Corporate credit 101. A range of topics. 1. Corporate bond and spread, pricing, risk and drivers. 2. What are HYG and LQD? 3. An alternative way to think of corporate bond valuation.

1. A corporate bond is a liability issued by a corporation with a fixed coupon and maturity

1. A corporate bond is a liability issued by a corporation with a fixed coupon and maturity

A corporate bond is a fixed income asset that is similar to a treasury bond with one key difference. A corporation can not print USD and thus cannot pay off its obligation (either interest payments or maturity) if the corp doesn& #39;t possess cash to pay. They can pay these things

In three ways. A. Cash on hand. B. Issue additional bonds or stock. C. Sell assets. If all of these are unable to pay off the obligation the corporation must default on all of its obligations. That default risk is why corp bonds have a higher coupon than US Treasury bonds

The difference between a similar maturity corp and treasury bond is called the credit spread. Conceptually the credit spread is the compensation required to pay an investor for default risk. For example let& #39;s say a corporate issues a 5 year bond. Current 5 year treasury is 1.82

If the corporate issues at 2.32 the credit spread is 50bp. That 50bp will be paid for 5 years and the bond will be paid off at maturity if all goes well. If things go badly for the corporate some or all of the 50bp will not be paid and the maturity will not be paid. Bankruptcy

Court will determine how much of the assets remaining in the corporate are paid out to the bond holder once the court resolves the case. Conceptually Corporate bonds get all of their money back before an equity holder gets any however more senior obligation holders get theirs

First. I won& #39;t go down that rabbit hole in this thread. So using the example and roughly assuming that the corporate will pay the interest for 5 years and then default and the bond holder will get 50% in bankruptcy court. 2.5% of coupons compensate an investor for 50% loss

Essentially the buyer takes a 50:2.5 bet that he will be paid off. In other words he thinks the default risk is a 5% probability.

Let& #39;s move on to drivers. Clearly the risk of default fluctuates and that causes credit spreads to shift. At a macro level the primary drivers are

Let& #39;s move on to drivers. Clearly the risk of default fluctuates and that causes credit spreads to shift. At a macro level the primary drivers are

Growth. Growing corporations reduce credit risk

Inflation. Inflation is double edged. Corporations that can pass on pricing and have low input costs benefit from inflation. Others are less fortunate.

Risk premium. Like all assets corporate bonds and the spread itself has an RP

Inflation. Inflation is double edged. Corporations that can pass on pricing and have low input costs benefit from inflation. Others are less fortunate.

Risk premium. Like all assets corporate bonds and the spread itself has an RP

Which behaves like other assets

BUT here is where things get murky and why I don& #39;t follow corporate bonds but only corporate spreads.

The owner of corporate bonds own both a US treasury and the corporate spread.

So when growth rises the credit spread falls which is good

But

BUT here is where things get murky and why I don& #39;t follow corporate bonds but only corporate spreads.

The owner of corporate bonds own both a US treasury and the corporate spread.

So when growth rises the credit spread falls which is good

But

The US treasury falls which is bad. So for portfolio construction purposes a hybrid security isn& #39;t perfect for macro. Which brings us to ETF& #39;s

2. The two most well known and liquid corporate bond ETF& #39;s are LQD and HY

2. The two most well known and liquid corporate bond ETF& #39;s are LQD and HY

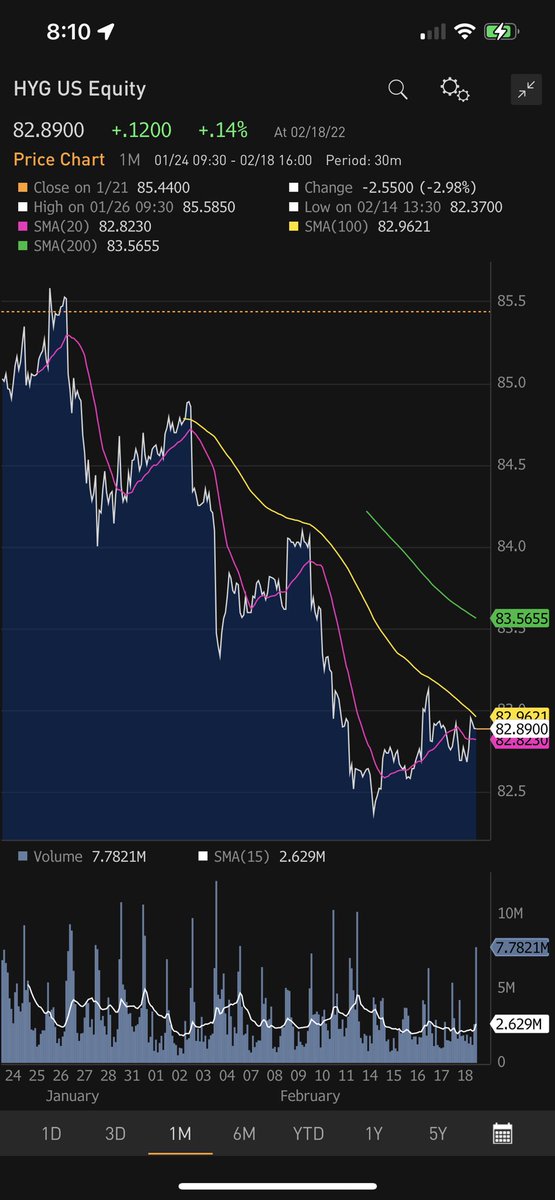

LQD is simply a portfolio of investment grade corporate bonds. HYG is a portfolio of junk bonds. Both are thus portfolios of US treasuries and credit spreads. Much has been made about the poor performance of these ETF& #39;s as the driver of RP associated with tightening Fed and QT

Has caused both portfolio elements to go down in price, up in yield. Corporate bonds have felt a double whammy. It happens. After three major mark downs of HYG extreme bearishness developed last weekend. But the treasury element caused a rally

While credit spreads did indeed get worse. Which outlines the difficulty in using these ETF& #39;s to express a macro or TA view

My suggestion is to pay attention to spreads not corporate bonds themselves. As the spread contains all information that corporate bonds have.

Now let& #39;s briefly mention that the derivatives market for corp bonds is highly developed and liquid. When I look at spreads I use

Now let& #39;s briefly mention that the derivatives market for corp bonds is highly developed and liquid. When I look at spreads I use

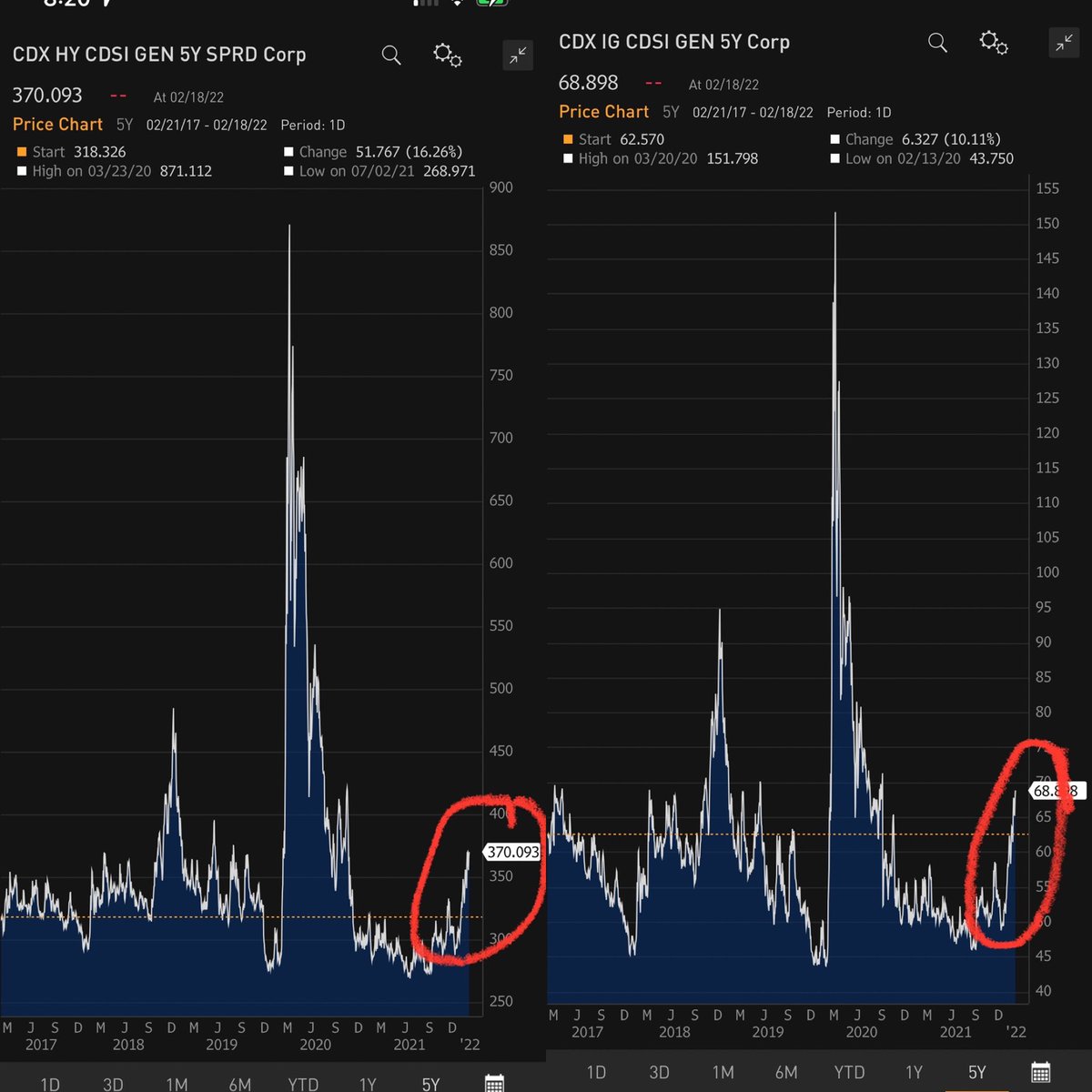

CDX HY and CDX IG. There are many rabbit holes I will avoid that credit people will recognize about the use of these benchmarks but for most of us these work great. Both of these markets have moved a lot in a bearish direction

And obviously the 2018 tightening level is itself a concern. Let& #39;s review our extremely rough heuristic on HY CDX the current spread of 375 bp for five years indicates an HY bond holder gets 18.75 % of coupons and assuming a 50% loss on principal is betting that 37.5% of the

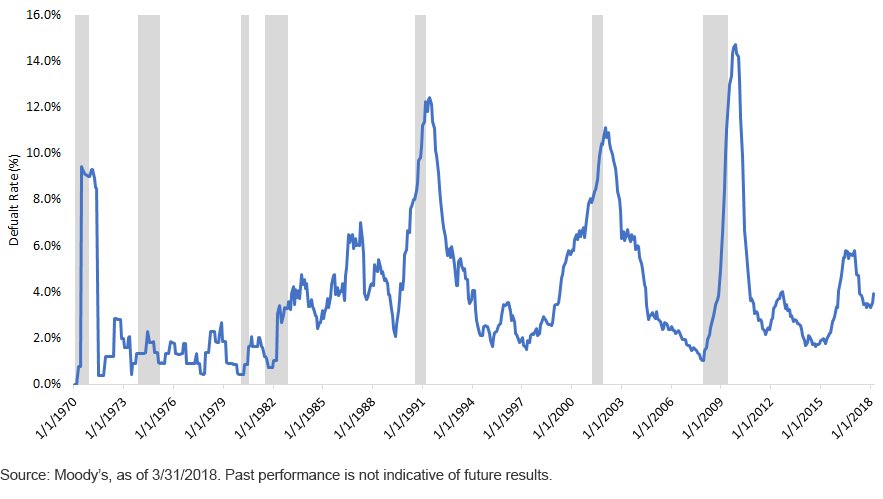

100 credits in the index will default. In December that number was 29%. So 8-9 additional companies out of the 100 credits are now priced for default. Seems like a lot to me. Just for example. Only 1% defaults occured in 2021 here is how they have moved through time

Notice that it& #39;s the 5 year running sum of these default rates that is priced in to markets so of course at this level the annual default rate would have to exceed 7.5% per year to lose money ROUGHLY. Ok on to my personal framework for corporate bonds.

Credit goes to noble prize winning economist Bob Merton who I met with at Salomon as he was consulting with those who founded LTCM. I have traded a Merton style credit model for 34 years since 1988 inspired by Bob. This is the concept

A corporation has assets liabilities and equity. Simply assets, corporate bonds and stock. The stock is entitled to all the upside of the assets once the bonds are paid off. It is essentially a call on the assets. The corporate bond is long the assets and has sold the call to

The equity holder. With some tricky put call parity transformation the corporate bond is a treasury bond plus a short put on the assets of the company. The put premium and the corporate spread are identical. What& #39;s the insight with this framework?

Well. It allows one to approximate the credit spread with the value of the assets and the volatility of the assets. Two concepts which are core to my macro framework. The assets are pro growth pro risk premium assets. The volatility of the assets will respond to the same drivers

AND we can by making a small leap use equity levels and far out of the money equity put implied volatility to model corporate spreads. I have arbitraged the difference between far otm equity puts and credit spreads for decades. Some call this capital structure arbitrage

But for me in macro using equity and equity implied as an alternative to credit spreads is the best insight. More on cap structure arb and my Merton model experiences over the years in another thread

Read on Twitter

Read on Twitter