Today LFG announced they have raised $1 billion dollars to form $BTC reserve for Terra& #39;s $UST, lead by Jump Crypto and Three Arrows Capital.

Here I explain why this deal is extremely important for Terra& #39;s stability, $LUNA& #39;s value capture, and future developments of LFG https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="collectie" aria-label="Emoji: collectie">

Here I explain why this deal is extremely important for Terra& #39;s stability, $LUNA& #39;s value capture, and future developments of LFG

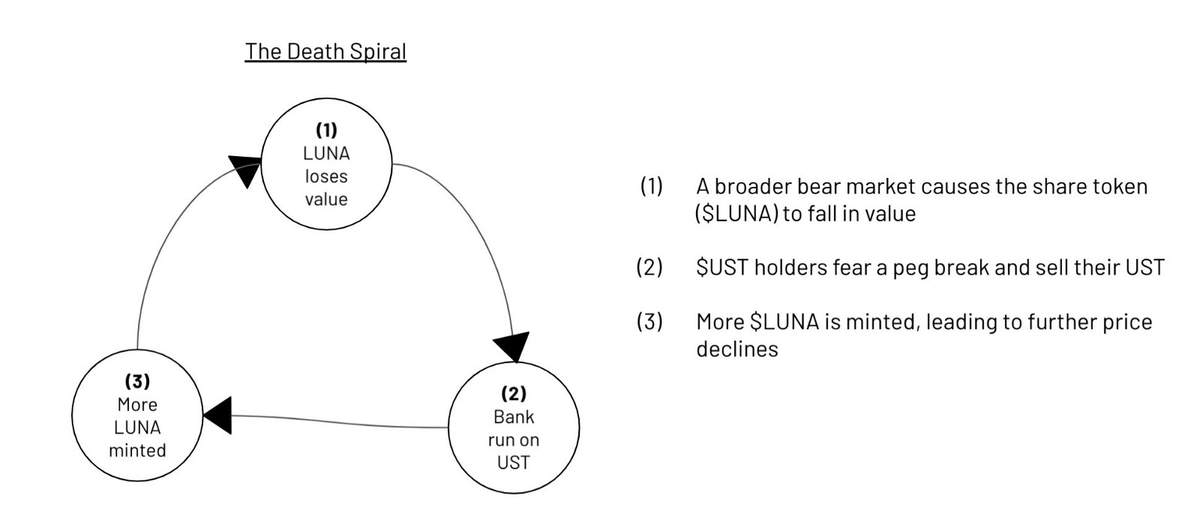

The main criticism of algorithmic stablecoins have to do with their inherent reflexivity. LUNA absorbs the volatility of UST& #39;s market: as UST goes above peg LUNA is bought and burned pushing LUNA& #39;s price up, and as UST goes below peg LUNA is minted and sold pushing its price down

When the market is bullish this can be extremely rewarding to LUNA& #39;s price, as more LUNA is bought and burned through arbitrage along with speculative price increases. However, in bearish environments when people are both selling LUNA and UST, this process could be detrimental

This process is what is known as a "bank run" or a "death spiral," and can be visualized below. (Source: @ZeMariaMacedo

With the introduction of BTC reserves, the risk of such a spiral is minimized. This is due to the reduction of stress on step 3 outlined above. Instead of being required to mint LUNA to arbitrage UST& #39;s price, there is now the option to swap UST to BTC instead.

The risk of a death spiral has long been known as the major risk for a seignorage-based stablecoins. This has caused many investors to pass on Terra or similar models in the past, (cc. Multicoin Capital)

Now that the largest risk for the peg has been minimized, this is extremely important for the long-term sustainability of the protocol, and decreases the psychological resistance to using $UST over what are perceived to be"safer" stablecoin options.

Using the same death spiral example above, by having other swap options for arbitragers when $UST price falls, this brings more value accrual to $LUNA as well. In times of contraction, less total $LUNA is minted into circulation as people choose to swap to $BTC instead.

This means over a long timer period, as Terra sees many waves of expansion and contraction, more $LUNA will be burned in aggregate. This increases the value of $LUNA, which also contributes to the peg& #39;s health and $LUNA becomes an even better way to bet on the growth of $UST

The OTC deal also involved many big-name investors including Jump Capital, Three Arrows and Defiance to name a few. The deal was outlined to have a four year vesting schedule for these firms, which means they are incentivized to see long-term growth of the ecosystem.

These names are also extremely important and influential within the crypto space, and have the ability to move markets and backstop risk. For example, the recent a hack of Wormhole for over 160,000 ETH was very quickly filled by Jump, a deal worth over $300 million dollars.

By having influential groups of people with large capital in such a deal, this can help bootstrap protocol value, as incentive alignment means they also benefit from the rise of Terra.

Then there is the use of $BTC as the reserve asset. Most people in crypto can agree that $BTC is truly the most decentralized, sound money on the planet. It is a pristine form of collateral and store-of-value making it a prime asset choice to backstop $UST

While the reserves are starting with $BTC, it has become clear that LFG is looking to include other decentralized assets in the reserves, as outlined in the announcement article.

While $BTC is pristine collateral, by having more options this 1) diversifies the basket of swap options and therefore reduces protocol risk, and 2) by including native smart contract assets allows $UST to more easily become the de-facto stablecoin on other chains besides Terra

This sets the stage for further steps from LFG and the community that will continue to minimize risk and increase the spread of $UST cross-chain.

Read on Twitter

Read on Twitter