Yesterday& #39;s 7.9% CPI didn& #39;t even take into account the escalation in prices due to the war in Ukraine and Russian sanctions.

Inflation will, unfortunately, continue to rise despite earlier trends of supply chain easing https://abs.twimg.com/emoji/v2/... draggable="false" alt="😩" title="Vermoeid gezicht" aria-label="Emoji: Vermoeid gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😩" title="Vermoeid gezicht" aria-label="Emoji: Vermoeid gezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

Inflation will, unfortunately, continue to rise despite earlier trends of supply chain easing

1/

In my previous threads I first explained why the source of inflation this time wasn’t entirely monetary: https://twitter.com/wolf_vukovic/status/1491079485663240194">https://twitter.com/wolf_vuko...

In my previous threads I first explained why the source of inflation this time wasn’t entirely monetary: https://twitter.com/wolf_vukovic/status/1491079485663240194">https://twitter.com/wolf_vuko...

2/

...followed by why the supply chain issues were the main culprit, and when they might ease: https://twitter.com/wolf_vukovic/status/1492166590116204548">https://twitter.com/wolf_vuko...

...followed by why the supply chain issues were the main culprit, and when they might ease: https://twitter.com/wolf_vukovic/status/1492166590116204548">https://twitter.com/wolf_vuko...

3/

However, despite positive trends in easing supply chain pressures and hence easing inflation

(I suggested it was peaking in Jan, Feb - as per yesterday& #39;s report)

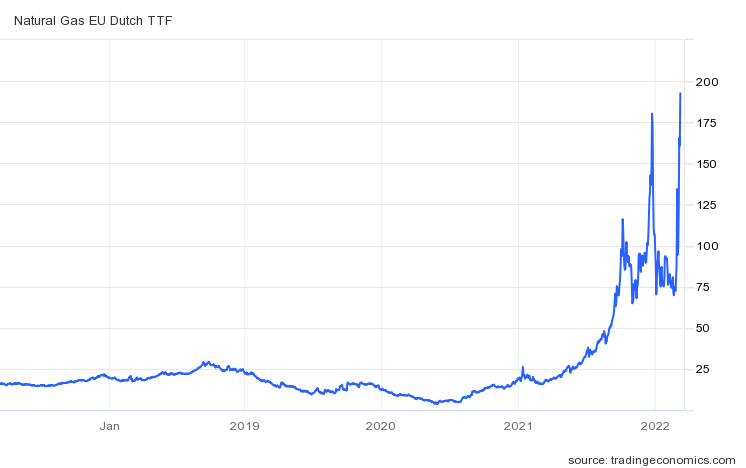

...recent developments with Russian sanctions pushed oil, gas, and some food and commodity prices sky-high

However, despite positive trends in easing supply chain pressures and hence easing inflation

(I suggested it was peaking in Jan, Feb - as per yesterday& #39;s report)

...recent developments with Russian sanctions pushed oil, gas, and some food and commodity prices sky-high

4/ Why?

A huge chunk of oil supply has been pulled off the market.

Firms are not buying Russian oil out of fear of negative repercussions

(e.g. being accused of financing the war)

Russian oil firms are offering 25% discount and still struggling to find buyers.

A huge chunk of oil supply has been pulled off the market.

Firms are not buying Russian oil out of fear of negative repercussions

(e.g. being accused of financing the war)

Russian oil firms are offering 25% discount and still struggling to find buyers.

5/

Same for food and commodities being produced in Russia and Ukraine.

Exports have stopped or have been significantly reduced.

Global supply is down.

Prices, amidst high demand, are up.

= Inflation.

Same for food and commodities being produced in Russia and Ukraine.

Exports have stopped or have been significantly reduced.

Global supply is down.

Prices, amidst high demand, are up.

= Inflation.

6/

So instead of easing the supply chain (see below),

domestic demand will once again be faced with replacing suppliers

(just like during COVID)

This is costly, takes time, and puts additional strains on the supply chain...

...AGAIN! https://twitter.com/Lvieweconomics/status/1496068041771302917">https://twitter.com/Lviewecon...

So instead of easing the supply chain (see below),

domestic demand will once again be faced with replacing suppliers

(just like during COVID)

This is costly, takes time, and puts additional strains on the supply chain...

...AGAIN! https://twitter.com/Lvieweconomics/status/1496068041771302917">https://twitter.com/Lviewecon...

8/

Oil is up so much (and it might continue to go up)

that many investors are now even more concerned of a recession.

Why are oil prices linked with recessions?

Because, historically, they exacerbated the Fed cycle.

How exactly?

Oil is up so much (and it might continue to go up)

that many investors are now even more concerned of a recession.

Why are oil prices linked with recessions?

Because, historically, they exacerbated the Fed cycle.

How exactly?

9/

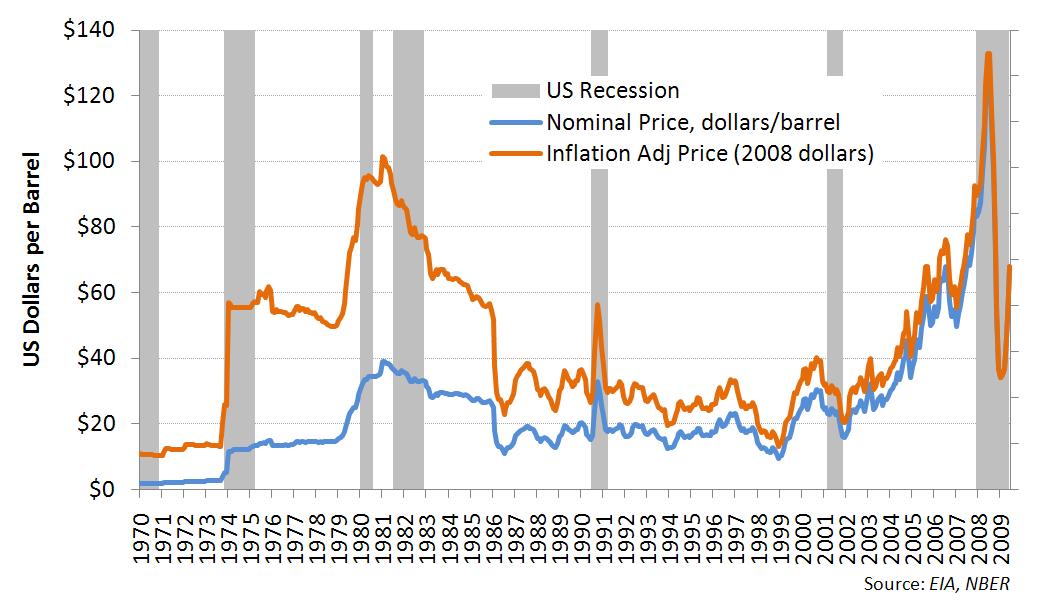

Oil prices are an important contributor to CPI.

Huge demand for oil across the economy (businesses and consumers) affects everyone’s budget.

This was particularly a problem during the stagflationary 1970s

(which is why many are evoking that decade today)

Oil prices are an important contributor to CPI.

Huge demand for oil across the economy (businesses and consumers) affects everyone’s budget.

This was particularly a problem during the stagflationary 1970s

(which is why many are evoking that decade today)

10/

When oil goes up, it adds to inflationary pressures,

and expectations of rate increases go up.

Other things are happening as well, so the Fed might raise rates anyway,

but high oil prices certainly amplify the need for the Fed to do so.

When oil goes up, it adds to inflationary pressures,

and expectations of rate increases go up.

Other things are happening as well, so the Fed might raise rates anyway,

but high oil prices certainly amplify the need for the Fed to do so.

11/

And when the Fed starts raising rates, we enter the late stages of the macro cycle.

What’s that?

Lower interest rates = apply during recessions to kick-start recovery, keep low until the economy starts to "overheat"

And when the Fed starts raising rates, we enter the late stages of the macro cycle.

What’s that?

Lower interest rates = apply during recessions to kick-start recovery, keep low until the economy starts to "overheat"

12/

As the economy overheats, the Fed raises rates to prevent inflation

High rates affect mortgages, borrowing costs, disposable income, consumption, and soon enough corporate earnings.

Demand down, layoffs up, the reinforcing negative spiral continues.

As the economy overheats, the Fed raises rates to prevent inflation

High rates affect mortgages, borrowing costs, disposable income, consumption, and soon enough corporate earnings.

Demand down, layoffs up, the reinforcing negative spiral continues.

13/

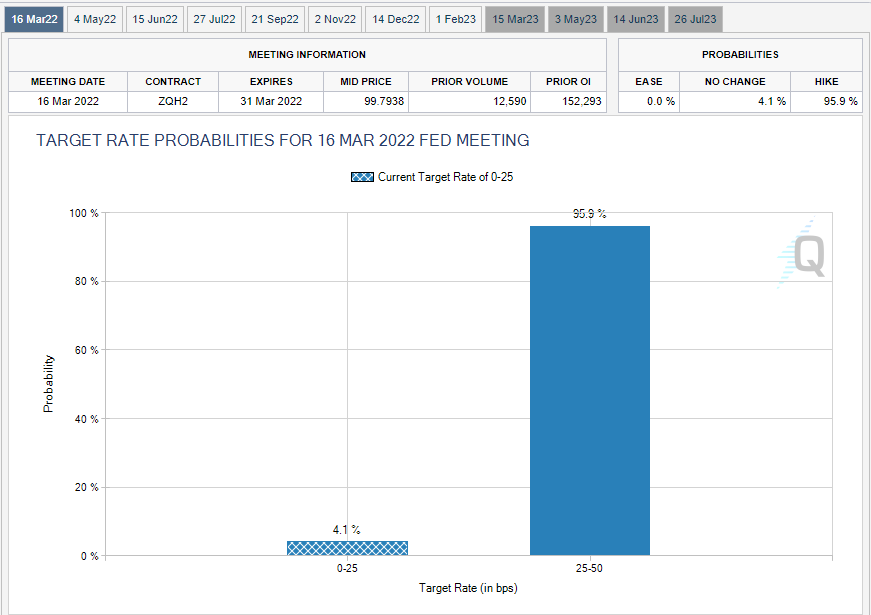

Yeah, but this time, while oil prices are booming,

expectations of a rate hike in March are strongly anchored around only a 25bps increase

(the 50bps is off the table for next week’s meeting)

So why aren’t investors pricing in higher rate hikes?

Yeah, but this time, while oil prices are booming,

expectations of a rate hike in March are strongly anchored around only a 25bps increase

(the 50bps is off the table for next week’s meeting)

So why aren’t investors pricing in higher rate hikes?

14/

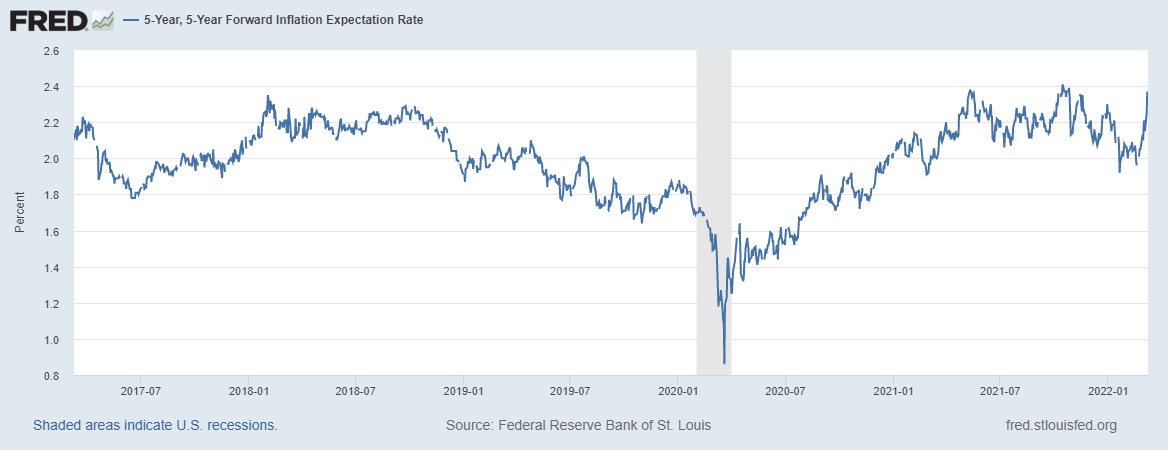

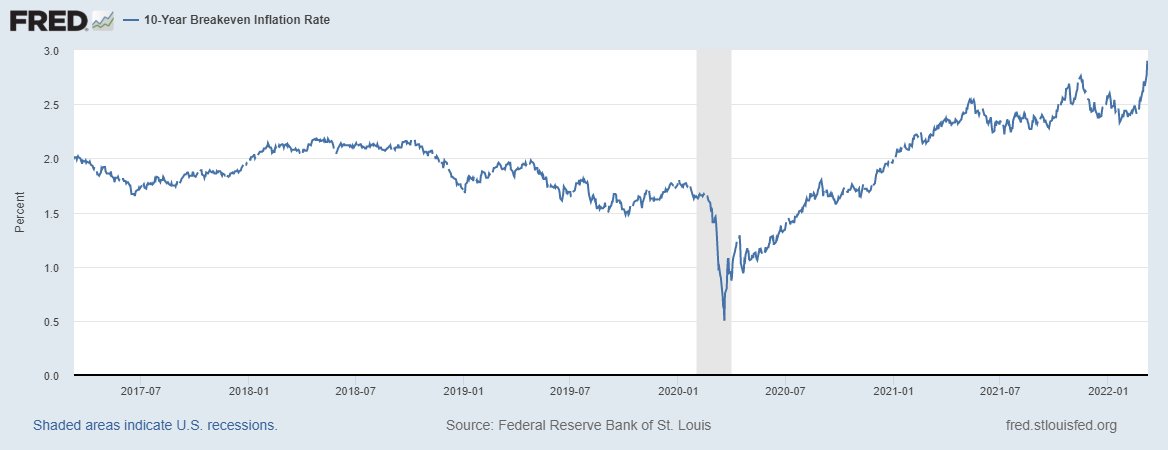

They actually are, over a more medium term.

(note the 5Y-5Y and 10Y exp)

The start of the war shaped expectations differently.

The Fed won’t slam on the breaks too hard, because they& #39;re afraid that economic consequences of the war might increase recessionary pressures.

They actually are, over a more medium term.

(note the 5Y-5Y and 10Y exp)

The start of the war shaped expectations differently.

The Fed won’t slam on the breaks too hard, because they& #39;re afraid that economic consequences of the war might increase recessionary pressures.

15/

The Fed was in a very difficult position before the war was even announced.

They are still balancing on tightrope:

(1) hike strongly in the near term to increase credibility but also increase prob of recession?

Or (2) lose credibility but prevent recession in near term?

The Fed was in a very difficult position before the war was even announced.

They are still balancing on tightrope:

(1) hike strongly in the near term to increase credibility but also increase prob of recession?

Or (2) lose credibility but prevent recession in near term?

16/

There are no best-case scenarios any more.

If the supply chain easing had continued this would have reduced some pressure off the Fed.

But then the war started, and it& #39;ll bring us back to November& #39;s highs.

There are no best-case scenarios any more.

If the supply chain easing had continued this would have reduced some pressure off the Fed.

But then the war started, and it& #39;ll bring us back to November& #39;s highs.

17/

We& #39;re up for a hard landing or a crash, a soft landing is no longer a viable outcome.

So yeah, we can blame it all on Putin then https://abs.twimg.com/emoji/v2/... draggable="false" alt="😄" title="Lachend gezicht met open mond en lachende ogen" aria-label="Emoji: Lachend gezicht met open mond en lachende ogen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😄" title="Lachend gezicht met open mond en lachende ogen" aria-label="Emoji: Lachend gezicht met open mond en lachende ogen">

(the meme will be right!)

We& #39;re up for a hard landing or a crash, a soft landing is no longer a viable outcome.

So yeah, we can blame it all on Putin then

(the meme will be right!)

18/

What should an investor do?

If you haven’t already, re-balance (sell cyclicals,tech)

You can go long oil via $USO, long gold via $GLD

or long food and commodities via $DBC or $PDBC

Increase cash for now (long USD)

At least until the war in Ukraine is resolved.

What should an investor do?

If you haven’t already, re-balance (sell cyclicals,tech)

You can go long oil via $USO, long gold via $GLD

or long food and commodities via $DBC or $PDBC

Increase cash for now (long USD)

At least until the war in Ukraine is resolved.

19/

Also, watch the Fed and bond yields for sings of yield curve inversions ($TBT is a good instrument here)

And remember, always keep a nice little $SPY tail-hedge: https://twitter.com/wolf_vukovic/status/1488205696210386949">https://twitter.com/wolf_vuko...

Also, watch the Fed and bond yields for sings of yield curve inversions ($TBT is a good instrument here)

And remember, always keep a nice little $SPY tail-hedge: https://twitter.com/wolf_vukovic/status/1488205696210386949">https://twitter.com/wolf_vuko...

Thanks for reading, hope you liked it!

Follow me at @wolf_vukovic

and join my Substack for our weekly market prediction competition.

Follow me at @wolf_vukovic

and join my Substack for our weekly market prediction competition.

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" title="Yesterday& #39;s 7.9% CPI didn& #39;t even take into account the escalation in prices due to the war in Ukraine and Russian sanctions.Inflation will, unfortunately, continue to rise despite earlier trends of supply chain easing https://abs.twimg.com/emoji/v2/... draggable="false" alt="😩" title="Vermoeid gezicht" aria-label="Emoji: Vermoeid gezicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" title="Yesterday& #39;s 7.9% CPI didn& #39;t even take into account the escalation in prices due to the war in Ukraine and Russian sanctions.Inflation will, unfortunately, continue to rise despite earlier trends of supply chain easing https://abs.twimg.com/emoji/v2/... draggable="false" alt="😩" title="Vermoeid gezicht" aria-label="Emoji: Vermoeid gezicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

(the meme will be right!)" title="17/We& #39;re up for a hard landing or a crash, a soft landing is no longer a viable outcome.So yeah, we can blame it all on Putin then https://abs.twimg.com/emoji/v2/... draggable="false" alt="😄" title="Lachend gezicht met open mond en lachende ogen" aria-label="Emoji: Lachend gezicht met open mond en lachende ogen"> (the meme will be right!)" class="img-responsive" style="max-width:100%;"/>

(the meme will be right!)" title="17/We& #39;re up for a hard landing or a crash, a soft landing is no longer a viable outcome.So yeah, we can blame it all on Putin then https://abs.twimg.com/emoji/v2/... draggable="false" alt="😄" title="Lachend gezicht met open mond en lachende ogen" aria-label="Emoji: Lachend gezicht met open mond en lachende ogen"> (the meme will be right!)" class="img-responsive" style="max-width:100%;"/>