An $18 billion stablecoin is losing its dollar peg with all the magical chaos of algorithmic stables, with a dash of Bitcoin systemic risk drama.

Here& #39;s everything you need to know.

The $UST Depeg Thread:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

Here& #39;s everything you need to know.

The $UST Depeg Thread:

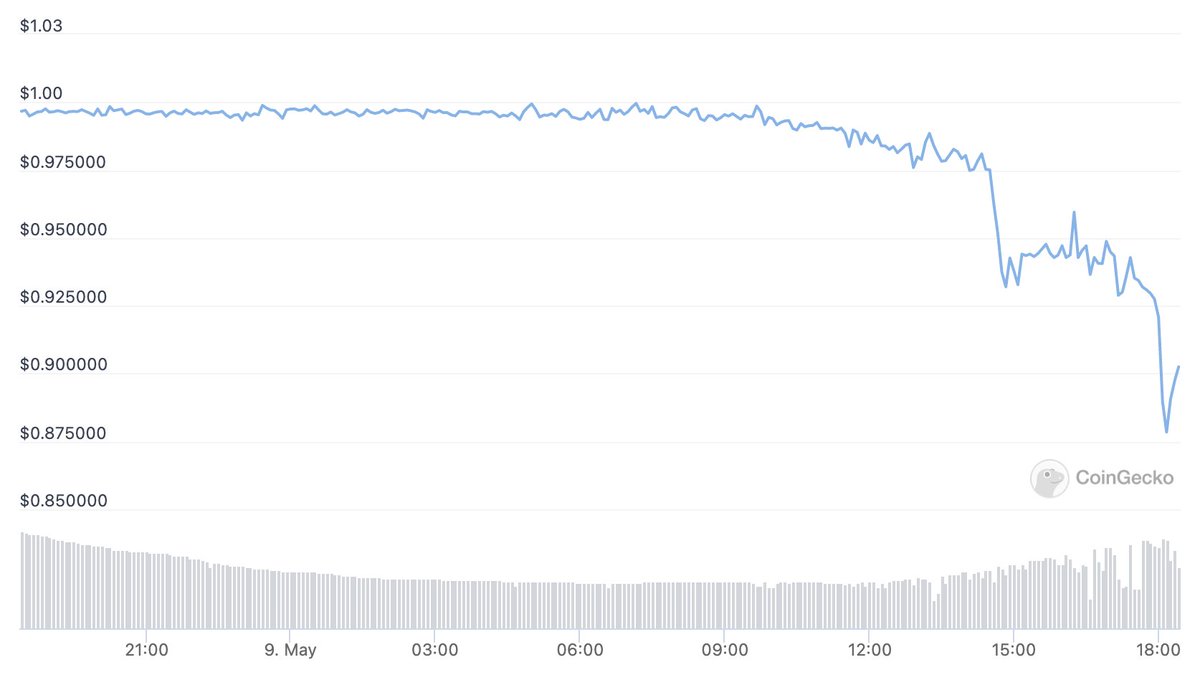

$UST is a dollar-pegged stablecoin that has depegged twice in the last few days, now hovering around $0.90 to the dollar.

Just a reminder on how $UST works:

You can always redeem $LUNA for $UST dollar-for-dollar, and vice versa.

If $LUNA is at $50, you can redeem it for 50 $UST.

Similarly you can redeem 50 $UST for 1 $LUNA. https://twitter.com/Route2FI/status/1479500417025417220">https://twitter.com/Route2FI/...

You can always redeem $LUNA for $UST dollar-for-dollar, and vice versa.

If $LUNA is at $50, you can redeem it for 50 $UST.

Similarly you can redeem 50 $UST for 1 $LUNA. https://twitter.com/Route2FI/status/1479500417025417220">https://twitter.com/Route2FI/...

It& #39;s worth noting you can always redeem 1 $UST for $1 worth of $LUNA, even if $UST is worth <$1.

It& #39;s meant to be a stabilizing mechanism:

If $UST is trading at $0.99, arbitrageurs can buy it and redeem it for $1 of $LUNA.

It& #39;s meant to be a stabilizing mechanism:

If $UST is trading at $0.99, arbitrageurs can buy it and redeem it for $1 of $LUNA.

We all know Stablecoins Require Utility™ to maintain demand and defend their peg.

So where does $UST get utility?

Simple, Anchor Protocol.

Anchor Protocol is (nominally) a money market, but the important tl;dr is it pays you 19.5% to stake $UST.

So where does $UST get utility?

Simple, Anchor Protocol.

Anchor Protocol is (nominally) a money market, but the important tl;dr is it pays you 19.5% to stake $UST.

A huge proportion of $UST& #39;s circulating supply is in Anchor.

Right now, it& #39;s only ~40%, but it& #39;s been as high as 70%+ historically.

So, why hold $UST?

Easy: because they& #39;re paying you 20% per year to hold it.

Right now, it& #39;s only ~40%, but it& #39;s been as high as 70%+ historically.

So, why hold $UST?

Easy: because they& #39;re paying you 20% per year to hold it.

Two obvious questions:

1) if something is paying you 20% risk-free, why not just borrow a ton of money and make it pay you like, 100%+?

Oh uhm, that& #39;s exactly what Abracadabra / $MIM& #39;s degenbox did: https://twitter.com/jwang815/status/1455900334774177794">https://twitter.com/jwang815/...

1) if something is paying you 20% risk-free, why not just borrow a ton of money and make it pay you like, 100%+?

Oh uhm, that& #39;s exactly what Abracadabra / $MIM& #39;s degenbox did: https://twitter.com/jwang815/status/1455900334774177794">https://twitter.com/jwang815/...

Degenbox and the rest of the Frog Nation DeFi ecosystem unwound in January, depegging $UST and sending $LUNA from $100 down to $46.

Sound kinda familiar?

Something something history may not repeat itself but it can rhyme.

Sound kinda familiar?

Something something history may not repeat itself but it can rhyme.

2) How does one give out 20% in free money every year?

Well that& #39;s also easy, the LFG (Luna Foundation Guard), overseers of Terra& #39;s multi-billion dollar ecosystem fund.

We& #39;ll come back to that.

Well that& #39;s also easy, the LFG (Luna Foundation Guard), overseers of Terra& #39;s multi-billion dollar ecosystem fund.

We& #39;ll come back to that.

First we need to figure out what the $LUNA token does:

I& #39;m not going to focus on what drives its fundamental value and focus instead narrative:

~Every $UST in circulation reduces the circulation of $LUNA~

The win scenario is every single $LUNA on earth gets burned for $UST.

I& #39;m not going to focus on what drives its fundamental value and focus instead narrative:

~Every $UST in circulation reduces the circulation of $LUNA~

The win scenario is every single $LUNA on earth gets burned for $UST.

You can see the basic appeal:

The more $UST, the less $LUNA.

Holders should want to diamond-hands $LUNA:

If there& #39;s unstoppable demand for $UST and you& #39;re the last $LUNA holder on earth, you have immense redemption power.

It& #39;s right on their site: https://www.terra.money/intro-to-terra ">https://www.terra.money/intro-to-...

The more $UST, the less $LUNA.

Holders should want to diamond-hands $LUNA:

If there& #39;s unstoppable demand for $UST and you& #39;re the last $LUNA holder on earth, you have immense redemption power.

It& #39;s right on their site: https://www.terra.money/intro-to-terra ">https://www.terra.money/intro-to-...

That& #39;s kind of why the $LUNA mcap < the $UST mcap is FUD.

It doesn& #39;t matter what the total implied value of $LUNA is.

What matters is the marginal value of each $LUNA that is redeemed for $UST, or vice versa, aka $LUNA& #39;s price. https://twitter.com/DegenSpartan/status/1523715756760133632">https://twitter.com/DegenSpar...

It doesn& #39;t matter what the total implied value of $LUNA is.

What matters is the marginal value of each $LUNA that is redeemed for $UST, or vice versa, aka $LUNA& #39;s price. https://twitter.com/DegenSpartan/status/1523715756760133632">https://twitter.com/DegenSpar...

But what& #39;s even MORE important is the directionality and stability of $LUNA& #39;s price.

It& #39;s a Big Motherfucking Problem if the average redemption price of $LUNA for $UST is high relative to $LUNA& #39;s current price.

It& #39;s a Big Motherfucking Problem if the average redemption price of $LUNA for $UST is high relative to $LUNA& #39;s current price.

Let me slow that one down:

- $LUNA price high

- $LUNA burned, many $UST minted

- $LUNA& #39;s price fall

- $UST redeemed for many $LUNA

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rug van hand met naar rechts wijzende wijsvinger" aria-label="Emoji: Rug van hand met naar rechts wijzende wijsvinger"> That is bad mmkay?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rug van hand met naar rechts wijzende wijsvinger" aria-label="Emoji: Rug van hand met naar rechts wijzende wijsvinger"> That is bad mmkay?

- $LUNA price high

- $LUNA burned, many $UST minted

- $LUNA& #39;s price fall

- $UST redeemed for many $LUNA

It& #39;s useful to illustrate using extremes.

Say the price of $LUNA is $1 billion.

Then someone could mint 1 billion $UST by burning a single $LUNA.

Then let& #39;s say the price of $LUNA falls to $1 for no good reason.

That person could redeem their UST for 1 billion $LUNA.

Say the price of $LUNA is $1 billion.

Then someone could mint 1 billion $UST by burning a single $LUNA.

Then let& #39;s say the price of $LUNA falls to $1 for no good reason.

That person could redeem their UST for 1 billion $LUNA.

So suddenly--again, for no good reason at all--there& #39;s a shit-ton more $LUNA in circulation being dumped on the open market.

This is--in essence--what& #39;s happening today.

This is--in essence--what& #39;s happening today.

So now back to the Luna Foundation Guard:

$UST has the same dynamics as many other algo-stables, except in addition to the "algo" part they also have LFG.

In other words, UST is stabilized by:

1) Contracts.

2) The gigantic gravity well created by the size of Do Kwon& #39;s nuts.

$UST has the same dynamics as many other algo-stables, except in addition to the "algo" part they also have LFG.

In other words, UST is stabilized by:

1) Contracts.

2) The gigantic gravity well created by the size of Do Kwon& #39;s nuts.

Previously the LFG was in charge of the Anchor bootstrapping strategy:

Take treasury $LUNA, sell it, and fill up the Anchor Protocol Reserve (the big slush fund that pays $UST stakers 20%).

Every other L1 eco fund does shit like this, just less directly.

Don& #39;t @ me.

Take treasury $LUNA, sell it, and fill up the Anchor Protocol Reserve (the big slush fund that pays $UST stakers 20%).

Every other L1 eco fund does shit like this, just less directly.

Don& #39;t @ me.

The bet?

- $UST burned for staking

- $LUNA price goes up

- Sell more $LUNA to fund the Protocol Reserve

And, longer term:

- $UST takes off as a widely-used stable before LFG runs out of money

- $LUNA goes to the moon

- Everyone happy

Hence this tweet: https://twitter.com/stablekwon/status/1485874118029635589">https://twitter.com/stablekwo...

- $UST burned for staking

- $LUNA price goes up

- Sell more $LUNA to fund the Protocol Reserve

And, longer term:

- $UST takes off as a widely-used stable before LFG runs out of money

- $LUNA goes to the moon

- Everyone happy

Hence this tweet: https://twitter.com/stablekwon/status/1485874118029635589">https://twitter.com/stablekwo...

This was all challenged in January when Degenbox collapsed.

That implosion took down a big push for $UST to be used in a 10-figure cross-chain ecosystem headed by Daniele Sesta.

That& #39;s when Jump, 3AC, and others piled into the $1 billion Luna OTC deal to buy Bitcoin.

That implosion took down a big push for $UST to be used in a 10-figure cross-chain ecosystem headed by Daniele Sesta.

That& #39;s when Jump, 3AC, and others piled into the $1 billion Luna OTC deal to buy Bitcoin.

The story there?

1) Get the Bitcoin gang on board (every cycle needs one crazy billionaire to go hard for the King)

2) Give redemptions a $UST -> $BTC offramp in addition to the existing $UST -> $LUNA one. https://twitter.com/WestieCapital/status/1496223635396255747">https://twitter.com/WestieCap...

1) Get the Bitcoin gang on board (every cycle needs one crazy billionaire to go hard for the King)

2) Give redemptions a $UST -> $BTC offramp in addition to the existing $UST -> $LUNA one. https://twitter.com/WestieCapital/status/1496223635396255747">https://twitter.com/WestieCap...

Now there& #39;s been a full weekend of gigantic, 9-figure moves market-selling $UST and pressuring the peg. https://twitter.com/CaetanoManfrini/status/1523145923571814400">https://twitter.com/CaetanoMa...

As with all algo stables, the downside cycle is the opposite of the upside:

- $UST unstaked and dumped

- $UST depegs due to downward pressure

- $UST holders redeem for $1 of $LUNA

- Dump $LUNA

What complicates things is all the Bitcoin in the treasury.

- $UST unstaked and dumped

- $UST depegs due to downward pressure

- $UST holders redeem for $1 of $LUNA

- Dump $LUNA

What complicates things is all the Bitcoin in the treasury.

Recall WHEN the LFG was buying Bitcoin.

Remember the $1 billion OTC news?

That triggered a massive run-up in $LUNA, which allowed for tons of high-basis $UST minting.

Simultaneously, the LFG DCA& #39;d into Bitcoin at an average price north of $40K.

Remember the $1 billion OTC news?

That triggered a massive run-up in $LUNA, which allowed for tons of high-basis $UST minting.

Simultaneously, the LFG DCA& #39;d into Bitcoin at an average price north of $40K.

Now, Bitcoin is being driven lower due to macro and (ironically) expectations that LFG will be forced Bitcoin sellers due to $UST peg pressure.

Any redemptions of $UST -> $BTC now will essentially be booked losses for LFG, when they could have just sat on stables instead.

Any redemptions of $UST -> $BTC now will essentially be booked losses for LFG, when they could have just sat on stables instead.

So now what& #39;s the plan?

As of this morning, commit $1.5B to defending the $UST peg, collateralized against Bitcoin reserves: https://twitter.com/LFG_org/status/1523512201088143360">https://twitter.com/LFG_org/s...

As of this morning, commit $1.5B to defending the $UST peg, collateralized against Bitcoin reserves: https://twitter.com/LFG_org/status/1523512201088143360">https://twitter.com/LFG_org/s...

Why?

The deeper the liquidity the harder it is for any one actor to "dig out" and move the price (even further) away from $1: https://twitter.com/jonwu_/status/1393307304985047044?s=20&t=eVfDaWYT_Z_fMbPpUgJVBA">https://twitter.com/jonwu_/st...

The deeper the liquidity the harder it is for any one actor to "dig out" and move the price (even further) away from $1: https://twitter.com/jonwu_/status/1393307304985047044?s=20&t=eVfDaWYT_Z_fMbPpUgJVBA">https://twitter.com/jonwu_/st...

Liquidity, peg defense, market making?

That& #39;s why Jump Capital and 3AC are involved (they were part of the consortium that bought $1 billion of Luna OTC in February).

They& #39;re deep-pocketed, sophisticated traders willing to do whatever it takes to prevent a $UST death-spiral.

That& #39;s why Jump Capital and 3AC are involved (they were part of the consortium that bought $1 billion of Luna OTC in February).

They& #39;re deep-pocketed, sophisticated traders willing to do whatever it takes to prevent a $UST death-spiral.

So what& #39;s next?

Friendly marketmakers go to work on deploying a piece of the $BTC treasury to market-buy $UST and keep the peg up.

Hope is there& #39;s more (falling-knife) $BTC collateral in LFG than there is bank-run pressure from people fudding $UST.

Friendly marketmakers go to work on deploying a piece of the $BTC treasury to market-buy $UST and keep the peg up.

Hope is there& #39;s more (falling-knife) $BTC collateral in LFG than there is bank-run pressure from people fudding $UST.

Possible outcomes:

1) The treasury gets drained, but $UST stabilizes.

For now, $BTC seems to have stopped dumping on liquidations and liquidation fears.

1) The treasury gets drained, but $UST stabilizes.

For now, $BTC seems to have stopped dumping on liquidations and liquidation fears.

1a) The LFG also seems aware & intent on buying $BTC back at low basis.

There& #39;s a win where:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Groot wit vinkje" aria-label="Emoji: Groot wit vinkje"> $BTC gets pressured to $30K

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Groot wit vinkje" aria-label="Emoji: Groot wit vinkje"> $BTC gets pressured to $30K

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Groot wit vinkje" aria-label="Emoji: Groot wit vinkje"> $UST peg restores

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Groot wit vinkje" aria-label="Emoji: Groot wit vinkje"> $UST peg restores

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Groot wit vinkje" aria-label="Emoji: Groot wit vinkje"> LFG buys back into $BTC at lower basis

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Groot wit vinkje" aria-label="Emoji: Groot wit vinkje"> LFG buys back into $BTC at lower basis

There& #39;s a win where:

"Sell" BTC, restore peg, buy BTC.

Profit!

Better yet, $BTC somehow moons and we get a @feiprotocol situation where despite a difficult situation, the underlying collateral goes up in value and the protocol ends up fully collateralized.

Profit!

Better yet, $BTC somehow moons and we get a @feiprotocol situation where despite a difficult situation, the underlying collateral goes up in value and the protocol ends up fully collateralized.

And for completeness, since it would never happen:

2) Do Kwon and the LFG cease their $UST defense, annihilating Luna holders and allowing the $UST to settle at collateral value https://twitter.com/hasufl/status/1523739160817070080?s=20&t=nohWT1B2GkxYKk2ZhBJQzQ">https://twitter.com/hasufl/st...

2) Do Kwon and the LFG cease their $UST defense, annihilating Luna holders and allowing the $UST to settle at collateral value https://twitter.com/hasufl/status/1523739160817070080?s=20&t=nohWT1B2GkxYKk2ZhBJQzQ">https://twitter.com/hasufl/st...

tl;dr

$UST is 100 magic dollars backed by 20 bitcorns and 80 magic beans, but some people don& #39;t think it& #39;s worth 100 real dollars, so LFG is selling bitcorns to buy more magic dollars to convince people they& #39;re worth 100 real dollars, all so the magic bean holders don& #39;t get sad

$UST is 100 magic dollars backed by 20 bitcorns and 80 magic beans, but some people don& #39;t think it& #39;s worth 100 real dollars, so LFG is selling bitcorns to buy more magic dollars to convince people they& #39;re worth 100 real dollars, all so the magic bean holders don& #39;t get sad

Oh and follow me if you want to learn more about DeFi, scaling, and crypto privacy  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏽" title="Gevouwen handen (getinte huidskleur)" aria-label="Emoji: Gevouwen handen (getinte huidskleur)"> appreciate chy’all

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏽" title="Gevouwen handen (getinte huidskleur)" aria-label="Emoji: Gevouwen handen (getinte huidskleur)"> appreciate chy’all

Read on Twitter

Read on Twitter