Have you heard about “On-Chain Analysis” and thought – I’m DEFINITELY not smart enough for that?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

Well, let’s fix that, TODAY I want to teach you your first TOOL that I use as Step 1 in my on-chain analysis of NEW projects.

In fact, I’ll teach you in less than 3 minutes https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

Well, let’s fix that, TODAY I want to teach you your first TOOL that I use as Step 1 in my on-chain analysis of NEW projects.

In fact, I’ll teach you in less than 3 minutes

First, I will get the contract of the token I want to analyse.

You can do this by going to http://dexscreener.com"> http://dexscreener.com and typing the name of your coin/project in the search bar. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">

Once you found the right one, click on the & #39;copy& #39; button as seen below to copy the address.

You can do this by going to http://dexscreener.com"> http://dexscreener.com and typing the name of your coin/project in the search bar.

Once you found the right one, click on the & #39;copy& #39; button as seen below to copy the address.

Next, go to http://tokensniffer.com"> http://tokensniffer.com , paste the address and click enter!

Click on the top link, as shown below to go to the appropriate network tracker. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

Click on the top link, as shown below to go to the appropriate network tracker.

You will now see the contract page in the scanner that you went to, Congratulations!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Feestknaller" aria-label="Emoji: Feestknaller">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Feestknaller" aria-label="Emoji: Feestknaller">

This is a very important page in on-chain analysis and you now know (one way) to find it! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">

Next, let& #39;s click on the & #39;Holders& #39; tab as seen below. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

This is a very important page in on-chain analysis and you now know (one way) to find it!

Next, let& #39;s click on the & #39;Holders& #39; tab as seen below.

Now, we are going to leave this tab there for abit.

It& #39;s time to choose which new project you want to investigate!

For this example, let& #39;s choose @hiveinvestments! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐝" title="Honingbij" aria-label="Emoji: Honingbij">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐝" title="Honingbij" aria-label="Emoji: Honingbij">

I want you to find their whitepaper - normally on the website, and go to & #39;Tokenomics& #39; or & #39;Token Distribution& #39;

It& #39;s time to choose which new project you want to investigate!

For this example, let& #39;s choose @hiveinvestments!

I want you to find their whitepaper - normally on the website, and go to & #39;Tokenomics& #39; or & #39;Token Distribution& #39;

Hive have done a GREAT job making their Token Distribution very clear to understand.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Klappende handen-teken" aria-label="Emoji: Klappende handen-teken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Klappende handen-teken" aria-label="Emoji: Klappende handen-teken">

ALOT of projects struggle in this area, so if you can& #39;t find this info in your project,

Maybe you need to use this tool for other projects, and other analysis types for this project.

ALOT of projects struggle in this area, so if you can& #39;t find this info in your project,

Maybe you need to use this tool for other projects, and other analysis types for this project.

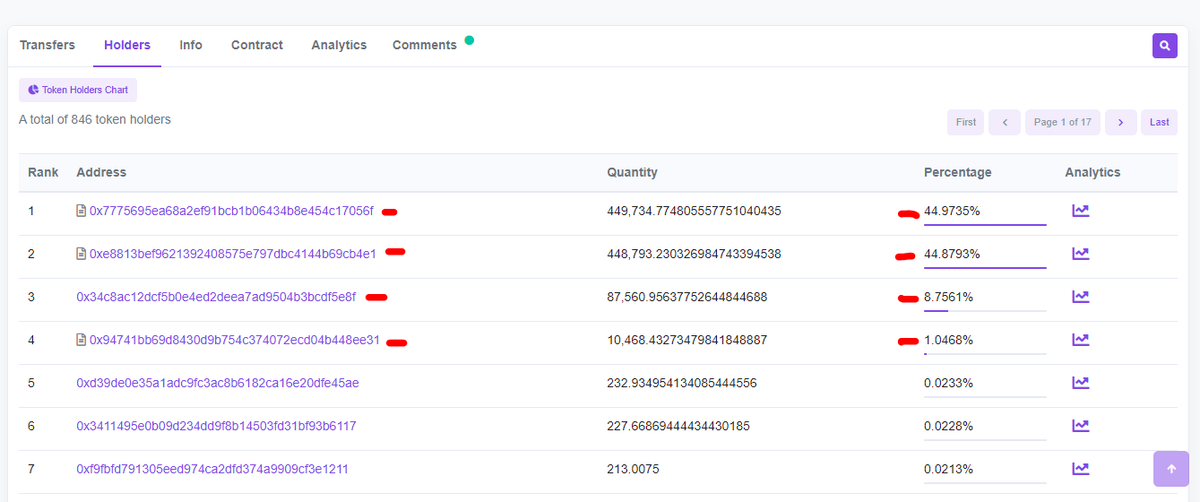

Anyway, let& #39;s assume we have this info, now we go back to our original tab, scroll down...

And COMPARE the % distributions that we see on the contract VS the whitepaper! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😲" title="Verwonderd gezicht" aria-label="Emoji: Verwonderd gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😲" title="Verwonderd gezicht" aria-label="Emoji: Verwonderd gezicht">

This shows the % of how much each wallet holds of $HNY - HIVE& #39;s is PERFECT ALIGNED w/ their whitepaper!

And COMPARE the % distributions that we see on the contract VS the whitepaper!

This shows the % of how much each wallet holds of $HNY - HIVE& #39;s is PERFECT ALIGNED w/ their whitepaper!

Side note: We do NOT need this to be perfect, and most times it won& #39;t be! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lachend gezicht met open mond en angstzweet" aria-label="Emoji: Lachend gezicht met open mond en angstzweet">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lachend gezicht met open mond en angstzweet" aria-label="Emoji: Lachend gezicht met open mond en angstzweet">

But for NEW projects, we would like to see ATLEAST SOME resemblance between their whitepaper distribution and their on-chain distribution!

Let& #39;s try another one: @PlayCrabada, here& #39;s their whitepaper:

But for NEW projects, we would like to see ATLEAST SOME resemblance between their whitepaper distribution and their on-chain distribution!

Let& #39;s try another one: @PlayCrabada, here& #39;s their whitepaper:

Now, let& #39;s see what the distribution of their tokens is NOW on the chain!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">

Focus on the first few; P2E wallet was set at 30%, now is 24% - that is pretty darn close!!

Staking Rewards were meant to be 13% and THEY ARE! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">

Again, we can& #39;t get all of them right, we wont...

Focus on the first few; P2E wallet was set at 30%, now is 24% - that is pretty darn close!!

Staking Rewards were meant to be 13% and THEY ARE!

Again, we can& #39;t get all of them right, we wont...

So, why are there differences? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">

And what if my project looked nothing like these??

Great question friend! Now, you& #39;re thinking how you should during on-chain analysis.

First thing to note is - this was the INITIAL distribution - before NEW WALLETS from the public bought in!

And what if my project looked nothing like these??

Great question friend! Now, you& #39;re thinking how you should during on-chain analysis.

First thing to note is - this was the INITIAL distribution - before NEW WALLETS from the public bought in!

So, using that logic - the LONGER a project is around and the MORE wallets get a cut of the pie...

The LESS these charts will align with the on-chain values- some exceptions apply. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">

AND, some projects will use more wallets for the SAME token distribution as their whitepaper!

The LESS these charts will align with the on-chain values- some exceptions apply.

AND, some projects will use more wallets for the SAME token distribution as their whitepaper!

So, with that being said, when is this tool useful?

As I said originally, when I come across a NEW project, this is STEP 1 in my on-chain analysis.

JUST because a project doesn& #39;t align these two indicators - I will NOT stop my analysis.

As I said originally, when I come across a NEW project, this is STEP 1 in my on-chain analysis.

JUST because a project doesn& #39;t align these two indicators - I will NOT stop my analysis.

However, if I DO see a near-perfect alignment, such as with @hiveinvestments, then I use this insight to confidently stride to Step 2 of my on-chain analysis!

So the bottom line is, MANY indicators contribute to your analysis, and this is JUST ONE...

So the bottom line is, MANY indicators contribute to your analysis, and this is JUST ONE...

But, I promised to teach you ONE basic tool you can use on your new on-chain analysis journey!

Let me know if you found this helpful,

And if you have any questions, fire away friend! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💛" title="Geel hart" aria-label="Emoji: Geel hart">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💛" title="Geel hart" aria-label="Emoji: Geel hart">

Let me know if you found this helpful,

And if you have any questions, fire away friend!

Read on Twitter

Read on Twitter Once you found the right one, click on the & #39;copy& #39; button as seen below to copy the address." title="First, I will get the contract of the token I want to analyse.You can do this by going to http://dexscreener.com and typing the name of your coin/project in the search bar. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">Once you found the right one, click on the & #39;copy& #39; button as seen below to copy the address." class="img-responsive" style="max-width:100%;"/>

Once you found the right one, click on the & #39;copy& #39; button as seen below to copy the address." title="First, I will get the contract of the token I want to analyse.You can do this by going to http://dexscreener.com and typing the name of your coin/project in the search bar. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">Once you found the right one, click on the & #39;copy& #39; button as seen below to copy the address." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">" title="Next, go to http://tokensniffer.com , paste the address and click enter!Click on the top link, as shown below to go to the appropriate network tracker. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">" title="Next, go to http://tokensniffer.com , paste the address and click enter!Click on the top link, as shown below to go to the appropriate network tracker. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Nadenkend gezicht" aria-label="Emoji: Nadenkend gezicht">" class="img-responsive" style="max-width:100%;"/>

This is a very important page in on-chain analysis and you now know (one way) to find it! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">Next, let& #39;s click on the & #39;Holders& #39; tab as seen below. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" title="You will now see the contract page in the scanner that you went to, Congratulations! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Feestknaller" aria-label="Emoji: Feestknaller">This is a very important page in on-chain analysis and you now know (one way) to find it! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">Next, let& #39;s click on the & #39;Holders& #39; tab as seen below. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

This is a very important page in on-chain analysis and you now know (one way) to find it! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">Next, let& #39;s click on the & #39;Holders& #39; tab as seen below. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" title="You will now see the contract page in the scanner that you went to, Congratulations! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Feestknaller" aria-label="Emoji: Feestknaller">This is a very important page in on-chain analysis and you now know (one way) to find it! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">Next, let& #39;s click on the & #39;Holders& #39; tab as seen below. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

I want you to find their whitepaper - normally on the website, and go to & #39;Tokenomics& #39; or & #39;Token Distribution& #39;" title="Now, we are going to leave this tab there for abit.It& #39;s time to choose which new project you want to investigate!For this example, let& #39;s choose @hiveinvestments! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐝" title="Honingbij" aria-label="Emoji: Honingbij">I want you to find their whitepaper - normally on the website, and go to & #39;Tokenomics& #39; or & #39;Token Distribution& #39;" class="img-responsive" style="max-width:100%;"/>

I want you to find their whitepaper - normally on the website, and go to & #39;Tokenomics& #39; or & #39;Token Distribution& #39;" title="Now, we are going to leave this tab there for abit.It& #39;s time to choose which new project you want to investigate!For this example, let& #39;s choose @hiveinvestments! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐝" title="Honingbij" aria-label="Emoji: Honingbij">I want you to find their whitepaper - normally on the website, and go to & #39;Tokenomics& #39; or & #39;Token Distribution& #39;" class="img-responsive" style="max-width:100%;"/>

This shows the % of how much each wallet holds of $HNY - HIVE& #39;s is PERFECT ALIGNED w/ their whitepaper!" title="Anyway, let& #39;s assume we have this info, now we go back to our original tab, scroll down...And COMPARE the % distributions that we see on the contract VS the whitepaper! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😲" title="Verwonderd gezicht" aria-label="Emoji: Verwonderd gezicht">This shows the % of how much each wallet holds of $HNY - HIVE& #39;s is PERFECT ALIGNED w/ their whitepaper!" class="img-responsive" style="max-width:100%;"/>

This shows the % of how much each wallet holds of $HNY - HIVE& #39;s is PERFECT ALIGNED w/ their whitepaper!" title="Anyway, let& #39;s assume we have this info, now we go back to our original tab, scroll down...And COMPARE the % distributions that we see on the contract VS the whitepaper! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😲" title="Verwonderd gezicht" aria-label="Emoji: Verwonderd gezicht">This shows the % of how much each wallet holds of $HNY - HIVE& #39;s is PERFECT ALIGNED w/ their whitepaper!" class="img-responsive" style="max-width:100%;"/>

But for NEW projects, we would like to see ATLEAST SOME resemblance between their whitepaper distribution and their on-chain distribution! Let& #39;s try another one: @PlayCrabada, here& #39;s their whitepaper:" title="Side note: We do NOT need this to be perfect, and most times it won& #39;t be!https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lachend gezicht met open mond en angstzweet" aria-label="Emoji: Lachend gezicht met open mond en angstzweet">But for NEW projects, we would like to see ATLEAST SOME resemblance between their whitepaper distribution and their on-chain distribution! Let& #39;s try another one: @PlayCrabada, here& #39;s their whitepaper:" class="img-responsive" style="max-width:100%;"/>

But for NEW projects, we would like to see ATLEAST SOME resemblance between their whitepaper distribution and their on-chain distribution! Let& #39;s try another one: @PlayCrabada, here& #39;s their whitepaper:" title="Side note: We do NOT need this to be perfect, and most times it won& #39;t be!https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lachend gezicht met open mond en angstzweet" aria-label="Emoji: Lachend gezicht met open mond en angstzweet">But for NEW projects, we would like to see ATLEAST SOME resemblance between their whitepaper distribution and their on-chain distribution! Let& #39;s try another one: @PlayCrabada, here& #39;s their whitepaper:" class="img-responsive" style="max-width:100%;"/>

Focus on the first few; P2E wallet was set at 30%, now is 24% - that is pretty darn close!!Staking Rewards were meant to be 13% and THEY ARE! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">Again, we can& #39;t get all of them right, we wont..." title="Now, let& #39;s see what the distribution of their tokens is NOW on the chain! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">Focus on the first few; P2E wallet was set at 30%, now is 24% - that is pretty darn close!!Staking Rewards were meant to be 13% and THEY ARE! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">Again, we can& #39;t get all of them right, we wont..." class="img-responsive" style="max-width:100%;"/>

Focus on the first few; P2E wallet was set at 30%, now is 24% - that is pretty darn close!!Staking Rewards were meant to be 13% and THEY ARE! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">Again, we can& #39;t get all of them right, we wont..." title="Now, let& #39;s see what the distribution of their tokens is NOW on the chain! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">Focus on the first few; P2E wallet was set at 30%, now is 24% - that is pretty darn close!!Staking Rewards were meant to be 13% and THEY ARE! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Vuur" aria-label="Emoji: Vuur">Again, we can& #39;t get all of them right, we wont..." class="img-responsive" style="max-width:100%;"/>