The EPIC CRASH of Terra is not about it’s mechanism - it’s all about the operation.

In this thread, I’ll talk about the FUNDAMENTAL REASON OF CRASH.

In this thread, I’ll talk about the FUNDAMENTAL REASON OF CRASH.

1/ As you all know, the price of UST crashed for last few days. In my opinion, Terra’s price stabilizing mechanisms themselves were not the problem.

In fact, their oracle, onchain market, and Luna staking reward mechanisms are designed very carefully.

In fact, their oracle, onchain market, and Luna staking reward mechanisms are designed very carefully.

2/ Then what’s the problem? It’s their operation policies. TFL launched anchor protocol which gives 20% fixed earn rate, making over 70% of the UST supply reside in anchor deposits.

This means that the demand of UST is totally concentrated on one use-case (14B out of 17B).

This means that the demand of UST is totally concentrated on one use-case (14B out of 17B).

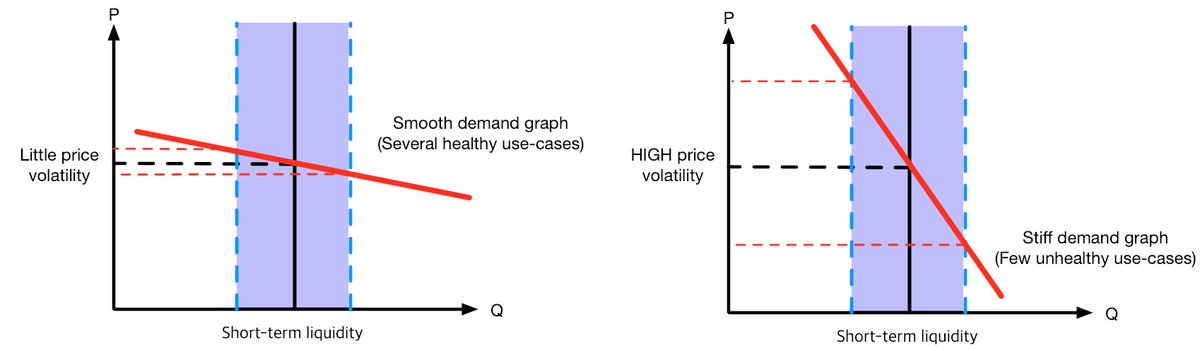

3/ As there are more healthy use-cases using UST as a value of $1, the demand graph becomes smoother. On the other hand, if the demand is concentrated on a single use-case, the demand graph becomes stiffer, which is the case for UST.

4/ Stiff demand graph means high price volatility, which means UST had intrinsic weakness in price stability due to its concentrated demand.

Even with the slight depegging of UST would lead to large change in UST demand.

Even with the slight depegging of UST would lead to large change in UST demand.

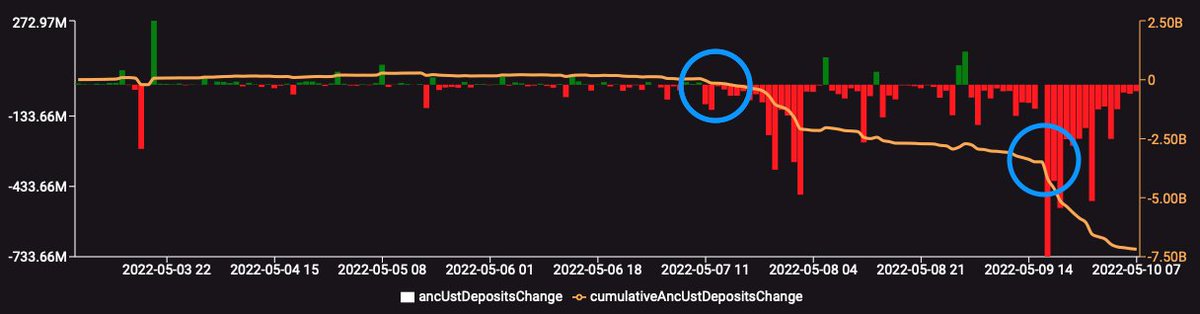

5/ This intrinsic weakness is the essense of UST crash. Anchor deposit nosedived only with slight depegging caused by some attacks, and accelerated the crash.

- 6/ Lesson learned:

- don’t boost the demand of stablecoin with a single unhealthy use-case. They can blow up with a slight depeg.

- mind the size of liquidity that the protocol can tolerate and coordinate the demand with the liquidity.

- don’t boost the demand of stablecoin with a single unhealthy use-case. They can blow up with a slight depeg.

- mind the size of liquidity that the protocol can tolerate and coordinate the demand with the liquidity.

If you liked my thread, press like, retweet and follow me. https://twitter.com/0xStableLabs/status/1523477916436549632?s=20&t=JbiZ1TOUntnXWpVXEcGx_g">https://twitter.com/0xStableL...

Read on Twitter

Read on Twitter