Tokenomics.

Crypto twitter throws this word around a lot but never explains it except "DYOR".

What& #39;s the secret that OGs and projects don’t want you to know? And wish you& #39;d never find out as a newbie?

Here’s a simple guide to tokenomics for beginners.

Crypto twitter throws this word around a lot but never explains it except "DYOR".

What& #39;s the secret that OGs and projects don’t want you to know? And wish you& #39;d never find out as a newbie?

Here’s a simple guide to tokenomics for beginners.

In this thread, I& #39;ll cover

▸Definition of Tokenomics

▸How to Analyze Tokenomics with a Simple Framework

▸3 Takeaways for Tokenomics Research

(+my checklist to filter crap)

Let& #39;s dive in.

▸Definition of Tokenomics

▸How to Analyze Tokenomics with a Simple Framework

▸3 Takeaways for Tokenomics Research

(+my checklist to filter crap)

Let& #39;s dive in.

So What Exactly is Tokenomics?

SUPPLY AND DEMAND B*TCH!

In another word, it’s the economics of token. And supply & demand is really what econ& #39;s about at the most fundamental level.

Willing buyers & willing sellers trading coins. Period.

(1st line& #39;s Breaking Bad reference)

SUPPLY AND DEMAND B*TCH!

In another word, it’s the economics of token. And supply & demand is really what econ& #39;s about at the most fundamental level.

Willing buyers & willing sellers trading coins. Period.

(1st line& #39;s Breaking Bad reference)

A Simple Framework to Analyze Tokenomics (Part 1)

I& #39;m a simple man with simple logic.

Chicken and eggs questions don& #39;t matter if there aint no cum. So you have to look at where the source is for the right outcomes.

Supply. There& #39;s where we start our quest.

I& #39;m a simple man with simple logic.

Chicken and eggs questions don& #39;t matter if there aint no cum. So you have to look at where the source is for the right outcomes.

Supply. There& #39;s where we start our quest.

You Gonna Get Rek If You Dont Ask Yourself:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> How many tokens are in the market right now?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> How many tokens are in the market right now?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> How many tokens will ever exist?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> How many tokens will ever exist?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> How will the market supply change over time?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> How will the market supply change over time?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Who owns most of the supply? When can they sell?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Who owns most of the supply? When can they sell?

To answer them, we need to look at the numba.

To answer them, we need to look at the numba.

Supply Metrics You Need to Know

• Circulating Supply: How many exists in market now

• Total Supply: How many were created on blockchain

• Max Supply: The most that can ever exist

What do they mean?

• Circulating Supply: How many exists in market now

• Total Supply: How many were created on blockchain

• Max Supply: The most that can ever exist

What do they mean?

Let& #39;s break it down.

CS: Numba that can be freely traded right now.

TS: How many were..

- created (but yet to unlock)

- released to market

- removed forever from market (through burning, we’ll touch on this later)

MS: Max it WILL and CAN exist.

CS: Numba that can be freely traded right now.

TS: How many were..

- created (but yet to unlock)

- released to market

- removed forever from market (through burning, we’ll touch on this later)

MS: Max it WILL and CAN exist.

Why Should You Care about Them?

It helps you to grasp the current and future supplies. Plus you can also predict the market& #39;s reaction in advance.

• Supply shrinks by 50%? My precious. AAHHH!!

• 100b supply to flood the market? GTFO! ship’s sinkin!

Use it to your advantage.

It helps you to grasp the current and future supplies. Plus you can also predict the market& #39;s reaction in advance.

• Supply shrinks by 50%? My precious. AAHHH!!

• 100b supply to flood the market? GTFO! ship’s sinkin!

Use it to your advantage.

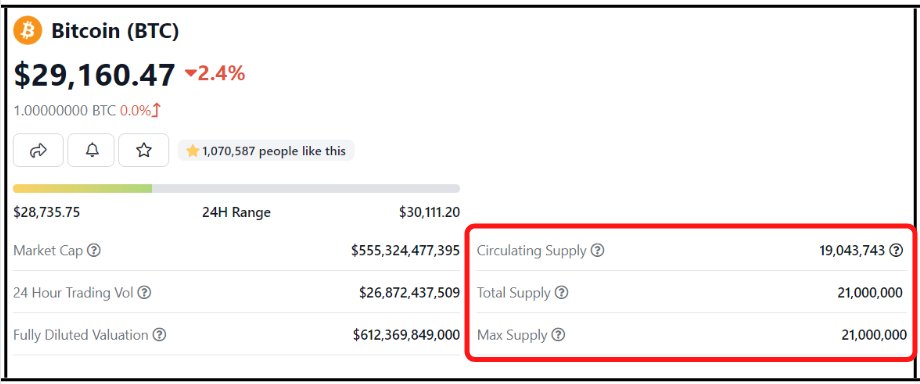

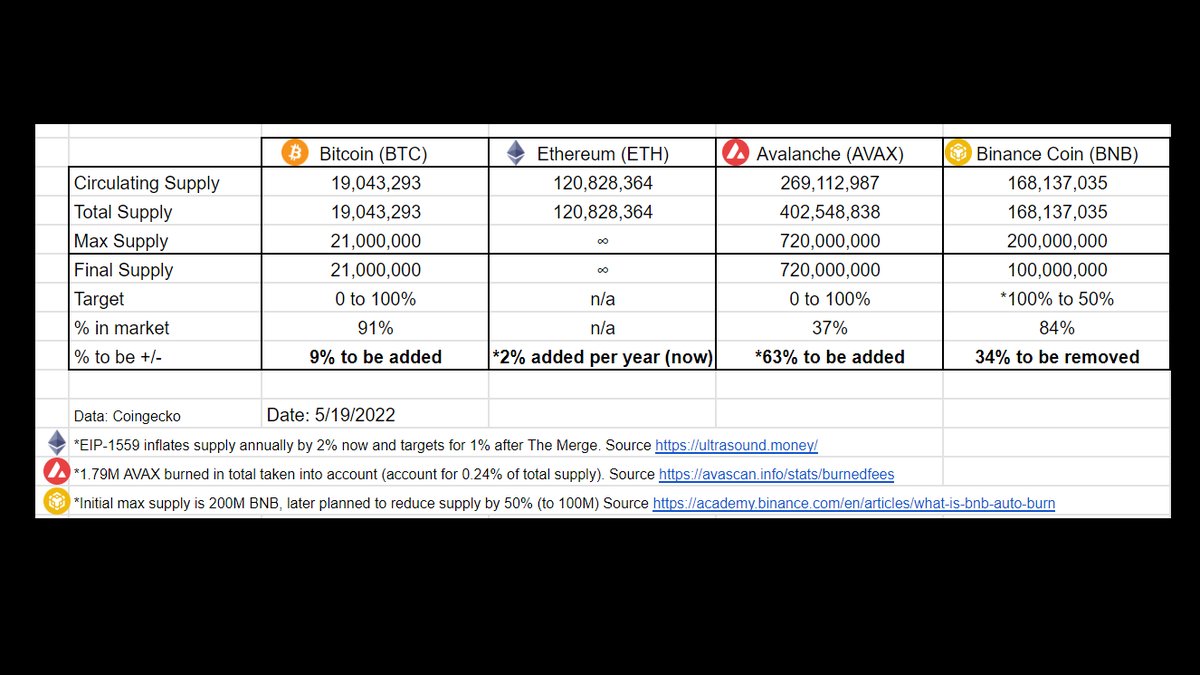

Now let’s put that into practice.

Here are 4 coins with 4 different situations. What can you observe?

Think of the 3 metrics we just went through.

Here are 4 coins with 4 different situations. What can you observe?

Think of the 3 metrics we just went through.

At first glance, we know that

• Everyone has MAX supplies, except ETH.

• BTC has MOST of its supply in circulation (about 91%).

• BNB comes in second while AVAX has the least of its supply in circulation.

What does this tell you?

• Everyone has MAX supplies, except ETH.

• BTC has MOST of its supply in circulation (about 91%).

• BNB comes in second while AVAX has the least of its supply in circulation.

What does this tell you?

• BTC: Max supply with expected low inflation. No hidden (bad) surprise.

• Avax & BNB: Limited supply but a portion has yet to enter the market. Potential time bomb.

• ETH: Infinite supply. Money printer that goes brrr.

This is our first analysis. But what if we dig deeper?

• Avax & BNB: Limited supply but a portion has yet to enter the market. Potential time bomb.

• ETH: Infinite supply. Money printer that goes brrr.

This is our first analysis. But what if we dig deeper?

Under the hood..

• BTC: Low & steady (9%/118 yrs = 0.07% per yr on avg)

• AVAX: Alert (50% yet to unlock from TS & 63% from MS)

• BNB: 50% discount w/ 34% more to be destroyed

• ETH: Easier to stomach w/ 1-2% inflation per yr (despite infinity)

A more balanced view eh?

• BTC: Low & steady (9%/118 yrs = 0.07% per yr on avg)

• AVAX: Alert (50% yet to unlock from TS & 63% from MS)

• BNB: 50% discount w/ 34% more to be destroyed

• ETH: Easier to stomach w/ 1-2% inflation per yr (despite infinity)

A more balanced view eh?

So by simply looking at these numbers and with a little more digging, you can:

- guess the overall market perception & expectation

- adjust ur holding timeframe based on current & future supply.

That& #39;s what you can gather from simple research on supply.

- guess the overall market perception & expectation

- adjust ur holding timeframe based on current & future supply.

That& #39;s what you can gather from simple research on supply.

Brief Look into Market Capitalization

Market cap: Current Price * Circulating Supply

Fully Diluted Market Cap: Current Price * Max Supply

*Note FDMC is interchangeable with FDV, Fully Diluted Valuation.

Market cap: Current Price * Circulating Supply

Fully Diluted Market Cap: Current Price * Max Supply

*Note FDMC is interchangeable with FDV, Fully Diluted Valuation.

Translation:

MC: market value for public money buying up all the circulating supply NOW.

FDMC: market value if public money WERE to buy all the future supply.

MC: market value for public money buying up all the circulating supply NOW.

FDMC: market value if public money WERE to buy all the future supply.

MC/FDMC ratio - A simple ratio to measure inflation.

It tells you how excessive is the future supply for current market demand to absorb.

Closer to 1. Low future inflation. Most (max) supply has entered the market. We comfy.

Closer to 0. High future inflation. Incoming dump.

It tells you how excessive is the future supply for current market demand to absorb.

Closer to 1. Low future inflation. Most (max) supply has entered the market. We comfy.

Closer to 0. High future inflation. Incoming dump.

Now we have a rough understanding of the supply. We can easily put these tokens into 4 groups based on inflation & supply cap.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Inflationary + cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Inflationary + cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Inflationary + no cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Inflationary + no cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Deflationary + cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Deflationary + cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Deflationary + no cap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪" title="Klein zwart vierkant" aria-label="Emoji: Klein zwart vierkant"> Deflationary + no cap

Let& #39;s go through them one by one.

Let& #39;s go through them one by one.

1) Bitcoin - inflationary w/ cap

• 21 million. Supply is capped and no one can change that. Period.

• Miner rewards decrease by half every four years. Less and less supply flowing into market over time. Emission slowly dries out.

• This is why it& #39;s called the digital gold.

• 21 million. Supply is capped and no one can change that. Period.

• Miner rewards decrease by half every four years. Less and less supply flowing into market over time. Emission slowly dries out.

• This is why it& #39;s called the digital gold.

2) Dogecoin - inflationary w/ no cap

• No cap, no limit.

• 5B DOGE to join the market every year. Inflation rate& #39;ll go down (due to growin base). But the money printer never stops.

• Fun fact: Everyone on earth could have 1B DOGE & still have 125B leftovers in the supply.

• No cap, no limit.

• 5B DOGE to join the market every year. Inflation rate& #39;ll go down (due to growin base). But the money printer never stops.

• Fun fact: Everyone on earth could have 1B DOGE & still have 125B leftovers in the supply.

3) Binance Coin - deflationary w/ cap

• Capped at 200M w/ plans to reduce to 100M w/ burning events.

• Burning: to destroy tokens by sending them to a frozen address that no one has access to. This removes them from supply forever.

• Lighting fire on limited supply. Gud.

• Capped at 200M w/ plans to reduce to 100M w/ burning events.

• Burning: to destroy tokens by sending them to a frozen address that no one has access to. This removes them from supply forever.

• Lighting fire on limited supply. Gud.

4) Deflationary w/ no cap

• No one sits here.

• Ethereum plans to lower supply thru EIP-1559 (burns fee) & Proof of Stake consensus (lock token).

• However, it still emits 1-2% of supply per yr right now. Until the Merge happens, ETH sits next right to Doge (or US dollar).

• No one sits here.

• Ethereum plans to lower supply thru EIP-1559 (burns fee) & Proof of Stake consensus (lock token).

• However, it still emits 1-2% of supply per yr right now. Until the Merge happens, ETH sits next right to Doge (or US dollar).

Big Fish. Little Fish.

Supply numba& #39;s important and it tells us stuff. But we cant move on with our research and smack the buy button without figuring out:

Who OWNS the supply? And WHEN can they sell?

I gotchu fam.

Supply numba& #39;s important and it tells us stuff. But we cant move on with our research and smack the buy button without figuring out:

Who OWNS the supply? And WHEN can they sell?

I gotchu fam.

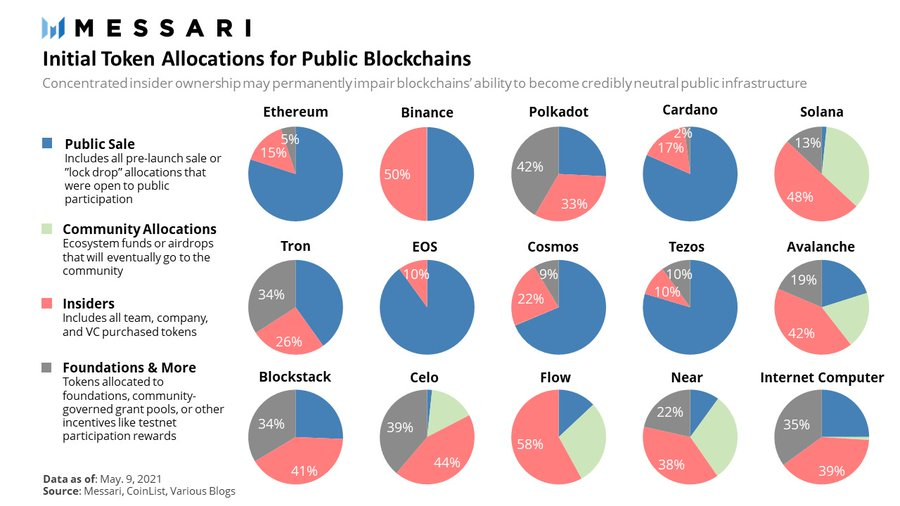

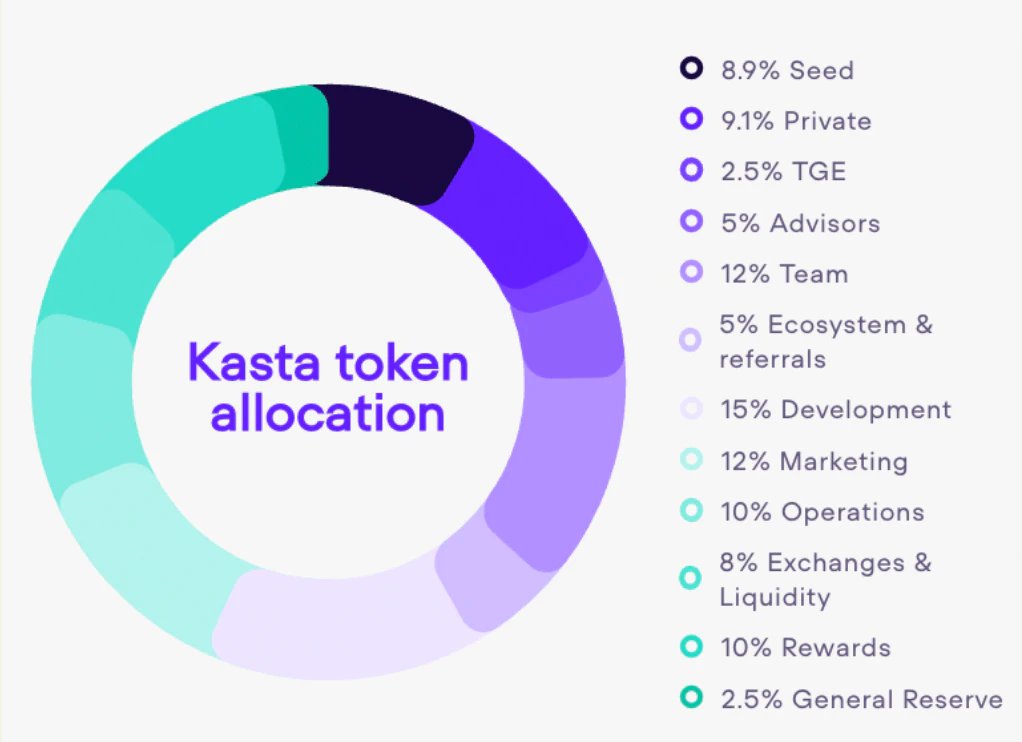

This comes down to allocation, vesting schedule, and market distribution.

a) How was it initially allocated?

• Pre-mined: Insiders preserve a portion for themselves before going public.

• Fair launch: Everyone buys/competes on the market.

Who gets a larger share of the pie?

a) How was it initially allocated?

• Pre-mined: Insiders preserve a portion for themselves before going public.

• Fair launch: Everyone buys/competes on the market.

Who gets a larger share of the pie?

The Weak Hands Theory

The lower the cost basis, the weaker the hands.

- At $1 for X token, there are winners of 1x, 10x or 100x cuz a difference in entry prices.

- The lower they get in, the comfier they are.

So who has the lowest cost basis?

The lower the cost basis, the weaker the hands.

- At $1 for X token, there are winners of 1x, 10x or 100x cuz a difference in entry prices.

- The lower they get in, the comfier they are.

So who has the lowest cost basis?

The team.

- Tokens& #39;re created from thin air and distributed to themselves.

- So their cost basis is practically zero.

- At $1, they make $1 paper profit for each token they own.

(multiply by a billy. They make a billy)

But with big bags comes great responsibility. They grind.

- Tokens& #39;re created from thin air and distributed to themselves.

- So their cost basis is practically zero.

- At $1, they make $1 paper profit for each token they own.

(multiply by a billy. They make a billy)

But with big bags comes great responsibility. They grind.

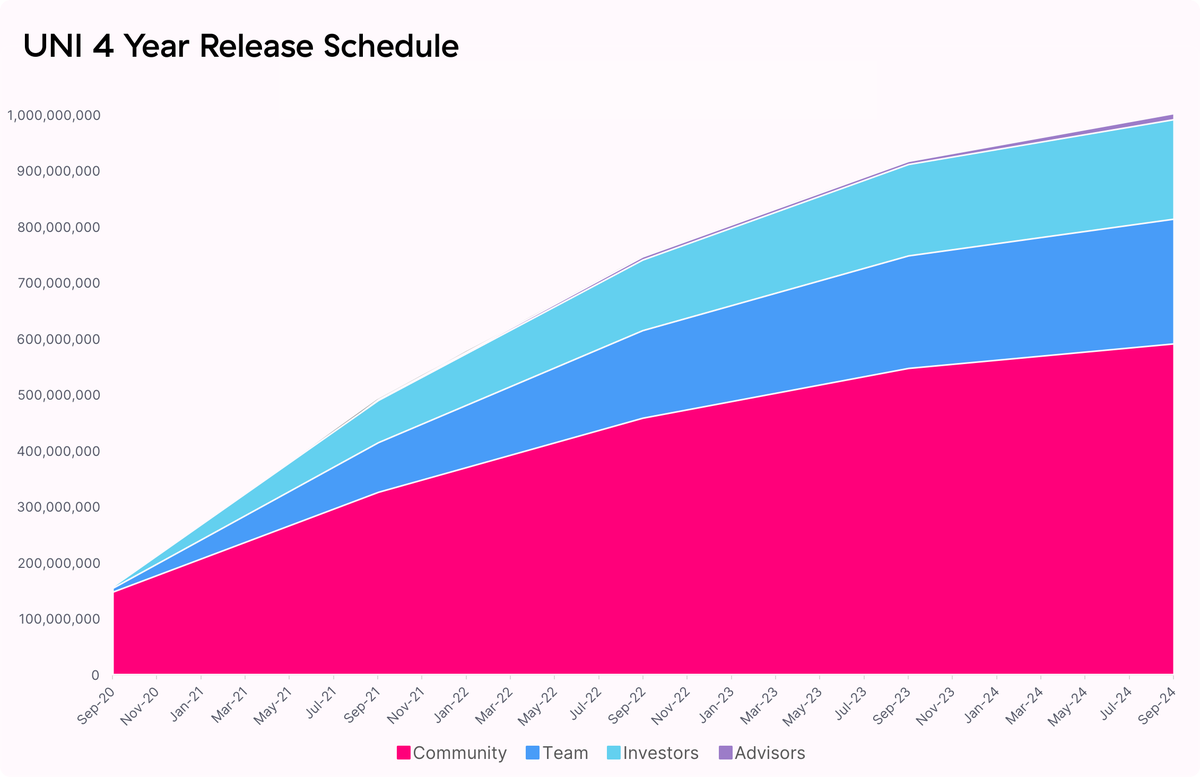

b) When can they sell? Check vesting schedule.

Tokens are released into the market in 2 stages namely:

• Cliff: Time needs to pass before first token release.

• Vesting: The amount unlocked slowly over time.

Keep track of time and it& #39;s no big deal.

Tokens are released into the market in 2 stages namely:

• Cliff: Time needs to pass before first token release.

• Vesting: The amount unlocked slowly over time.

Keep track of time and it& #39;s no big deal.

c) Any whales in open market? Use blockchain explorer to pick them up.

Example: Uniswap on @etherscan

Step:

1) Search [token name/address]

2) Scroll down and select “Holders”

3) Select “Token Holders Chart”

4) Voilà, the top 100 token holders chart

Example: Uniswap on @etherscan

Step:

1) Search [token name/address]

2) Scroll down and select “Holders”

3) Select “Token Holders Chart”

4) Voilà, the top 100 token holders chart

Things to look out for

• Number of holders

• How much do top 100 holders collectively own

• Any individual wallet stands out with a huge share of the total supply

You can even go whale-hunting and learn from their strategies hanging. But that& #39;s topic for another day.

• Number of holders

• How much do top 100 holders collectively own

• Any individual wallet stands out with a huge share of the total supply

You can even go whale-hunting and learn from their strategies hanging. But that& #39;s topic for another day.

Some ramblings

1. Be aware of marketing terms like fair allocation/community own crap. Anyone can control 50 or >100 wallets.

2. There& #39;s no fair launch. Insiders always have an edge over you.

3. Big eco/dev fund ≠ always bullish. Team pay expense. We all live on fiat, innit?

1. Be aware of marketing terms like fair allocation/community own crap. Anyone can control 50 or >100 wallets.

2. There& #39;s no fair launch. Insiders always have an edge over you.

3. Big eco/dev fund ≠ always bullish. Team pay expense. We all live on fiat, innit?

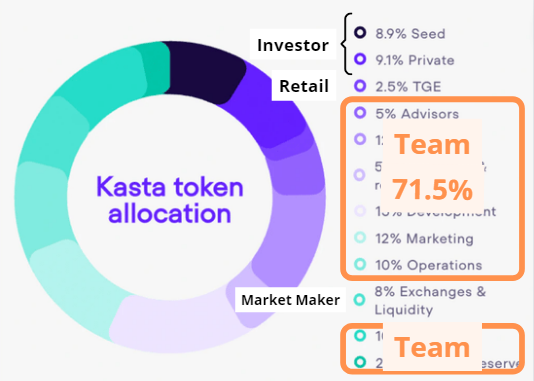

Pop quiz answer:

Team. They own 71.5% of the total supply.

Did you get guess it?

"incentives structures" by @cobie

Team. They own 71.5% of the total supply.

Did you get guess it?

"incentives structures" by @cobie

Part 2 of Simple Framework to Analyze Tokenomics

Again, chicken and egg questions dont matter if there aint no KFC in your town.

For this framework to work, we now have to shift our focus to the last piece of the puzzle: DEMAND.

Again, chicken and egg questions dont matter if there aint no KFC in your town.

For this framework to work, we now have to shift our focus to the last piece of the puzzle: DEMAND.

The Driving Force Behind Demand

Demand can be broken mainly into 3 forces:

• Utility

• Value Accrual and Redistribution

• Memes

Simple and straightforward.

Demand can be broken mainly into 3 forces:

• Utility

• Value Accrual and Redistribution

• Memes

Simple and straightforward.

1) Utility aka What does this token do?

a) Gas fee - Access to use the service.

• Want to send your friend a few dogecoins for fun? Pay txn fees in DOGE.

• Want to save time for a transaction on Ethereum? Pay more gas in ETH.

a) Gas fee - Access to use the service.

• Want to send your friend a few dogecoins for fun? Pay txn fees in DOGE.

• Want to save time for a transaction on Ethereum? Pay more gas in ETH.

b) Vote - Influence to sway important protocol decision that involves money.

• Firearm manufacturers bribe lobbyists to push pro-gun policies, so they can sell more guns.

• Protocols bribe $CRV holders to direct liquidity to themselves so their tokens are worth a dime.

• Firearm manufacturers bribe lobbyists to push pro-gun policies, so they can sell more guns.

• Protocols bribe $CRV holders to direct liquidity to themselves so their tokens are worth a dime.

c) Stability: Protection from market volatility.

• Stablecoin protects your bags from volatility. World war III or zombie apocalypse, stablecoin stabilizes.

(except UST)

• Stability → Adoption → Liquidity. Comfy bag for retirement.

• Stablecoin protects your bags from volatility. World war III or zombie apocalypse, stablecoin stabilizes.

(except UST)

• Stability → Adoption → Liquidity. Comfy bag for retirement.

2) Value Accrual and Redistribution

Do you get any actual benefits to hold it?

Don’t buy into the “for community, by community” bullsh*t. Leave that to the pros to steer the ship.

You’re here to make money, not to liberate North Korea sitting half-naked in your mom& #39;s basement.

Do you get any actual benefits to hold it?

Don’t buy into the “for community, by community” bullsh*t. Leave that to the pros to steer the ship.

You’re here to make money, not to liberate North Korea sitting half-naked in your mom& #39;s basement.

Example

• Hold (and stake) to save more trading fees on exchanges like @FTX or @Binance.

• Hold to get access (raffle) to allocation of a token sale.

• Hold to share revenue. Make sure it is actually delivered to you NOW. Not next week, next month, or “when the time comes”.

• Hold (and stake) to save more trading fees on exchanges like @FTX or @Binance.

• Hold to get access (raffle) to allocation of a token sale.

• Hold to share revenue. Make sure it is actually delivered to you NOW. Not next week, next month, or “when the time comes”.

Smol Reminder

APY (Annual Percentage Yield) of a native token is just another word for inflation. If nothing backs it (and delivers to you immediately), it is just a bigger pie with same amount of ingredient.

Meaning it gets diluted.

APY (Annual Percentage Yield) of a native token is just another word for inflation. If nothing backs it (and delivers to you immediately), it is just a bigger pie with same amount of ingredient.

Meaning it gets diluted.

Lesson of the story

• Ride on memes w/ strong consensus, esp those can tape into emotions and unite people for a cause. Example, @ConstitutionDAO

• Evaluate marketing strength of the project. Social media execution & performance. Quality of Discord moderation. Stress test the

• Ride on memes w/ strong consensus, esp those can tape into emotions and unite people for a cause. Example, @ConstitutionDAO

• Evaluate marketing strength of the project. Social media execution & performance. Quality of Discord moderation. Stress test the

..team to check if they’re up for the job when attention floods in.

• Evaluate community foundation. Check how cult-like are the members? Do they go all out for the project (look for tattoos post lol, vocal to praise, promote, defend project on Reddit, Twitter, Facebook etc)

• Evaluate community foundation. Check how cult-like are the members? Do they go all out for the project (look for tattoos post lol, vocal to praise, promote, defend project on Reddit, Twitter, Facebook etc)

Simple check: Sit in Discord Stage or Twitter spaces and listen. Judge how enthusiastic is the speaker and crowd.

Meme is just like a virus. It is only as infectious as how long it lives and how far it spreads.

Meme is just like a virus. It is only as infectious as how long it lives and how far it spreads.

3 Takeaways

• Supply. STUDY the whitepapers.

• Demand. Ask why would anyone buy this token. And their incentives to hold long term.

• Cult. Step out of echo chamber sometimes. Pay attention to the FUDs. Multiple warnings circulated on Twitter months before Luna’s collapse.

• Supply. STUDY the whitepapers.

• Demand. Ask why would anyone buy this token. And their incentives to hold long term.

• Cult. Step out of echo chamber sometimes. Pay attention to the FUDs. Multiple warnings circulated on Twitter months before Luna’s collapse.

Finally here& #39;s a checklist I use to filter crap when reasearching a token.

I may miss a few things or be completely wrong about certain parts.

So always feel free to add/change rules that suits you better.

I may miss a few things or be completely wrong about certain parts.

So always feel free to add/change rules that suits you better.

That& #39;s a wrap

Follow me @0xnyew for more threads like this. I& #39;ll keep writing about defi and investing stuff during the bear market. I& #39;m staying this time.

Like/retweet this tweet down below if you think it& #39;s helpful. https://twitter.com/0xnyew/status/1528760382667362304?s=20&t=v2qwRDHOweUR9FyOVz4klg">https://twitter.com/0xnyew/st...

Follow me @0xnyew for more threads like this. I& #39;ll keep writing about defi and investing stuff during the bear market. I& #39;m staying this time.

Like/retweet this tweet down below if you think it& #39;s helpful. https://twitter.com/0xnyew/status/1528760382667362304?s=20&t=v2qwRDHOweUR9FyOVz4klg">https://twitter.com/0xnyew/st...

Everyone all credits should go to @thedefiedge for inspiring me to write this thread.

He’s always been my inspiration ever since I come across his work on Defi. Do give him a follow and trust me, he never disappoints.

He’s always been my inspiration ever since I come across his work on Defi. Do give him a follow and trust me, he never disappoints.

Read on Twitter

Read on Twitter

![c) Any whales in open market? Use blockchain explorer to pick them up.Example: Uniswap on @etherscanStep:1) Search [token name/address]2) Scroll down and select “Holders”3) Select “Token Holders Chart”4) Voilà, the top 100 token holders chart c) Any whales in open market? Use blockchain explorer to pick them up.Example: Uniswap on @etherscanStep:1) Search [token name/address]2) Scroll down and select “Holders”3) Select “Token Holders Chart”4) Voilà, the top 100 token holders chart](https://pbs.twimg.com/media/FTc_kIUVIAAH_dX.png)