Crypto is giving us a once in a lifetime opportunity to achieve financial freedom.

But sadly, 99% of investors will likely never get there. Here’s how you can make the 1%.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">: Your guide to building a successful crypto portfolio, and how to keep it.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">: Your guide to building a successful crypto portfolio, and how to keep it.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

But sadly, 99% of investors will likely never get there. Here’s how you can make the 1%.

2/ In this thread, I’ll be covering:

• Portfolio theory (risk/reward)

• How to manage your portfolio like a pro

• Yield maximisation and profit taking

Not financial advice of course.

• Portfolio theory (risk/reward)

• How to manage your portfolio like a pro

• Yield maximisation and profit taking

Not financial advice of course.

3/ Firstly, let’s clear up a common misconception.

To make money in crypto you don’t need to get every call correct.

In fact, you can make 10 bets and only hit 1 winner to still come out ahead.

To make money in crypto you don’t need to get every call correct.

In fact, you can make 10 bets and only hit 1 winner to still come out ahead.

4/ Let’s say you put $1k in 10 projects ($10k total).

If 9 of them go to 0, but 1 does an 11x, you still profit $1k.

I don’t strive for perfection in crypto, I strive for profitability.

If 9 of them go to 0, but 1 does an 11x, you still profit $1k.

I don’t strive for perfection in crypto, I strive for profitability.

5/ This means taking losses along the way in pursuit of positive returns.

So what can you do to implement this strategy?

Firstly, diversify. Over diversification is a bad thing, but under diversification can also be harmful.

So what can you do to implement this strategy?

Firstly, diversify. Over diversification is a bad thing, but under diversification can also be harmful.

6/ That’s why I recommend to most new investors to build a portfolio of 20 great projects.

That way, you’ll still capture the overall trend of the market - but you’re not spreading yourself too thin.

That way, you’ll still capture the overall trend of the market - but you’re not spreading yourself too thin.

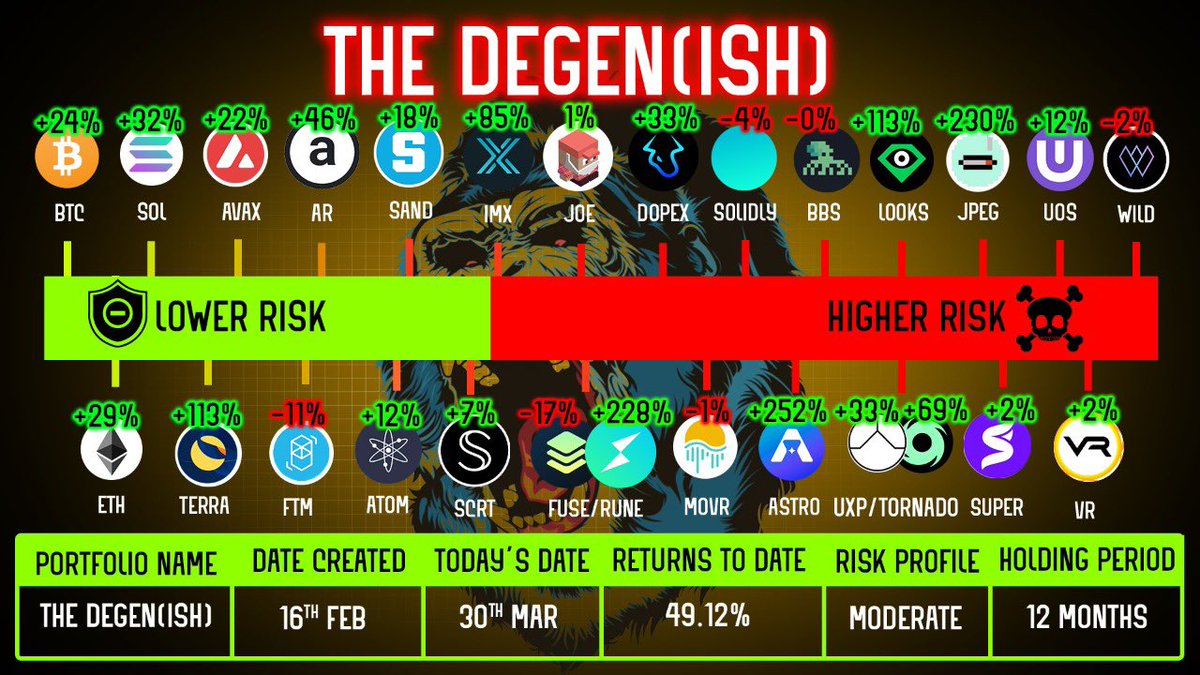

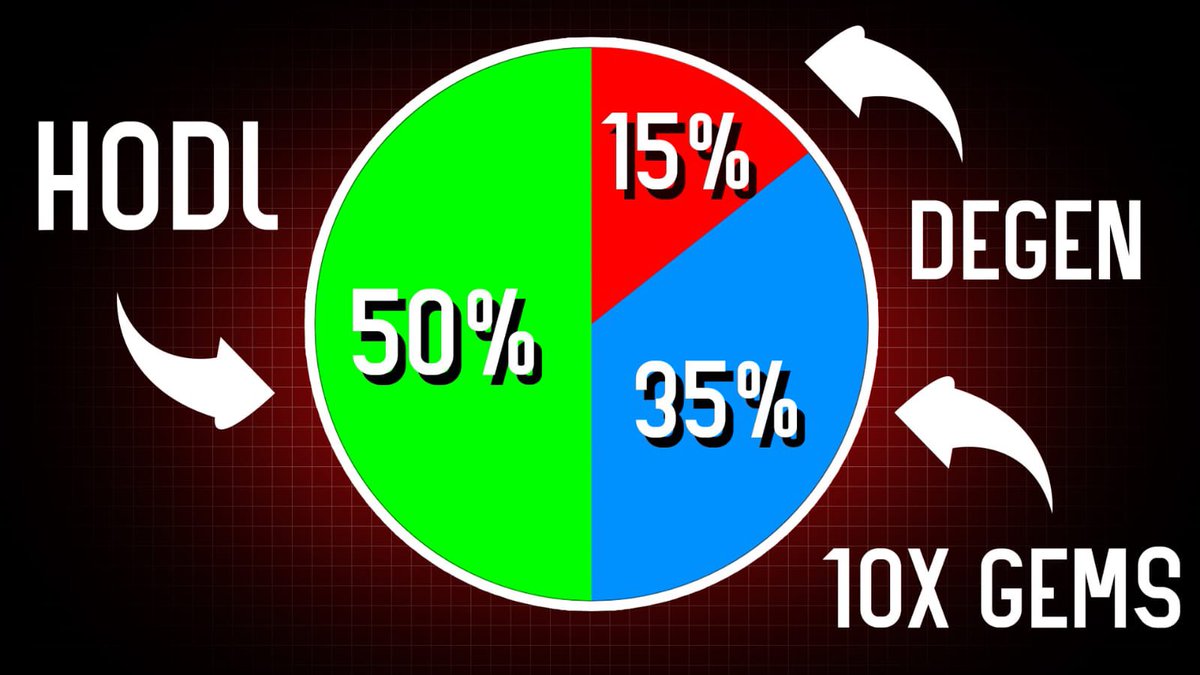

7/ Here’s an example of a well rounded (albeit risky) portfolio.

At least 50% should be in blue chips, with 20%+ in stables.

The tokens you hold depend on what narratives you have conviction in.

I’m constantly presenting new ideas on my YT and Twitter.

At least 50% should be in blue chips, with 20%+ in stables.

The tokens you hold depend on what narratives you have conviction in.

I’m constantly presenting new ideas on my YT and Twitter.

8/ If you’re more experienced in crypto, you’ll likely be able to manage a larger portfolio.

But remember, the more projects you hold l, the more time you’ll need to dedicate to managing it.

But remember, the more projects you hold l, the more time you’ll need to dedicate to managing it.

9/ If the market is bullish, having exposure to more assets is generally advantageous.

However in a choppy/sideways market like this, you have to be more careful about the quality and quantity of projects you hold.

However in a choppy/sideways market like this, you have to be more careful about the quality and quantity of projects you hold.

10/ What does managing a portfolio consist of?

• Taking profits

• Finding the best yield opportunities

• Staking and compounding

• Rebalancing based on performance

• Finding new projects and discarding existing holdings (if your thesis has changed).

• Taking profits

• Finding the best yield opportunities

• Staking and compounding

• Rebalancing based on performance

• Finding new projects and discarding existing holdings (if your thesis has changed).

11/ Let’s break down some of these key categories to help you become the ultimate portfolio manager.

Firstly, taking profits.

How you take profits depends on a multitude of factors, such as your:

• Time horizon

• Risk tolerance

• Financial goals

This is what I do:

Firstly, taking profits.

How you take profits depends on a multitude of factors, such as your:

• Time horizon

• Risk tolerance

• Financial goals

This is what I do:

12/ Whenever a project doubles, I aim to take out my initial investment and let the rest ride.

This means you’re essentially holding tokens “risk free”.

I implement this strategy for my riskier holdings, as I don’t touch my blue chips long term.

This means you’re essentially holding tokens “risk free”.

I implement this strategy for my riskier holdings, as I don’t touch my blue chips long term.

13/ I currently put 50% of profits into both $UST and $BTC.

I have the long term goal of stacking as much #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> as possible, as I believe it’s the only form of sound money on the planet. https://twitter.com/milesdeutscher/status/1507458048603865092">https://twitter.com/milesdeut...

https://abs.twimg.com/hashflags... draggable="false" alt=""> as possible, as I believe it’s the only form of sound money on the planet. https://twitter.com/milesdeutscher/status/1507458048603865092">https://twitter.com/milesdeut...

I have the long term goal of stacking as much #bitcoin

14/ Aim to keep at least 20% of your portfolio in stables.

This means you’ll always have dry powder to buy the dip.

I do this by taking profits on the way up, and farming stables in the meantime.

When I deploy, I restock stables at the next best opportunity.

This means you’ll always have dry powder to buy the dip.

I do this by taking profits on the way up, and farming stables in the meantime.

When I deploy, I restock stables at the next best opportunity.

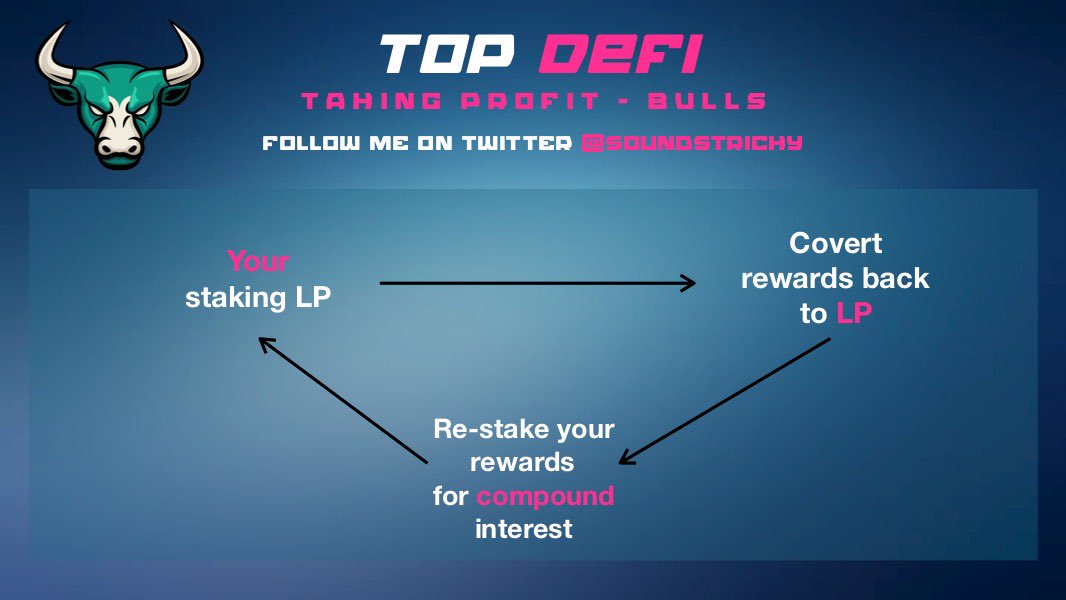

15/ If you have a portfolio of 20 projects, you might want to consider staking 10 of them in order to maximise yield.

I don’t stake everything due to smart contract risk, but I try to stake 50% across a variety of DeFi protocols.

I don’t stake everything due to smart contract risk, but I try to stake 50% across a variety of DeFi protocols.

16/ Where can you find the best yields? Firstly, @0xCoindix has a great product to scan APRs across multiple chains.

Secondly, keep your eye on Twitter and YouTube for new opportunities.

I don’t mean to toot my own horn, but I post many of my strategies across YT and Twitter.

Secondly, keep your eye on Twitter and YouTube for new opportunities.

I don’t mean to toot my own horn, but I post many of my strategies across YT and Twitter.

17/ But staking comes at a time cost. You’ll need to stay on top of your pools, as rates are highly variable in crypto.

How? Set aside a time each week to manage your LPs and farms, to ensure you’re compounding and seeking the best opportunities.

How? Set aside a time each week to manage your LPs and farms, to ensure you’re compounding and seeking the best opportunities.

18/ Don’t have time? Well, maybe DeFi isn’t for you.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😆" title="Lachend gezicht met open mond en dichtgeknepen ogen" aria-label="Emoji: Lachend gezicht met open mond en dichtgeknepen ogen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😆" title="Lachend gezicht met open mond en dichtgeknepen ogen" aria-label="Emoji: Lachend gezicht met open mond en dichtgeknepen ogen">

But if you insist, then you can use autocompounders like @beefyfinance and @Reaper_Farm which make the job easier.

But remember, there’s an added layer of risk when you use autocompounders.

But if you insist, then you can use autocompounders like @beefyfinance and @Reaper_Farm which make the job easier.

But remember, there’s an added layer of risk when you use autocompounders.

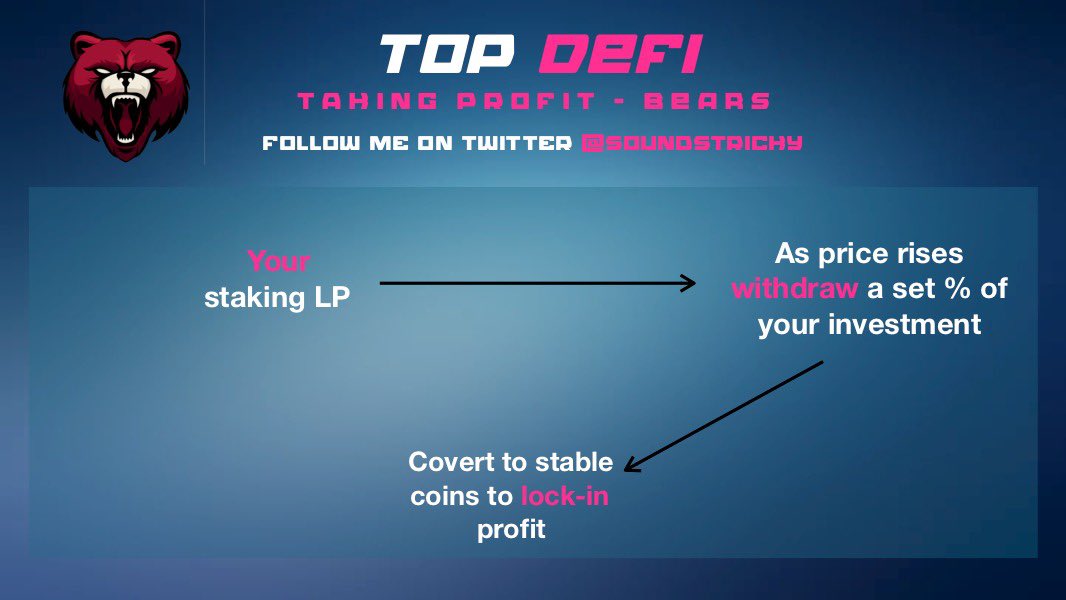

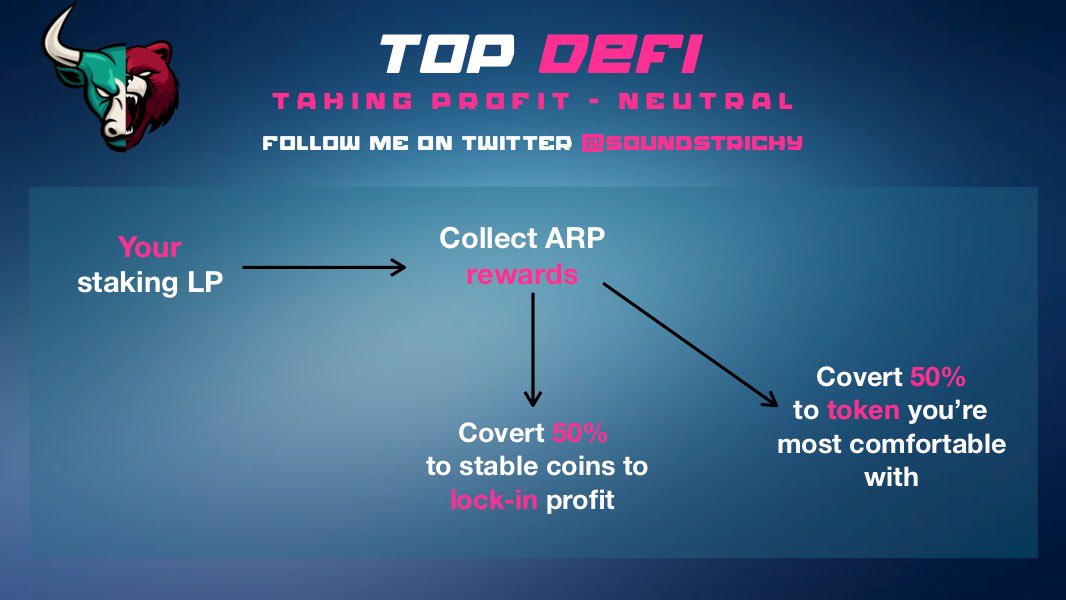

19/ You may want to take a % of your profits from yield farming into stables along the way.

Here are my 3 profit taking strategies for different market phases @SoundsTricky

• Bullish when market is low

• Bearish when market is high

• Mixed when you’re unsure:

Here are my 3 profit taking strategies for different market phases @SoundsTricky

• Bullish when market is low

• Bearish when market is high

• Mixed when you’re unsure:

20/ Here comes the hard part of portfolio management: Rebalancing.

Tokens can move drastically in price from the time of purchase.

You might put in $1k into a project which is now worth $5k, yet another $1k investment may now be $200.

Here’s where rebalancing comes in.

Tokens can move drastically in price from the time of purchase.

You might put in $1k into a project which is now worth $5k, yet another $1k investment may now be $200.

Here’s where rebalancing comes in.

21/ As tokens move in price, the risk profile of your portfolio may change.

For example, many $LUNA investors’ portfolios started to skew heavily towards $LUNA as the price rocketed.

For example, many $LUNA investors’ portfolios started to skew heavily towards $LUNA as the price rocketed.

22/ In this scenario you have a choice:

a) Rebalance *some* holdings into other tokens to maintain a favourable risk profile.

b) Continue to HODL, but funnel fresh capital into other areas to rebalance over time.

a) Rebalance *some* holdings into other tokens to maintain a favourable risk profile.

b) Continue to HODL, but funnel fresh capital into other areas to rebalance over time.

23/ It’s all about opportunity cost. Remember, holding a token is the same as buying it at current levels.

So, if you’re holding $LUNA at $120, you’re essentially saying you’d be willing to buy it at those prices.

However keep in mind the tax implications of realising gains.

So, if you’re holding $LUNA at $120, you’re essentially saying you’d be willing to buy it at those prices.

However keep in mind the tax implications of realising gains.

24/ I could write a 100-part thread on this topic, but let’s leave it here for now.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gezicht met tranen van geluk" aria-label="Emoji: Gezicht met tranen van geluk">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gezicht met tranen van geluk" aria-label="Emoji: Gezicht met tranen van geluk">

I’ll continue to post similar content to help you succeed in this crazy market.

Give me a follow if you’re interested in seeing more!

I’ll continue to post similar content to help you succeed in this crazy market.

Give me a follow if you’re interested in seeing more!

If you enjoyed this thread, do me a favour by liking and retweeting the first part, so more people can see it!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💙" title="Blauw hart" aria-label="Emoji: Blauw hart"> https://twitter.com/milesdeutscher/status/1516131581903134730">https://twitter.com/milesdeut...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💙" title="Blauw hart" aria-label="Emoji: Blauw hart"> https://twitter.com/milesdeutscher/status/1516131581903134730">https://twitter.com/milesdeut...

Read on Twitter

Read on Twitter