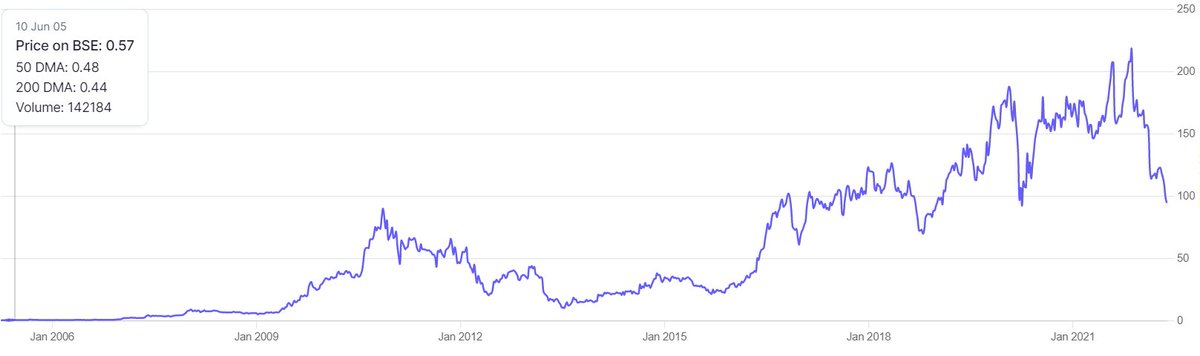

Manappuram fell by -10% today.

In fact it has fallen a whopping -58% from its top on 9th Nov-21

What happened?

And what should you do?

1/n

In fact it has fallen a whopping -58% from its top on 9th Nov-21

What happened?

And what should you do?

1/n

Gold loan is the safest loan. Why?

The collateral ie gold is already in possession of the lender.

Gold is the most liquid form of asset and can be sold anytime, anywhere in the world.

3/n

The collateral ie gold is already in possession of the lender.

Gold is the most liquid form of asset and can be sold anytime, anywhere in the world.

3/n

What is the risk in gold lending?

- Gold loans are bullet repayment loans ie principal needs to be repaid only at the end of the loan tenure

- Gold price fluctuation

4/n

- Gold loans are bullet repayment loans ie principal needs to be repaid only at the end of the loan tenure

- Gold price fluctuation

4/n

These risks can be reduced using 2 things

- Keeping the gold loan tenure low (say 3 months)

- Asking the borrower to pay interest every month instead of at the end of the loan

5/n

- Keeping the gold loan tenure low (say 3 months)

- Asking the borrower to pay interest every month instead of at the end of the loan

5/n

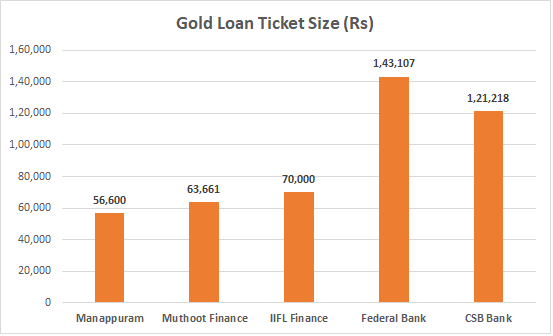

What is the main difference between gold loans given by Cos like Manappuram / Muthoot and the banks?

- Interest rate

- Avg ticket size

- Tenure

6/n

- Interest rate

- Avg ticket size

- Tenure

6/n

Banks majorly target the larger ticket size customers (>1 lac)

Whereas NBFCs target the lower ticket sizes

7/n

Whereas NBFCs target the lower ticket sizes

7/n

Now, let us come to what went wrong with Manappuram?

When pandemic hit us in Mar-20

Banks & NBFCs were scared to lend

Also, RBI drastically reduced interest rates and flooded the banking system with liquidity

Banks did not know whom to lend to?

9/n

When pandemic hit us in Mar-20

Banks & NBFCs were scared to lend

Also, RBI drastically reduced interest rates and flooded the banking system with liquidity

Banks did not know whom to lend to?

9/n

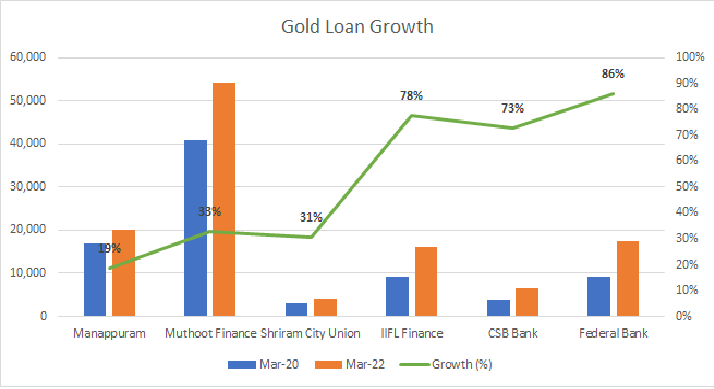

Gold loan was the safest and the easiest option

Co like IIFL Finance, CSB bank, Federal Bank grew their gold loan book by 70%+

10/n

Co like IIFL Finance, CSB bank, Federal Bank grew their gold loan book by 70%+

10/n

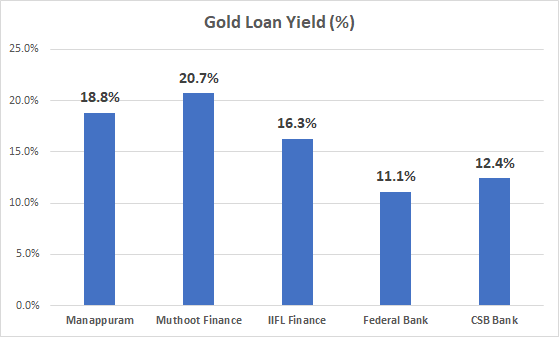

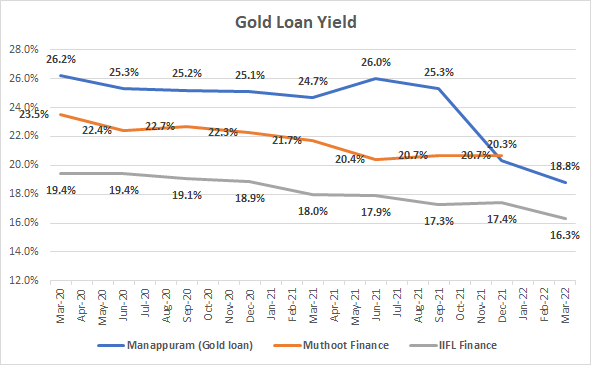

With cost of funds reducing and competition becoming aggressive, gold loan yields have been reducing

11/n

11/n

Manappuram used to make 25% yield for several years

But, in Dec-21 qtr, it acknowledged that it is losing business to competition because it is charging higher interest rates.

Manappuram reduced interest rates and the yield came down from 25% to 18.8% in Mar-22 quarter

12/n

But, in Dec-21 qtr, it acknowledged that it is losing business to competition because it is charging higher interest rates.

Manappuram reduced interest rates and the yield came down from 25% to 18.8% in Mar-22 quarter

12/n

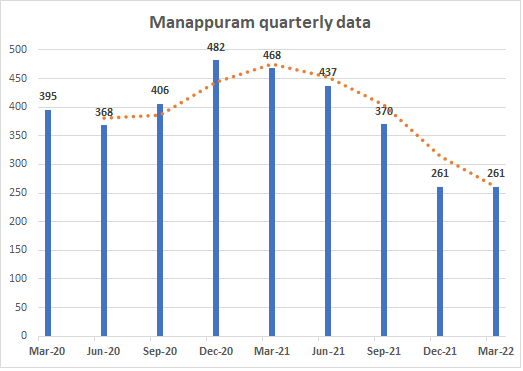

Is this a permanent reduction in profitability of Manappuram?

Is it going to get worse?

The market seems to think so

Valuation:

P/B <1

PE ratio ~ 8

(assuming permanent reduction in profitability to Rs 250 Cr per quarter)

14/n

Is it going to get worse?

The market seems to think so

Valuation:

P/B <1

PE ratio ~ 8

(assuming permanent reduction in profitability to Rs 250 Cr per quarter)

14/n

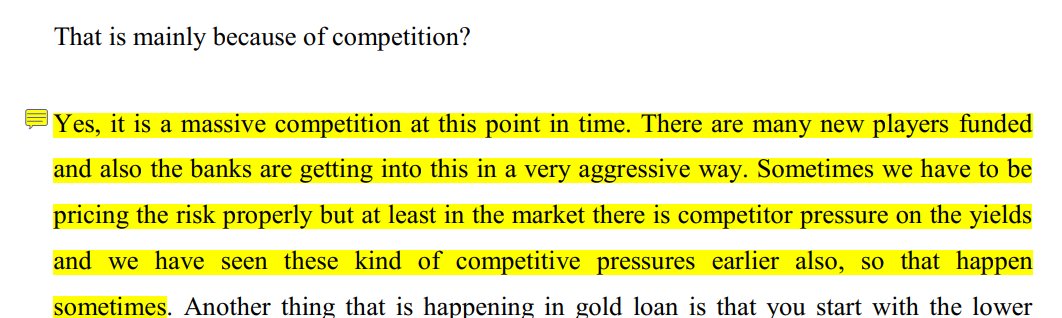

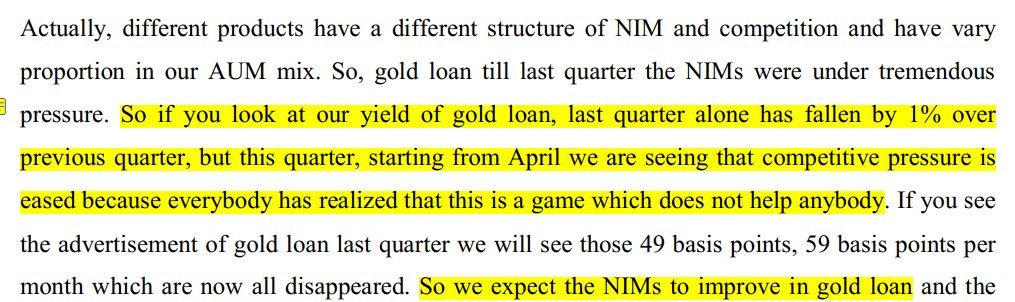

Will the competition remain so intense?

Are there signs of the intense competition for gold loans reducing?

Q3FY22 Con Call - IIFL Finance

15/n

Are there signs of the intense competition for gold loans reducing?

Q3FY22 Con Call - IIFL Finance

15/n

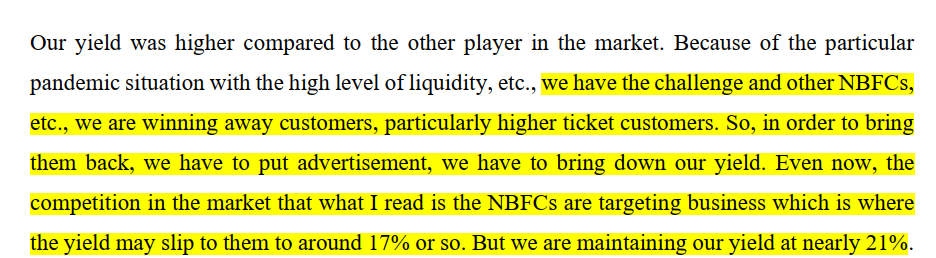

In Q4FY22, Manappuram was not able to maintain yields at 21%, but had to reduce to 18.8%

Again in Q4FY22 con call, management says that we will maintain yields at 21%

17/n

Again in Q4FY22 con call, management says that we will maintain yields at 21%

17/n

What gives me some confidence is that even IIFL Finance is saying that with increasing interest rates, yields are stabilizing

Q4FY22 Con Call - IIFL Finance

18/n

Q4FY22 Con Call - IIFL Finance

18/n

So, at least yields should not reduce further from here.

19/n

19/n

Also

Microfinance (Asirvad MFI) in the 2nd biggest vertical for Manappuram and it is struggling after Covid 2nd wave

However, given by the commentary from all the MFI competitors, things are fast improving and Asirvad MFI should also return to profitability in 2/3 quarters

20/n

Microfinance (Asirvad MFI) in the 2nd biggest vertical for Manappuram and it is struggling after Covid 2nd wave

However, given by the commentary from all the MFI competitors, things are fast improving and Asirvad MFI should also return to profitability in 2/3 quarters

20/n

Summary:

In my opinion,

1. The reducing trend of yields (&NIMs) has probably reached the bottom

2. MFI will start giving some profits in the next 6/12 months

21/n

In my opinion,

1. The reducing trend of yields (&NIMs) has probably reached the bottom

2. MFI will start giving some profits in the next 6/12 months

21/n

This might be a good price to add Manappuram to your portfolio

However, things are not improving in a hurry and one shud be prepared to hold for 3-5 years

Also, adding a little every month might be a good idea

22/22 (end)

However, things are not improving in a hurry and one shud be prepared to hold for 3-5 years

Also, adding a little every month might be a good idea

22/22 (end)

Read on Twitter

Read on Twitter