Crypto markets have found an outlet in centralized finance, or "DeFi"

Is DeFi the acceptable face of crypto?

Or can central bank digital currencies (CBDCs) do DeFi but without selling coins for speculation?

A thread on a panel I chaired this morning

Is DeFi the acceptable face of crypto?

Or can central bank digital currencies (CBDCs) do DeFi but without selling coins for speculation?

A thread on a panel I chaired this morning

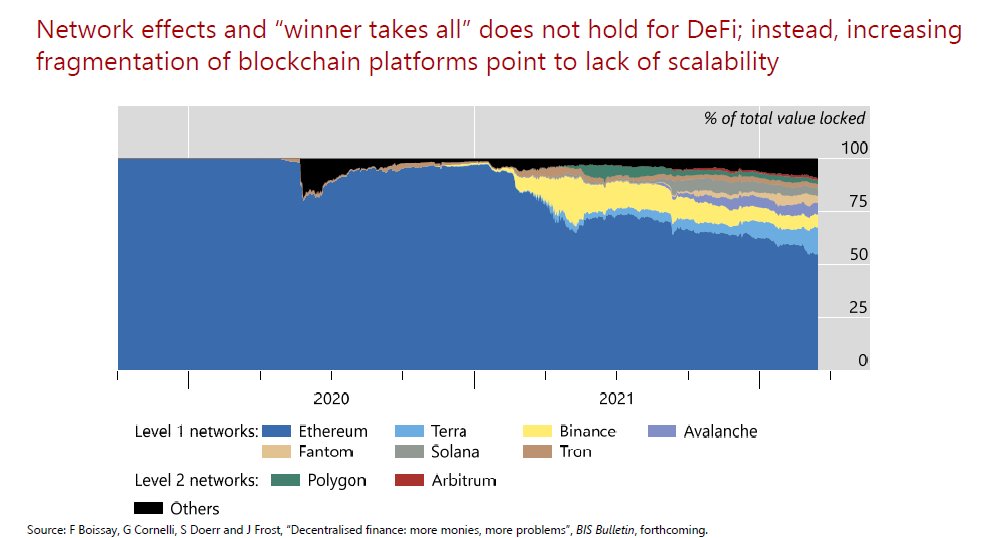

One notable development has been the fragmentation of the blockchain universe, with #Ethereum giving up its dominance to newer chains

The chart below shows the percentage of collateral value locked in various chains; #Ethereum had close to 100%; now barely 50%

The chart below shows the percentage of collateral value locked in various chains; #Ethereum had close to 100%; now barely 50%

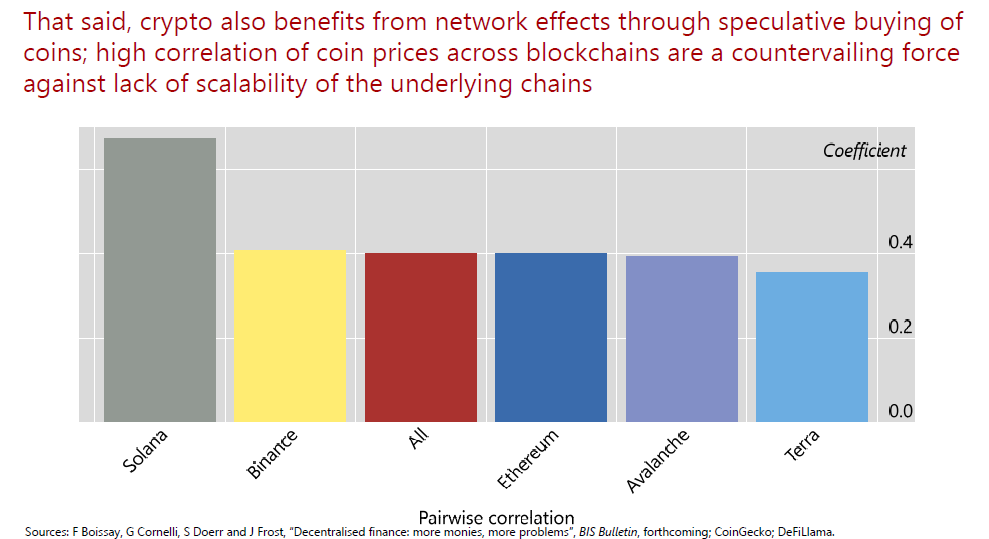

Such fragmentation suggests that network effects are not operating (or operating strongly); typically, businesses with network effects give rise to "winner takes tall"

Crypto markets are not an example of such markets

Crypto markets are not an example of such markets

The reasons for the fragmentation are well-known - the lack of scalability

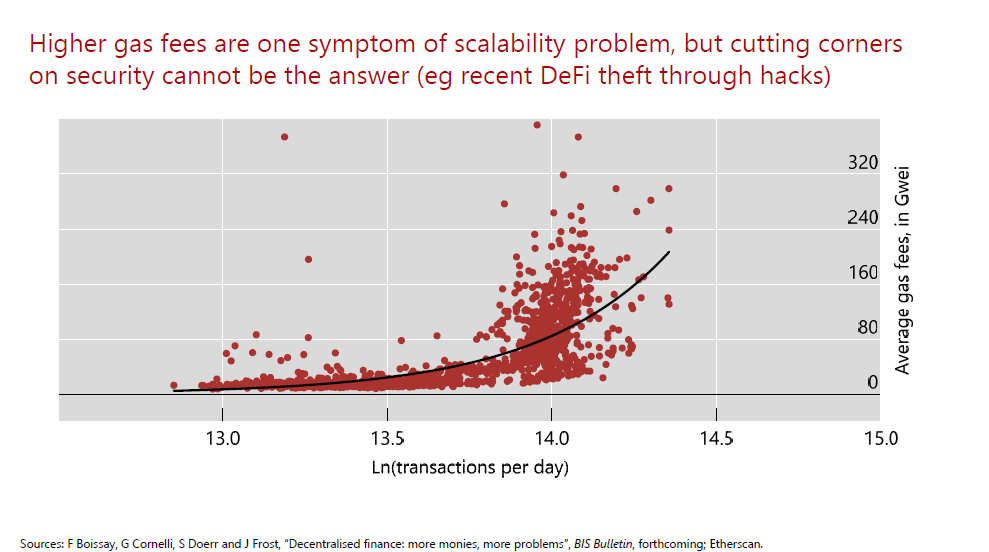

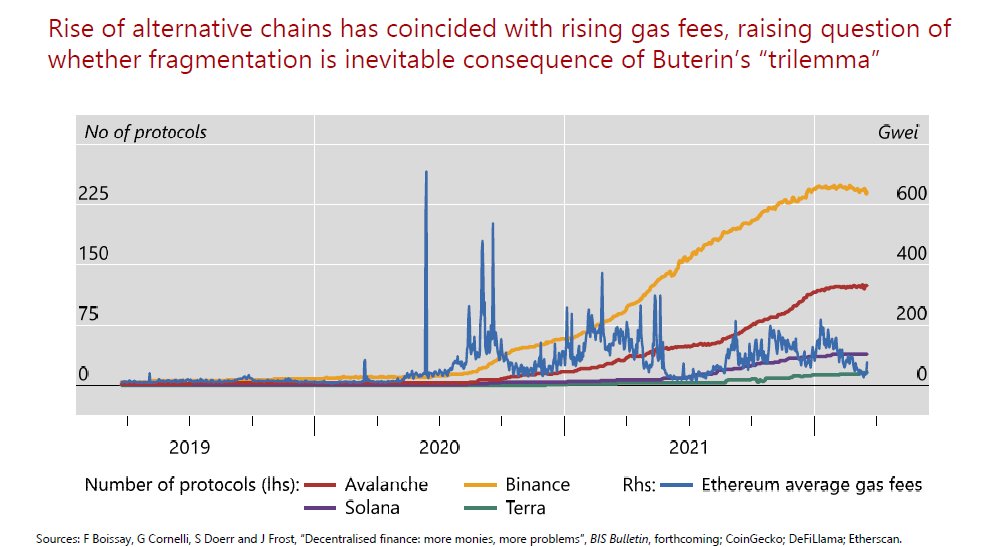

Higher gas fees are symptomatic of lack of scalability, leaving the door open to newer chains with more centralised business models that take advantage of the gaps

Higher gas fees are symptomatic of lack of scalability, leaving the door open to newer chains with more centralised business models that take advantage of the gaps

The spikes in gas fees put the rise of newer chains into context

The trilemma highlighted by @VitalikButerin between decentralisation, scalability and security is the right lens to view these developments

The trilemma highlighted by @VitalikButerin between decentralisation, scalability and security is the right lens to view these developments

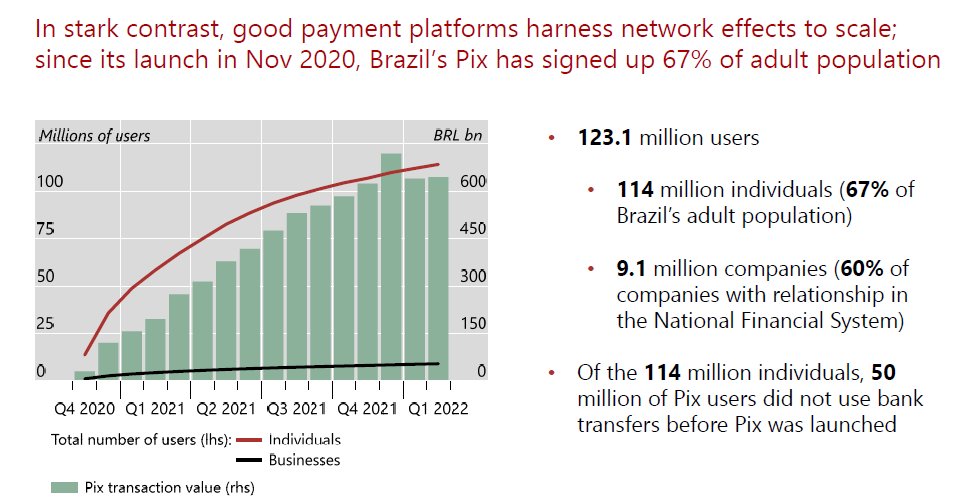

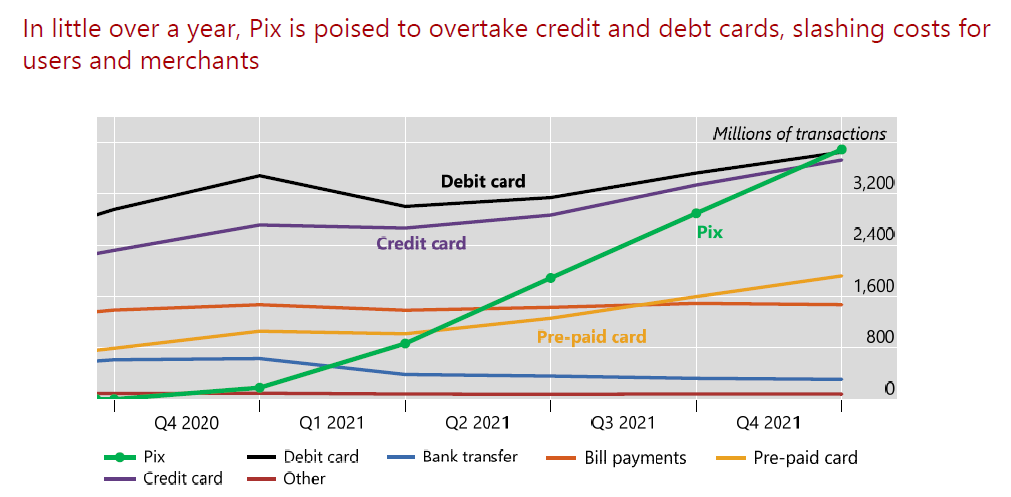

The contrast to instant payment systems is very stark

Network effects are very strong in instant payment systems

Brazil& #39;s Pix signed up two-thirds of the adult population in little over one year

https://www.bis.org/publ/bisbull52.htm">https://www.bis.org/publ/bisb...

Network effects are very strong in instant payment systems

Brazil& #39;s Pix signed up two-thirds of the adult population in little over one year

https://www.bis.org/publ/bisbull52.htm">https://www.bis.org/publ/bisb...

Pix is free for individuals and virtually free for merchants, further turbocharging the network effects

Pix transactions are poised to overtake credit and debt card transactions

Pix transactions are poised to overtake credit and debt card transactions

That said, one type of network effects plays an important role in DeFi (and crypto more generally)

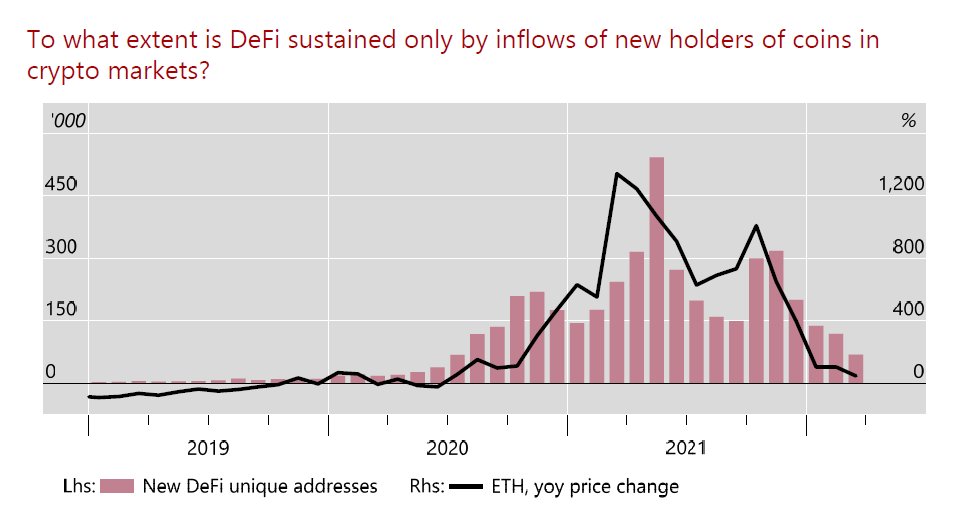

DeFi is sustained by selling coins; the positive correlation between coin prices across chains can create network effects that create spillover effects

DeFi is sustained by selling coins; the positive correlation between coin prices across chains can create network effects that create spillover effects

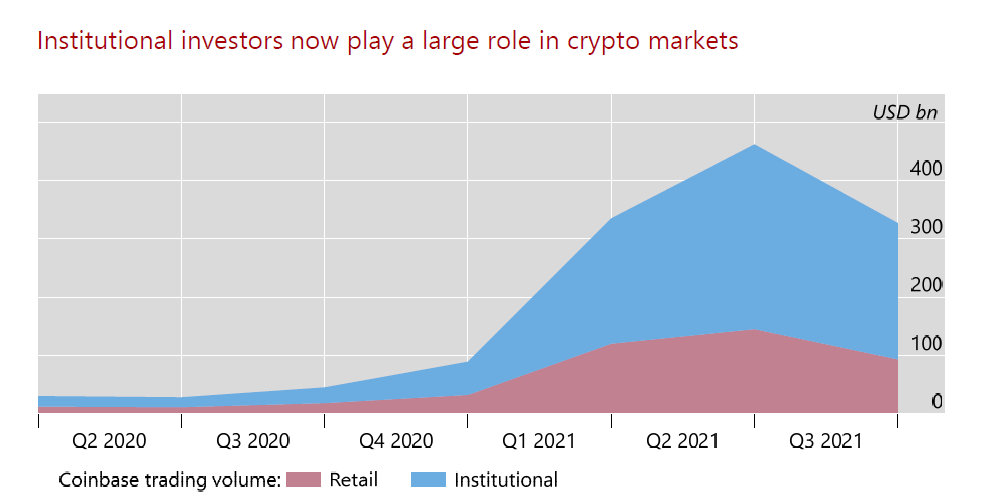

The fact that institutional investors are now big players in the crypto market underscores the importance of coin speculation in sustaining DeFi

DeFi activity is closely correlated with the price dynamics of the underlying coins

The test for the durability of DeFi will come once the crypto markets mature and new inflows slow to a trickle

The test for the durability of DeFi will come once the crypto markets mature and new inflows slow to a trickle

The panel also discussed how well DeFi can handle real world assets - we discussed tokenising bottles of wine, for example

The legal framework turns out to be key; so some degree of centralisation is inevitable

The legal framework turns out to be key; so some degree of centralisation is inevitable

We also discussed how CBDCs could be the basis for DeFi, but without selling coins

Smart contracts can be run on multi-CBDC platforms, such as the one trialed in Project Dunbar https://www.bis.org/publ/othp47.htm ">https://www.bis.org/publ/othp...

Smart contracts can be run on multi-CBDC platforms, such as the one trialed in Project Dunbar https://www.bis.org/publ/othp47.htm ">https://www.bis.org/publ/othp...

But DeFi using CBDCs will look very different

CBDCs use real names, unlike crypto

Ensuring privacy will mean that CBDC decentralisation cannot post all transactions to a public blockchain; no-one else needs to know which supermarket I buy my groceries from

CBDCs use real names, unlike crypto

Ensuring privacy will mean that CBDC decentralisation cannot post all transactions to a public blockchain; no-one else needs to know which supermarket I buy my groceries from

Project Dunbar is one of three multi-CBDC platforms currently being developed by the BIS Innovation Hub

Decentralisation is a necessity, because there is more than one currency (and hence more than one central bank involved)

The report goes into details https://www.bis.org/publ/othp47.htm ">https://www.bis.org/publ/othp...

Decentralisation is a necessity, because there is more than one currency (and hence more than one central bank involved)

The report goes into details https://www.bis.org/publ/othp47.htm ">https://www.bis.org/publ/othp...

I am grateful to my panelists this morning for a really great discussion

Jan Brzezek, Iota Nassr, Thomas Eichenberger and Evan Van Ness

Jan Brzezek, Iota Nassr, Thomas Eichenberger and Evan Van Ness

Is DeFi the acceptable face of crypto?

Video of the session is now up https://m.youtube.com/watch?v=q8kmDJV7YOU">https://m.youtube.com/watch...

Video of the session is now up https://m.youtube.com/watch?v=q8kmDJV7YOU">https://m.youtube.com/watch...

Read on Twitter

Read on Twitter