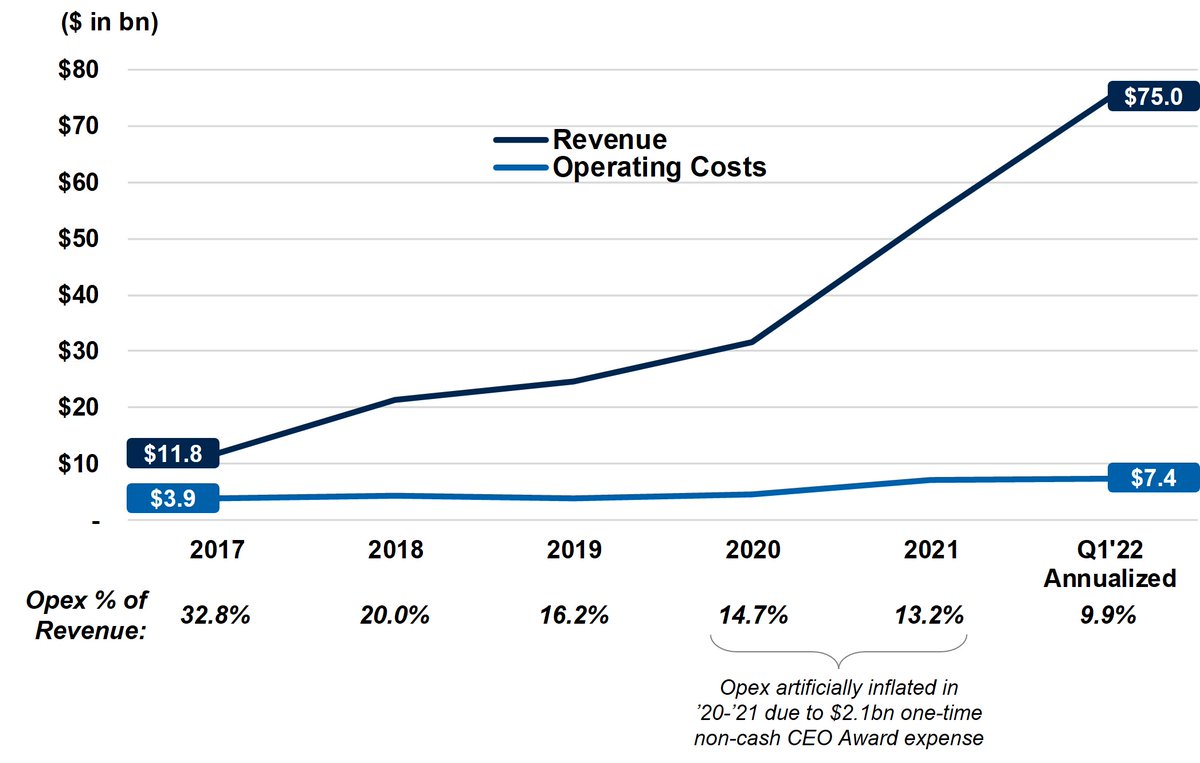

$TSLA& #39;s capital efficiency & operating leverage are the most underappreciated aspects of its business

How was this achieved and is it sustainable? What are the long-term implications going forward?

How was this achieved and is it sustainable? What are the long-term implications going forward?

This will briefly cover efficiencies in 3 areas (employees, capex/factories, R&D) before covering go-forward implications

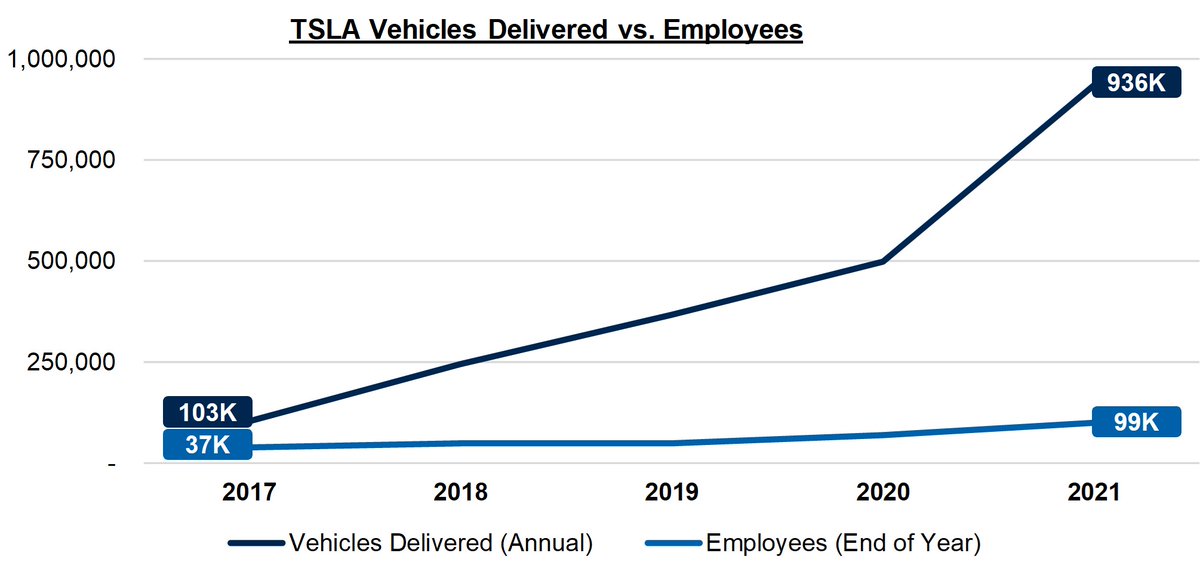

1) Employees

Over the past 5 years, Tesla grew deliveries by 9.1x while headcount grew only 2.6x

Higher production automation/efficiency & online sales mix combined with optimized service (i.e. mobile fleet) helps the business scale with low incremental labor costs

Over the past 5 years, Tesla grew deliveries by 9.1x while headcount grew only 2.6x

Higher production automation/efficiency & online sales mix combined with optimized service (i.e. mobile fleet) helps the business scale with low incremental labor costs

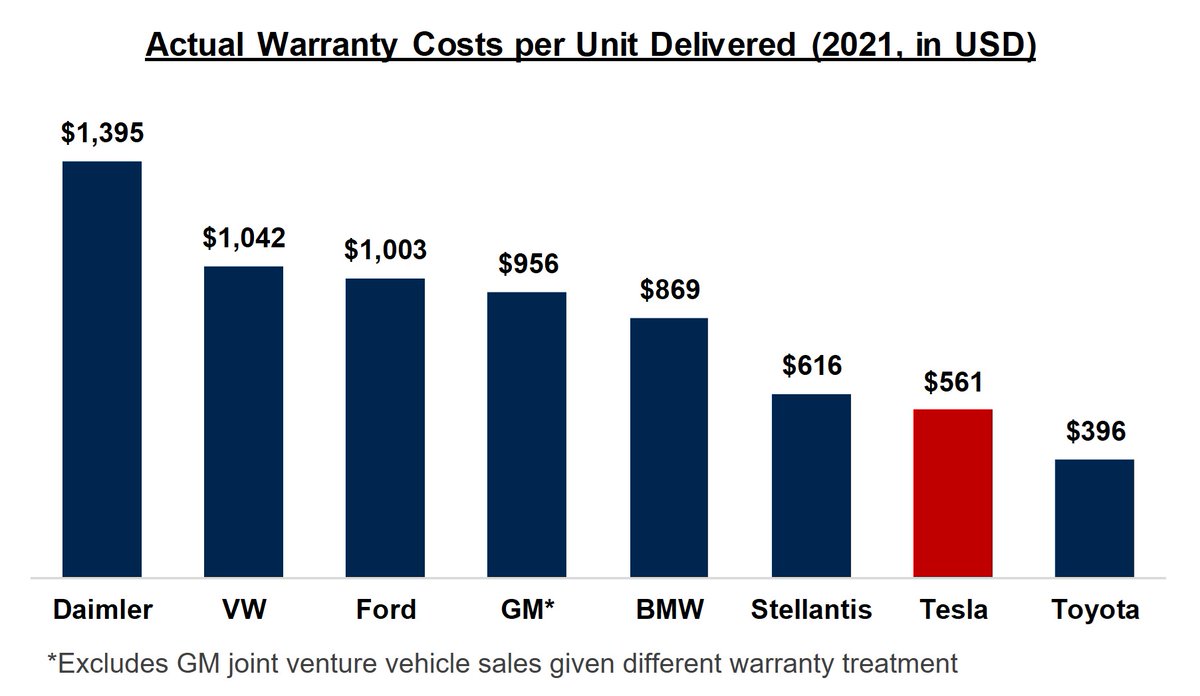

Tesla can also sell more vehicles per service employee. Actual warranty costs (not reserves) per unit continue to decrease as build quality improves

In fact, Tesla now has the 2nd lowest cash warranty cost per unit behind only Toyota

In fact, Tesla now has the 2nd lowest cash warranty cost per unit behind only Toyota

Also one of the most attractive employers in any industry, Tesla can be more selective & only hire the best/most productive engineers

This trend has improved noticeably in recent years, as # of applicants is up 4x since ’19. Of the 3mm applicants in ’21, Tesla only hired 1-2%

This trend has improved noticeably in recent years, as # of applicants is up 4x since ’19. Of the 3mm applicants in ’21, Tesla only hired 1-2%

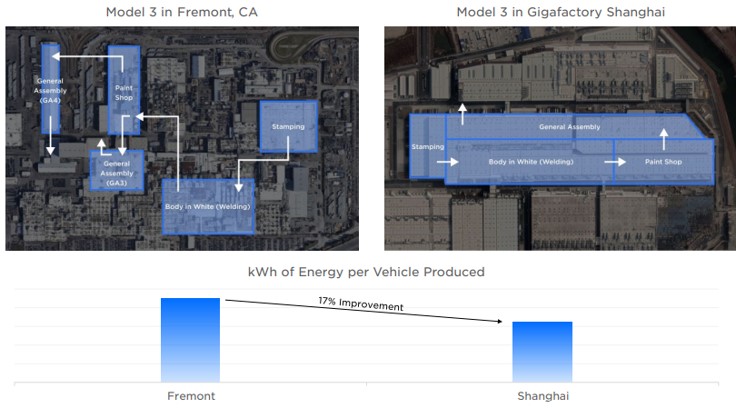

2) Capex/factories

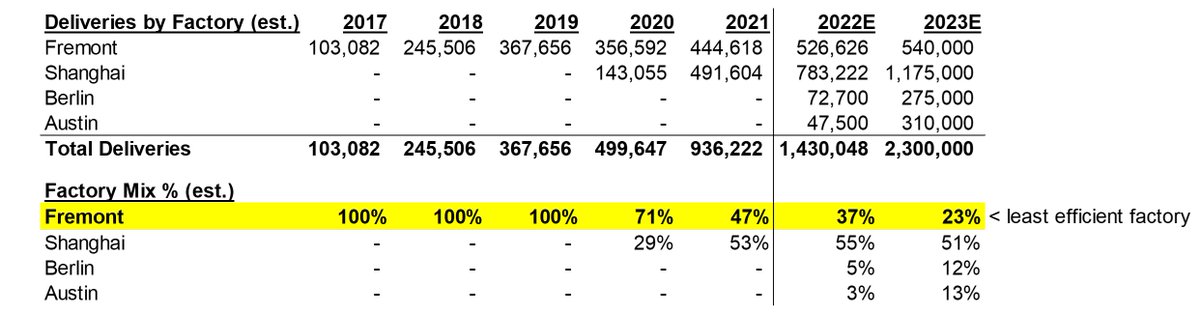

New factories are more efficient & have less associated space/overhead/equipment than the GM-built Fremont factory

Fremont mix was 100% until ’20 & will likely fall below 25% by next year

New factories are more efficient & have less associated space/overhead/equipment than the GM-built Fremont factory

Fremont mix was 100% until ’20 & will likely fall below 25% by next year

Capex efficiency has improved dramatically as each factory leverages learnings from older facilities

Capex/unit has declined -80% since ’17 despite frontloading investments in Austin & Berlin. Since capex was pulled forward, mgmt doesn’t expect capex to increase much through & #39;24

Capex/unit has declined -80% since ’17 despite frontloading investments in Austin & Berlin. Since capex was pulled forward, mgmt doesn’t expect capex to increase much through & #39;24

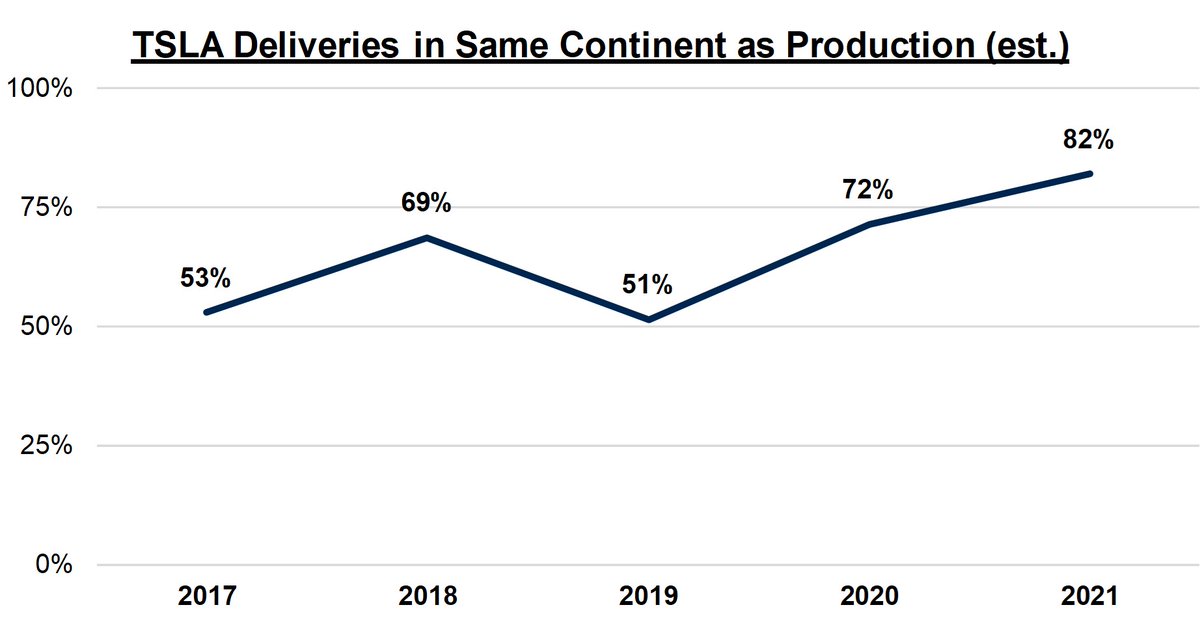

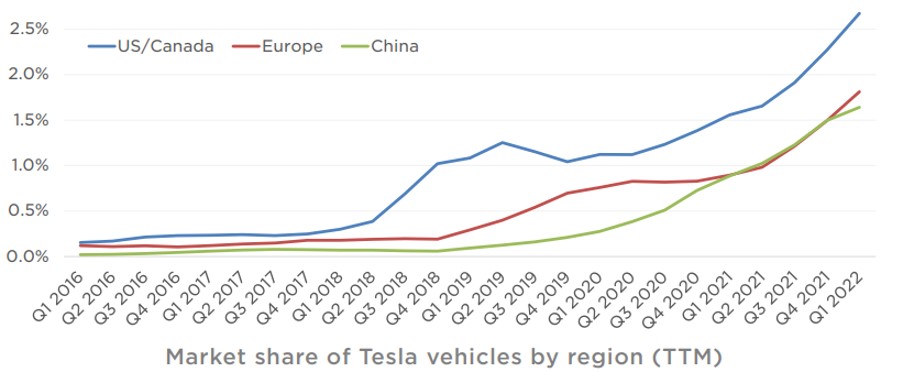

Localized production also reduces transit costs (for both raw materials & finished goods) and tariffs

The mix of locally-produced vehicles continues to increase towards their target of 100%

The mix of locally-produced vehicles continues to increase towards their target of 100%

3) R&D

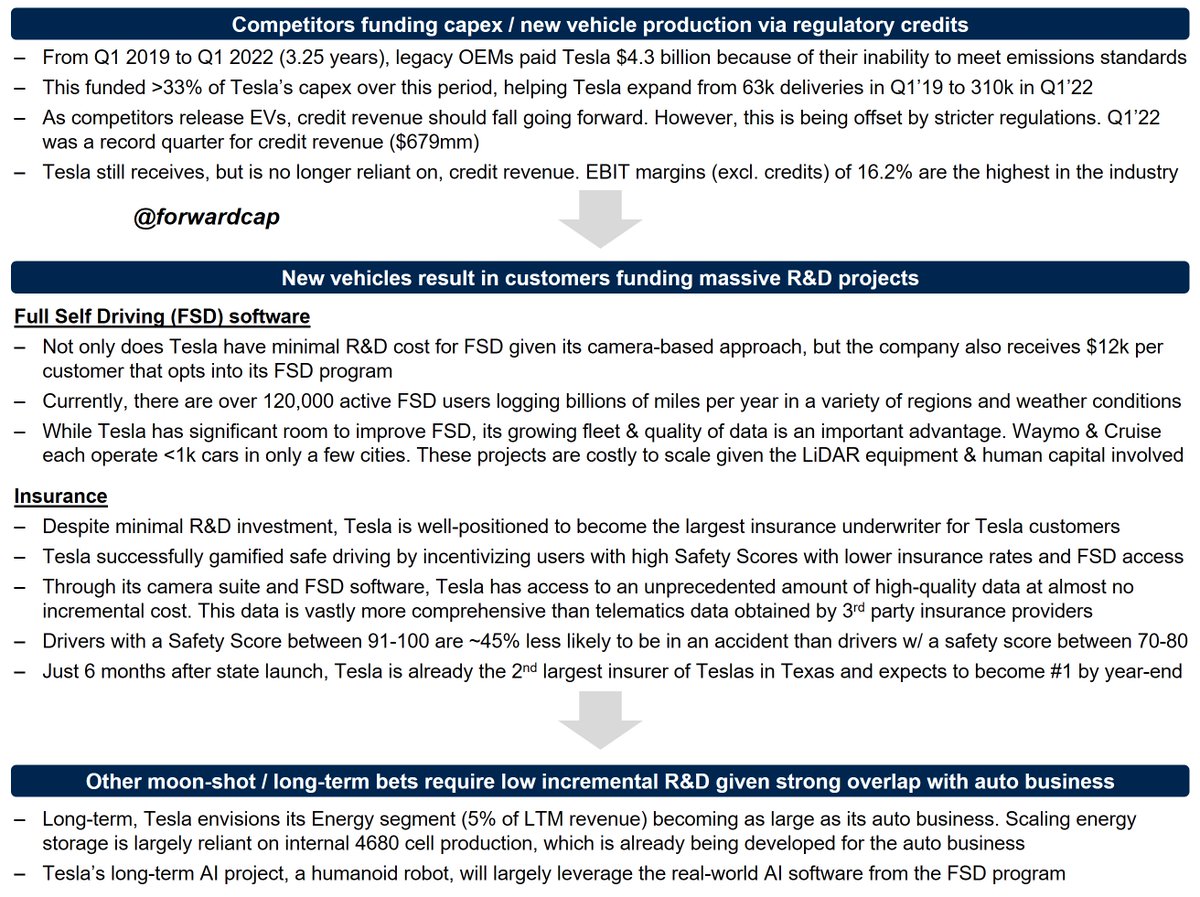

Tesla’s R&D budget is unique because it’s mostly either funded by customers or has strong overlap with the auto business

Tesla continues innovating & is well-positioned to expand into massive adjacent markets, despite R&D falling from 12% to 5% of sales from ’17-‘21

Tesla’s R&D budget is unique because it’s mostly either funded by customers or has strong overlap with the auto business

Tesla continues innovating & is well-positioned to expand into massive adjacent markets, despite R&D falling from 12% to 5% of sales from ’17-‘21

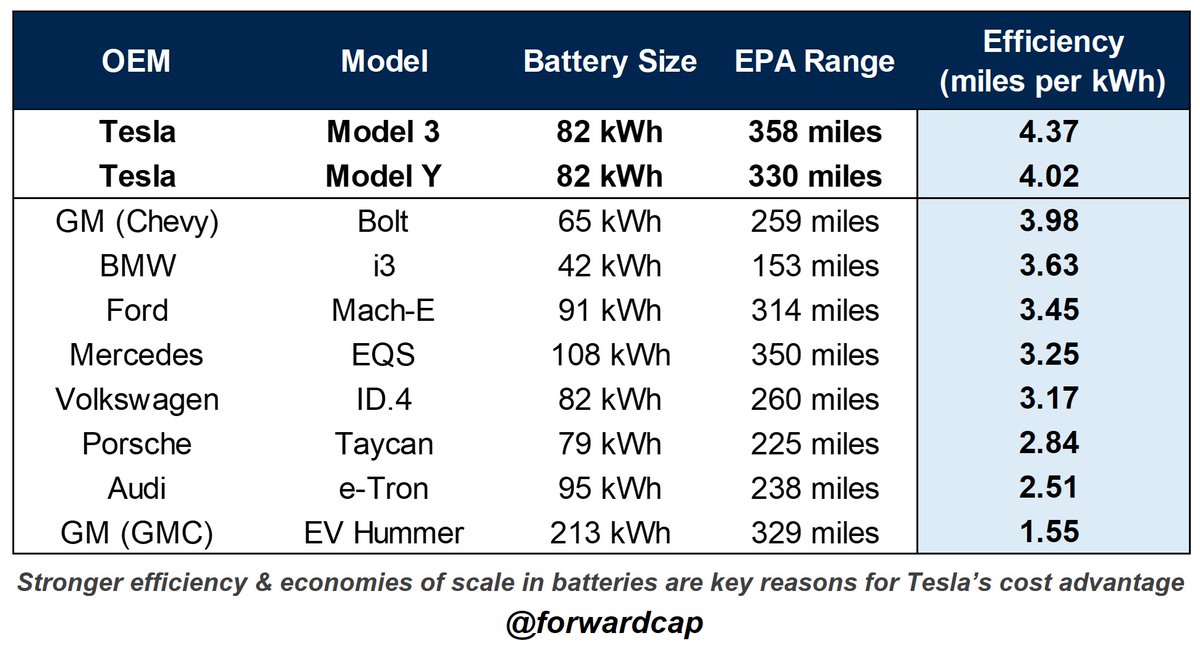

Even with a smaller R&D budget, Tesla’s products are improving quicker and have higher battery efficiency than competing EVs

Given the outsized cost of batteries in an EV, battery efficiency is key to cheaper production

Given the outsized cost of batteries in an EV, battery efficiency is key to cheaper production

All of these efficiencies have resulted in significant operating leverage that will compound with higher unit volumes

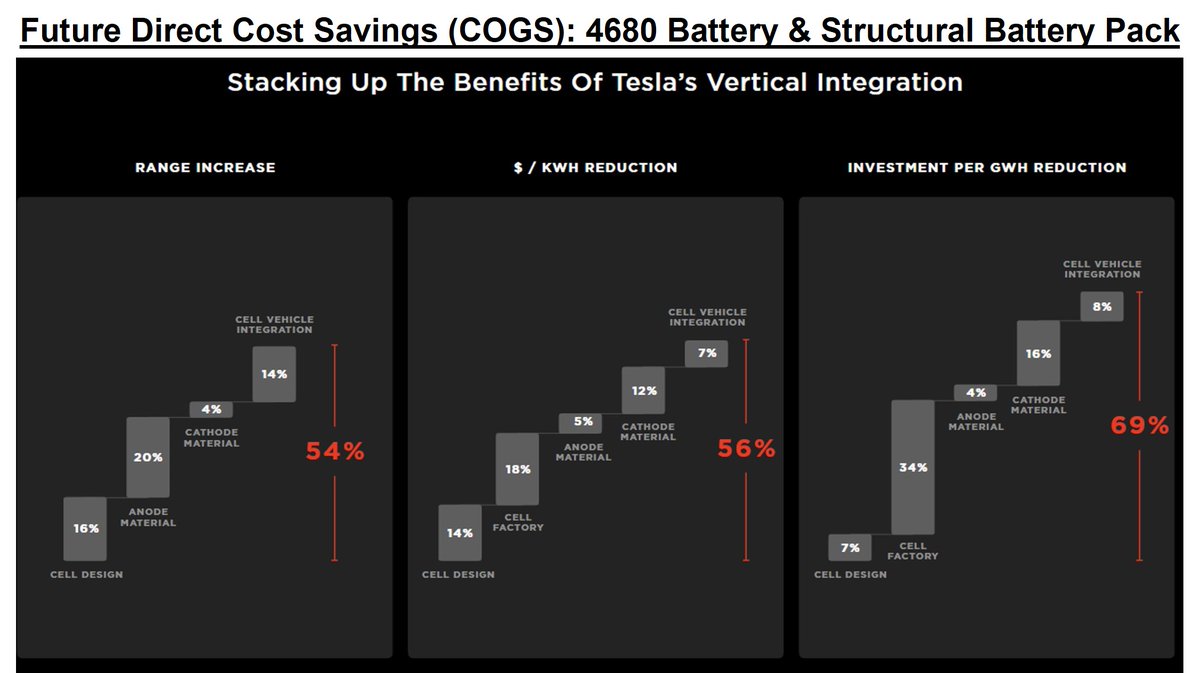

In addition, Tesla will also lower direct costs through 4680 & LFP cells, structural battery packs, front/rear castings, & other innovations

In addition, Tesla will also lower direct costs through 4680 & LFP cells, structural battery packs, front/rear castings, & other innovations

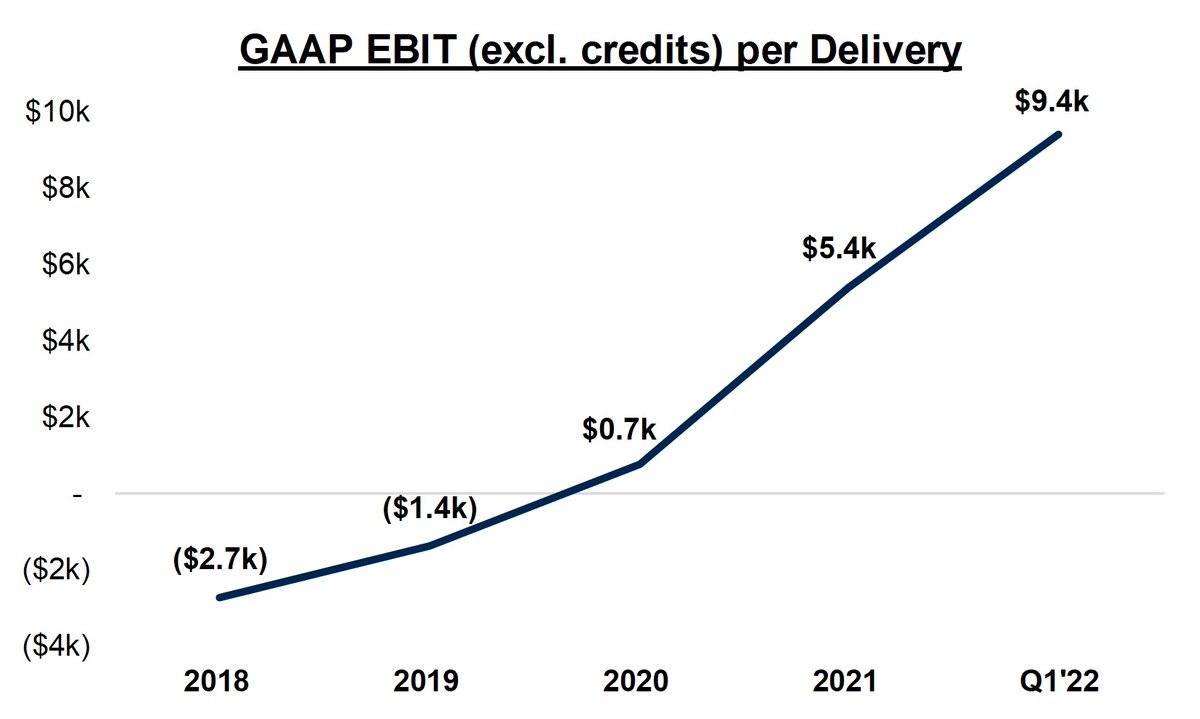

Tesla’s unit economics (excl. credits) are improving rapidly, from losing -$2.7k per delivery in ’18 to a profit of $9.4k per delivery in Q1’22

This leads the industry and is almost 3x more profit per car than the average competitor

This leads the industry and is almost 3x more profit per car than the average competitor

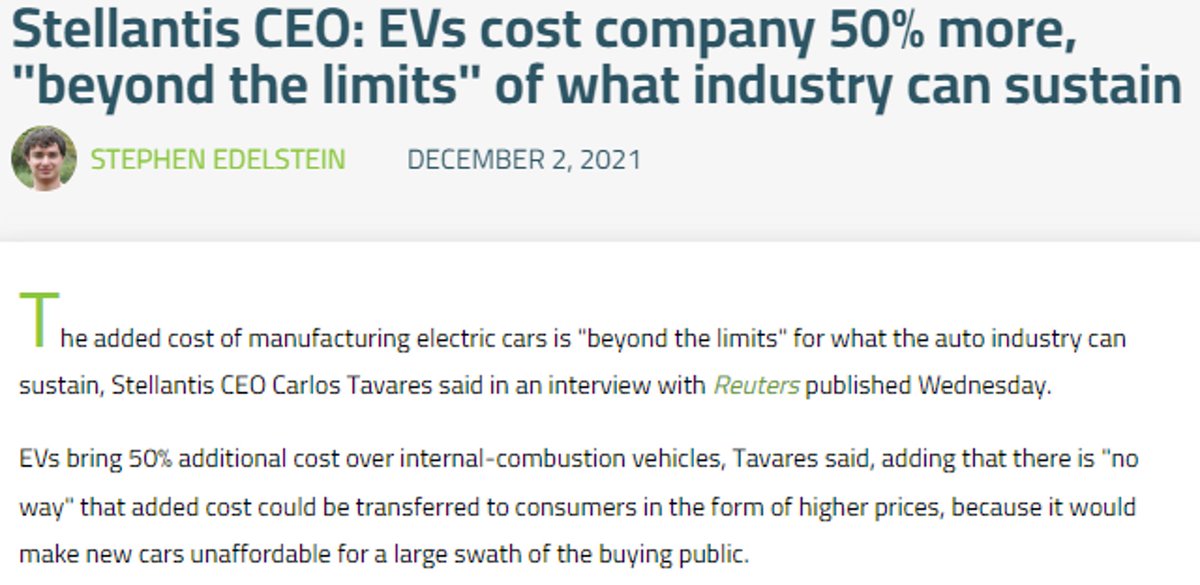

Cost inflation will be a margin headwind going forward, but Tesla is much better positioned than peers given much stronger:

- margin profile

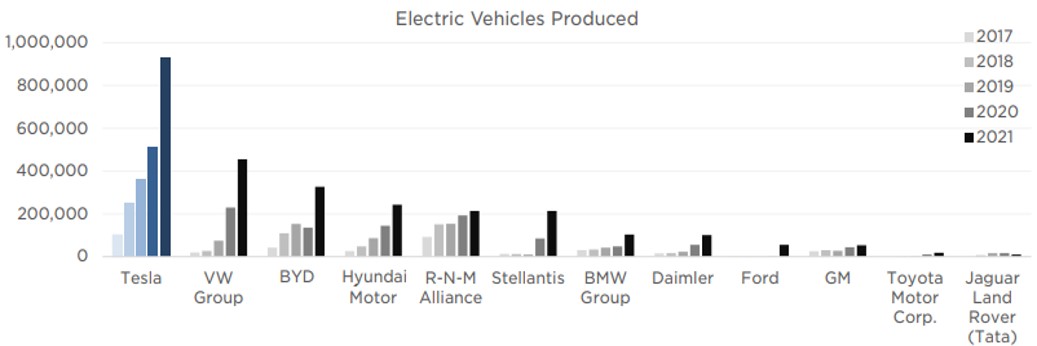

- EV scale

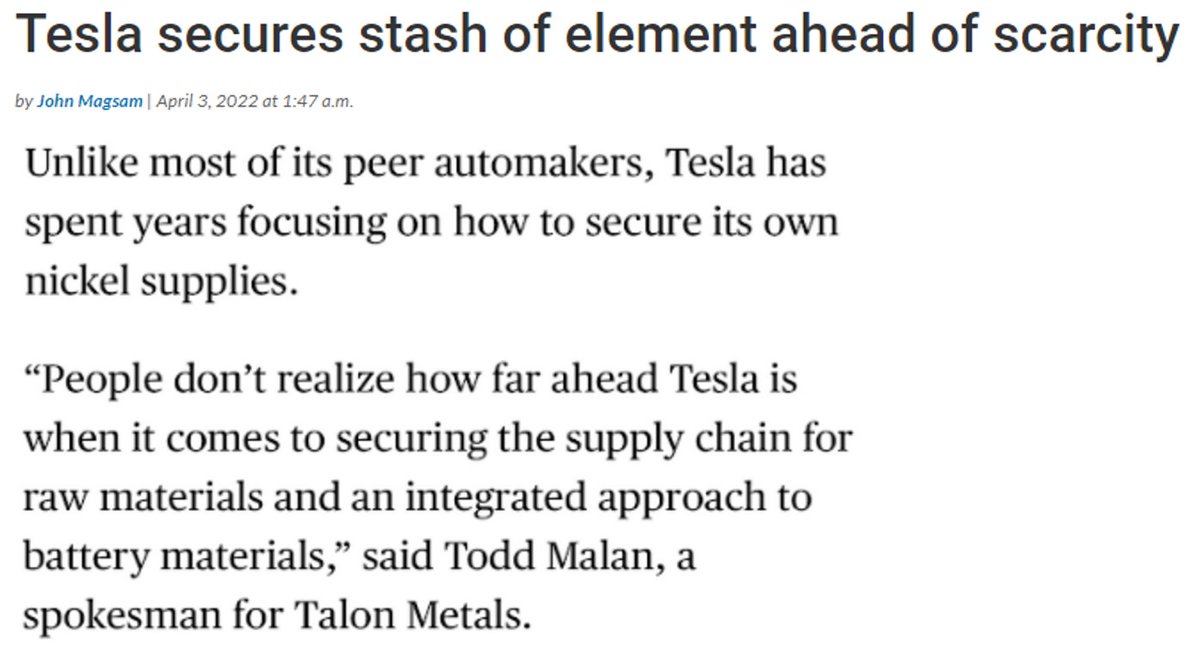

- raw materials sourcing capabilities

- supply chain integration

- margin profile

- EV scale

- raw materials sourcing capabilities

- supply chain integration

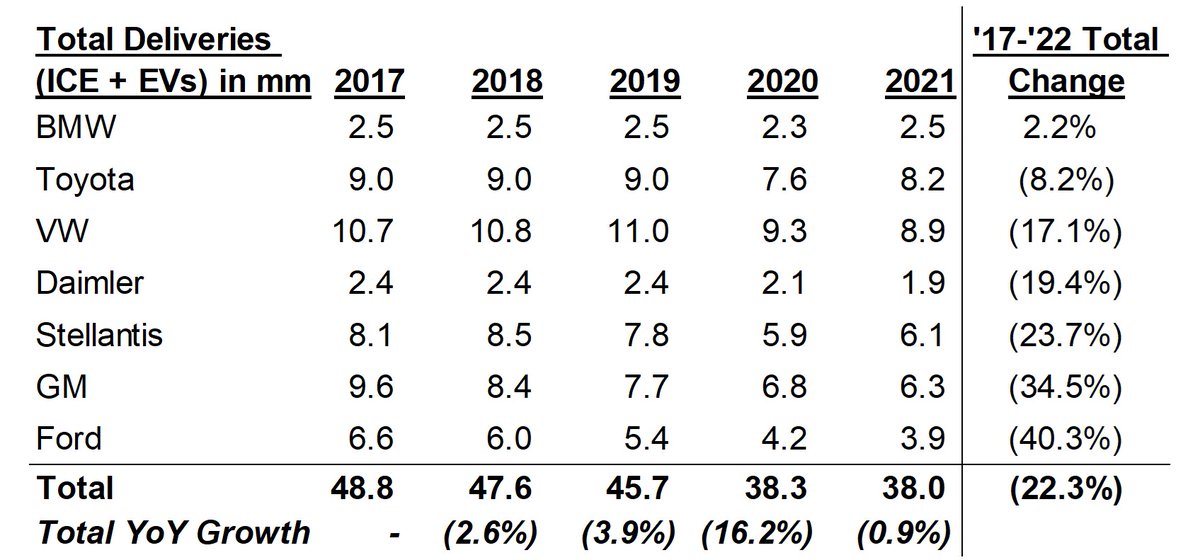

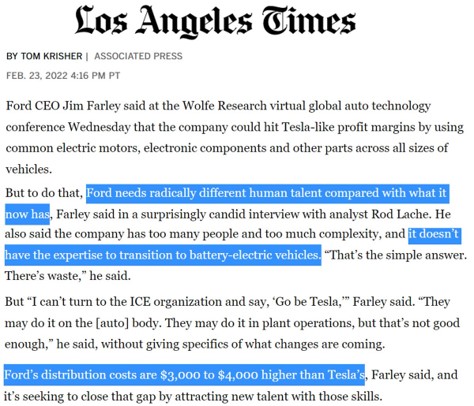

Tesla’s advantages in manufacturing, scale, and talent are compounding while core legacy OEM businesses (ICE) are in secular decline

Their new EVs will not drive incremental volumes, but cannibalize their ICE cars at significantly lower margins

What are long-term implications?

Their new EVs will not drive incremental volumes, but cannibalize their ICE cars at significantly lower margins

What are long-term implications?

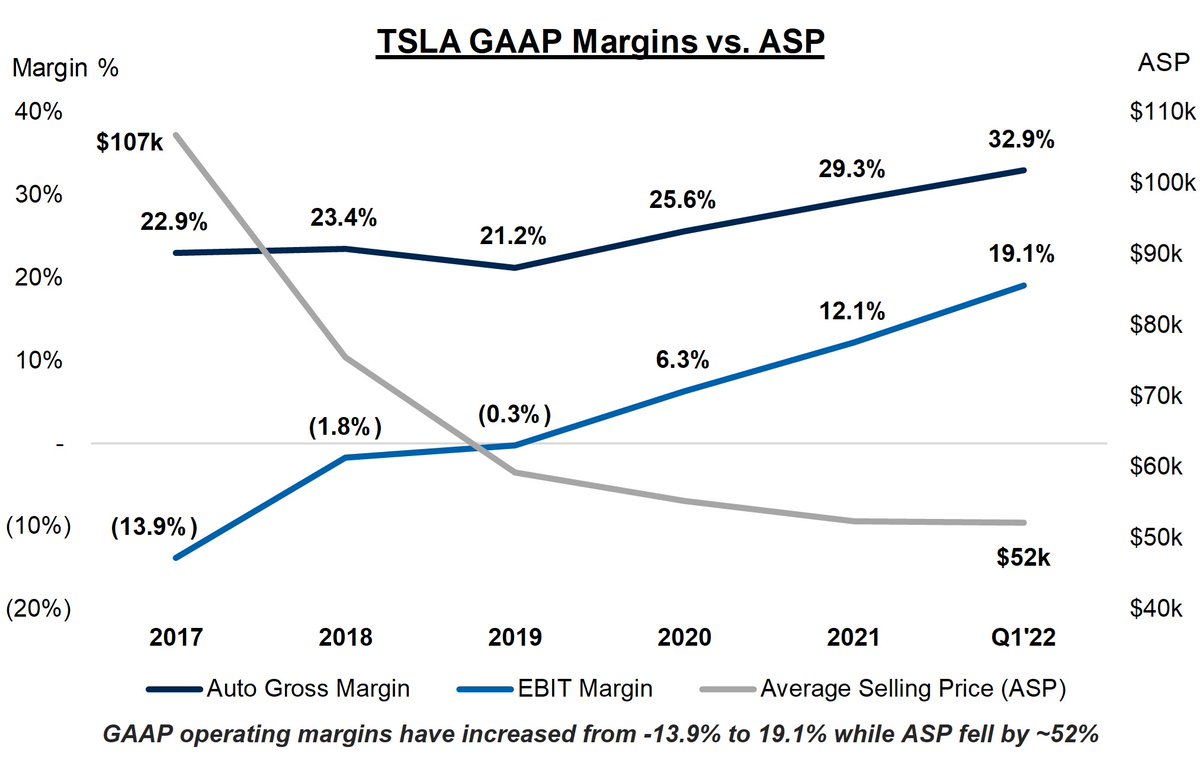

Tesla is likely to continue increasing margins despite lowering ASPs

Prices will remain elevated for the foreseeable future given record backlog/wait times, but lowering prices is critical to achieving their long-term goal of 20mm units annually

Prices will remain elevated for the foreseeable future given record backlog/wait times, but lowering prices is critical to achieving their long-term goal of 20mm units annually

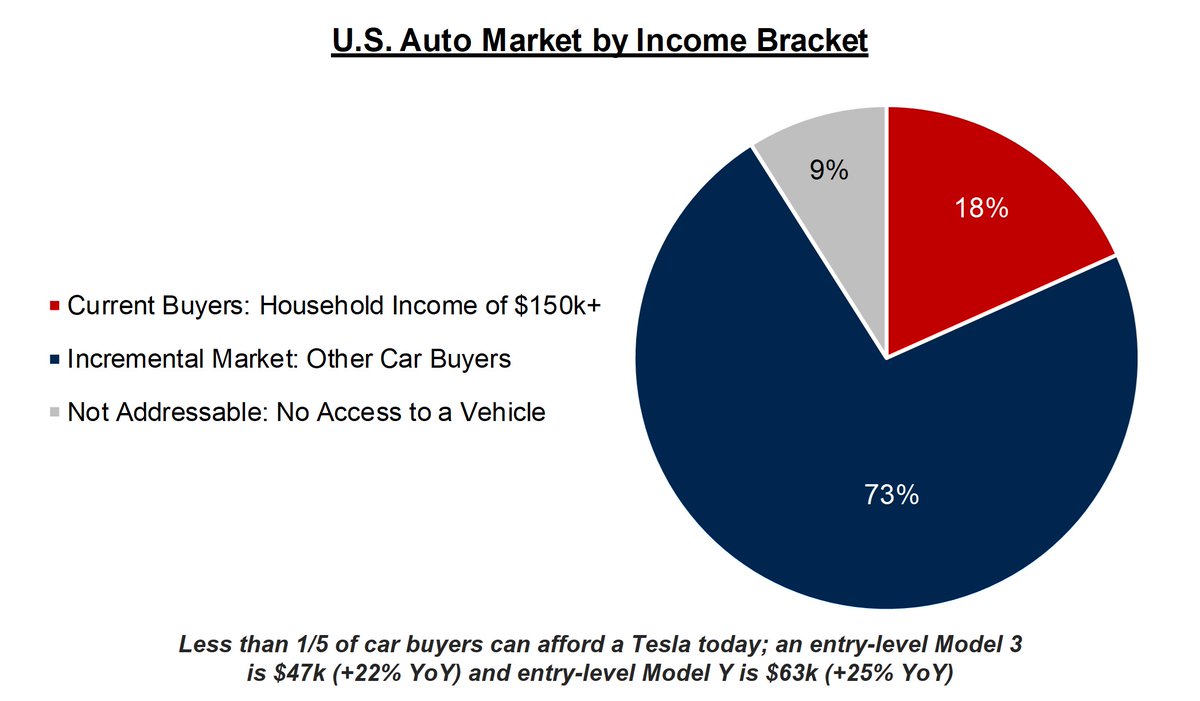

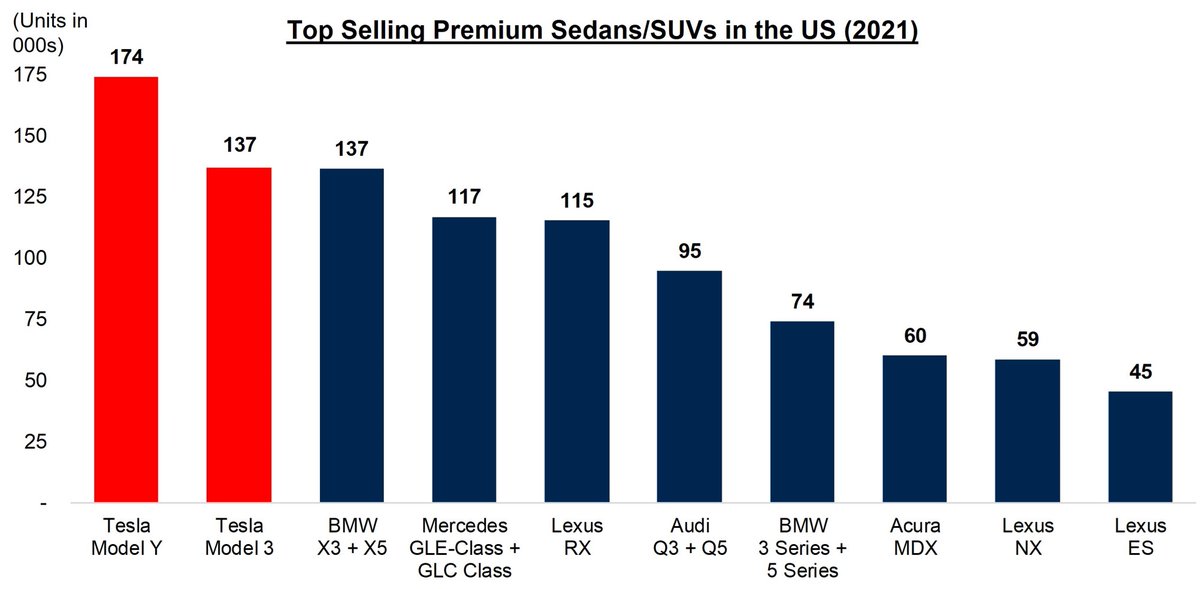

Given record wait times/strong demand at higher price points, Tesla is likely to take meaningful share in more affordable segments

Tesla’s dominate the luxury market segment, yet only account for ~2% of total auto sales annually

Tesla’s dominate the luxury market segment, yet only account for ~2% of total auto sales annually

Tesla is structurally better positioned to maintain lower ASPs than peers:

- higher margins that are expanding while competitors’ margins shrink

- greater EV scale

- integrated distribution (no dealers) & supply chain

- less expensive batteries

- no union or legacy asset burden

- higher margins that are expanding while competitors’ margins shrink

- greater EV scale

- integrated distribution (no dealers) & supply chain

- less expensive batteries

- no union or legacy asset burden

In summary: Tesla has unique advantages that will allow it to become the first OEM scaling significant EV volumes to more affordable segments of the market, while also widening its industry-leading margins

Read on Twitter

Read on Twitter