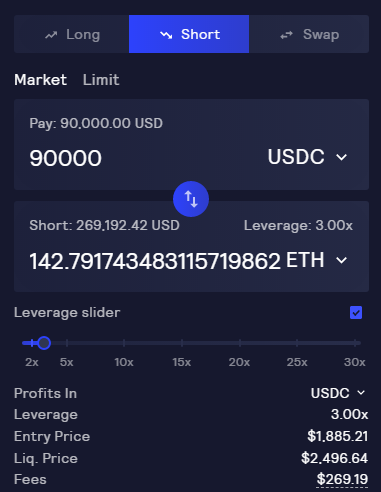

Now for the trade;

We will short ETH with $90,000 on @GMX_IO, creating a total exposure of $269,000 ($90,000 * 3x lev)

Liquidation price at $2,490.

We will short ETH with $90,000 on @GMX_IO, creating a total exposure of $269,000 ($90,000 * 3x lev)

Liquidation price at $2,490.

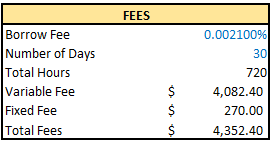

30 day position fees:

Fixed Fee - 0.1% of position size

Variable Fee - 0.0021% per hour

I have been given the highest tier trading ref link, which gives you 10% off these fees, in this case saving $435: https://gmx.io/?ref=riley ">https://gmx.io/...

Fixed Fee - 0.1% of position size

Variable Fee - 0.0021% per hour

I have been given the highest tier trading ref link, which gives you 10% off these fees, in this case saving $435: https://gmx.io/?ref=riley ">https://gmx.io/...

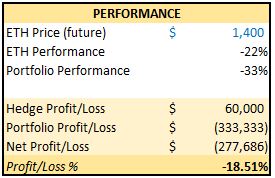

Now for the performance of the trade:

If ETH hits $1,400, our hedge will have made us $60,000, whilst our portfolio lost $333,333 in value.

The Net profit/Loss to our portfolio is therefore -$277,686, meaning we are 11% better off than without the hedge, not bad.

If ETH hits $1,400, our hedge will have made us $60,000, whilst our portfolio lost $333,333 in value.

The Net profit/Loss to our portfolio is therefore -$277,686, meaning we are 11% better off than without the hedge, not bad.

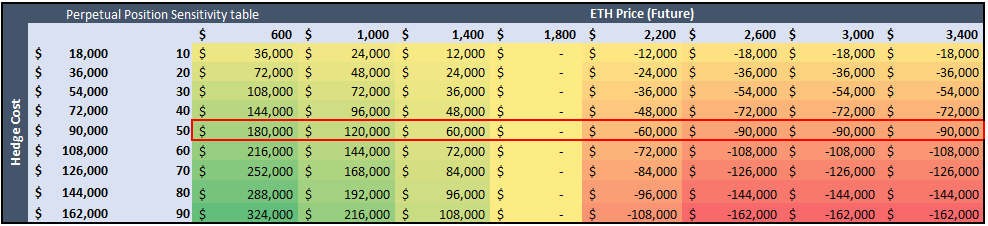

Now let& #39;s sensitize our position size and see how our hedge would& #39;ve performed for different future ETH prices.

These are the results for 3x Lev trade, so a 50 ETH hedge cost is shorting 50 ETH * 3x Lev = 150 ETH

These are the following results:

These are the results for 3x Lev trade, so a 50 ETH hedge cost is shorting 50 ETH * 3x Lev = 150 ETH

These are the following results:

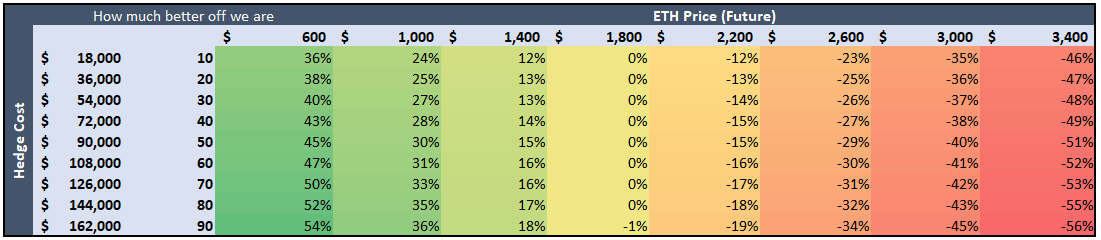

We can now calculate the total PnL of our portfolio, for different future ETH prices.

Again, I have sensitised the hedge cost.

We can see our entire portfolio is still in a net loss at any prices of ETH <$1,800. This is because of our large 66% spot long position.

Again, I have sensitised the hedge cost.

We can see our entire portfolio is still in a net loss at any prices of ETH <$1,800. This is because of our large 66% spot long position.

But how much better are we from having opened our hedge?

With our $90,000 short example, we can see how much better/worse off our entire portfolio is for different prices of ETH:

Worse/Better

At $2.2- We are 15% Worse

At $1.4K - We are 15% better

At $1K - We are 30% better

With our $90,000 short example, we can see how much better/worse off our entire portfolio is for different prices of ETH:

Worse/Better

At $2.2- We are 15% Worse

At $1.4K - We are 15% better

At $1K - We are 30% better

As you can see, a perp hedge is useful in protecting your portfolio to downside risk, without having to sell your spot bags

It& #39;s therefore a great tool to add for portfolio management

It& #39;s therefore a great tool to add for portfolio management

Perpetual hedge Excel sheet:

https://docs.google.com/spreadsheets/d/1PH3zOGCcqBmMatCwSSdnWiEsdxY1nrnu8cqOWZwItVs/edit?usp=sharing

Where">https://docs.google.com/spreadshe... to open a perpetual hedge on-chain for cheap (get 10% off fees with this link):

https://gmx.io/?ref=riley ">https://gmx.io/...

https://docs.google.com/spreadsheets/d/1PH3zOGCcqBmMatCwSSdnWiEsdxY1nrnu8cqOWZwItVs/edit?usp=sharing

Where">https://docs.google.com/spreadshe... to open a perpetual hedge on-chain for cheap (get 10% off fees with this link):

https://gmx.io/?ref=riley ">https://gmx.io/...

Read on Twitter

Read on Twitter