How to save tax when income is above 50 lakhs?

Here are 9 benefits of trading in a corporate account: https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">

Collaborated with @niki_poojary

Here are 9 benefits of trading in a corporate account:

Collaborated with @niki_poojary

1. Make a Pvt Ltd Company.

Form a company with family members and trade under it. The family members should be directors of the company. Will explain why later.

Why form a company?

You will only need to pay 25% flat tax. Individuals have to pay 30% tax above 10 lakh profits.

Form a company with family members and trade under it. The family members should be directors of the company. Will explain why later.

Why form a company?

You will only need to pay 25% flat tax. Individuals have to pay 30% tax above 10 lakh profits.

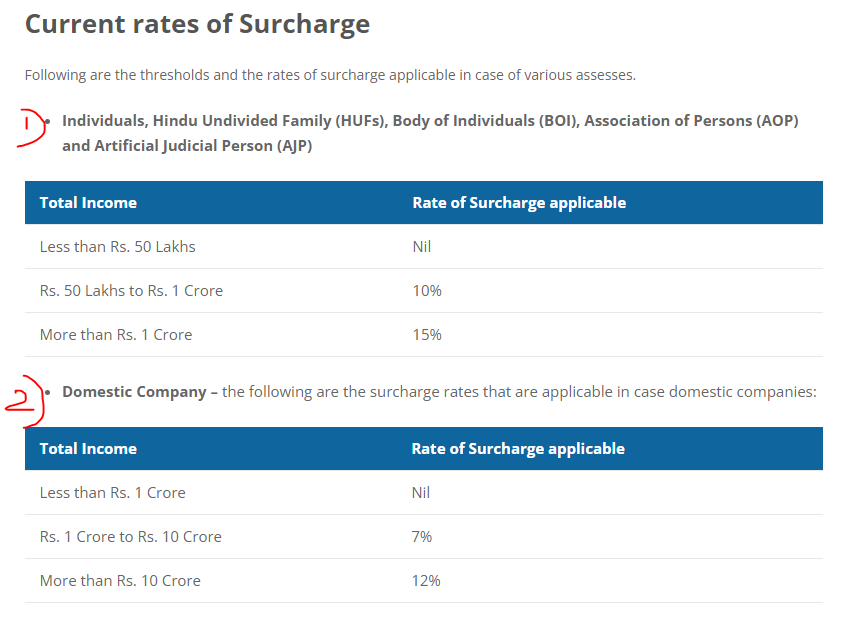

2. Surcharge Benefits:

You will be charged a lower surcharge in a corporate account.

Check the picture below:

You will be charged a lower surcharge in a corporate account.

Check the picture below:

Total Tax Outlay:

The total tax outlay for individuals is 30% plus surcharge. If you really earn a lot (10 cr +) then you will be paying 42% tax.

Whereas in a company you& #39;ll be paying a maximum of 28% tax.

This is how rich people save a lot of their money by paying low taxes.

The total tax outlay for individuals is 30% plus surcharge. If you really earn a lot (10 cr +) then you will be paying 42% tax.

Whereas in a company you& #39;ll be paying a maximum of 28% tax.

This is how rich people save a lot of their money by paying low taxes.

3. Expenses can be deducted.

All expenses can be deducted from a company account.

Companies:

1. First make a profit.

2. then deduct the expenses

3. & Pay tax on the remaining income

Individuals:

1. First Profit

2. Then Pay tax

3. Expenses with whatever is left.

All expenses can be deducted from a company account.

Companies:

1. First make a profit.

2. then deduct the expenses

3. & Pay tax on the remaining income

Individuals:

1. First Profit

2. Then Pay tax

3. Expenses with whatever is left.

This makes a huge difference in companies as you get to deduct expenses first and then have to pay tax on the remaining amount.

Individuals are first charged taxes and then get to spend with the remaining amount.

Over a long period, this turns into a huge gain for companies.

Individuals are first charged taxes and then get to spend with the remaining amount.

Over a long period, this turns into a huge gain for companies.

4. Which Expenses to charge?

1. Office Rent

2. Petrol

3. Car Depreciation

4. Salaries

5. Travel

6. Food in restaurants

Additionally, get to deduct housing loans as well.

1. Office Rent

2. Petrol

3. Car Depreciation

4. Salaries

5. Travel

6. Food in restaurants

Additionally, get to deduct housing loans as well.

5. Give a loan from your account to your company account.

Since all the family members will be directors in the company, the company can receive a loan from its directors without any hassle.

Start trading with that loan that you& #39;ve given yourself.

Don& #39;t repay the loan.

Since all the family members will be directors in the company, the company can receive a loan from its directors without any hassle.

Start trading with that loan that you& #39;ve given yourself.

Don& #39;t repay the loan.

6. Low Paid-up capital:

Keep paid-up capital as 1 lakh only.

Anything above that is a loan from directors.

I have confirmed this with multiple traders.

Keep paid-up capital as 1 lakh only.

Anything above that is a loan from directors.

I have confirmed this with multiple traders.

7. NBFC license required?

No NBFC licence is required. Have confirmed this with multiple CA& #39;s and multiple traders too. https://twitter.com/AdityaTodmal/status/1479309318478573568">https://twitter.com/AdityaTod...

No NBFC licence is required. Have confirmed this with multiple CA& #39;s and multiple traders too. https://twitter.com/AdityaTodmal/status/1479309318478573568">https://twitter.com/AdityaTod...

8. When should you open a corporate account?

If you& #39;re making a profit of higher than 50 lakhs then it makes sense to transfer money to a corporate account and trade from it rather than on an individual name as there are compliance costs as well.

If you& #39;re making a profit of higher than 50 lakhs then it makes sense to transfer money to a corporate account and trade from it rather than on an individual name as there are compliance costs as well.

9. Depreciation

In a corporate account, it is going to be easy to claim depreciation.

Tough to do in an individual account.

Additionally, if you buy a property in the company name, all interest paid is considered an expense.

In a corporate account, it is going to be easy to claim depreciation.

Tough to do in an individual account.

Additionally, if you buy a property in the company name, all interest paid is considered an expense.

Conclusion:

Everything you buy, buy under the company name. The total tax you pay will be lesser than 25%.

These are the advantages of trading in a corporate account. If you know of any other benefits list them below.

Everything you buy, buy under the company name. The total tax you pay will be lesser than 25%.

These are the advantages of trading in a corporate account. If you know of any other benefits list them below.

If you found this useful, please do RT first tweet.

Follow to never miss them.

See past threads here:

@AdityaTodmal & @niki_poojary

Follow to never miss them.

See past threads here:

@AdityaTodmal & @niki_poojary

Read on Twitter

Read on Twitter