Shit is hitting the fan  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😟" title="Bezorgd gezicht" aria-label="Emoji: Bezorgd gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😟" title="Bezorgd gezicht" aria-label="Emoji: Bezorgd gezicht">

I’ve worked in tech since 2010, and the whole time people have been publishing articles warning that there was a tech bubble just about to burst.

Now, the long-awaited tech correction might actually be happening.

I’ve worked in tech since 2010, and the whole time people have been publishing articles warning that there was a tech bubble just about to burst.

Now, the long-awaited tech correction might actually be happening.

(Perhaps in retrospect it is telling that "bubble" talk quieted down over the past few years?)

1. Stocks are down

Zoom, Shopify, Roblox, Peloton, Twilio, Snowflake, Coinbase, and many other have lost the majority of their value over the past few months. https://twitter.com/jasongoepfert/status/1520040516955643905">https://twitter.com/jasongoep...

Zoom, Shopify, Roblox, Peloton, Twilio, Snowflake, Coinbase, and many other have lost the majority of their value over the past few months. https://twitter.com/jasongoepfert/status/1520040516955643905">https://twitter.com/jasongoep...

2. Cryptocurrencies are down

Did you think BTC and ETH were supposed to be uncorrelated with public stock markets? Did you think with fears of inflation at an all time high people should be running to deflationary assets?

If you did, I don’t blame you. But you were wrong.

Did you think BTC and ETH were supposed to be uncorrelated with public stock markets? Did you think with fears of inflation at an all time high people should be running to deflationary assets?

If you did, I don’t blame you. But you were wrong.

Bitcoin peaked in November, same time as tech stocks, just short of $69k. Ethereum peaked that same month shortly after it passed $4,200. (You can’t make this up.)

Now both are down 42% and 44%, respectively.

Now both are down 42% and 44%, respectively.

3. NFT sales are (probably) down

There was a big article in the WSJ this week asking “is this the beginning of the end for NFTs?”

The NFT community hated it, and argues the data is “fake” and shouldn’t count the implosion of Axie Infinity.

This is a question mark for now...

There was a big article in the WSJ this week asking “is this the beginning of the end for NFTs?”

The NFT community hated it, and argues the data is “fake” and shouldn’t count the implosion of Axie Infinity.

This is a question mark for now...

4. LPs are down on VCs

Their total AUM is down (see #1 above) so now their % held in private companies is up. This is the "denominator" effect, triggering them to avoid VC for now. https://twitter.com/Beezer232/status/1522641453062803459">https://twitter.com/Beezer232...

Their total AUM is down (see #1 above) so now their % held in private companies is up. This is the "denominator" effect, triggering them to avoid VC for now. https://twitter.com/Beezer232/status/1522641453062803459">https://twitter.com/Beezer232...

5. VCs are (starting to become) down on startups

- Valuations are down (according to Carta data)

- Total capital deployed is down (according to CrunchBase data)

And for the first time in my career I& #39;m seeing tweets like this daily: https://twitter.com/DavidSacks/status/1521905564967612416">https://twitter.com/DavidSack...

- Valuations are down (according to Carta data)

- Total capital deployed is down (according to CrunchBase data)

And for the first time in my career I& #39;m seeing tweets like this daily: https://twitter.com/DavidSacks/status/1521905564967612416">https://twitter.com/DavidSack...

To be clear, this will take awhile to play out. Many VCs are investing funds they already raised, and they will continue to do so at a reasonable pace for the near future. Early stage seems unscathed.

But, as one investor said in my DMs:

But, as one investor said in my DMs:

6. Tech companies are down on employees

Huge uptick in layoffs this week across public and private tech cos. More will come, seeking safety in numbers. https://twitter.com/KateClarkTweets/status/1521970812571381760">https://twitter.com/KateClark...

Huge uptick in layoffs this week across public and private tech cos. More will come, seeking safety in numbers. https://twitter.com/KateClarkTweets/status/1521970812571381760">https://twitter.com/KateClark...

Taken together, this is a really different situation than I& #39;ve seen before.

I can& #39;t be certain what will happen next, but all I can say is I& #39;m damn relieved that @Every has near-infinite runway.

I can& #39;t be certain what will happen next, but all I can say is I& #39;m damn relieved that @Every has near-infinite runway.

What makes it more concerning is there is no obvious non-economic cause like a pandemic. (You could argue Ukraine war is playing a part, but I don& #39;t think that& #39;s primary here.)

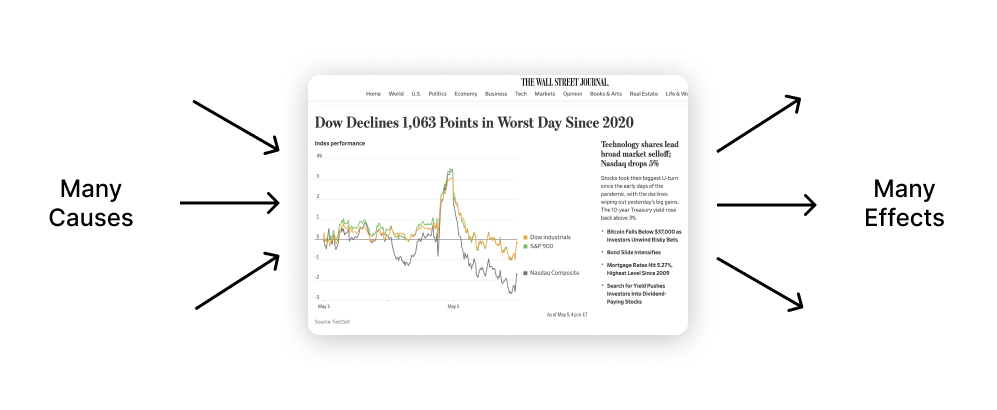

This seems to be about the cascading effects of financial decisions

This seems to be about the cascading effects of financial decisions

I& #39;m writing about this in more detail next week

Specifically, I& #39;m going to attempt to map out all the causal links between everything that& #39;s happening

(like literally, in Figma)

If you& #39;re interested sign up here: https://every.to/subscribe?publication=divinations">https://every.to/subscribe...

Specifically, I& #39;m going to attempt to map out all the causal links between everything that& #39;s happening

(like literally, in Figma)

If you& #39;re interested sign up here: https://every.to/subscribe?publication=divinations">https://every.to/subscribe...

Another really important one pointed out in my DMs

7. IPOs and Exits are down

this has huge effects for LPs and VCs, who will have less capital to re-deploy in the short-to-medium term because of it

7. IPOs and Exits are down

this has huge effects for LPs and VCs, who will have less capital to re-deploy in the short-to-medium term because of it

So what does this all mean?

It& #39;s not the end of the world. Tech is here to stay. Most people are keeping their jobs. Startups will continue to be built.

It& #39;s not going to be another 2000-style total implosion

It& #39;s not going to be a bull market though, I& #39;m fairly certain

It& #39;s not the end of the world. Tech is here to stay. Most people are keeping their jobs. Startups will continue to be built.

It& #39;s not going to be another 2000-style total implosion

It& #39;s not going to be a bull market though, I& #39;m fairly certain

And this has important implications for how you do business. It& #39;s important to extend your runway if you have less than a year of it. You might wanna take this opportunity to impose a bit of financial discipline and see where you can cut waste.

The point is not to freak out or panic, it& #39;s to be aware that things might look different this year than they have in other years over the past decade.

Plan accordingly!

Plan accordingly!

Read on Twitter

Read on Twitter