Twilio $TWLO 1Q22 Earnings

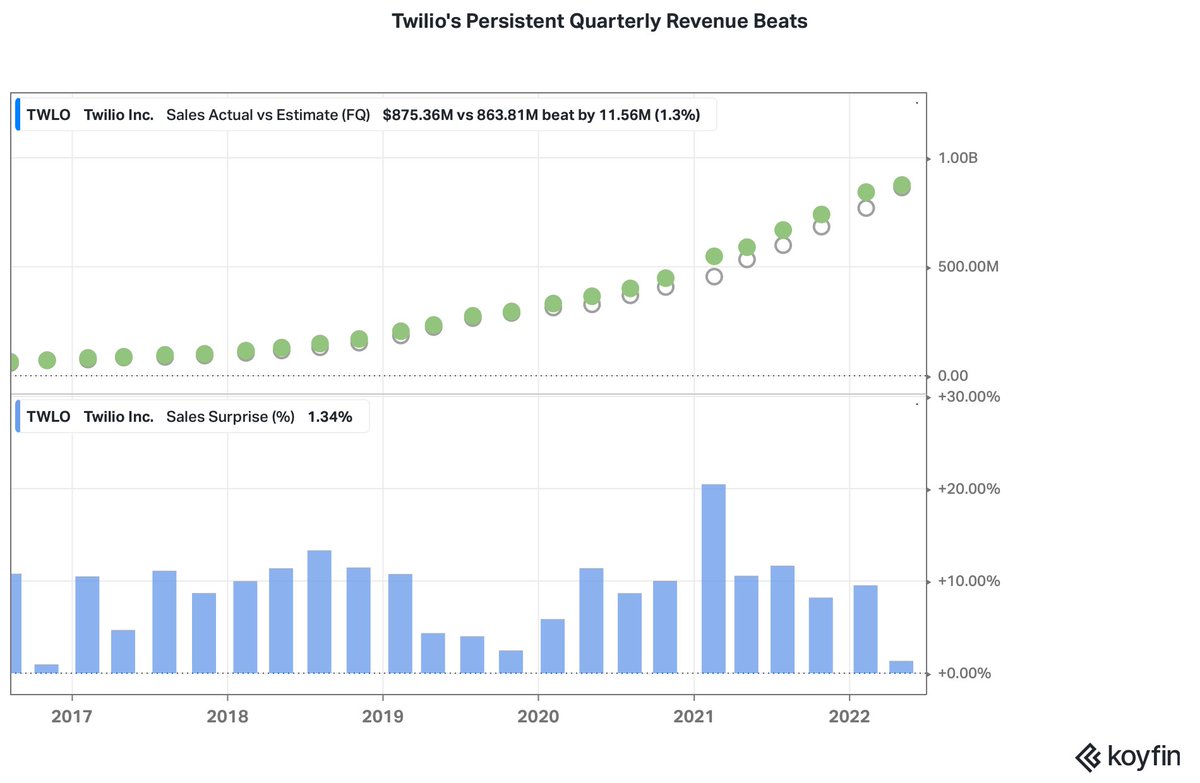

- Rev $875m +48% https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl"> (organic +35%)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl"> (organic +35%)

- Gross Profit $425m +42% https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl"> margin 49% -200 bps

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl"> margin 49% -200 bps  https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

- NG EBIT $5m -71% https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl"> margin 1% -236 bps

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl"> margin 1% -236 bps  https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

- NG Net Income $0m -96% https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl"> margin 0% -159 bps

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl"> margin 0% -159 bps  https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

- OCF $-18m https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl"> margin -2% -277 bps

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl"> margin -2% -277 bps  https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="Zuid-oost pijl" aria-label="Emoji: Zuid-oost pijl">

- Rev $875m +48%

- Gross Profit $425m +42%

- NG EBIT $5m -71%

- NG Net Income $0m -96%

- OCF $-18m

Business Metrics

- Topline Rev $875m +48% https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

- Topline Rev ex $32m Zipwhip +35% organic https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

- DBNER 127% (vs 133% 1Q21,126% 4Q21) https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pijl naar rechts" aria-label="Emoji: Pijl naar rechts">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pijl naar rechts" aria-label="Emoji: Pijl naar rechts">

- Active Customer Accounts 268K +33K +14% https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Noord-oost pijl" aria-label="Emoji: Noord-oost pijl">

- Topline Rev $875m +48%

- Topline Rev ex $32m Zipwhip +35% organic

- DBNER 127% (vs 133% 1Q21,126% 4Q21)

- Active Customer Accounts 268K +33K +14%

Management Guide

- 2Q22 Rev $922m +38% (organic +29%)

- 2Q22 NG EBIT -$35m

Strong 2Q21 Comps

“…in Q2 & #39;21 that we had a really, really strong organic growth quarter at 50% yoY.”

- 2Q22 Rev $922m +38% (organic +29%)

- 2Q22 NG EBIT -$35m

Strong 2Q21 Comps

“…in Q2 & #39;21 that we had a really, really strong organic growth quarter at 50% yoY.”

1 | Strong Quarter

“We delivered another strong quarter of results and continue to execute against our long-term strategy to build the world& #39;s leading customer engagement platform.”

“We delivered another strong quarter of results and continue to execute against our long-term strategy to build the world& #39;s leading customer engagement platform.”

2 | Mgmt Confident 30%+ Organic Revenue CAGR to 2024, & NG EBIT Profitability in 2023

“We remain confident in our ability to deliver 30% plus annual organic revenue growth through 2024, and we& #39;re committed to delivering annual non-GAAP operating profitability starting in 2023.”

“We remain confident in our ability to deliver 30% plus annual organic revenue growth through 2024, and we& #39;re committed to delivering annual non-GAAP operating profitability starting in 2023.”

3 | Twilio’s Inorganic Revenue Growth Trend 1Q22 +48%YoY  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Pijl naar rechts en dan naar beneden gebogen" aria-label="Emoji: Pijl naar rechts en dan naar beneden gebogen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Pijl naar rechts en dan naar beneden gebogen" aria-label="Emoji: Pijl naar rechts en dan naar beneden gebogen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">

4 | Twilio’s acquisitions masking the broader long-term seemingly more structural underlying Organic Revenue Growth Deceleration  https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">

5 |  https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Coincides with Twilio’s declining Dollar Based Net Expansion Rates as well.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Coincides with Twilio’s declining Dollar Based Net Expansion Rates as well.

6 |  https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Twilio’s Persistent Declining Gross Profit Margins over the last three years from an already low base to start with

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Twilio’s Persistent Declining Gross Profit Margins over the last three years from an already low base to start with  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">

7 | Long-Term GPM Targets of 60%+  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

“…long-term targets around 60%+ over time, we continue to see a lot of tailwind there, and we continue to like the software businesses quite a lot.”

“…we feel great about our longer-term gross margin guidance of 60%+.”

“…long-term targets around 60%+ over time, we continue to see a lot of tailwind there, and we continue to like the software businesses quite a lot.”

“…we feel great about our longer-term gross margin guidance of 60%+.”

8 | Unclear Operating Leverage and Improving FCF Margins

When we invested, there were signs of operating leverage, and improving OCF and FCF margins, but it has not been the case for the last 3 years, with OCF and FCF margins flatlining between 0% to -10%.

When we invested, there were signs of operating leverage, and improving OCF and FCF margins, but it has not been the case for the last 3 years, with OCF and FCF margins flatlining between 0% to -10%.

Seemingly still strong organic revenue growth (30%+ 3Y), supported by still solid customer retention ~125%+, but unclear if declining GPM and still negative cash flow margins (OCF and FCF) can reverse in the right direction in 2023.

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">" title="3 | Twilio’s Inorganic Revenue Growth Trend 1Q22 +48%YoY https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Pijl naar rechts en dan naar beneden gebogen" aria-label="Emoji: Pijl naar rechts en dan naar beneden gebogen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">" title="3 | Twilio’s Inorganic Revenue Growth Trend 1Q22 +48%YoY https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Pijl naar rechts en dan naar beneden gebogen" aria-label="Emoji: Pijl naar rechts en dan naar beneden gebogen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">" class="img-responsive" style="max-width:100%;"/>

" title="4 | Twilio’s acquisitions masking the broader long-term seemingly more structural underlying Organic Revenue Growth Deceleration https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">" class="img-responsive" style="max-width:100%;"/>

" title="4 | Twilio’s acquisitions masking the broader long-term seemingly more structural underlying Organic Revenue Growth Deceleration https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rood sierlijk vraagteken" aria-label="Emoji: Rood sierlijk vraagteken">" class="img-responsive" style="max-width:100%;"/>

Coincides with Twilio’s declining Dollar Based Net Expansion Rates as well." title="5 | https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Coincides with Twilio’s declining Dollar Based Net Expansion Rates as well." class="img-responsive" style="max-width:100%;"/>

Coincides with Twilio’s declining Dollar Based Net Expansion Rates as well." title="5 | https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Coincides with Twilio’s declining Dollar Based Net Expansion Rates as well." class="img-responsive" style="max-width:100%;"/>

Twilio’s Persistent Declining Gross Profit Margins over the last three years from an already low base to start with https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">" title="6 | https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Twilio’s Persistent Declining Gross Profit Margins over the last three years from an already low base to start with https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">" class="img-responsive" style="max-width:100%;"/>

Twilio’s Persistent Declining Gross Profit Margins over the last three years from an already low base to start with https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">" title="6 | https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kruis" aria-label="Emoji: Kruis"> Twilio’s Persistent Declining Gross Profit Margins over the last three years from an already low base to start with https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">" class="img-responsive" style="max-width:100%;"/>